下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Explaining Inflation

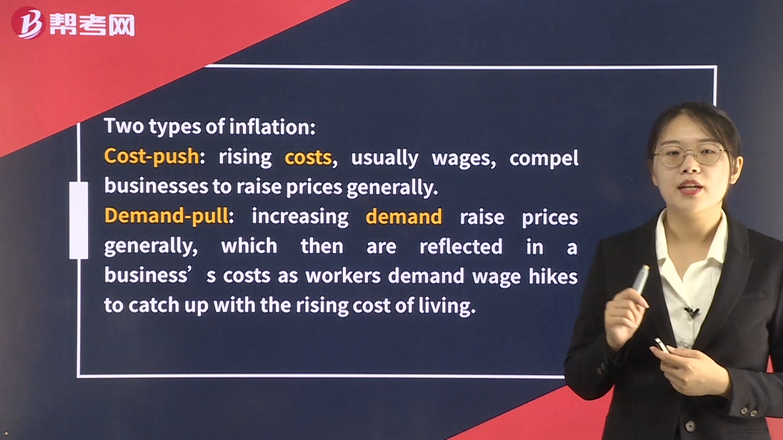

Two types of inflation:

Cost-push: rising costs, usually wages, compel businesses to raise prices generally.

Demand-pull: increasing demand raise prices generally, which then are reflected in a business’s costs as workers demand wage hikes to catch up with the rising cost of living.

Cost-Push Inflation

Practitioners focus most particularly on wage-push inflation.

The higher the unemployment rate, the lower the likelihood that shortages will develop in labor markets, whereas the lower the unemployment rate, the greater likelihood that shortages will drive up wages.

Non-accelerating inflation rate of unemployment (NAIRU): effective unemployment rate, below which pressure emerges in labor markets or, the natural rate of unemployment (NARU).

Productivity, or output per hour, is an essential part of wage-push inflation analysis

The equation for unit labor cost (ULC) indicator:

ULC = W/O,

where

ULC = unit labor costs

O = output per hour per worker

W = total labor compensation per hour per worker

Demand-Pull Inflation

The higher the rate of capacity utilization or the closer actualGDP is to potential, the more likely an economy will suffer shortages, bottlenecks, a general inability to satisfy demand, and hence, price increases.

Monetarists contend that a surplus of money will inflate the money price of everything in the economy. (too much money chases too few goods)

If money growth outpaces the growth of the nominal economy, there is an inflationary potential.

Disinflationary or deflationary potential if money growth trails the economy’s rate of expansion.

187

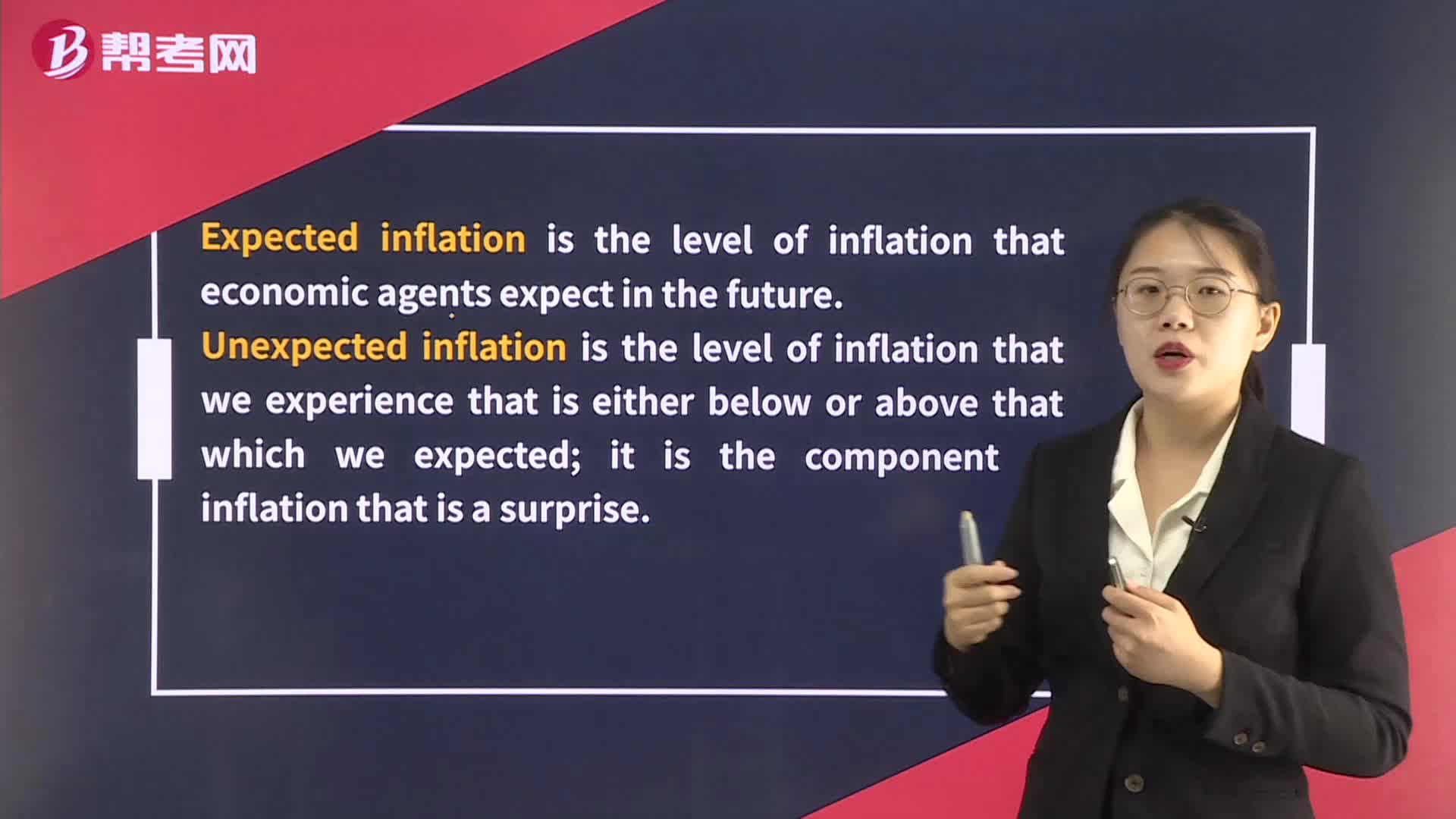

187The Costs of Inflation:inflation is the level of inflation that economic agents:expect in the future.;Unexpected;reduce the information content of market prices.

135

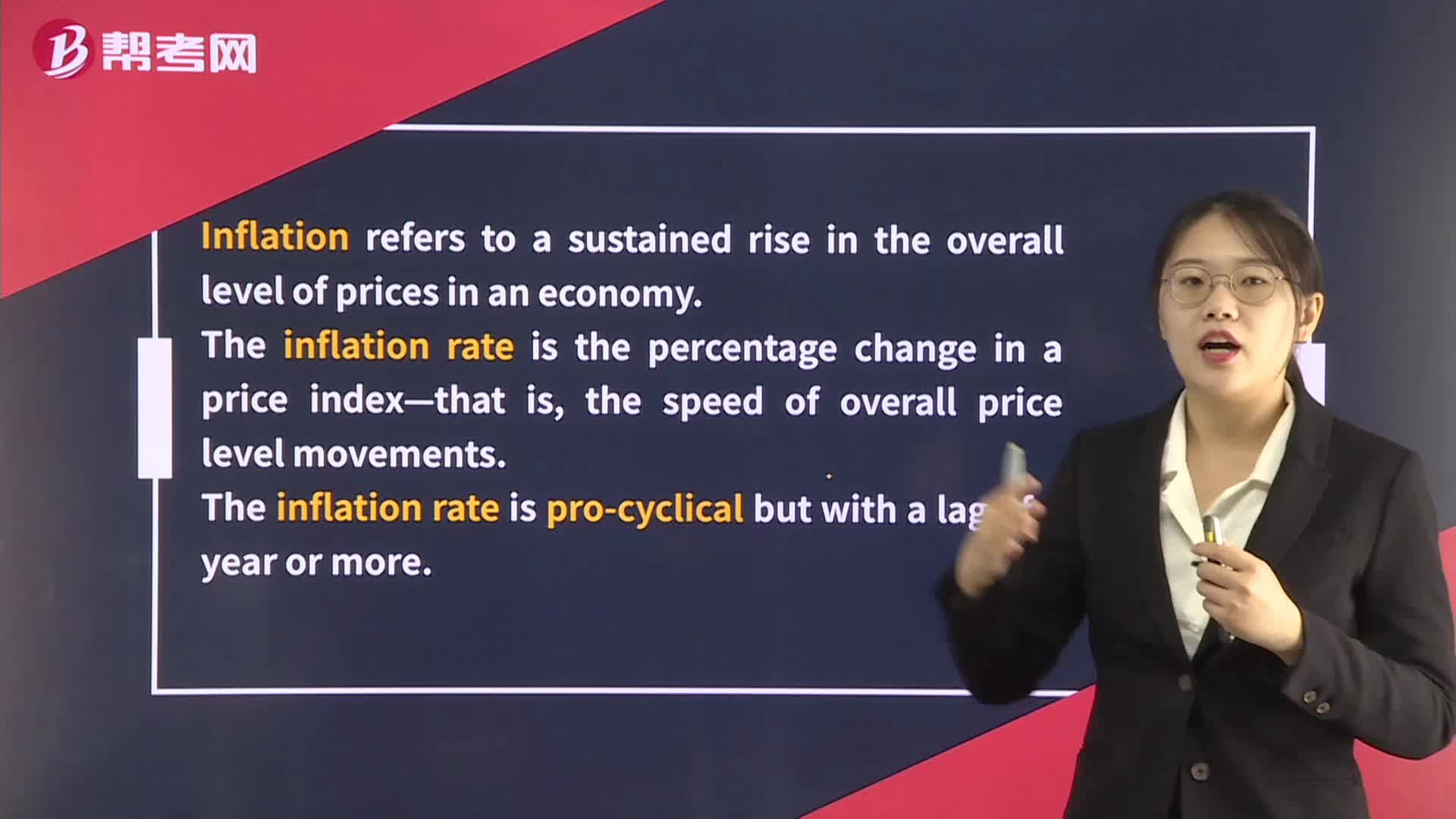

135Inflation:is thought to be effective.

347

347Inflation Targeting:Central:with targeting inflation has a degree of independence from its government.;Credibility:doubt.;Transparency:Inflation Reports consider and outline their;

微信扫码关注公众号

获取更多考试热门资料