下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2022年CFA考试《CFA一级》试题共240道,均为单选题。帮考网今天为大家准备了5道每日一练题目(附答案解析),帮助各位小伙伴考前自测提升。每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、An analyst does research about commodity markets.Which of the followingstatements about investing in commodities is least accurate?【单选题】

A.Investing in commodity futures is the most common strategy for commodityinvesting.

B.A collateralized futures position consists entirely of long position in futuresfora given amount of underlying value.

C.Commodities tend to have a low to negative correlation with stock and bondreturns and a desired positive correlation with inflation.

正确答案:B

答案解析:通过期货合约来投资于商品是一种低成本的投资办法,也是商品投资最普遍的方法,所以选项A是正确的。抵押商品期货头寸(collateralized futures position)包括期货合约多头头寸和与头寸等值的国债,所以选项B是错误的。商品与股票和债券的回报的相关性低或者是负相关,与通货膨胀是正相关,商品投资是一种很好的分散化风险和抵御通货膨胀的投资。

2、Fora 10-year floating-rate security, if market interest rates change by 1%, the change in the value of the security will most likely be:【单选题】

A.zero.

B.related to the security’s coupon resetfrequency.

C.similar to an otherwise identical fixed-rate security.

正确答案:B

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 356–357

Study Session 15-54-e

Explain the interest rate risk of a floating-rate security and why its price may differ from par value.

B is correct because the interest rate sensitivity of a floating-rate security comes primarily from the time remaining until its next coupon reset.

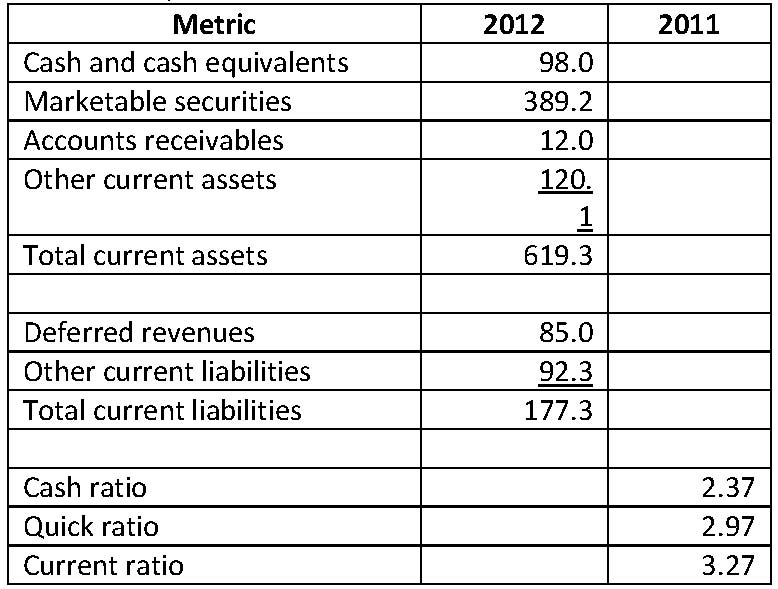

3、The following selected balance sheet and ratio data are available fora company:

Which of the following ratios decreased between 2011 and 2012?【单选题】

A.Cash

B.Quick

C.Current

正确答案:B

答案解析:“Understanding Balance Sheets,” Elaine Henry, CFA and Thomas R. Robinson, CFA

2013 Modular Level I, Vol. 3, Section 7.2, Exhibit 19, Example 8

Study Session: 8-26-i

Calculate and interpret liquidity and solvency ratios.

B is correct.

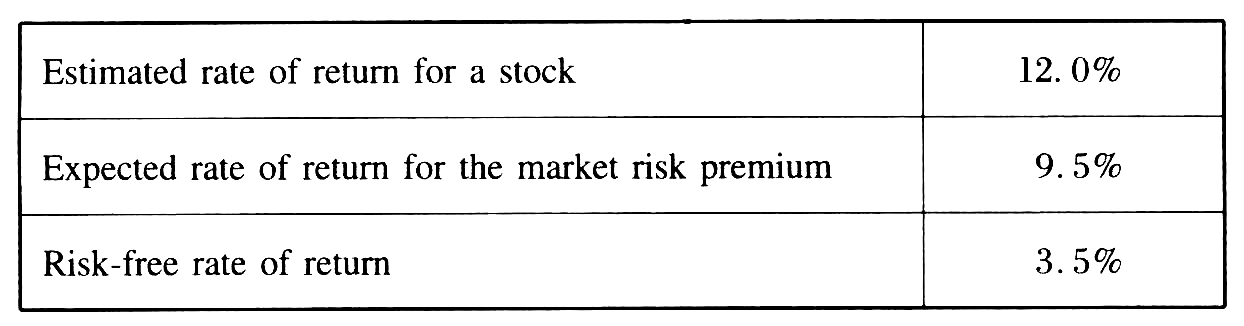

4、An analyst does research about capital assetpricing model and gathers the followinginformation:

If the covariance of the returns on the stock with the returns on the market portfoliois equal to the variance of the returns on the market portfolio, theanalyst\\\\\\\\\\\\\\\\'s most appropriate conclusion is that the stock is:【单选题】

A.overvalued.

B.properly valued.

C.undervalued because the required rate of return forthe stock is greaterthan 9.5%.

正确答案:A

答案解析:因为股票与市场组合的协方差等于市场组合的方差,所以必要回报 = 3.5% + 1 ×9.5% = 13%>12%的预期回报,因此股票被高估了。注意,题目中用的是市场风险溢价(market risk premium),而不是市场回报(market return),所以公式中不需要再减去无风险收益率。

5、Which of the following most accurately describes the computation of nearly all bond market indices, U.S. and global?【单选题】

A.Model priced

B.Trader priced

C.Market priced

正确答案:B

答案解析:“Security-Market Indexes,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 54-60

Study Session 13-53-b

Compare and contrast majorstructural features of domestic and global stock indices, bond indices, and composite stock-bond indices.

According to Exhibit 13 (pp.58-59), 11 out of the 12 majorbond indexes are trader priced and only one index (Ryan Treasury) is market priced. Two other indices, Lehman Brothers and Merrill Lynch, are both trader priced and model priced.

希望以上内容能够帮助到大家,如果你们还有什么疑问,敬请关注帮考网。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料