下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Continuous Random Variables

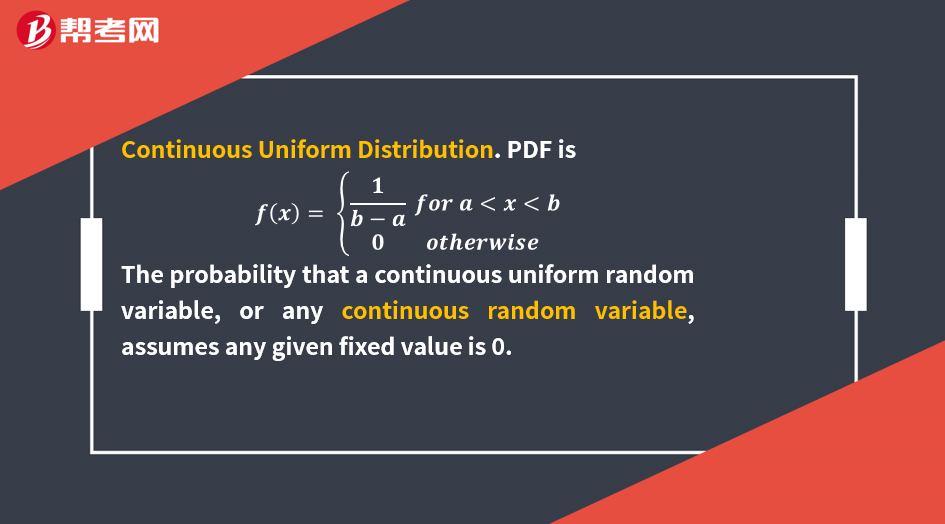

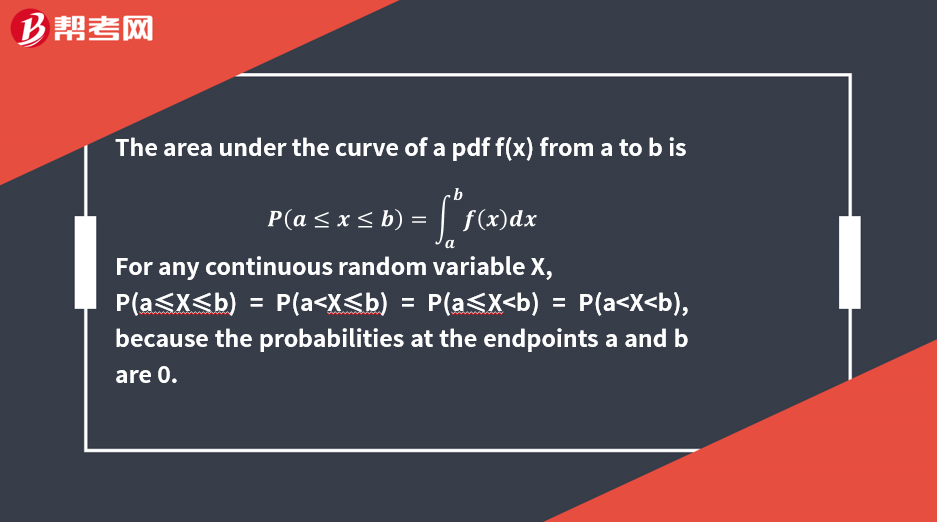

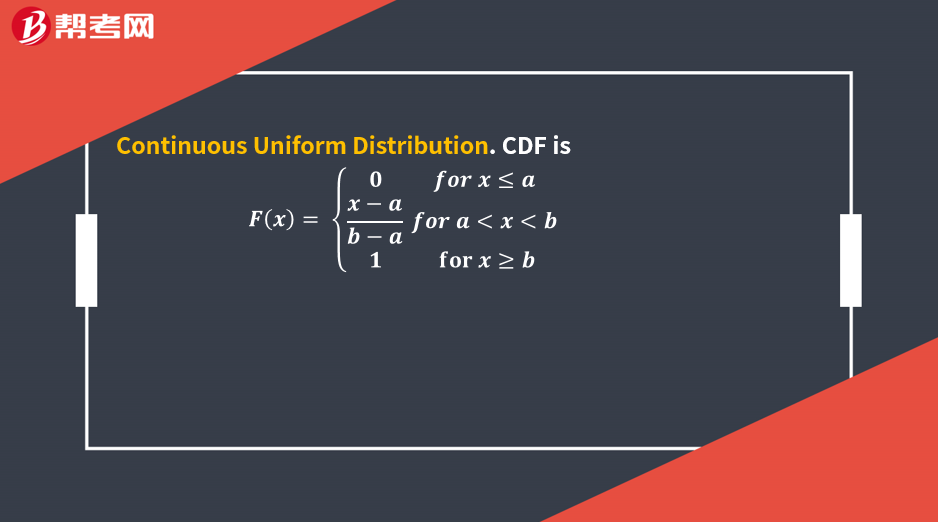

[Practice Problems] A random number between zero and one is generated according to a continuous uniform distribution. What is the probability that the first number generated will have a value of exactly 0.30?

A. 0%

B. 30%

C. 70%

[Solutions] A

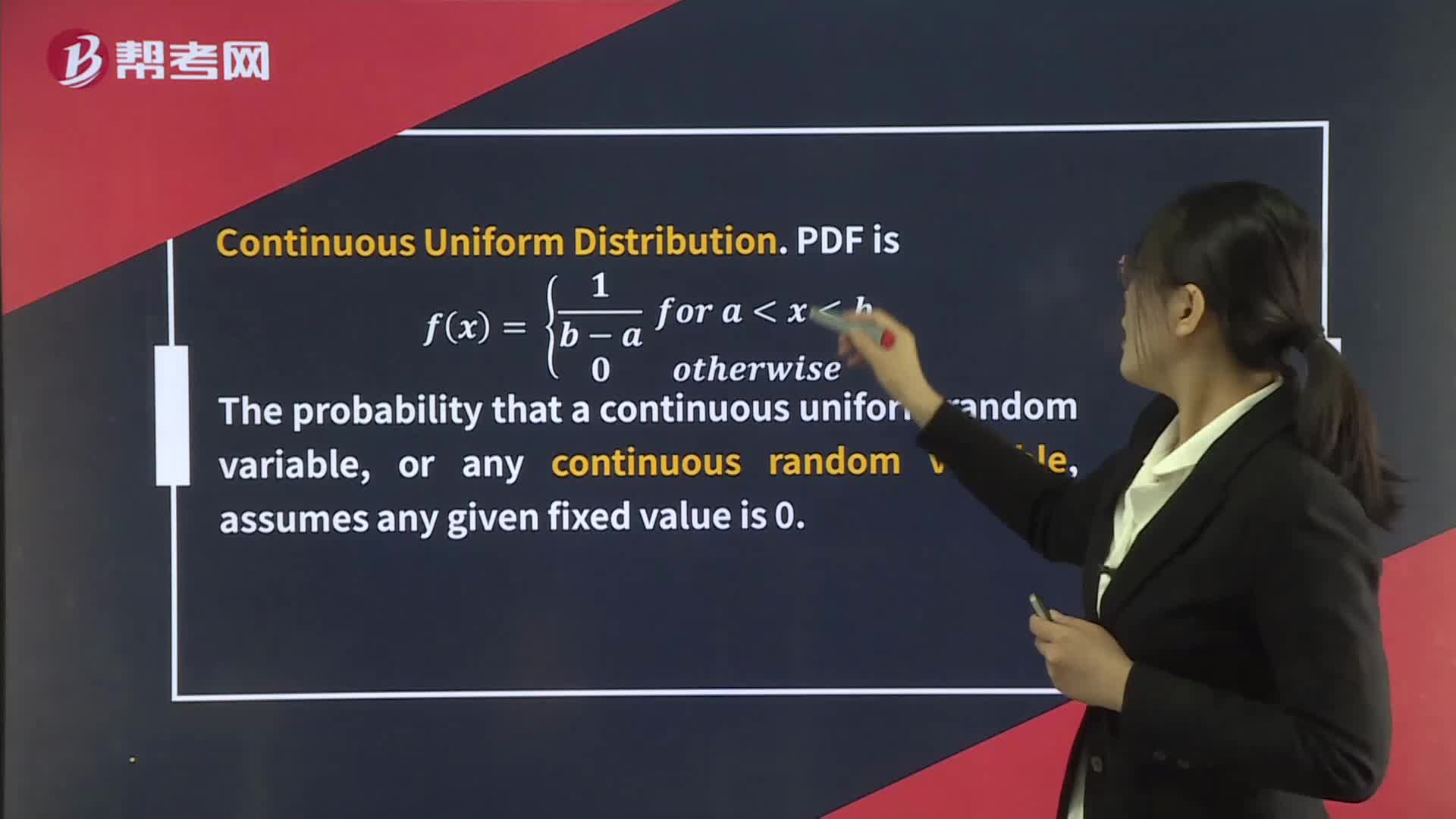

The probability of generating a random number equal to any fixed point under a continuous uniform distribution is zero.

The central limit theorem states that the sum (and mean) of a large number of independent random variables is approximately normally distributed.

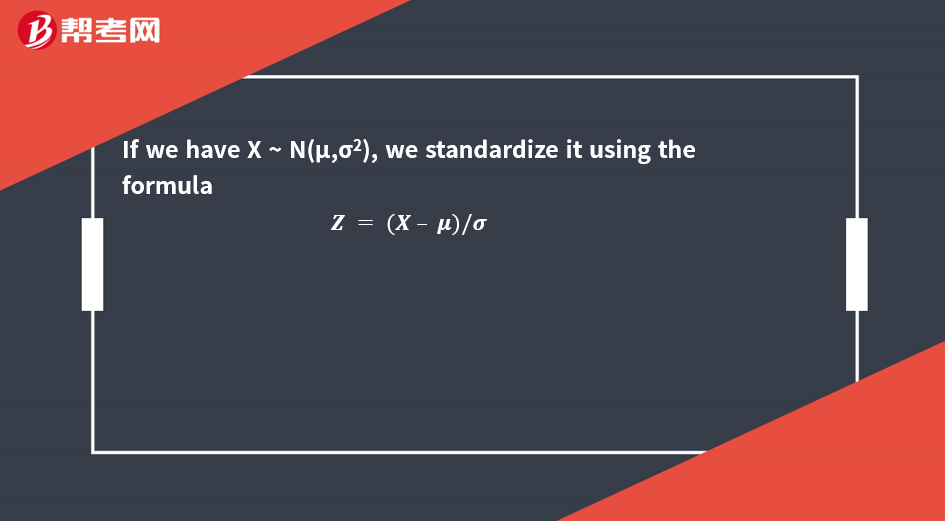

The normal distribution is completely described by two parameters—its mean, μ, and variance, σ2, indicated as X ~ N(μ, σ2).

The normal distribution has a skewness of 0 (it is symmetric), a kurtosis of 3; excess kurtosis 0. The mean, median, and the mode are all equal.

A linear combination of two or more normal random variables is also normally distributed.

The normal density with μ = 0 and σ = 1 is called the standard normal distribution (or unit normal distribution).

Approximately 68% of all observations fall in the interval μ ± σ.

Approximately 90% fall in μ ± 1.65σ.

Approximately 95% fall in μ ± 1.96σ.

Approximately 99% fall in μ ± 2.58σ.

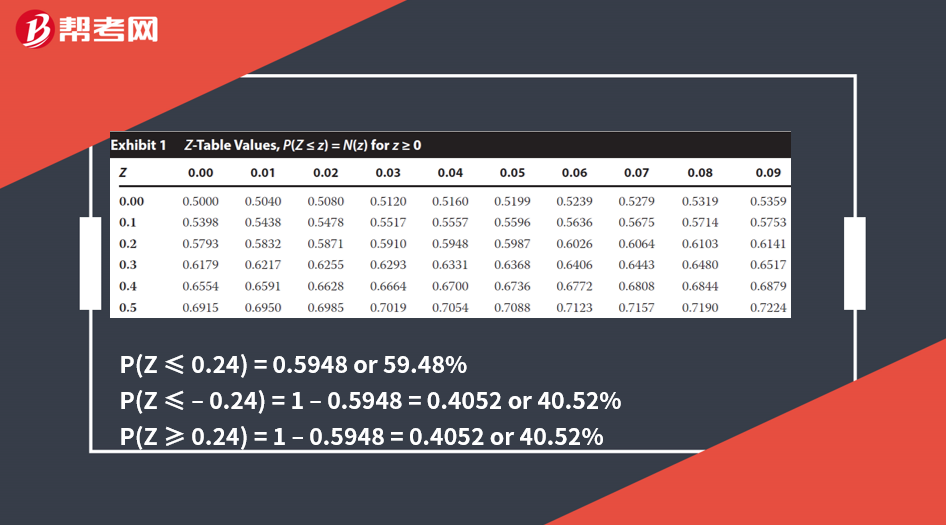

N(x) is a conventional notation for the cdf of a standard normal variable.

P(Z ≤ 1.282) = N(1.282) = 0.90 or 90 percent

P(Z ≤ 1.65) = N(1.65) = 0.95 or 95 percent

P(Z ≤ 2.327) = N(2.327) = 0.99 or 99 percent

P(Z ≥ x) = 1.0 − N(x)

N(−x) = 1.0 − N(x)

P(Z ≥ −x) = N(x)

[Practice Problems] A portfolio has an expected mean return of 8% and standard deviation of 14%. The probability that its return falls between 8 and 11 percent is closest to:

A. 8.3%

B. 14.8%.

C. 58.3%.

[Solutions] A

P(8% ≤ Portfolio return ≤ 11%) = N(Z corresponding to 11%) – N(Z corresponding to 8%). For the first term, Z = (11% – 8%)/14% = 0.21 approximately, N(0.21) = 0.5832. 8 percent is the mean, N(Z corresponding to 8%) must equal 50%. So P(8% ≤ Portfolio return ≤ 11%) = 0.5832 – 0.50 = 0.0832 or approximately 8.3 percent.

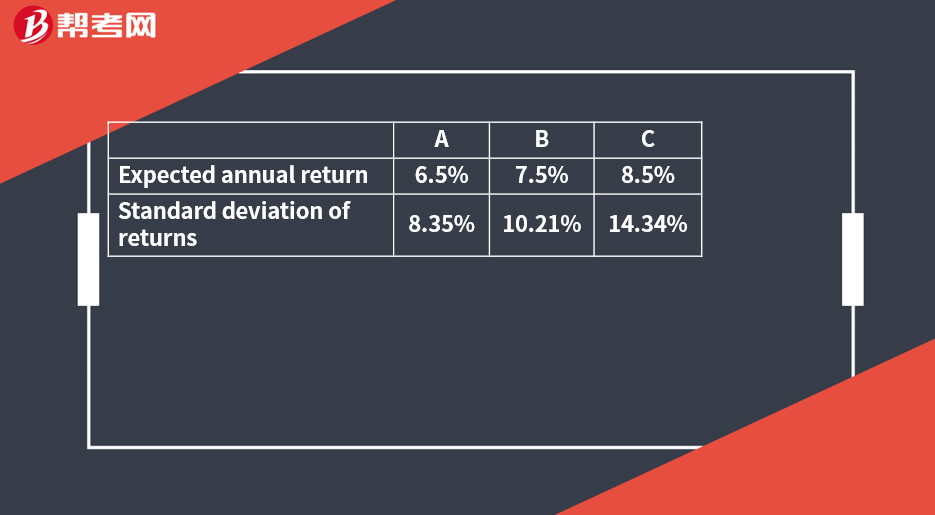

[Practice Problems] A client holding a £2,000,000 portfolio wants to withdraw £90,000 in one year without invading the principal. According to Roy’s safety-first criterion, which of the following portfolio allocations is optimal?

A. Allocation A

B. Allocation B

C. Allocation C

[Solutions] B

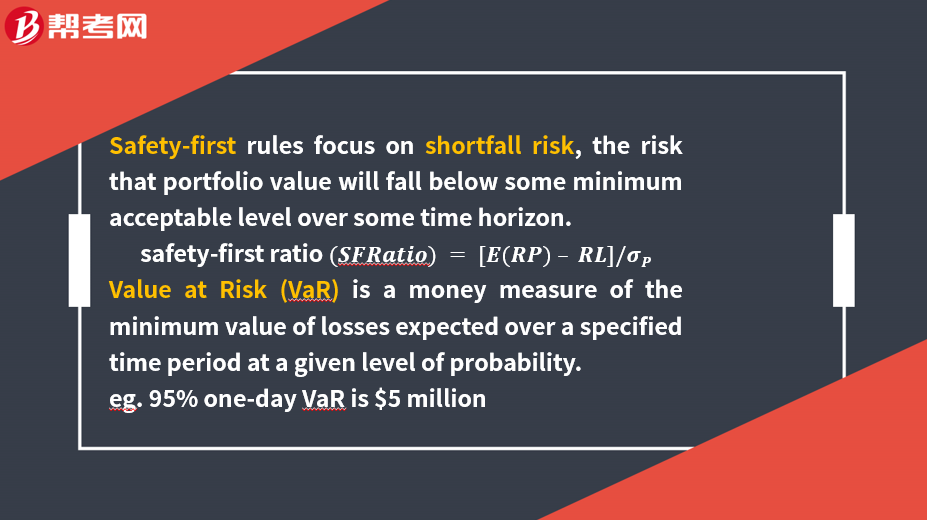

Allocation B has the highest SF ratio. The threshold return level RL is £90,000/£2,000,000 = 4.5%. To compute the allocation that is safety-first optimal, select the alternative with the highest ratio:

Allocation A = (6.5 – 4.5) / 8.35 = 0.240

Allocation B = (7.5 – 4.5) / 10.21 = 0.294

Allocation C = (8.5 – 4.5) / 14.34 = 0.279

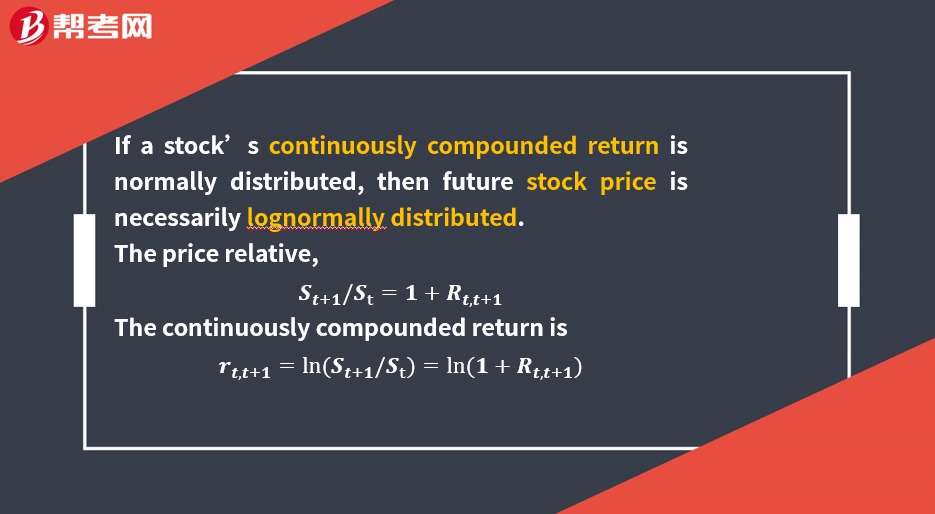

A random variable Y follows a lognormaldistribution if its natural logarithm, lnY, is normally distributed.

Lognormal distribution is bounded below by 0 and it is skewed to the right. A usefully accurate description of the distribution of asset prices.

[Practice Problems] In contrast to normal distributions, lognormal distributions:

A. are skewed to the left.

B. have outcomes that cannot be negative.

C. are more suitable for describing asset returns than asset prices.

[Solutions] B

By definition, lognormal random variables cannot have negative values.

237

237Discrete Random Variables:Cannot count the outcomes of a continuous random variable. eg. rate;For a discrete random variable:propertiesremains constant.

284

284Continuous Random Variables:equal to any fixed point under a continuous uniform distribution is zero.

969

969Discrete Random Variables:Cannot count the outcomes of a continuous random variable. eg. rate;density function pdf.,specified outcomes:ThepC.[Practice

微信扫码关注公众号

获取更多考试热门资料