下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Identification of Market Structure – HHI

Herfindahl–Hirschman Index (HHI):

the market shares of the top N companies are first squared and then added.

HHI does not take the possibility of entry into account, nor the elasticity of demand.

The HHI has limited use for estimating the potential profitability of a company or group of companies.

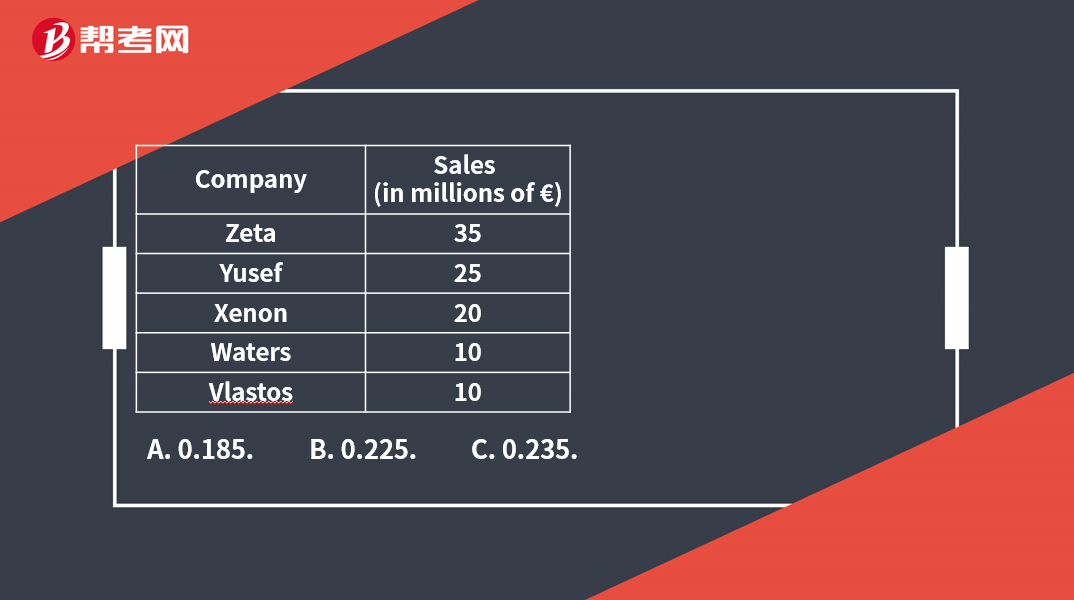

[Practice Problems] An analyst gathered the following market share data for an industry comprised of five companies:

The industry’s three-firm Herfindahl–Hirschmann Index is closest to:

[Solutions] B

The three-firm Herfindahl–Hirschmann Index is 0.352 + 0.252 + 0.202 = 0.225.

Note: (0.35 + 0.25 + 0.20)2 = 0.7569, much higher than 0.225.

76

76Stackelberg Model in Oligopoly Market:strategy.while the follower earns less.

279

279Market Structure:and monopoly.:Perfect,competition,capital.differentiation.market.change.

182

182Identification of Market Structure – HHI:HHI does not take the possibility of entry into account:[PracticeThe three-firm Herfindahl–Hirschmann Index is 0.352 + 0.252 + 0.202 = 0.225.Notemuch higher than 0.225.

微信扫码关注公众号

获取更多考试热门资料