下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Alternative Investments5道练习题,附答案解析,供您备考练习。

1、An analyst compares different real estate valuation methods.A factor common tothe sales comparison approach and the income approach is that both approachesrequire :【单选题】

A.identification of benchmark properties.

B.knowledge of investor's marginal tax rate.

C.calculation of the property's net operating income.

正确答案:A

答案解析:销售比较法(sales comparison approach)不需要计算房地产项目的经营性净收入(NOI),所以也不需要知道投资者的边际税率(marginal tax rate)。但销售比较法和收入法都需要定义一个标的资产,销售比较法需要寻找基准的房地产用来得到其销售价格,并用以计算该房地产的价格;收入法需要寻找基准的房地产用来得到市场的资本化率(marketcapitalization rate),并用来折现该房地产的经营性净收入,得到房地产的价格。

1、Which of the following is most likely a private equity strategy?【单选题】

A.Merger arbitrage

B.Quantitative directional

C.Venture capital

正确答案:C

答案解析:Venture capital is a private equity strategy in which private equity companies invest and get activelyinvolved in the management of portfolio companies.

CFA Level I

"Introduction to Alternative Investments," Terri Duhon, George Spentzos, and Scott D. Stewart

Section 4.2.2

1、An analyst does research about hedge funds.The returns from hedge funds thatcontain infrequently traded assets most likely exhibit a downward bias with respectto correlations with:【单选题】

A.both conventional equity returns and conventional fixed income returns.

B.conventional equity returns but not with conventional fixed income returns.

C.conventional fixed income returns but not with conventional equity returns.

正确答案:A

答案解析:由于对冲基金对业绩披露的要求并不严格,而对冲基金持有交易并不活跃的资产,此时无法得到该资产真实的市场价格,往往需要通过估计得到,而估计会使得资产价格有平滑的趋势,并不能真实反映出最新最真实的市场价格,因此所得出的对冲基金收益率与传统的股票和固定收益产品收益率的相关性降低。

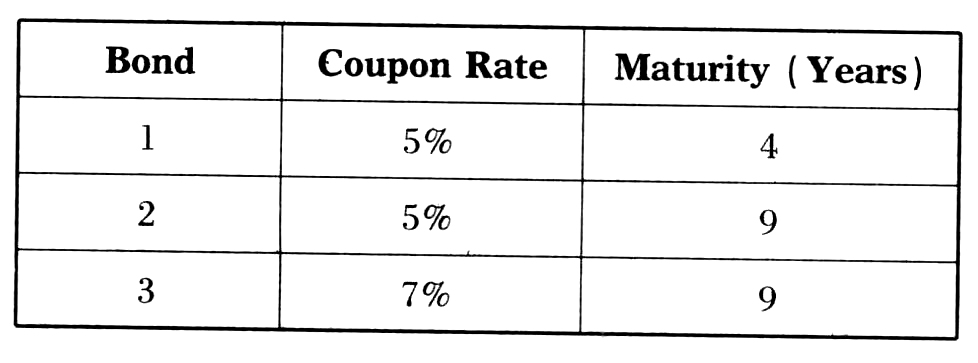

1、An analyst does research about interest rate risk of fixed income securities andgathers the following information about three option-free bonds selling at par:

The bond with the lowest interest rate risk is:【单选题】

A.Bond 1.

B.Bond 2.

C.Bond 3.

正确答案:B

答案解析:息票率(Coupon Rate)越低,利率风险越大,因为大部分比例的现金流在未来造成价格变动的可能性增加。期限(Maturity)越长,利率风险越大,因为未来面临的不确定性增加。由于利率变动,折现值也会比较波动。

1、When investing in commodities through a collateralized commodity futures position, the return associated with rolling forward the maturity of a futures contract is referred to as the:【单选题】

A.collateral yield.

B.spot price return.

C.convenience yield.

正确答案:C

答案解析:“Investing in Commodities,” Ronald G. Layard-Liesching

2010 Modular Level I, Vol. 6, pp. 268-269

Study Session 18-74-b

Describe the sources of return and risk for a commodity investment and the effect on a portfolio of adding an allocation to commodities.

C is correct because the roll or convenience yield is the return from rolling forward the maturity of the derivatives position. The roll yield can be either negative or positive.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料