下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

各位小伙伴大家好,很多想要报考美国CPA考试的考生不知道该如何准备全英文考试,为了帮助大家更好地备考,帮考网为大家带来了练习题供考生练习,帮助大家熟悉题目,具体内容如下:

一、 An employer\\'s obligation forpostretirement health benefits that are expected tobe provided to orforan employee must be fully accrued by the date the:

a. Benefits are paid.

b. Employee retires.

c. Employee is fully eligible forbenefits.

d. Benefits are utilized.

答案:c

二、Big Brown Corporation\\'s derivative investments had the following fair values at December 31, Year 1 and December 31, Year 2:

12/31/Year 1 12/31/Year 2

Speculative derivatives

$280,000 $310,000

Derivatives used as fair value hedges

$600,000 $745,000

Derivatives used as cash flow hedges

$430,000 $510,000

The derivatives used as fair value hedges and cash flow hedges were both considered highly effective in Year 2. What amount of gain from these derivative investments should Big Brown report in its Year 2 net income and other comprehensive income?

Net Income OCI

a. $0 $255,000

b. $80,000 $175,000

c. $175,000 $80,000

d. $255,000 $0

答案:c

三、On June 19, Don Co., a U.S. company, sold and delivered merchandise on a 30-day account to Cologne GmbH, a German corporation, for200,000 euros. On July 19, Cologne paid Don in full. Relevant currency exchange rates were:

June 19 July 19

Spot rate $.988 $.995

30-day forward rate .990 1.000

What amount should Don record on June 19 as an account receivable forits sale to Cologne?

a. $199,000

b. $198,000

c. $197,600

d. $200,000

答案:c

四、Gains and losses from changes in the fair value of a derivative designated and qualified as a fair value hedge should be:

a. Recognized as a component of other comprehensive income in the period in which the fair value of the derivative changes.

b. Recognized in current net income in the period in which the fair value of the derivative changes.

c. Disregarded until the derivative is settled.

d. Recognized as a deferred debit ordeferred credit in the balance sheet until the derivative is settled.

答案:a

五、North Corp. has an employee benefit plan forcompensated absences that gives employees 10 paid vacation days and 10 paid sick days. Both vacation and sick days can be carried over indefinitely. Employees can elect to receive payment in lieu of vacation days; however, no payment is given forsick days not taken. At December 31, North\\'s unadjusted balance of liability forcompensated absences was $21,000. North estimated that there were 150 vacation days and 75 sick days available at December 31. North\\'s employees earn an average of $100 per day. In its December 31 balance sheet, what amount of liability forcompensated absences is North required to report?

a. $21,000

b. $22,500

c. $36,000

d. $15,000

答案:d

六、At December 31, Year 1, Grey, Inc. owned 90% of Winn Corp., a consolidated subsidiary, and 20% of Carr Corp., an investee in which Grey cannot exercise significant influence. On the same date, Grey had receivables of $300,000 from Winn and $200,000 from Carr. In its December 31, Year 1 consolidated balance sheet, Grey should report accounts receivable from affiliates of:

a. $200,000

b. $230,000

c. $500,000

d. $340,000

答案:a

七、P Co. purchased term bonds at a premium on the open market. These bonds represented 20 percent of the outstanding class of bonds issued at a discount by S Co., P\\'s wholly owned subsidiary. P intends to hold the bonds until maturity. In a consolidated balance sheet, the difference between the bond carrying amounts in the two companies would be:

a. Included as an increase to retained earnings.

b. Reported as a deferred credit to be amortized over the remaining life of the bonds.

c. Included as a decrease to retained earnings.

d. Reported as a deferred debit to be amortized over the remaining life of the bonds.

答案:c

八、Taylor, an unmarried taxpayer, had $90,000 in adjusted gross income forthe current year. During the current year, Taylordonated land to a church and made no other contributions. Taylorpurchased the land 15 years ago as an investment for

$14,000. The land\\'s fair market value was $25,000 on the day of the donation. What is the maximum amount of charitable contribution that Taylormay deduct as an itemized deduction forthe land donation forthe current year?

a. $11,000

b. $25,000

c. $0

d. $14,000

答案:b

以上就是今天分享的全部内容了,各位小伙伴根据自己的情况进行查阅,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注帮考网!

86

862020年AICPA考试用什么教材学习?:2020年AICPA考试用什么教材学习?在美国有数百种AICPA考试的辅导书籍或资料,Becker's CPA Review 教材和学习系统在美国已有50年以上历史,使用Becker教材通过美国注册会计师考试的人数是未使用该教材人数的两倍;75%的考试通过者、90%的一次通过者以及95%的高分区学员皆选用Becker教材。美国各地超过70多所大学院校选择Becker教材作为他们的课程。

30

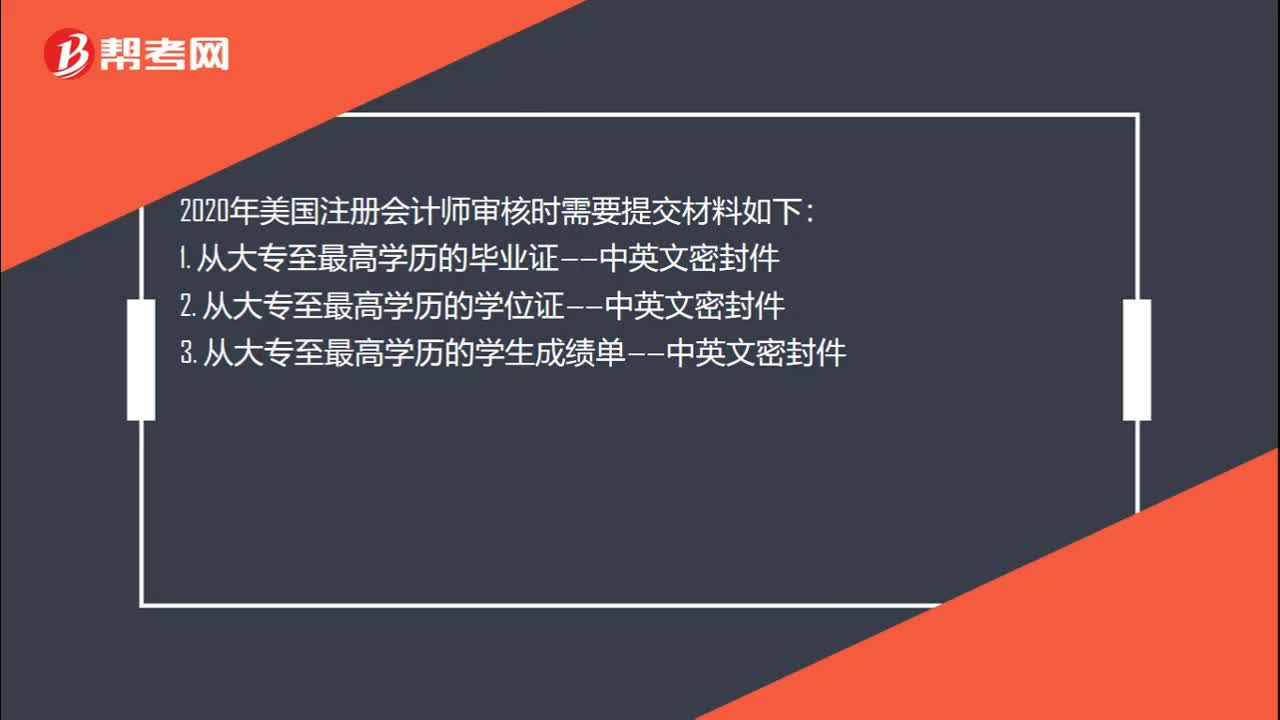

302020年AICPA怎么报考?:2020年AICPA怎么报考?AICPA报考流程如下:1.学历预评估。2. 学分评估,确认报考州。3.学历认证。4.补学分。5.申请NTS。6.预约考位。7. 安排行程。8.申请执照。

22

222020年美国CPA考哪些科目?:2020年美国CPA考哪些科目?2020年美国CPA考试科目有:FAR财务会计与报告,AUD审计与鉴证,REG法规,BEC商业环境与理论。共有3种考试题型:分别是选择题,案例分析题,写作题。不同科目题型分配不同,FAR,AUD,REG都是有50%的选择题和50%的案例分析题组成,另外BEC还有个写作题,其BEC题型是由50%的选择+35%的案例分析+15%的写作题组成。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料