下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

备考2020年美国注册会计师的小伙伴赶紧来围观,帮考网为大家准备了美国CPA《财务会计与报告》考试例题,以供小伙伴们备考练习。

1.ABC Company owns stock in XYZ Company.The stock is traded on the New York Stock Exchange and the London Stock Exchange.Stock price information from the two stock exchanges on December 31 is as follows:

Exchange Quoted Stock Price Transaction Costs Net

New York $103 $1 $102

London $106 $5 $101

What is the fair value of the XYZ stock on December 31 if there is no principal market for the stock?

a.$101

b.$102

c.$103

d.$106

Explanation

Choice “c” is correct. If there is no principal market,then the price in the most advantageous market is the fair value of the stock.The most advantageous market is the market with the best price after considering transaction costs.Although the London quoted market price is higher,after transaction costs the net amount is lower,so New York is the most advantageous market and the fair value is $103.

2. Eagle and Falk are partners with capital balances of $45,000 and 25,000,respectively.They agree to admit Robb as a partner.After the assets of the partnership are revalued,Robb will have a 25% interest in capital and profits,for an investment of $30,000.What amount should be recorded as goodwill to the original partners?

a.$0

b.$5,000

c.$7,500

d.$20,000

CPA-00721 Explanation

Choice “d” is correct,$20,000.

Robb\'s investment:

25% of total capital=$30,000

Calculate total capital $30,000/.25

Total capital=$120,000

Less existing capital balances:

Eagle $45,000

Falk 25,000

Robb 30,000

Total assets contributed=$100,000

Goodwill to original partners=$ 20,000

3.Eagle and Falk are partners with capital balances of $45,000 and $25,000,respectively.They agree to admit Robb as a partner.After the assets of the partnership are revalued,Robb will have a 25% interest in capital and profits,for an investment of $30,000.What amount should be recorded as a bonus to the original partners?

a.$0

b.$5,000

c.$7,500

d.$20,000

Explanation

Choice “b” is correct,$5,000.

Total equity of new partnership:

Eagle $45,000

Falk $25,000

Robb $30,000

Total $100,000

Since Robb is receiving a 25% interest in the partnership,his capital account will be credited with 25% of the total equity of the new partnership,or $25,000.The difference between his contribution of $30,000,and his capital account balance of $25,000,is credited to the other partners as a bonus.

以上就是本次帮考网分享给大家的关于美国注册会计师考试试题,如果大家对于美国注CPA考试还有别的问题,可以多多关注帮考网,我们将继续为大家答疑解惑!

86

862020年AICPA考试用什么教材学习?:2020年AICPA考试用什么教材学习?在美国有数百种AICPA考试的辅导书籍或资料,Becker's CPA Review 教材和学习系统在美国已有50年以上历史,使用Becker教材通过美国注册会计师考试的人数是未使用该教材人数的两倍;75%的考试通过者、90%的一次通过者以及95%的高分区学员皆选用Becker教材。美国各地超过70多所大学院校选择Becker教材作为他们的课程。

30

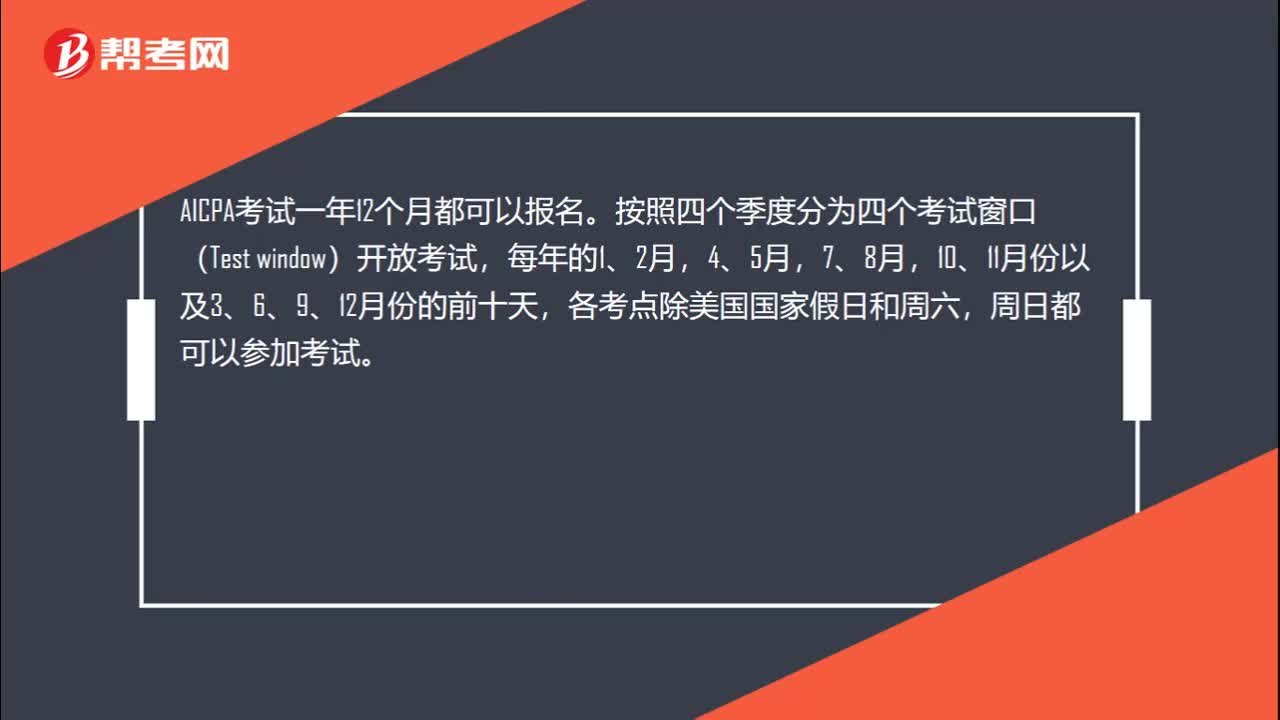

302020年AICPA怎么报考?:2020年AICPA怎么报考?AICPA报考流程如下:1.学历预评估。2. 学分评估,确认报考州。3.学历认证。4.补学分。5.申请NTS。6.预约考位。7. 安排行程。8.申请执照。

22

222020年美国CPA考哪些科目?:2020年美国CPA考哪些科目?2020年美国CPA考试科目有:FAR财务会计与报告,AUD审计与鉴证,REG法规,BEC商业环境与理论。共有3种考试题型:分别是选择题,案例分析题,写作题。不同科目题型分配不同,FAR,AUD,REG都是有50%的选择题和50%的案例分析题组成,另外BEC还有个写作题,其BEC题型是由50%的选择+35%的案例分析+15%的写作题组成。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料