下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Portfolio Management5道练习题,附答案解析,供您备考练习。

1、An analyst does research about active and passive management.If the marketfor the asset class is insufficient, which of the following statements is most accurate?A skilled investor should choose:【单选题】

A.Index investing.

B.passive management.

C.active management.

正确答案:C

答案解析:如果市场是有效的,流动性是比较好的,投资者则应该采取被动投资策略,如投资于指数;而市场如果是不充分的,有经验的投资者则应该采用积极的投资管理策略。

2、Which of the following is not an assumption of the Markowitz model? Investors:【单选题】

A.have homogeneous expectations.

B.maximize one-period expected utility.

C.base decisions solely on expected return and risk.

正确答案:A

答案解析:“An Introduction to Portfolio Management,” Frank K. Reilly and Keith C. Brown

2010 Modular Level I, Vol. 4, p.241

Study Session 12-50-b

List the assumptions about investor behavior underlying the Markowitz model.

A is correct. This is not an assumption of the Markowitz model, it is an assumption of the Capital Asset Pricing Model (CAPM).

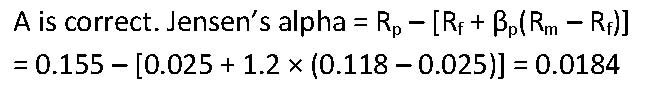

3、A portfolio manager generated a rate of return of 15.5% on a portfolio with beta of 1.2. If the risk-free rate of return is 2.5% and the market return is 11.8%, Jensen’s alpha for the portfolio is closest to:【单选题】

A.1.84%.

B.3.70%.

C.4.34%.

正确答案:A

答案解析:“Portfolio Risk and Return Part II”, Vijay Singal, CFA

2013 Modular Level I, Vol. 4, Reading 44, Section 4.3.2

Study Session 12-44-h

Describe and demonstrate applications of the CAPM and the SML.

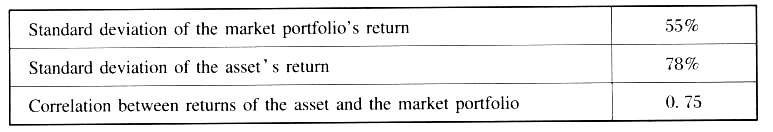

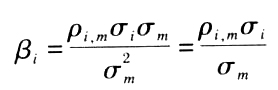

4、An analyst does research about beta and gathers the following information aboutan asset and the market portfolio:

The beta of the asset is closest to:【单选题】

A.0.53

B.1.06

C.1.89

正确答案:B

答案解析: 代入数据得:

代入数据得:

0.75 × 78%/55% = 1.06。

5、A portfolio manager decides to temporarily invest more of a portfolio in equities than the investment policy statement prescribes, because he expects equities will generate a higher return than other asset classes. This decision is most likely an example of:【单选题】

A.rebalancing.

B.tactical asset allocation.

C.strategic asset allocation.

正确答案:B

答案解析:Basics of Portfolio Planning and Construction,” Alistair Byrne, CFA, and Frank E. Smudde, CFA

2011 Modular Level I, Vol. 4, pp. 450, 467, 477

Study Session 12-54-g

Discuss the principles of portfolio construction and the role of asset allocation in relation to the IPS.

B is correct. Tactical asset allocation is the decision to deliberately deviate from the policy exposures to systematic risk factors with the intent to add value based on forecasts of the near-term returns of those asset classes.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料