下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

On July 31, Year 10, Tern Co. amended its single employee defined benefit pension plan by granting increased benefits for services provided prior to Year 10. Under IFRS, this past service cost will be reflected in the financial statement(s) for:

a. Year 10, and years before and following Year 10.

b. Years before Year 10 only.

c. Year 10, and following years only.

d. Year 10 only.

答案:D

Explanation

Choice "d" is correct. Under IFRS, past service cost is recognized on the income statement in the period of the plan amendment.

Choice "b" is incorrect. No retroactive adjustment is made when a plan amendment is made.

Choice "a" is incorrect. Under IFRS, past service cost is recognized on the income statement in the period of the plan amendment. Retroactive charges to past periods are not made and it is not necessary to amortize the cost to future periods because it has already been recognized in earnings.

Choice "c" is incorrect. Under IFRS, past service cost is recognized on the income statement in the period of the plan amendment. It is not reported in other comprehensive income and therefore recognition in future periods through amortization is not required.

86

862020年AICPA考试用什么教材学习?:2020年AICPA考试用什么教材学习?在美国有数百种AICPA考试的辅导书籍或资料,Becker's CPA Review 教材和学习系统在美国已有50年以上历史,使用Becker教材通过美国注册会计师考试的人数是未使用该教材人数的两倍;75%的考试通过者、90%的一次通过者以及95%的高分区学员皆选用Becker教材。美国各地超过70多所大学院校选择Becker教材作为他们的课程。

30

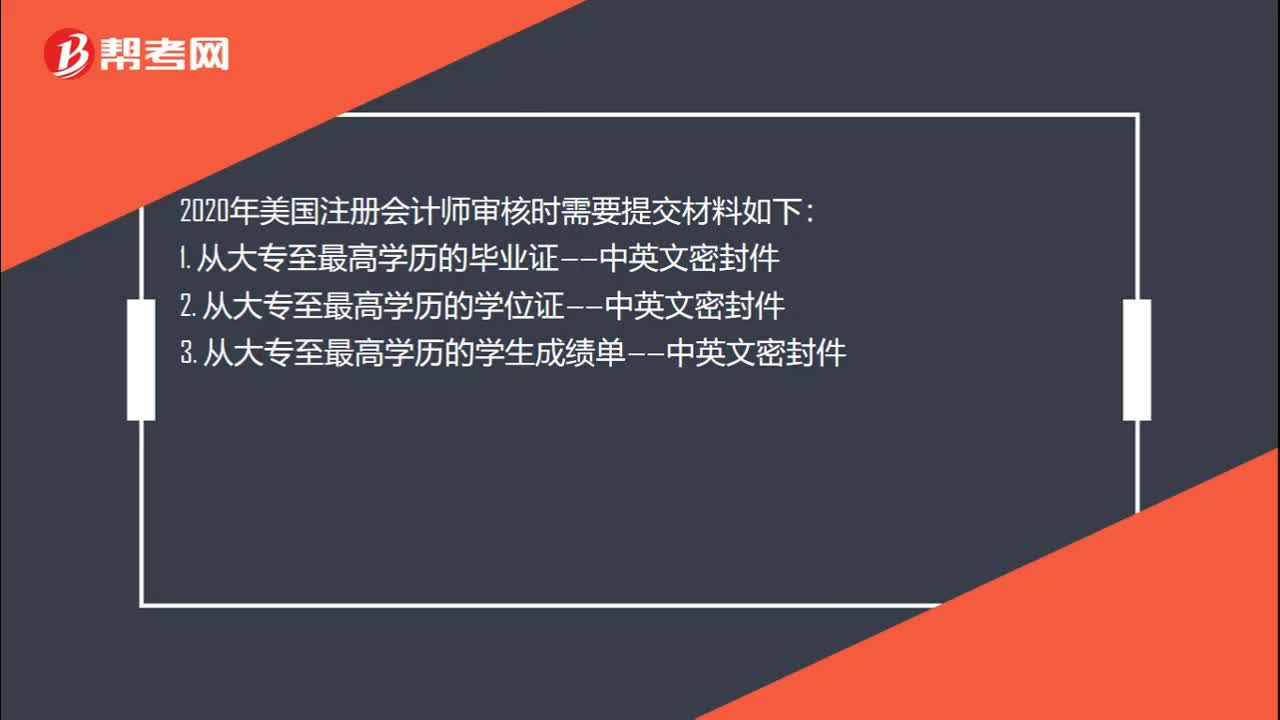

302020年AICPA怎么报考?:2020年AICPA怎么报考?AICPA报考流程如下:1.学历预评估。2. 学分评估,确认报考州。3.学历认证。4.补学分。5.申请NTS。6.预约考位。7. 安排行程。8.申请执照。

22

222020年美国CPA考哪些科目?:2020年美国CPA考哪些科目?2020年美国CPA考试科目有:FAR财务会计与报告,AUD审计与鉴证,REG法规,BEC商业环境与理论。共有3种考试题型:分别是选择题,案例分析题,写作题。不同科目题型分配不同,FAR,AUD,REG都是有50%的选择题和50%的案例分析题组成,另外BEC还有个写作题,其BEC题型是由50%的选择+35%的案例分析+15%的写作题组成。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料