下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Equity Investments5道练习题,附答案解析,供您备考练习。

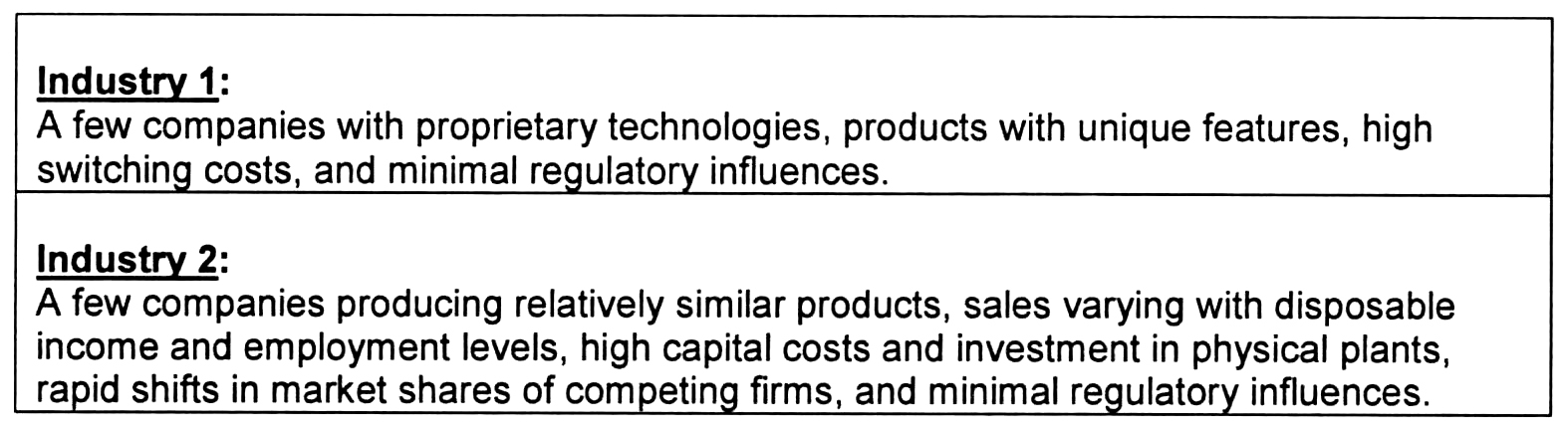

1、An equity analyst follows two industries with the following characteristics:

Based on the above information, the analyst will most appropriately conclude that, compared with thefirms in Industry 2, those in Industry 1 would potentially have:【单选题】

A.over-capacity problems.

B.larger economic profits.

C.high bargaining power of customers.

正确答案:B

答案解析:The economic profit (the spread between the return on invested capital and the cost of capital) tendsto be larger in industries with differentiated products, greater pricing power, and high switching coststo customers. Industry 1 has these features. In contrast, firms in Industry 2 have little pricing power(undifferentiated products and rapid shifts in market shares, indicating intense rivalry), which isindicative of potentially smaller economic profits.

CFA Level I

"Introduction to Industry and Company Analysis," Patrick W. Dorsey, Anthony M. Fiore, and IanRossa O'Reilly

Section 5.1

1、Which of the following multiples is most useful when comparing companies with significant differences in capital structure?【单选题】

A.EV/EBITDA

B.Price-to-book ratio

C.Price-to-cash flow ratio

正确答案:A

答案解析:“Overview of Equity Securities,” Ryan C. Fuhrmann, CFA and Asjeet S. Lamba, CFA

2013 Modular Level I, Vol. 5, Reading 49, Section 7.1

“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFA

2013 Modular Level I, Vol. 5, Reading 51, Sections 5.2 - 5.4

Study Session 14-49-g, 14-51-h, i

Distinguish between the market value and book value of equity securities.

Calculate and interpret the following multiples: price to earnings, price to an estimate of operating cash flow, price to sales, and price to book value.

Explain the use of enterprise value multiples in equity valuation and demonstrate the use of enterprise value multiples to estimate equity value.

A is correct. The EV/EBITDA approach is most useful when comparing companies with significant differences in capital structure. EBITDA is computed prior to payment to any of the company’s financial stakeholders and is not impacted by the amount of debt leverage.

1、Which of the following statements concerning the objectives of market regulation is least accurate?Regulators:【单选题】

A.set standards to ensure that all agents acting in the market are skilled.

B.ensure systems are in place to prevent fraud.

C.promote fair and orderly markets.

正确答案:A

答案解析:Regulators help solve agency problems by setting minimum standards of competence, not skill, foragents and by defining and enforcing minimum standards of practice.

CFA Level I

"Market Organization and Structure," Larry Harris

Section 10

1、An analyst does research about price-to-earnings ratio.With respect to pricemultipliers based on fundamentals, and all else being equal, an increase in whichof the following inputs most likely will cause the price-to-earnings ratio to increase?【单选题】

A.Retention ratio.

B.Required rate of return.

C.Growth rate of earnings.

正确答案:C

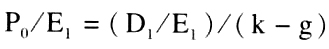

答案解析:以基本面为基础得到的市盈率公式为: 。其中:

。其中: 代表股利发放比率,也等于1减去股利留存比率;k代表必要收益率;g代表盈利增长率。因此,当股利留存比率变大时,股利发放比率变小,会使得P/E比率降低;必要收益率增加也会使得P/E 比率降低;盈利增长率增大时,k - g会变小,P/E会增加。

代表股利发放比率,也等于1减去股利留存比率;k代表必要收益率;g代表盈利增长率。因此,当股利留存比率变大时,股利发放比率变小,会使得P/E比率降低;必要收益率增加也会使得P/E 比率降低;盈利增长率增大时,k - g会变小,P/E会增加。

1、A company’s $100 par perpetual preferred stock has a dividend rate of 7 percent and a required rate of return of 11 percent. The company’s earnings are expected to grow at a constant rate of 3 percent per year. If the market price per share for the preferred stock is $75, the preferred stock is most appropriately described as being:【单选题】

A.overvalued by $11.36.

B.undervalued by $15.13.

C.undervalued by $36.36.

正确答案:A

答案解析:“An Introduction to Security Valuation,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 134-135

Study Session 14-56-c

Calculate and interpret the value of both a preferred stock and a common stock using the dividend discount model (DDM).

Value of perpetual preferred stock = Dividend / Investor’s required rate of return

$7/ 0.11 = $63.64. The stock is overvalued by $75.00 – 63.64 = $11.36.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料