下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Ethical and Professional Standards5道练习题,附答案解析,供您备考练习。

1、Brendan Witt, CFA, is a sell-side analyst within a research team covering companiesin the technology sector.The team reaches a consensus to recommend sellinga mining company after long time debating.Witt does not agree with theteam's investment conclusion and believes the mining company is a potential targetof takeover.According to the Standards of Professional Conduct relating todiligence and reasonable basis, which of the following statements is most accurate?Witt must:【单选题】

A.decline to be identified with the report.

B.dissociate from the report because it does not reflect his opinion.

C.ensure the consensus opinion has a reasonable and adequate basis and is independentand objective to keep her name on the report.

正确答案:C

答案解析:个人观点与集体观点不同时,也可以在报告上署名,只要确信参与写这个报告的其他人都做到了勤勉尽责和独立客观即可。

1、While waiting in the business class lounge before boarding an airplane, Becca Msafari, CFA, an equity analyst, overhears a conversation by a group of senior managers, including members of the board, from a large publicly listed bank. The managers discuss staff changes necessary to accommodate their regional expansion plans. Msafari hears several staff names mentioned. Under what circumstances could Msafari most likely use this information when making an investment recommendation to her clients? She can use the information:【单选题】

A.if she does not breach the confidentiality of the names of the staff.

B.if the discussed changes are unlikely to affect investor perception of the bank.

C.under no circumstances.

正确答案:B

答案解析:To comply with the Code and Standards, a member or candidate cannot use material nonpublic information when making investment recommendations. The information overheard would not be considered material only if any public announcement of the staff removal would be unlikely to move the share price of the bank, nor would the regional expansion substantially impact the value of the bank.

2014 CFA Level I

"Guidance for Standards I-VII," CFA Institute

Standard II(A)

1、Alex Burl is an investment advisor at Helpful Investments, a local investment advisoryfirm.Helpful Investments requires its employees to invest in the samestocks which Helpful Investments recommends to its clients.Helpful Investmentsalso has established strict procedures determining when trades can be executed inits employees' own portfolios to avoid any conflict of interests with its clients.This procedure is most likely in place to help Burl avoid violations of the Standardsof Professional Conduct relating to:【单选题】

A.only material non-public information.

B.only priority of transactions.

C.both independence and material non-public information.

正确答案:B

答案解析:个人交易应该在为客户交易和雇主交易之后,公司规定员工个人交易的时间是为了避免员工在为客户交易前进行交易,从而避免了违反优先交易权操作方法,该题与重大的非公开信息无关。

1、Benefits of compliance with the CFA Institute Global Investment Performance Standards (GIPS?) least likely include:【单选题】

A.strengthening of internal controls.

B.participation in competitive bidding.

C.elimination of in-depth due diligence for investors.

正确答案:C

答案解析:“Introduction to the Global Investment Performance Standards (GIPS?),” CFA Institute2011 Modular Level I, Vol. 1, pp. 172–173Study Session 1-3-aExplain why the GIPS standards were created, what parties the GIPS standards apply to, and who is served by the standards.

C is correct because compliance with the GIPS standards does not eliminate the need for in-depth due diligence on the part of the investor.

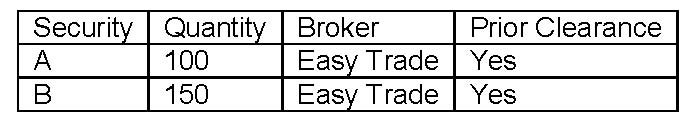

1、Amanda Covington, CFA, works for McJan Investment Management. McJan employees must receive prior clearance of their personal investments in accordance with McJan’s compliance procedures. To obtain prior clearance, McJan employees must provide a written request identifying the security, the quantity of the security to be purchased, and the name of the broker through which the transaction will be made. Precleared transactions are approved only for that trading day. As indicated below, Covington received prior clearance.

Two days after she received prior clearance, the price of Stock B decreased, so Covington decided to purchase 250 shares of Stock B only. In her decision to purchase 250 shares of Stock B only, did Covington violate any CFA Institute Standards of Professional Conduct?【单选题】

A.Yes, relating to diligence and reasonable basis

B.No

C.Yes, relating to her employer's complicance procedures

正确答案:C

答案解析:Prior-clearance processes guard against potential and actual conflicts of interest; members are required to abide by their employe's compliance procedures. (See Standard VI(B)). 2014 CFA Level I "Guidance for Standards I-VII," CFA Institute Standard V(A), Standard VI(B)

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料