下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Portfolio Management5道练习题,附答案解析,供您备考练习。

1、An analyst does research aboutthe capital asset pricing model (CAPM) and thesecurity market line (SML).With respect to the CAPM and SML, if a securityhas a beta of 1.3, that security should:【单选题】

A.plot above the security market line.

B.have an above average risk premium.

C.have above average unsystematic risk.

正确答案:B

答案解析:如果贝塔系数大于1,说明比市场组合的风险大,所以有超过平均的风险溢价;如果被正确定价,仍然在SML上,同时在CAPM中的市场组合中已经包含了所有风险性证券,就没有非系统性风险了。

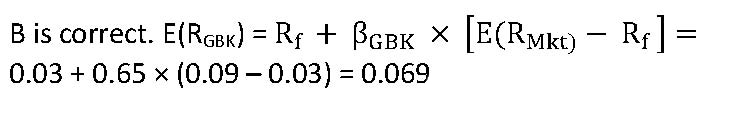

2、The stock of GBK Corporation has a beta of 0.65. If the risk-free rate of return is 3% and the expected market return is 9%, the expected return for GBK is closest to:【单选题】

A.3.9%.

B.6.9%.

C.10.8%.

正确答案:B

答案解析:“Portfolio Risk and Return: Part II”, Vijay Singal, CFA

2013 Modular Level I, Vol. 4, Reading 44, Section 3.2.6

Study Session 12-44-g

Calculate and interpret the expected return of an asset using the CAPM.

3、An analyst does research about security market line (SML).With respect tothe security market line, if an investor's estimated return is below the SML, asecurity is most likely:【单选题】

A.overvalued.

B.correctly valued.

C.undervalued.

正确答案:A

答案解析:如果预期回报低于由资本市场定价理论(CAPM)决定的必要回报,那么该证券会在SML线下面,表明该证券价格被高估了。

4、Which of the following performance measures most likely relies on systematic risk as opposed to total risk when calculating risk-adjusted return?【单选题】

A.M-squared

B.Sharpe ratio

C.Treynor ratio

正确答案:C

答案解析:“Portfolio Risk and Return: Part II" by Vijay Singal, CFA

Modular Level I, Vol. 4, Reading 44, Section 4.3.2

Study Session 12-44-h

Describe and demonstrate applications of the CAPM and the SML.

C is correct because the Treynor ratio measures the return premium of a portfolio versus the risk free asset relative to the portfolio’s beta which is a measure of systematic risk.

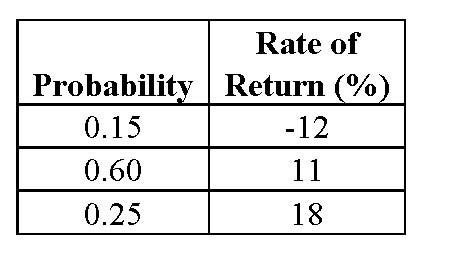

5、The table below provides a probability distribution of stock returns for shares of Orion Corporation:

The variance of returns for Orion Corporation stock is closest to:【单选题】

A.44.36

B.50.94

C.88.71

正确答案:C

答案解析:“An Introduction to Portfolio Management,” Frank K. Reilly and Keith C. Brown

2010 Modular Level I, Vol. 4, pp.242-244

Study Session 12-50-c

Compute and interpret the expected return, variance, and standard deviation for an

individual investment and the expected return and standard deviation for a portfolio.

C is correct. The table below provides the calculation of the variance

Expected return E( R) = 9.3%

Variance of returns = 88.71

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料