下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Equity Investments5道练习题,附答案解析,供您备考练习。

1、A company reports the following information in its financial statements in 2011:

● Net income is $85 000

● Common share dividends is $40 000

● Average total assets is $570 500

● Average total liabilities is $320 500

● Tax rate is 40%

The company's sustainable growth rate is closest to:【单选题】

A.8%

B.11%

C.18%

正确答案:C

答案解析:可持续增长率(sustainable growth rate)的计算如下:

g = ROE × (1 - dividend payout ratio) = $85 0001($570 500 -$320 500) × (1 - $40 000/$85 000) = 34% × 0.5294 = 18.00%.

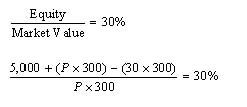

2、An investor opens a margin account with an initial deposit of $5,000. He then purchases 300 shares of a stock at $30 each on margin, and his account requires a maintenance margin of 30%. Ignoring commissions and interest, the price at which the investor will receive a margin call is closest to:【单选题】

A.$23.08.

B.$19.05.

C.$23.81.

正确答案:B

答案解析:

P = $19.05

2014 CFA Level I

“Market Organization and Structure,” by Larry Harris

Section 5.2

3、Which of the following is most likely a characteristic of real assets?【单选题】

A.High liquidity

B.Homogeneity

C.Substantial management costs

正确答案:C

答案解析:Real assets are characterized by illiquidity, not high liquidity. The heterogeneity of real assets, their illiquidity, and the substantial costs of managing them are all factors that complicate the valuation of real assets.

2014 CFA Level I

“Market Organization and Structure,” by Larry Harris

Section 3.6

4、An analyst doesresearch about security market indices.Which of the followingstatements is least accurate to explain that a fixed-income market index is moredifficult to create and compute than a stock market index?【单选题】

A.The universe of fixed-income securities is changing constantly.

B.Fixed-income markets are predominantly dealer markets.

C.The number of fixed-income securities is much less than the number ofequity securities.

正确答案:C

答案解析:固定收益指数比股票指数更加难以编制,其中一个原因是债券的种类总处在不断变化中,如是否到期限、是否转换,等等。固定收益指数比股票指数更加难以编制的另一个原因是,固定收益市场主要是交易商市场,无法通过公开市场交易而获得价格信息。另外,固定收益证券的数量要远远超过股票的数量,固定收益证券有不同的发行人、不同的特征以及不同的期限。

5、The type of voting in board elections that is most beneficial to shareholders with a small number of shares is best described as:【单选题】

A.statutory voting.

B.voting by proxy.

C.cumulative voting.

正确答案:C

答案解析:“The Corporate Governance of Listed Companies: A Manual for Investors,” Kurt Schacht, James C. Allen, and Matthew Orsagh

2012 Modular Level I, Vol. 4, pp. 263–266“Overview of Equity Securities,” Ryan C. Fuhrmann and Asjeet S. Lamba

2012 Modular Level I, Vol. 5, p. 171

Study Session 11-42-g, 14-50-b

Evaluate, from a shareowner’s perspective, company policies related to voting rules, shareowner-sponsored proposals, common stock classes, and takeover defenses.

Describe differences in voting rights and other ownership characteristics among different equity classes.

C is correct. Cumulative voting allows shareholders to direct their total voting rights to specific candidates, as opposed to having to allocate their voting rights evenly among all candidates. Thus, applying all of the votes to one candidate provides the opportunity for a higher level of representation on the board than would be allowed under statutory voting.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料