下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Equity Investments5道练习题,附答案解析,供您备考练习。

1、In an efficient market, fundamental analysis most likely requires that the analyst must:【单选题】

A.extrapolate historical data to estimate future values and take investment decisions.

B.do a superior job of estimating the relevant variables and predict earnings surprises.

C.use trading rules for detecting the price movements that lead to new equilibrium prices.

正确答案:B

答案解析:“Efficient Capital Markets,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 91-93

Study Session 13-54-c

Explain the implications of stock market efficiency for technical analysis, fundamental analysis, the portfolio management process, the role of the portfolio manager, and the rationale for investing in index funds.

To take advantage of the long-run price movements in an efficient capital market the analyst must do a superior job of estimating the relevant variables and predict earnings surprises.

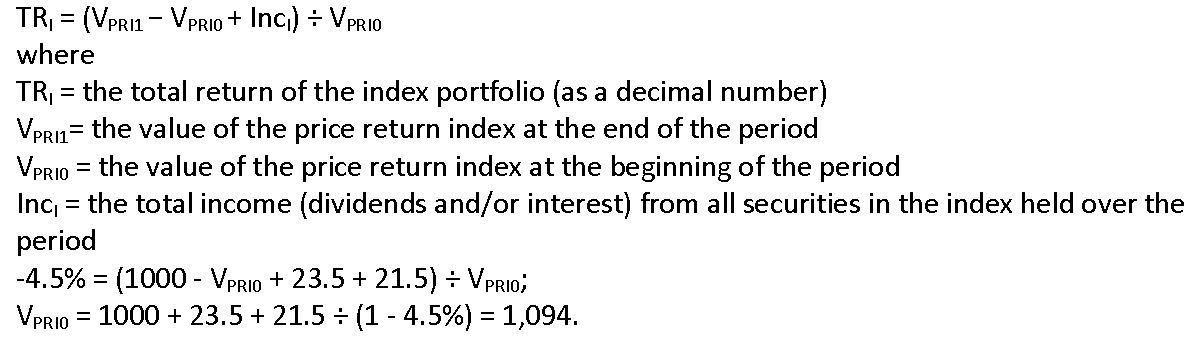

2、An investor gathers the following information for an index:

The value of the index as of January 1, 2012 is closest to:【单选题】

A.1,047.

B.1,070.

C.1,094.

正确答案:C

答案解析:“Security Market Indices,” Paul D. Kaplan, CFA, and Dorothy C. Kelly, CFA.

2013 Modular Level I, Vol. 5, Reading 47, Section 2

Study Session 13-47-b

Calculate and interpret the value, price return, and total return of an index.

C is correct. The total return of an index is the price appreciation, or change in the value of the price return index, plus income (dividends and/or interest) over the period, expressed as a percentage of the beginning value of the price return index.

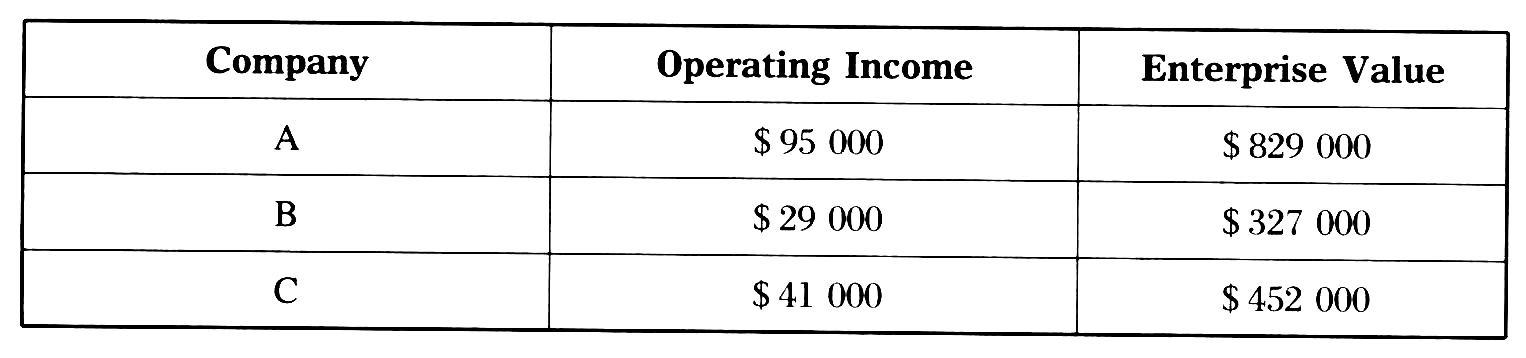

3、An analyst does research about market multiple models and gathers the followinginformation about three companies in the same industry:

Based on this information, which of the following companies is likely the mostovervalued?【单选题】

A.Company A.

B.Company B.

C.Company C.

正确答案:B

答案解析:该乘数模型是基于公司价值与利息、税收、折旧和摊销前利润或者收入等之间的比例来判断公司价值是否被高估或低估。3个公司的公司价值除以经营性利润(EV/operatingincome)的乘数分别为:

公司 A:829 000/95 000 = 8.726

公司 B:327 000/29 000 = 11.276

公司 C:452 000/41 000 = 11.024

显然,公司B的EV/operating income乘数在平均值之上,该乘数最高,所以公司B的价值最有可能被高估。

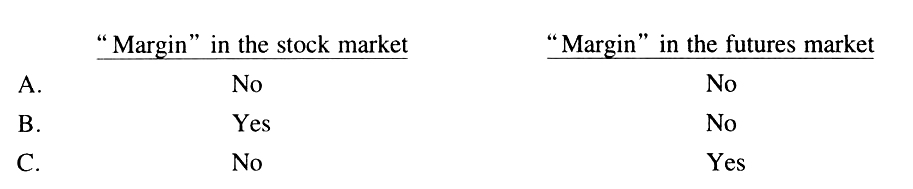

4、Do "margin" in the stock market and "margin" in the futures market, respectively,mean that an investor has received a loan that reduces the amount of hisown money required to complete the transaction?【单选题】

A.

B.

C.

正确答案:B

答案解析:股票市场中的保证金交易是指投资者向券商进行借款,以减少自己使用投资资金的金额,并用购买的证券作为抵押品,到期后归还出借人贷款;而期货市场中的保证金是真正的保证,是将现金或者流动性较好的债券作为抵押品,逐日盯市计算盈亏,并结算保证金账户的余额。

5、Which of the following is least likely to be directly reflected in the returns on a commodity index?【单选题】

A.Roll yield

B.Changes in the spot prices of underlying commodities

C.Changes in the futures prices of commodities in the index

正确答案:B

答案解析:“Security Market Indices,” Paul D. Kaplan and Dorothy C. Kelly

2012 Modular Level I, Vol. 5, p. 109–110

Study Session 13-48-j

Discuss indices representing alternative investments.

B is correct. Commodity index returns reflect the changes in future prices and the roll yield. Changes in the underlying commodity spot prices are not reflected in a commodity index.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料