下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

备考是一条艰辛而又漫长的旅程,只有掌握了学习方法,才能轻松应对。为了帮助大家更好的备考,下面帮考网给大家分享一些USCPA考试FAR财务会计与报告模拟试题,备考的小伙伴赶紧来练练手吧。

1.Taylor, an unmarried taxpayer, had $90,000 in adjusted gross income for the current year. During the current year, Taylor donated land to a church and made no other contributions. Taylor purchased the land 15 years ago as an investment for $14,000. The land\'s fair market value was $25,000 on the day of the donation. What is the maximum amount of charitable contribution that Taylor may deduct as an itemized deduction for the land donation for the current year?

a. $11,000

b. $25,000

c. $0

d. $14,000

答案:B

2.On January 2, Year 3, to better reflect the variable use of its only machine, Holly, Inc. elected to change its method of depreciation from the straight-line method to the units of production method. The original cost of the machine on January 2, Year 1, was $50,000, and its estimated life was 10 years. Holly estimates that the machine\'s total life is 50,000 machine hours. Machine hours usage was 8,500 during Year 2 and 3,500 during Year 1.

Holly\'s income tax rate is 30%. Holly should report the accounting change in its Year 3 financial statements as a(n):

a. The correct treatment is not provided in any of the answer choices.

b. Adjustment to beginning retained earnings of $2,000.

c. Cumulative effect of a change in accounting principle of $1,400 in its income statement.

d. Cumulative effect of a change in accounting principle of $2,000 in its income statement.

答案:A

3. At December 31, Year 1, Grey, Inc. owned 90% of Winn Corp., a consolidated subsidiary, and 20% of Carr Corp., an investee in which Grey cannot exercise significant influence. On the same date, Grey had receivables of $300,000 from Winn and $200,000 from Carr. In its December 31, Year 1 consolidated balance sheet, Grey should report accounts receivable from affiliates of:

a. $200,000

b. $230,000

c. $500,000

d. $340,000

答案:a

4. P Co. purchased term bonds at a premium on the open market. These bonds represented 20 percent of the outstanding class of bonds issued at a discount by S Co., P\'s wholly owned subsidiary. P intends to hold the bonds until maturity. In a consolidated balance sheet, the difference between the bond carrying amounts in the two companies would be:

a. Included as an increase to retained earnings.

b. Reported as a deferred credit to be amortized over the remaining life of the bonds.

c. Included as a decrease to retained earnings.

d. Reported as a deferred debit to be amortized over the remaining life of the bonds.

答案:c

5. A tax return preparer may disclose or use tax return information without the taxpayer\'s consent to:

a. Accommodate the request of a financial institution that needs to determine the amount of taxpayer\'s debt to it, to be forgiven.

b. Solicit additional nontax business.

c. Facilitate a supplier\'s or lender\'s credit evaluation of the taxpayer.

d. Be evaluated by a quality or peer review.

答案:D

以上就是本次帮考网带给大家的内容,希望可以帮助到备考的小伙伴。如果大家想了解更多关于美国注册会计师考试的试题,敬请关注帮考网!

22

222020年美国CPA考哪些科目?:2020年美国CPA考哪些科目?2020年美国CPA考试科目有:FAR财务会计与报告,AUD审计与鉴证,REG法规,BEC商业环境与理论。共有3种考试题型:分别是选择题,案例分析题,写作题。不同科目题型分配不同,FAR,AUD,REG都是有50%的选择题和50%的案例分析题组成,另外BEC还有个写作题,其BEC题型是由50%的选择+35%的案例分析+15%的写作题组成。

48

482020年AICPA考试多少分合格?:2020年AICPA考试多少分合格?美国注册会计师一共有4门科目,分别是财务会计与报告FAR,商业环境与理论BEC,法律法规REG,审计与鉴证AUD,成绩合格分数线均为75分,单科满分为99分。AICPA已经通过的考试科目单科成绩有效期是18个月,考生必须在通过一门科目后的18个月内考过剩余科目,否则已通过考试成绩也会被作废。

42

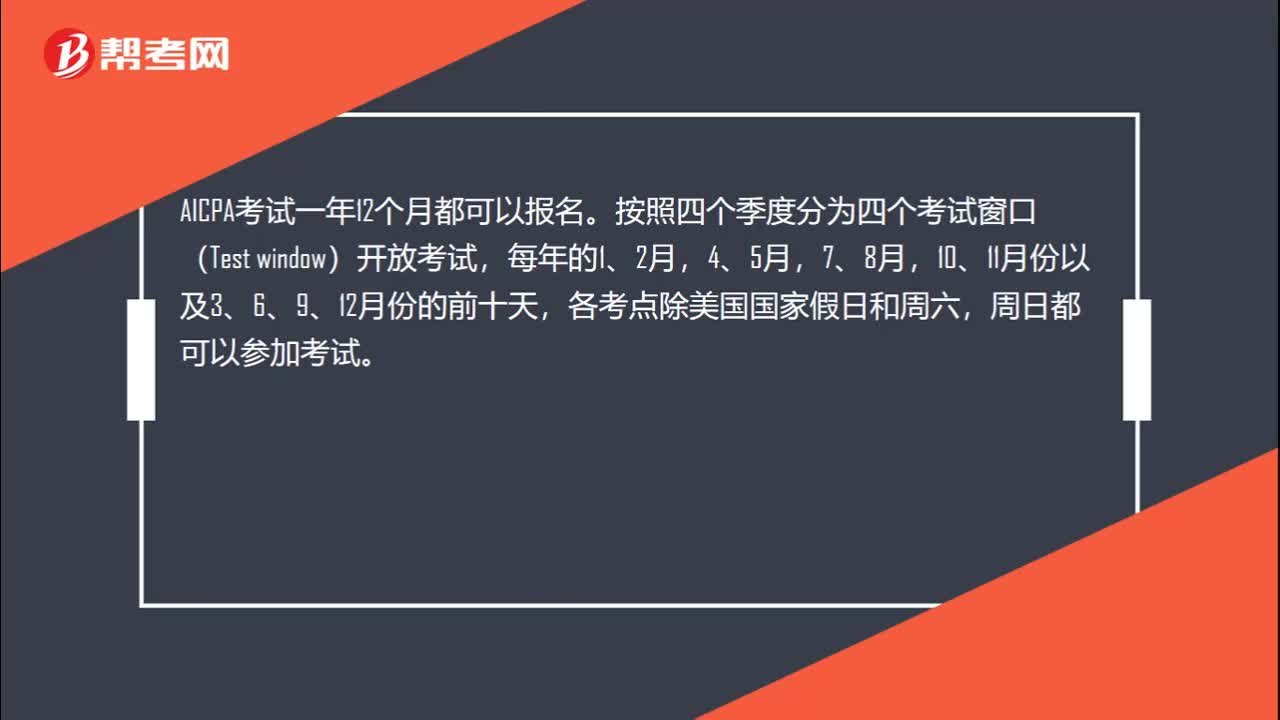

422020年AICPA考试预约考试后多久收到NTS准考证?:2020年AICPA考试预约考试后多久收到NTS准考证?NTS大约需要二到八周才能到达。在大多数州,一旦你收到NTS,它的有效期为六个月,你可以一次申请多个考试科目部分。当你重新申请时,收到你的NTS通常只需要1-2周时间。中国考生申请考试一般需要2-3个月的时间,取得NTS后,建议考生在考前45天去预约考试日期,以确保能参加考试。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料