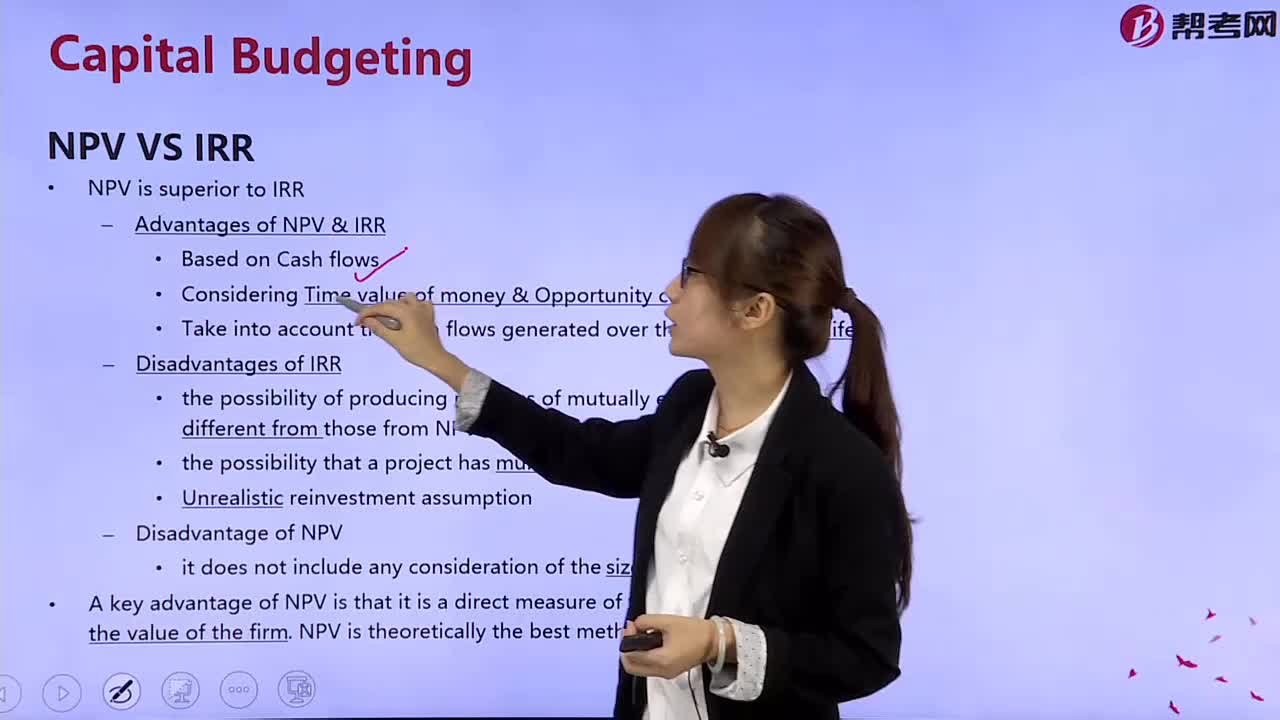

What is the difference between net present value and internal income?

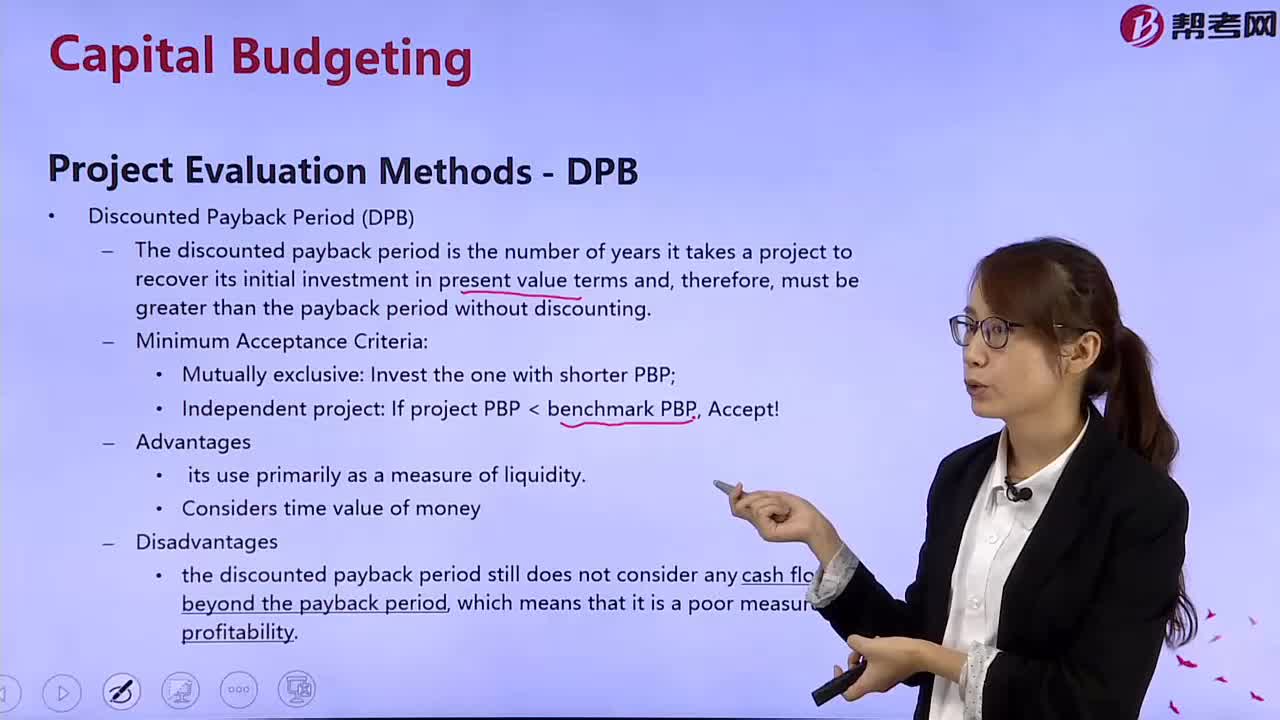

What is the discounted payback period?

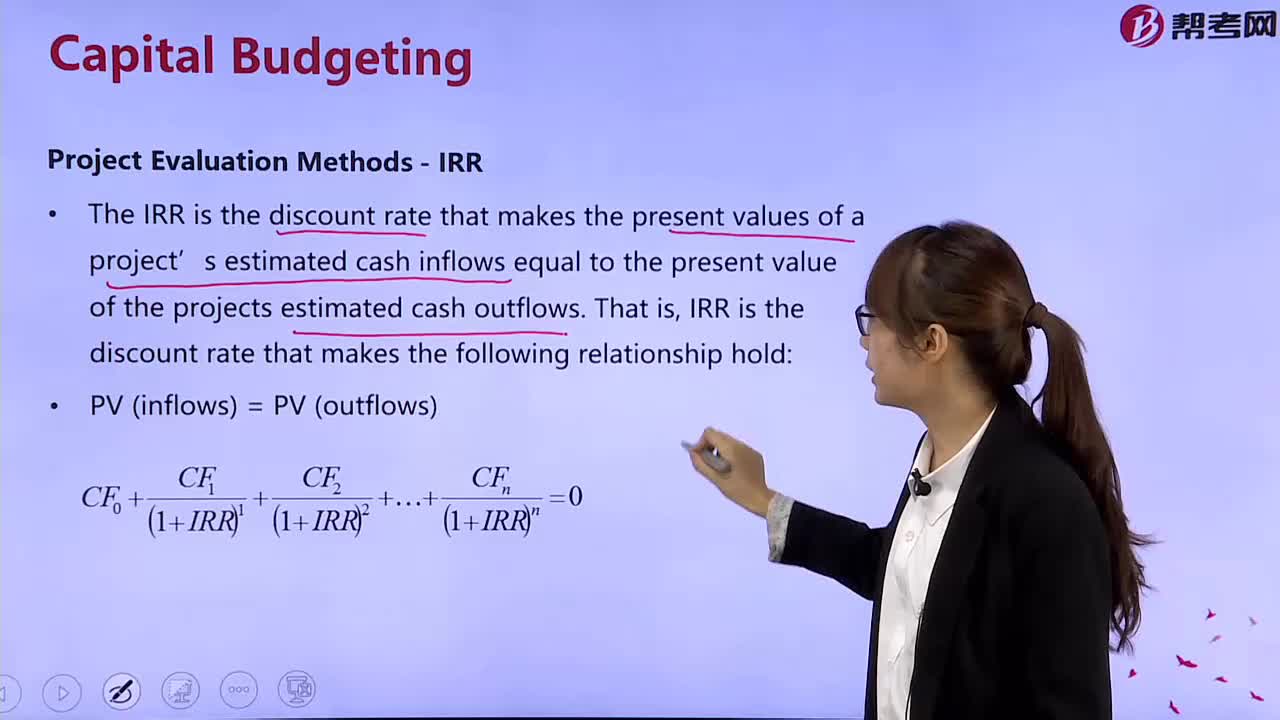

What is the IRR?

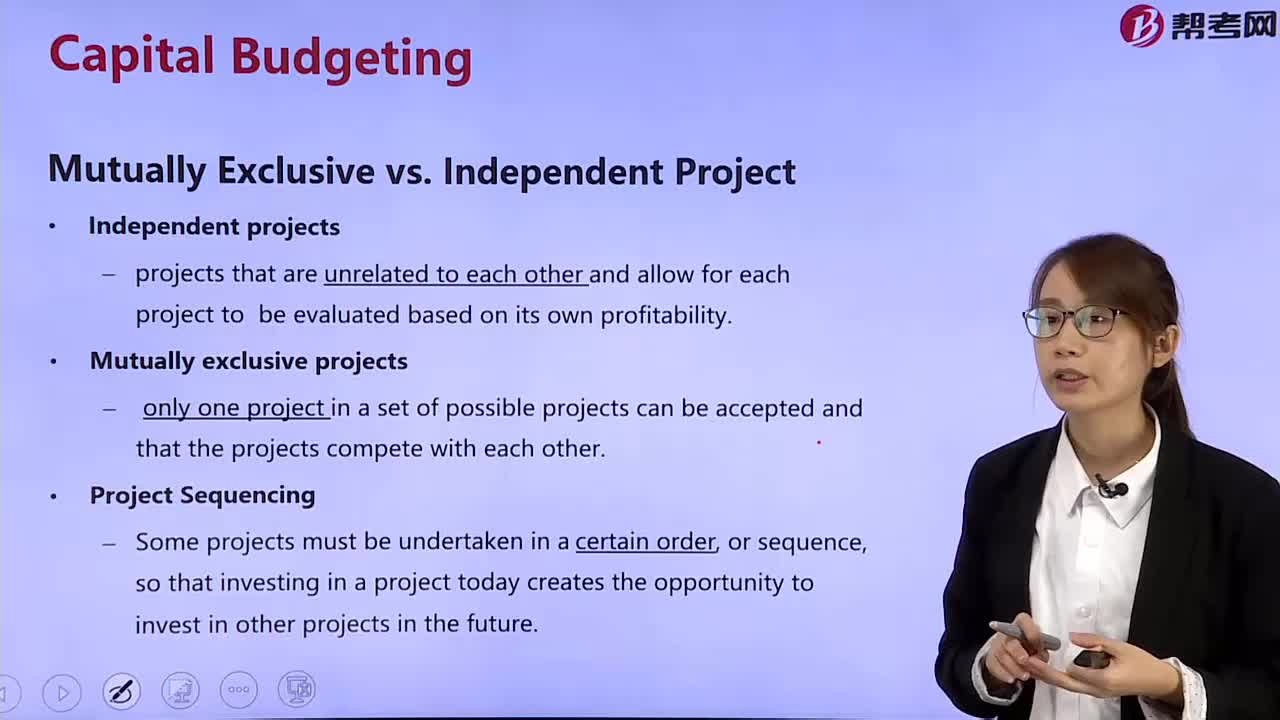

What's the difference between a mutually exclusive project and an independent project?

What is the net present value?

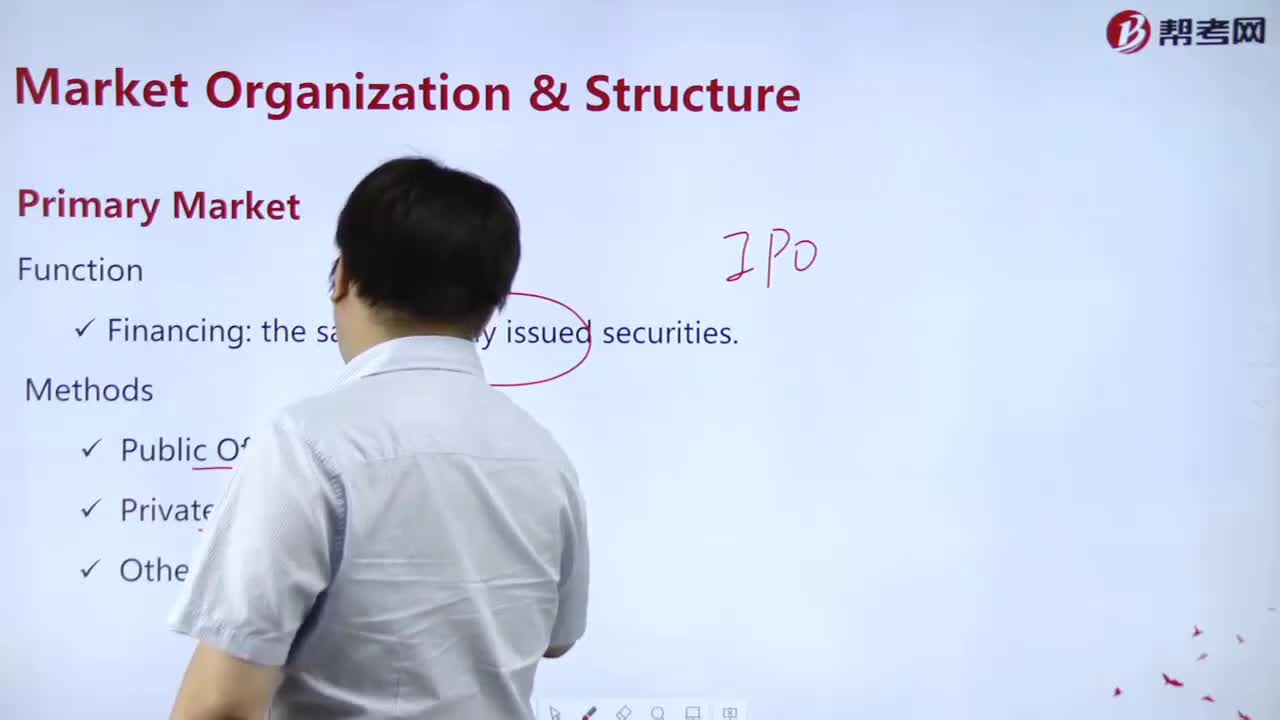

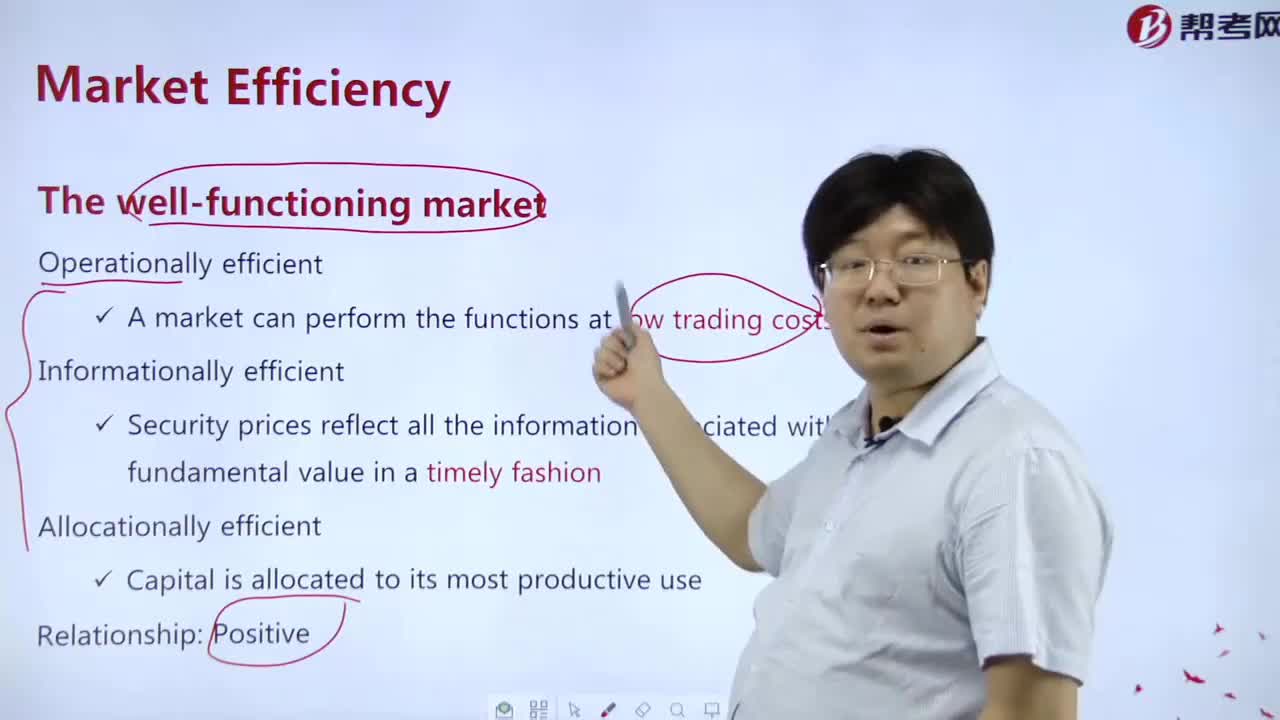

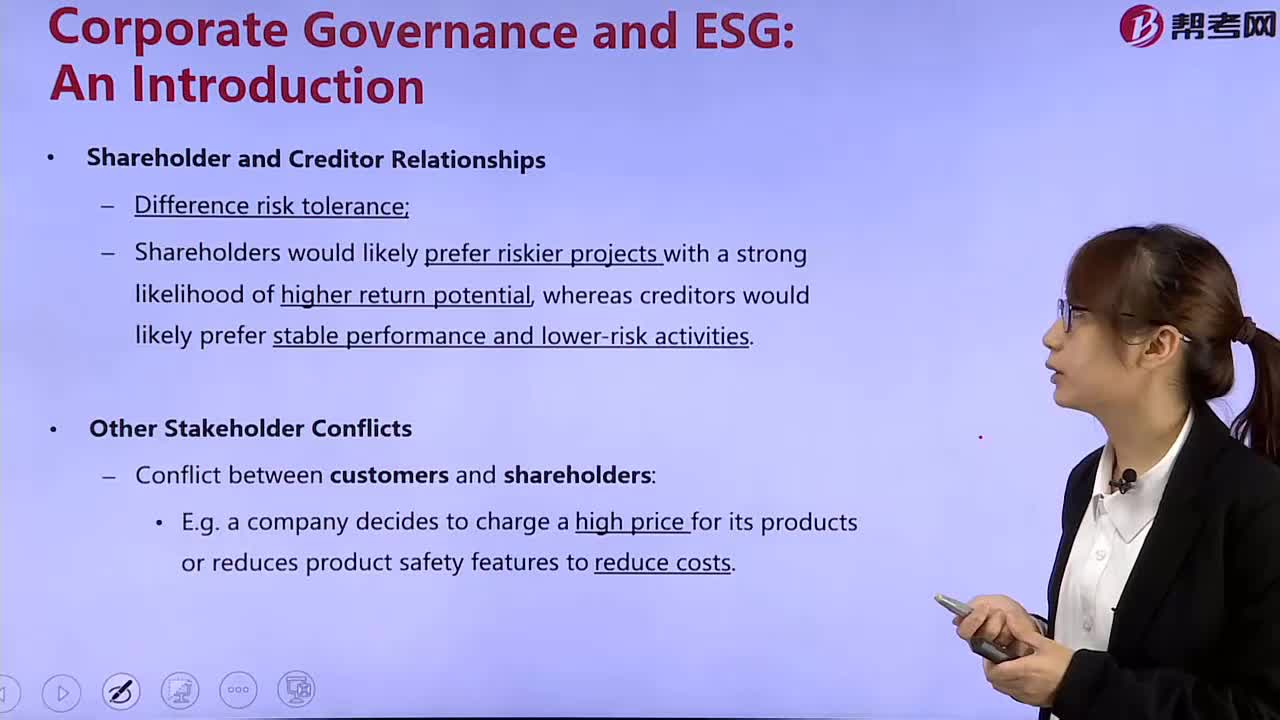

What is the relationship between shareholders and creditors?

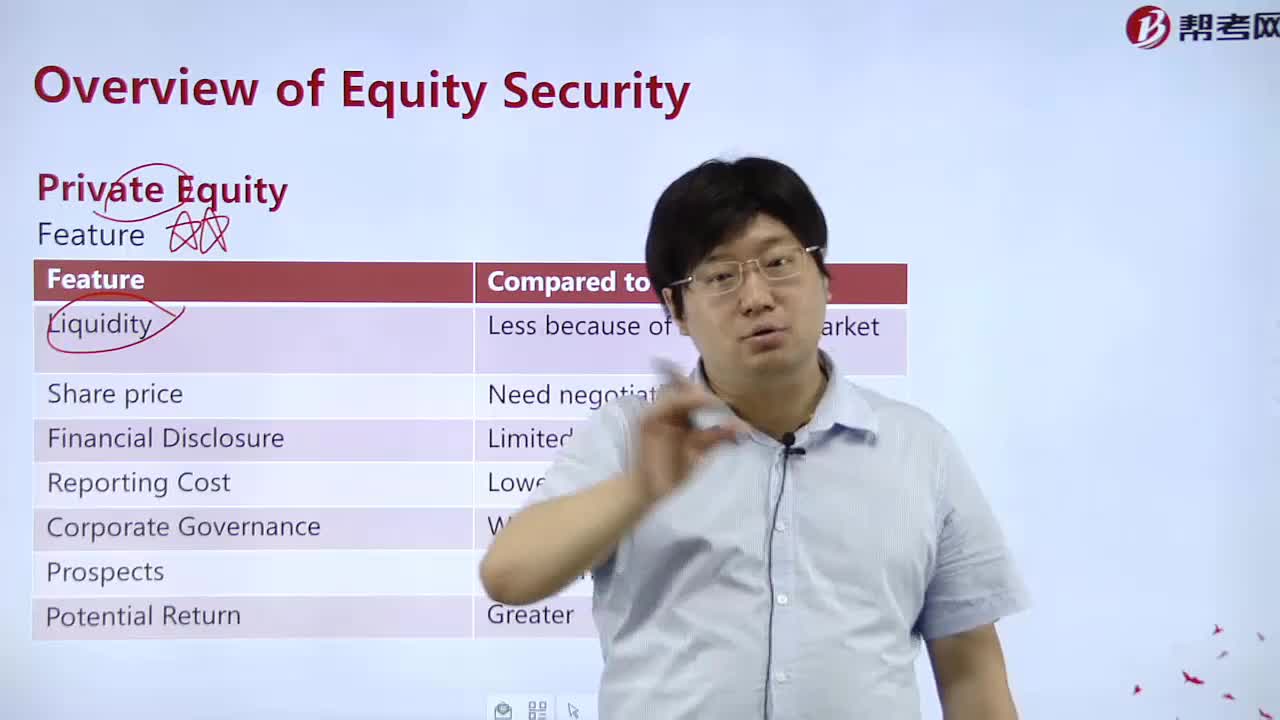

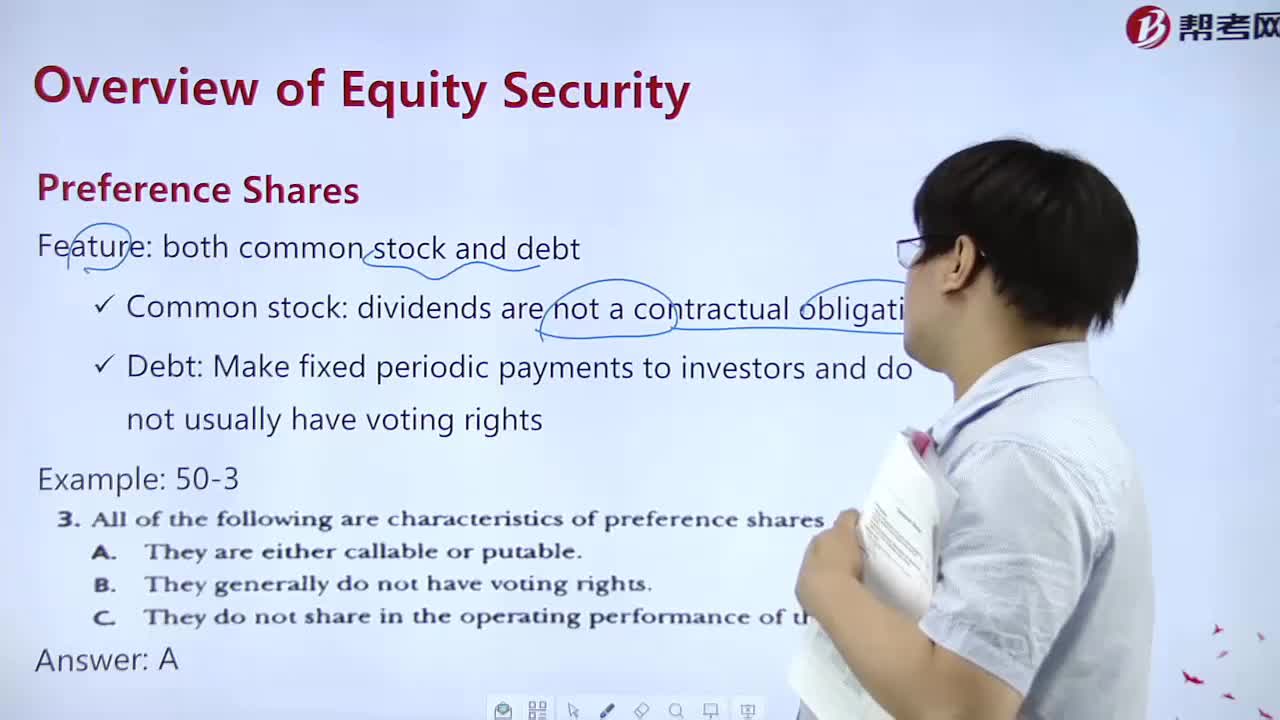

What is the structure of common stock?

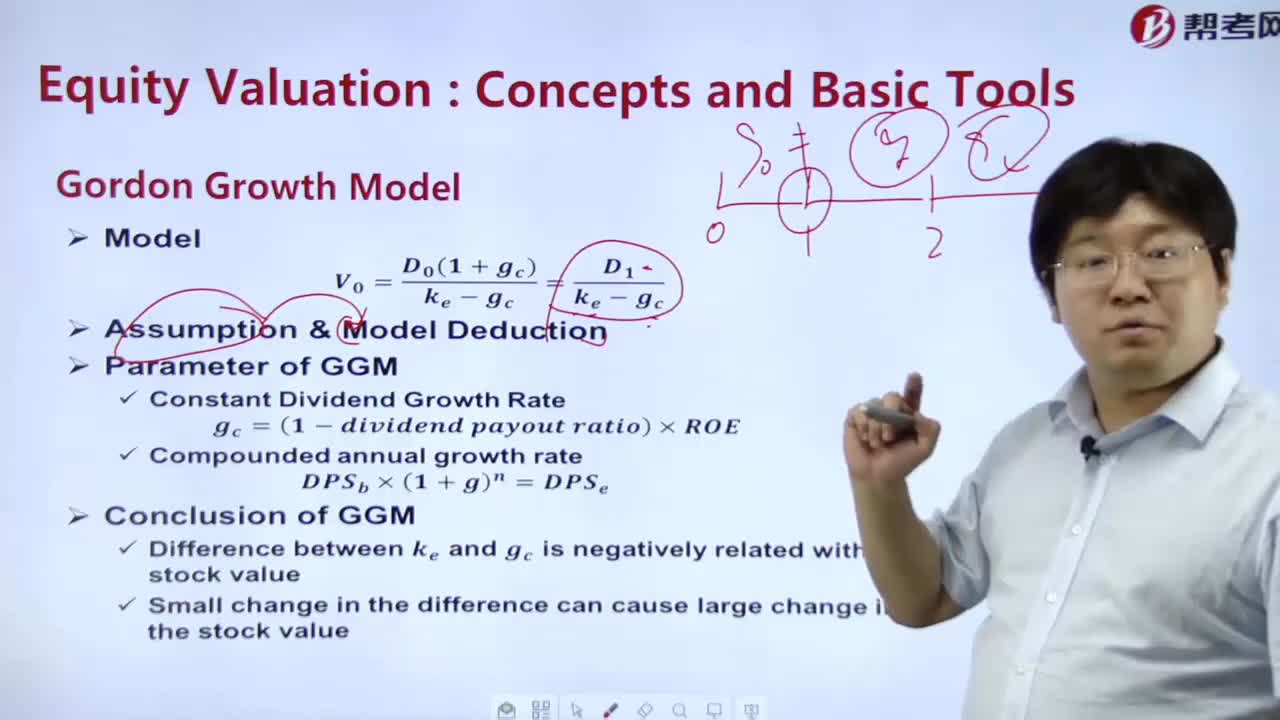

What is the formula of dividend discount model?

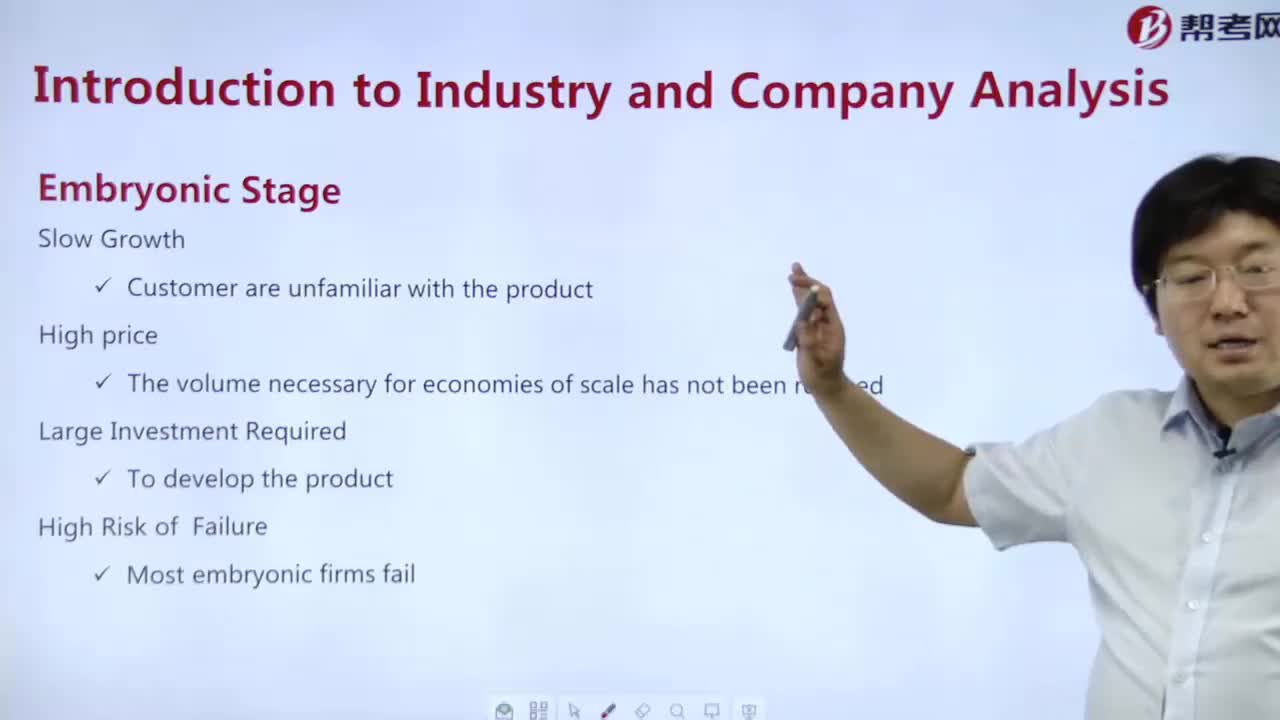

what is the moss stage?

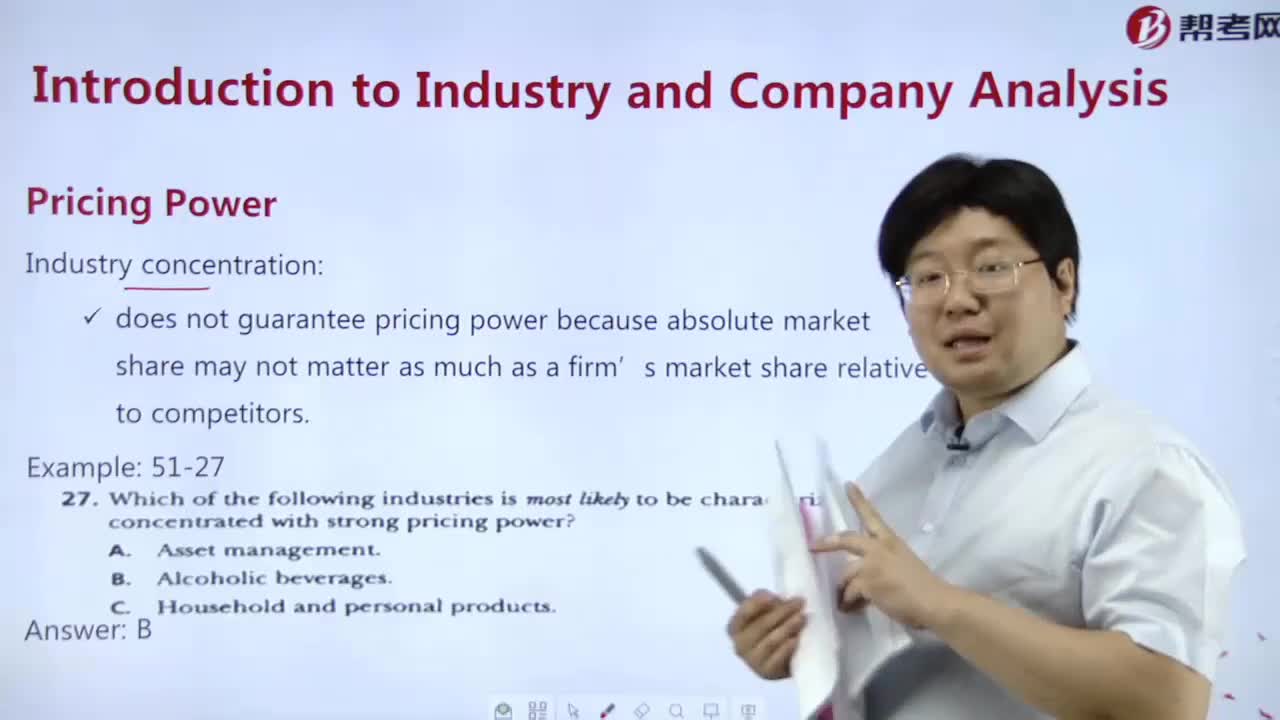

What is the content of pricing power?

What is the job of industrial analysis?

What is the value of the equity?

下载亿题库APP

联系电话:400-660-1360