下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

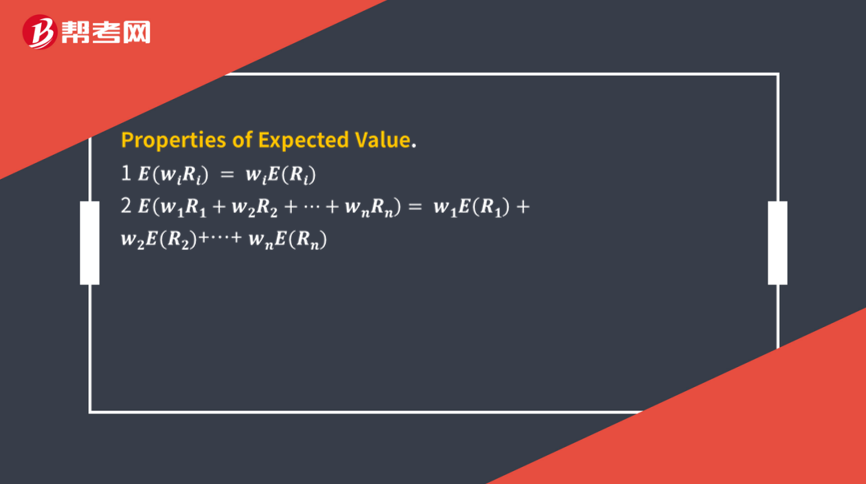

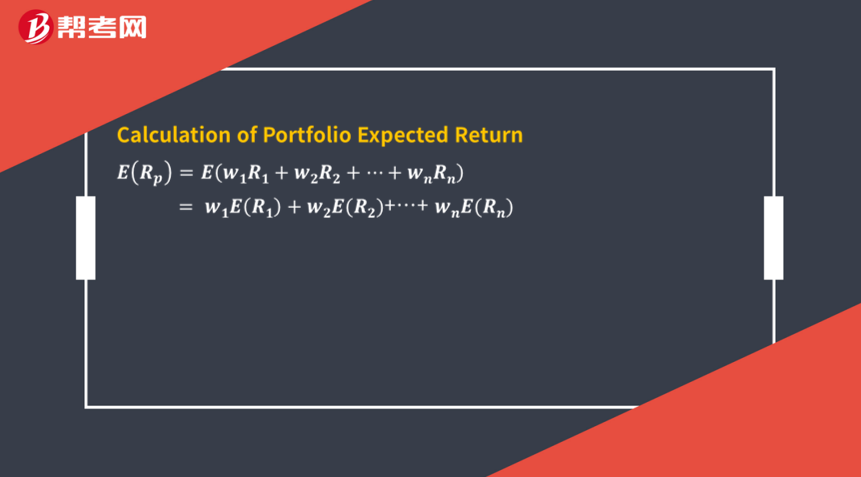

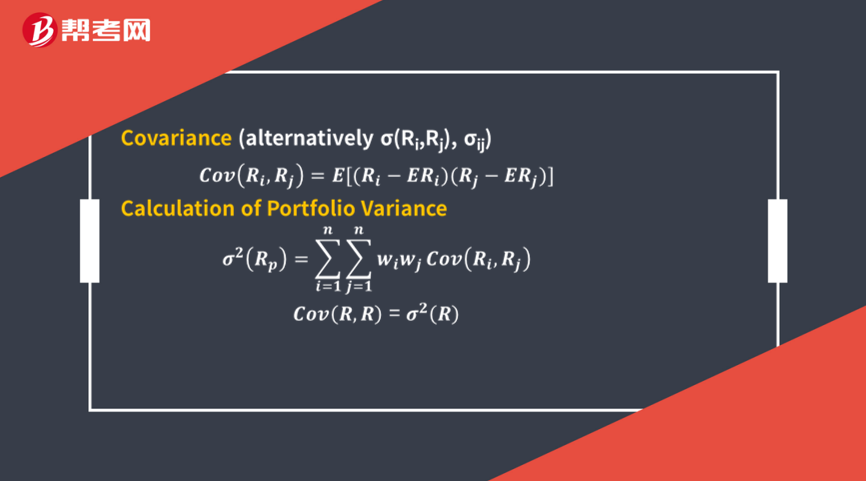

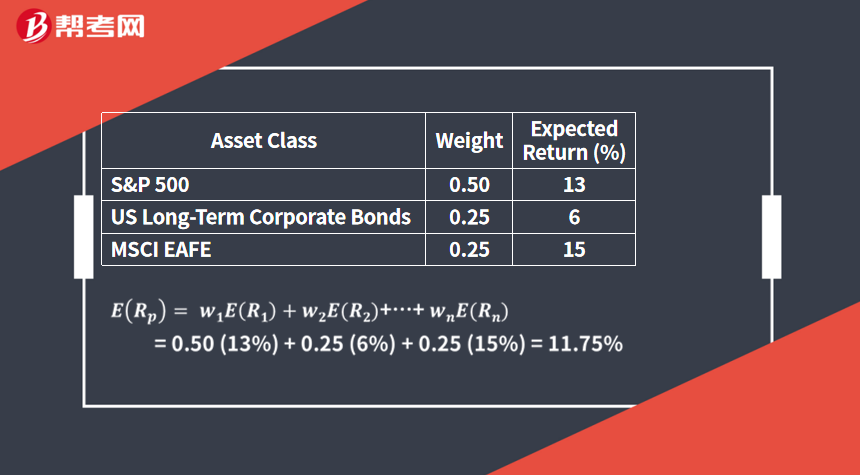

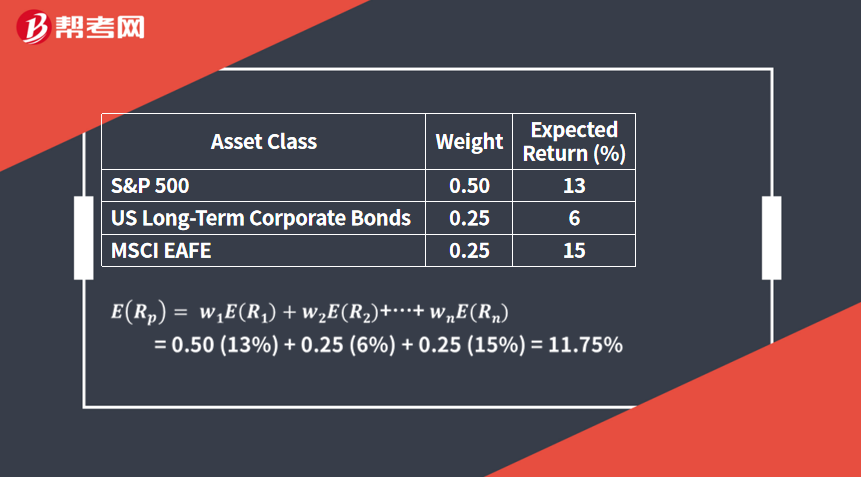

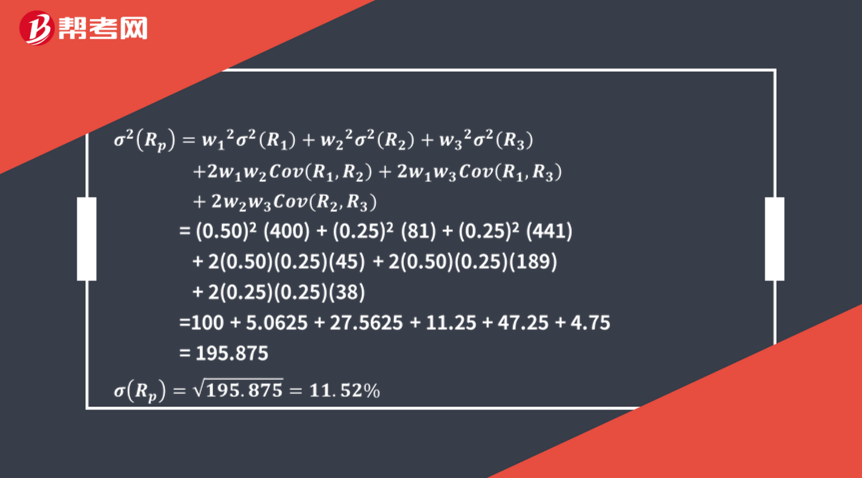

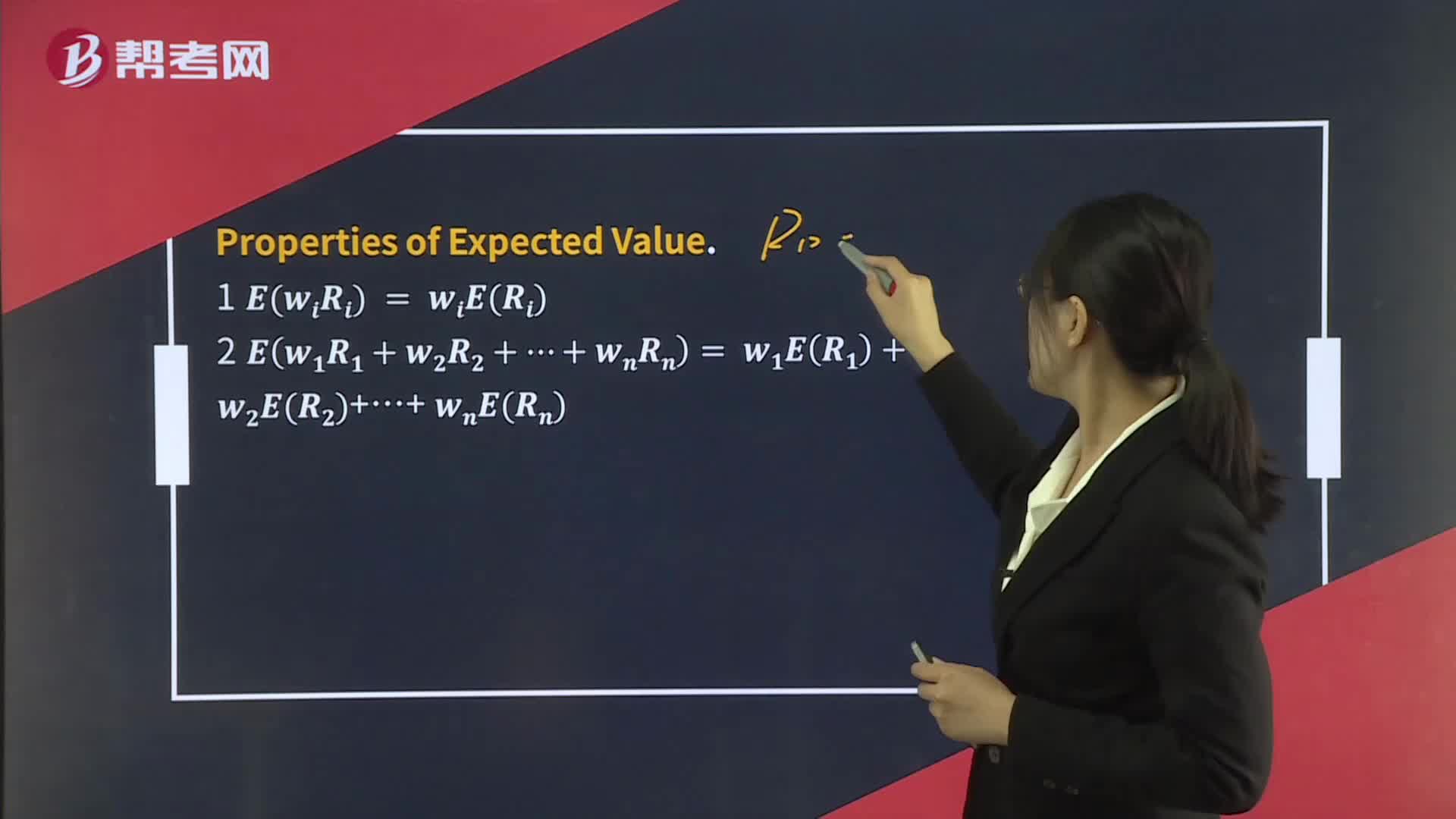

Portfolio Expected Return and Variance of Return

[Solutions] C

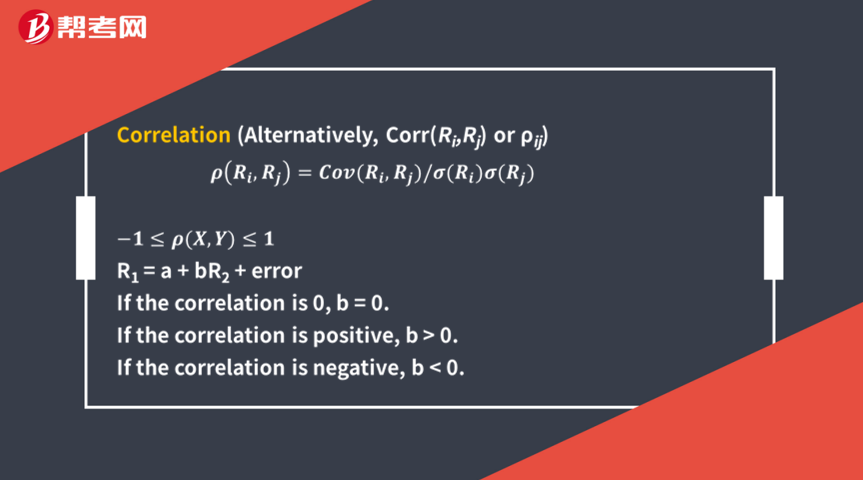

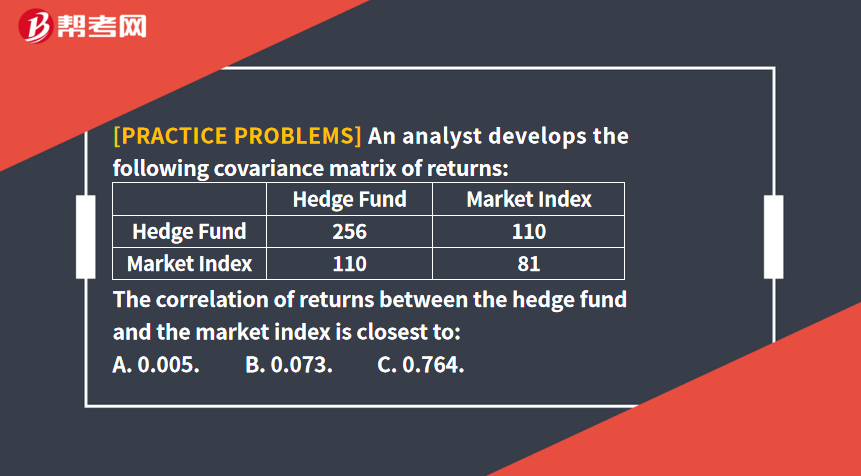

The correlation between two random variables Ri and Rj is defined as ρ(Ri,Rj) = Cov(Ri,Rj)/σ(Ri)σ(Rj). Using the subscript i to represent hedge funds and the subscript j to represent the market index, the standard deviations are σ(Ri) = 2561/2 = 16 and σ(Rj) = 811/2 = 9. Thus, ρ(Ri,Rj) = Cov(Ri,Rj)/σ(Ri)σ(Rj) = 110/(16 × 9) = 0.764.

A. 26.39.

B. 26.56.

C. 28.12.

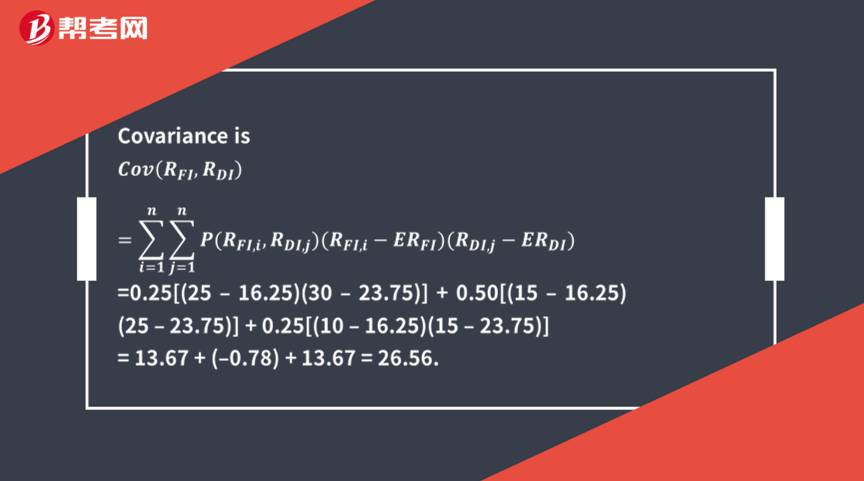

[Solutions] B

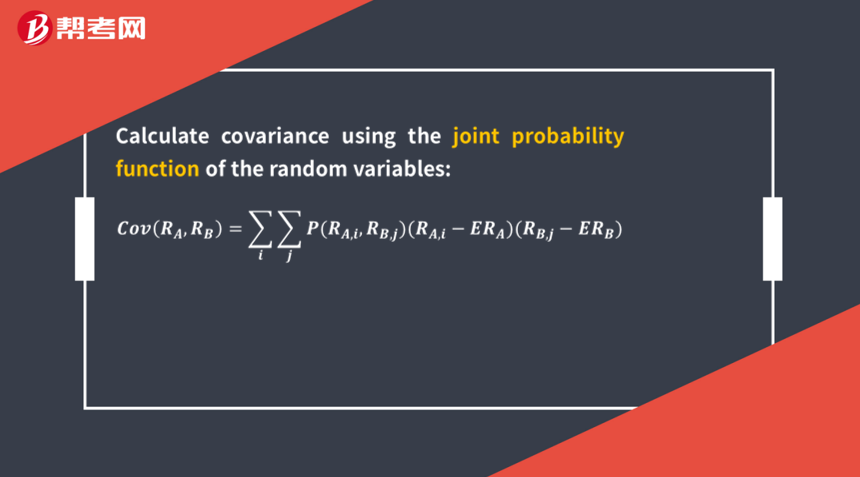

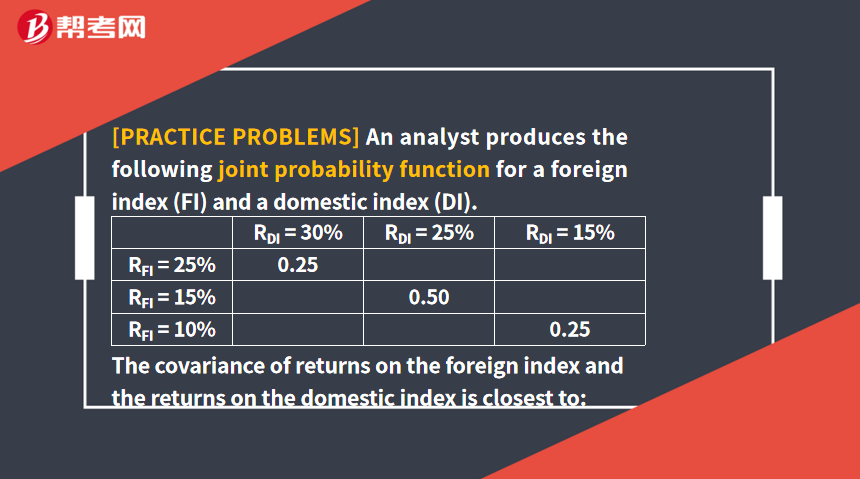

First, expected returns are

E(RFI) = (0.25 × 25) + (0.50 × 15) + (0.25 × 10)

= 6.25 + 7.50 + 2.50 = 16.25 and

E(RDI) = (0.25 × 30) + (0.50 × 25) + (0.25 × 15)

= 7.50 + 12.50 + 3.75 = 23.75.

900

900Portfolio Expected Return and Variance of Return:Return,RjFirst= 7.50 + 12.50 + 3.75 = 23.75.

446

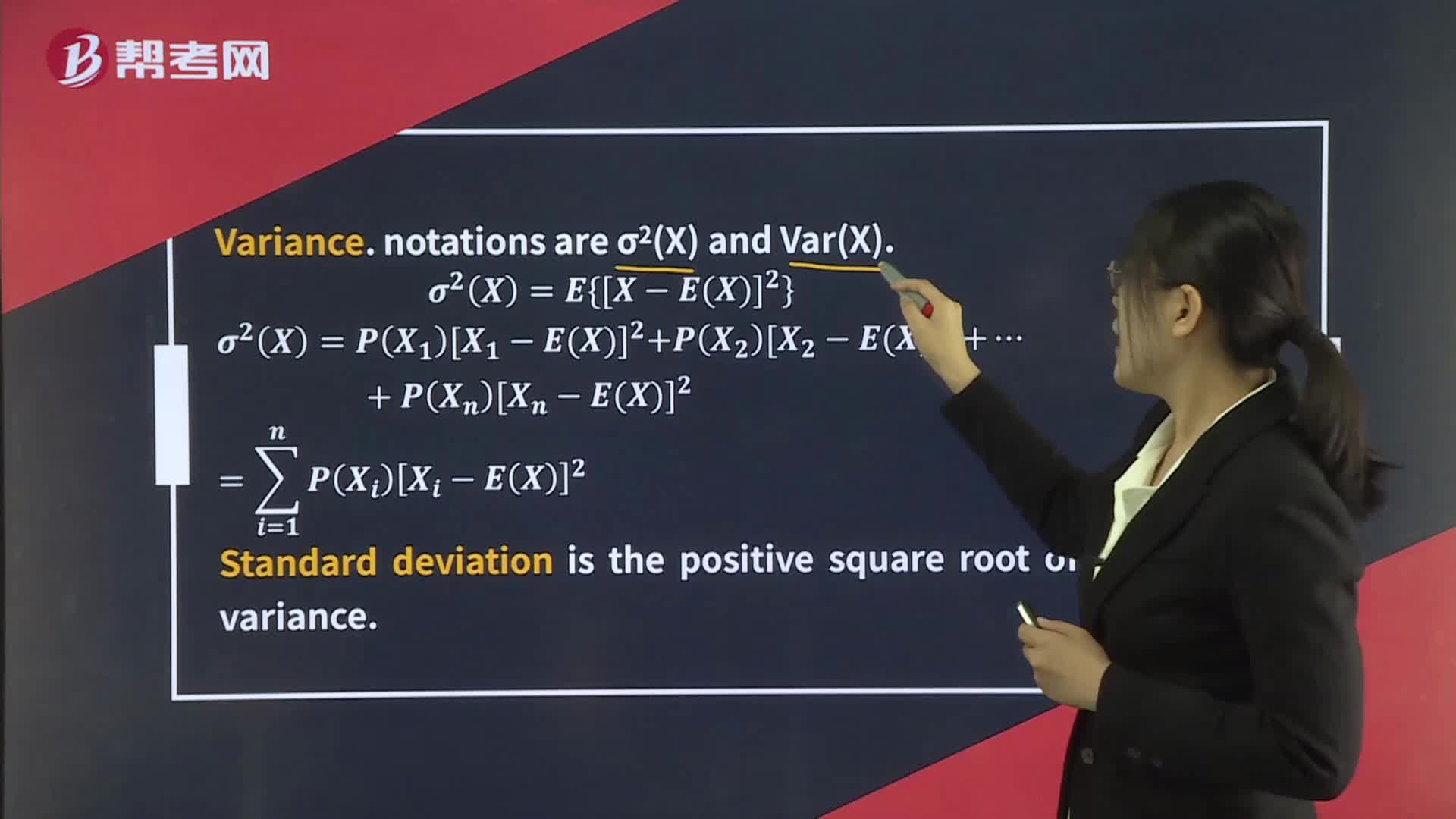

446Expected Value and Variance:A. $9.81:million.,0.05$70 – 37.752 + 0.70$40 – 37.752 + 0.25$25 – 37.752 = $96.18 million. The standard deviation is thus σ = $96.1812 = $9.81 million.,$63600.

583

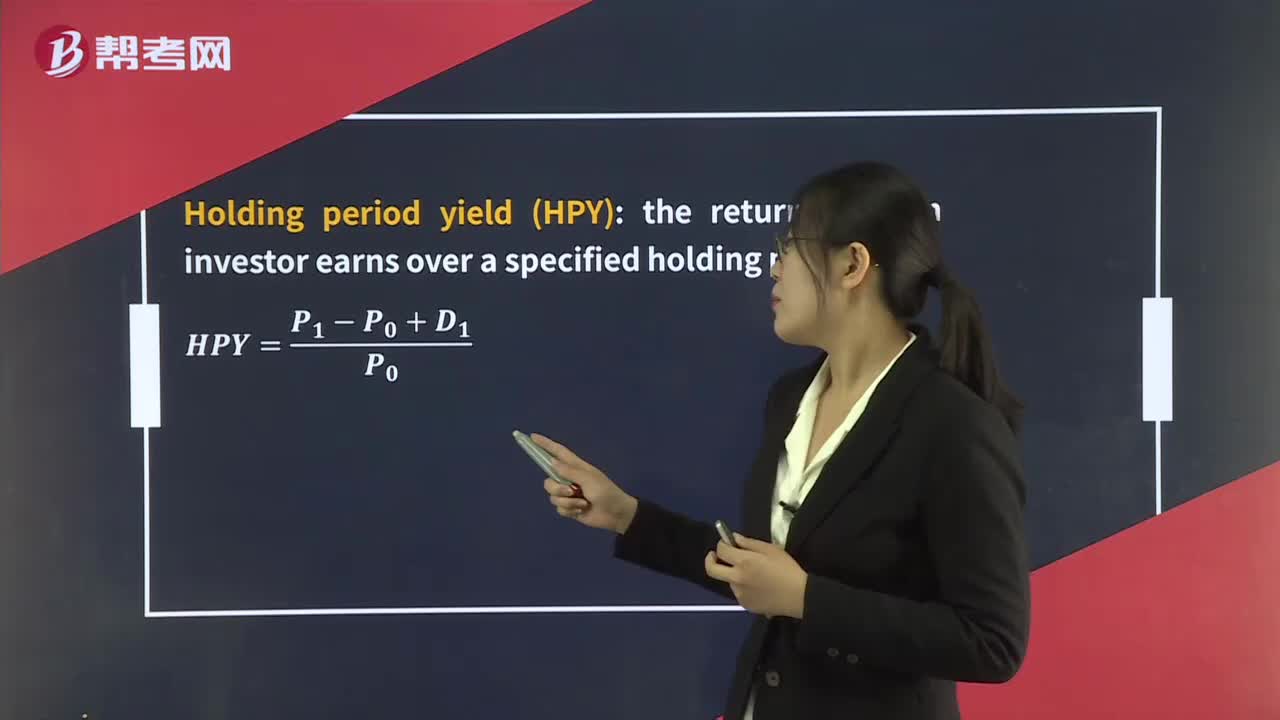

583Money-Weighted Rate of Return & Time-Weighted Rate of Return:[Solutions] C

微信扫码关注公众号

获取更多考试热门资料