下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2022年CFA考试《CFA一级》试题共240道,均为单选题。帮考网今天为大家准备了5道每日一练题目(附答案解析),帮助各位小伙伴考前自测提升。每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Which of the following statements is most accurate about the responsibilities of an auditorfora publicly traded firm in the United States? The auditor:【单选题】

A.assures the reader that the financial statements are free from error, fraud, orillegal acts.

B.must express an opinion about the effectiveness of the company’s internal control systems.

C.must state that he prepared the financial statements according to generally accepted accounting principles.

正确答案:B

答案解析:“Financial Statement Analysis: An Introduction,” Elaine Henry and Thomas R. Robinson

2012 Modular Level I, Vol. 3, pp. 28–31

Study Session 7-22-d

Describe the objective of audits of financial statements, the types of audit reports, and the importance of effective internal controls.

B is correct. Fora publicly traded firm in the United States, the auditormust express an opinion as to whether the company’s internal control system is in accordance with the Public Company Accounting Oversight Board, under the Sarbanes–Oxley Act. This is done either as a final paragraph in the auditor’s report oras a separate opinion.

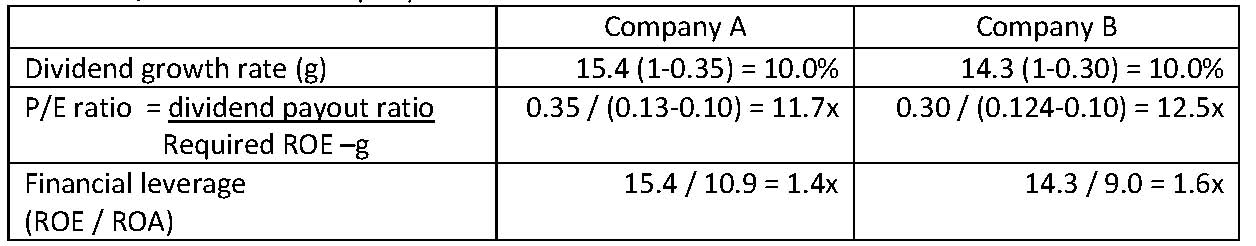

2、A fund manager compiles the following data on two companies:

Based on the information provided, the most accurate conclusion is that Company A’s stock is more attractive relative to that of Company B’s because of its:【单选题】

A.smaller P/E ratio.

B.greater financial leverage.

C.higher dividend growth rate.

正确答案:A

答案解析:“Financial Analysis Techniques,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn

2011 Modular Level I, Vol. 3, pp. 342-343

“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA, and Stephen E. Wilcox, CFA

2011 Modular Level I, Vol. 5, pp. 290-291

Study Session 8-35-f, 14-60-h

Demonstrate the application of and interpret changes in the component parts of the DuPont analysis (the decomposition of return on equity).

Calculate and interpret the following multiples: price to earnings, price to an estimate of operating cash flow, price to sales, and price to book value.

From the computations shown below Company A’s stock is more attractive because of its smaller P/E ratio than Company B’s stock.

3、According to the short-run Phillips curve, when inflation is less than expected, the most likely initial effect is that:【单选题】

A.real wage rates will fall.

B.real interest rates will fall.

C.unemployment will rise above its natural rate.

正确答案:C

答案解析:“U.S. Inflation, Unemployment, and Business Cycles,” Michael Parkin

2010 Modular Level I, Vol. 2, pp. 406-408

Study Session 6-25-e

Explain the impact of inflation on unemployment, and describe the short-run and long-run Phillips curve, including the effect of changes in the natural rate of unemployment.

The difference between actual and expected rates of inflation influences unemployment. When inflation falls below its expected rate, unemployment rises above the natural rate.

4、As a condition of his employment with an investment bank, Abasi Hasina, CFA, was required to sign an employment contract, including a non-compete clause restricting him from working fora competitorforthree years after leaving the employer. After one year, Hasina quits his job fora comparable position with an investment bank in a country where non-compete clauses are illegal. Lawyers with whom he consulted priorto taking the new position determined the non-compete clause was a violation of human rights and thus illegal. Did Hasina most likely violate the CFA Institute Code of Ethics?【单选题】

A.Yes

B.No, because the non-compete clause violates his human rights

C.No, because the non-compete clause is illegal in the new country of employment

正确答案:A

答案解析:“Code of Ethics and Standards of Professional Conduct,” CFA Institute2012 Modular Level I, Vol. 1, p. 15

Study Session 1-1-cExplain the ethical responsibilities required by the Code and Standards, including the multiple sub-sections of each standard.“Guidance forStandards I-VII,” CFA Institute2012 Modular Level I, Vol. 1, pp. 19–21, 46–47Study Session 1-2-aDemonstrate and explain the application of the Code of Ethics and Standards of Professional Conduct to situations involving issues of professional integrity.

A is correct because by failing to adhere to the non-compete clause he agreed to abide by when signing his employment contract, Hasina shows a lack of professional integrity toward his employer. This behaviorreflects poorly on the good reputation of members and is a violation of the Code of Ethics, which states that members and candidates must act with integrity, and Standard I (D) Misconduct, which states that members and candidates must not engage in any professional conduct involving dishonesty, fraud, ordeceit orcommit any act that reflects adversely on their professional reputation, integrity, orcompetence. The Code of Ethics at times requires a member orcandidate to uphold a higher standard than that required by law, rule, orregulation, orin this case the strict application of the employment agreement.

5、With respect to the portfolio management process, a well-constructed investmentpolicy statement is least likely to include:【单选题】

A.investorconstraints.

B.the return benchmark.

C.the specific securities that should be purchased.

正确答案:C

答案解析:投资策略说明书(IPS)中不包含购买特定证券的条款,但是对投资者的风险测评、投资目标、投资限制及收益率的基准等都有详细要求。

以上就是本次帮考网为大家带来的全部内容,如果大家还有不清楚的,请持续关注帮考网,我们将继续为大家答疑解惑,并带来更多有价值的考试资讯!

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料