下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

ACCOUNTING STANDARDS

CONCEPTUAL FRAMEWORKS UNDERLYING FINANCIAL ACCOUNTING

Three Organizations

SEC(Securities and Exchange Commission)

FASB(Financial Accounting Standards Board)

IASB(International Accounting Standards Board)

SEC(F1-3)

SEC was established by the Securities Exchange Act of 1934

SEC has the legal authority to establish GAAP

SEC relinquished the task of establishing GAAP to the private sector(FASB)

FASB(US GAAP=Codification,Rules-based)(F1-3)

In 1973 FASB was established as an independent full-time organization.

FASB determine GAAP since 1973(Relinquished by SEC)

7 full-time members

IASB(IFRS≈PRC GAAP,Principles-based)(F1-5)

The goal of the IFRS Foundation and the IASB is to develop,in the public interest,a single set of high-quality,understandable,enforceable and globally accepted financial reporting standards based upon clearly articulated principles.

European Union,PRC,HK,Brazil,Russia,Japan…

IASB/FASB Convergence(F1-6)

Goal:A single set of high-quality, international accounting standards that companies can use for both domestic and cross-border financial reporting.

Status:In progress…

In Becker materials,if no difference between IFRS and U.S. GAAP is noted, then the accounting rules are substantially the same.

Adoption of IFRS in the United States(F1-6)

-SEC supports the IASB/FASB convergence project.

U.S. GAAP = FASB ACCOUNTING STANDARDS CONDIFICATION(F1-3)

Effective July 1,2009,the FASB Accounting Standards Codification became the SINGLE source of authoritative nongovernmental U.S. GAAP.

Now U.S. GAAP=Codification Or. Codification=U.S. GAAP

What included in the Codification?(F1-4)

-“FEDPRIA”

- Relevant portions of the following authoritative pronouncements issued by the SEC.

Ongoing Standard-Setting Process(F1-5)

Exposure Drafts

Accounting Standards Updates(ASU)

Integrate into ASC

Conceptual framework provides a basis for financial accounting concepts for enterprises.

FASB conceptual framework called Statements of Financial Accounting Concepts (SFAC)。

SFAC serves as a basis for all FASB pronouncements.

The SFAC are not GAAP

FASB and IASB have a joint project to converge their financial reporting frameworks.

SFAC NO. 8 Conceptual Framework for Financial report is the result of convergence.(F1-7)

1 objective,2 Fundamental,4 Enhancing.

1 objective – Decision useful(F1-7)

2 fundamental qualitative characteristics – FAR (FAithful representation + Relevance)(F1-8)

4 enhancing qualitative characteristics – Compare and verify in time to understand(F1-9)

1 Objective:DECISION USEFUL.

SFAC NO. 8-chapter 1:The Objective of General Purpose Financial Reporting(F1-7)

Who make decision?Primary Users(existing and potential investors,lenders,and other creditors)

What decision?Whether providing resources to reporting entity.

How useful?use financial information(FI) to assess the reporting entity‘s prospects for future net cash inflows

2 fundamental qualitative characteristics – FAR(FAithful representation + Relevance)(F1-8)

SFAC NO.8-chapter 3:Qualitative Characteristics of Useful Financial Information

FAR = FAithful representation + Relevance

Relevance – “Does it related to my decision?”

“Passing Confirms Money(PCM)”

“Confirm Predictive value is Material”(PCM)

Predictive value:Help me predict future outcomes

Confirming value:Help me evaluate earlier prediction.

Materiality:Judgment. If an omission or misstatement of the information could affect the decision made by users,then it is material.

Faithful Representation - “Can I depend on it?”

“Completely Neutral is Free from error”

Completeness:All facts embedded in the information.

Neutrality:Free from bias;focus is on objectivity and balance.

Freedom from Error:Judgement. Would a sufficiently knowledgeable third party derive the same result?

66

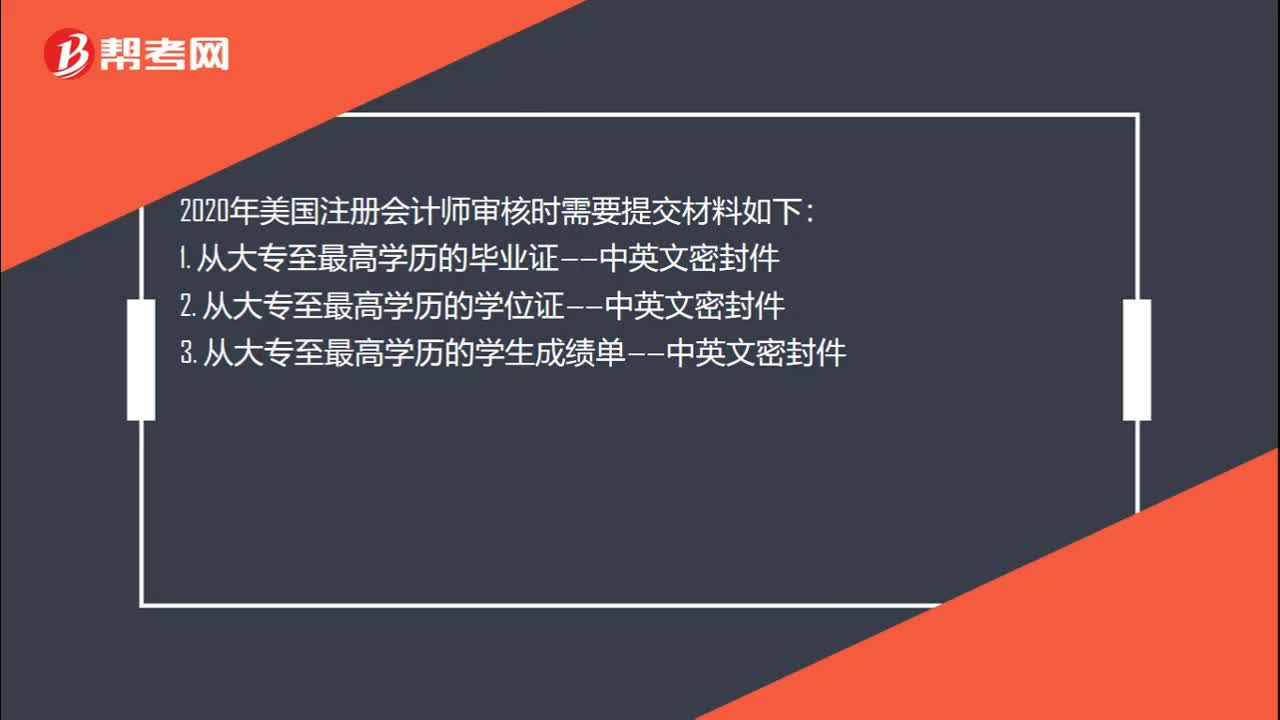

662020年AICPA报考条件和执照申请条件一样吗?:2020年AICPA报考条件和执照申请条件一样吗?AICPA执照申请和报考是两个不同的步骤和环节,AICPA执照和报考要求也是不同的,所以能报考的州并不一定是适合申请执照的。AICPA报考没有工作经验要求,一般看的是学历、学分,部分州有SSN等要求。AICPA执照条件一般除了看学历、学分,还有一定工作经验以及要求工作经验有USCPA或者上司USCPA签字证明等,此外有些州在报考时没有SSN要求。

30

302020年AICPA怎么报考?:2020年AICPA怎么报考?AICPA报考流程如下:1.学历预评估。2. 学分评估,确认报考州。3.学历认证。4.补学分。5.申请NTS。6.预约考位。7. 安排行程。8.申请执照。

22

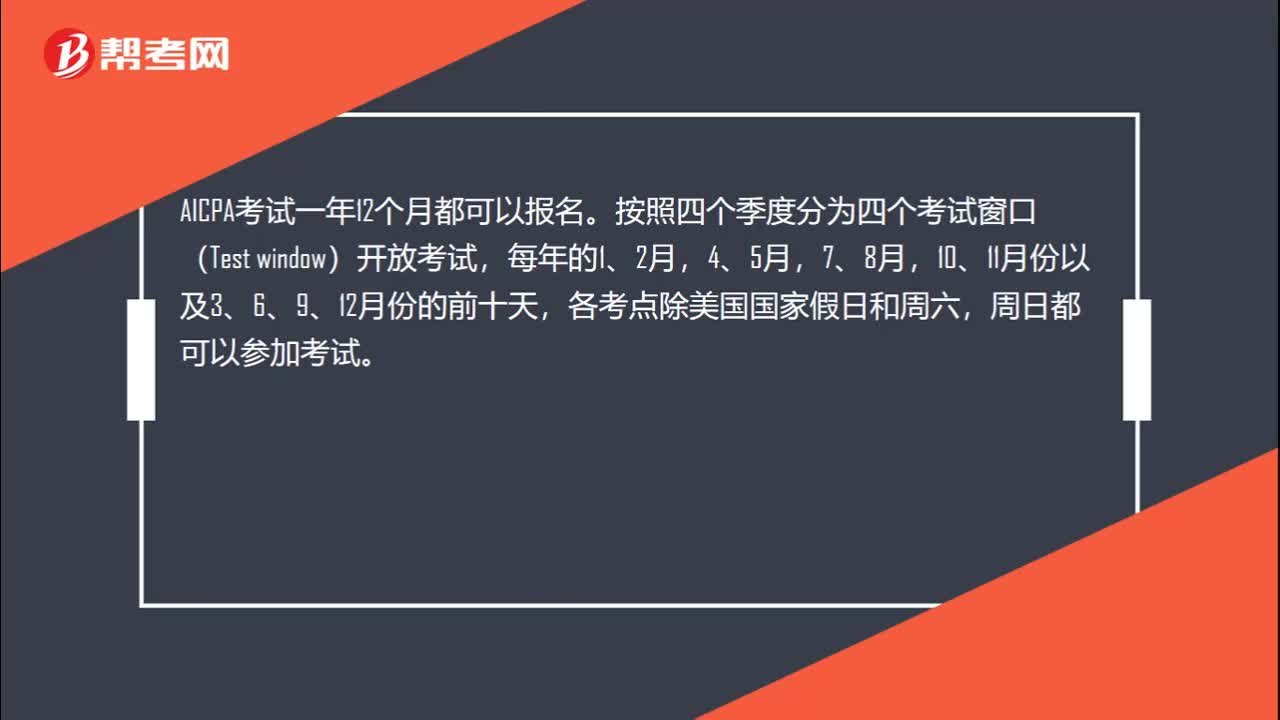

222020年美国CPA考哪些科目?:2020年美国CPA考哪些科目?2020年美国CPA考试科目有:FAR财务会计与报告,AUD审计与鉴证,REG法规,BEC商业环境与理论。共有3种考试题型:分别是选择题,案例分析题,写作题。不同科目题型分配不同,FAR,AUD,REG都是有50%的选择题和50%的案例分析题组成,另外BEC还有个写作题,其BEC题型是由50%的选择+35%的案例分析+15%的写作题组成。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料