-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

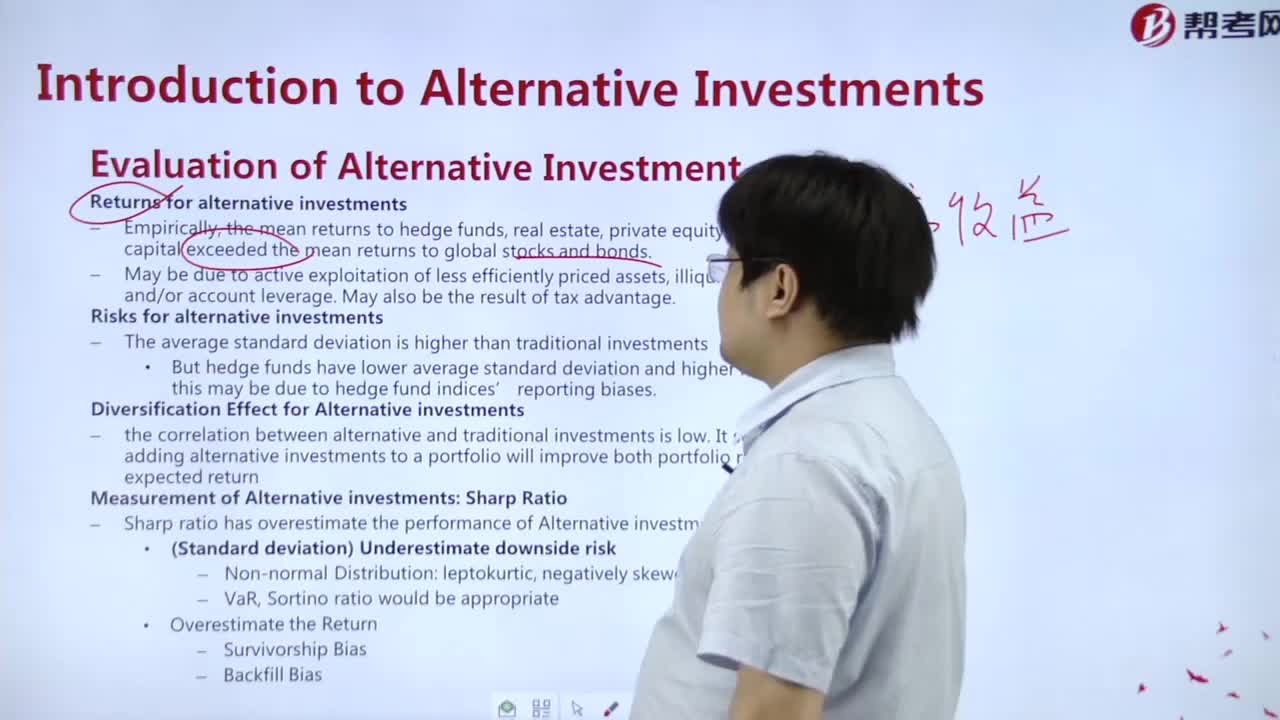

What is the assessment of alternative investments?

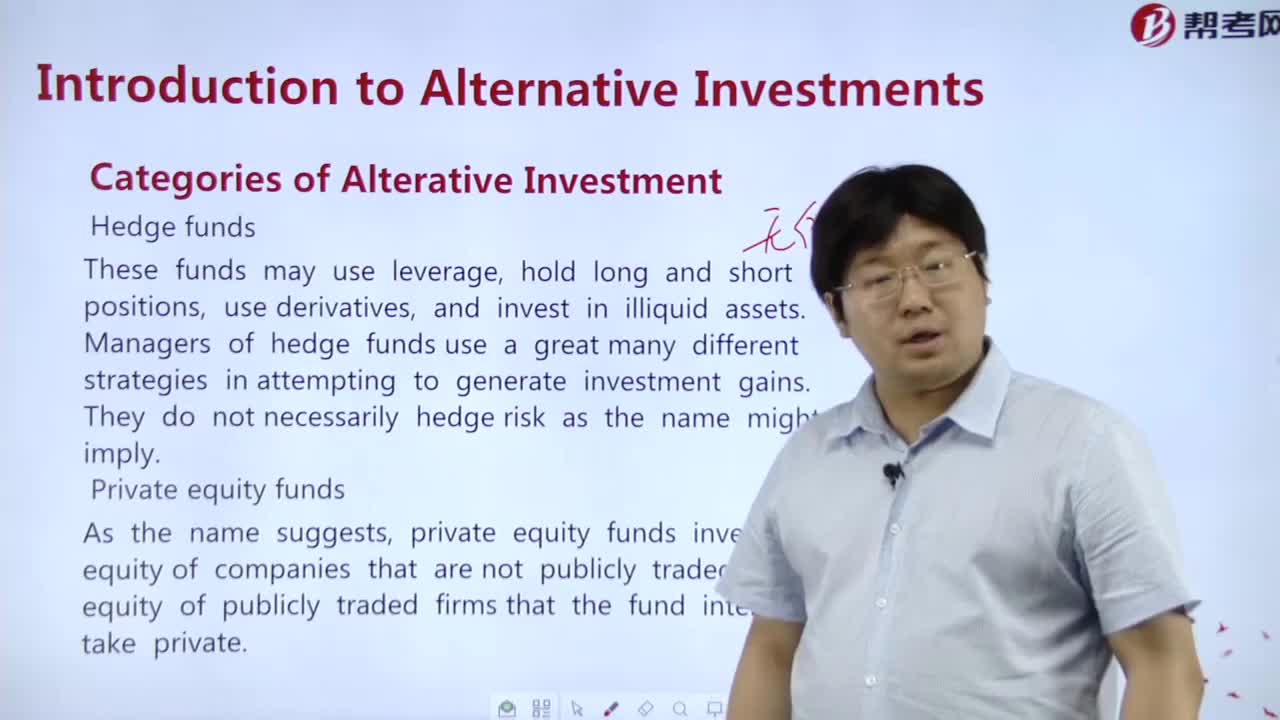

What are the types of alternative investments?

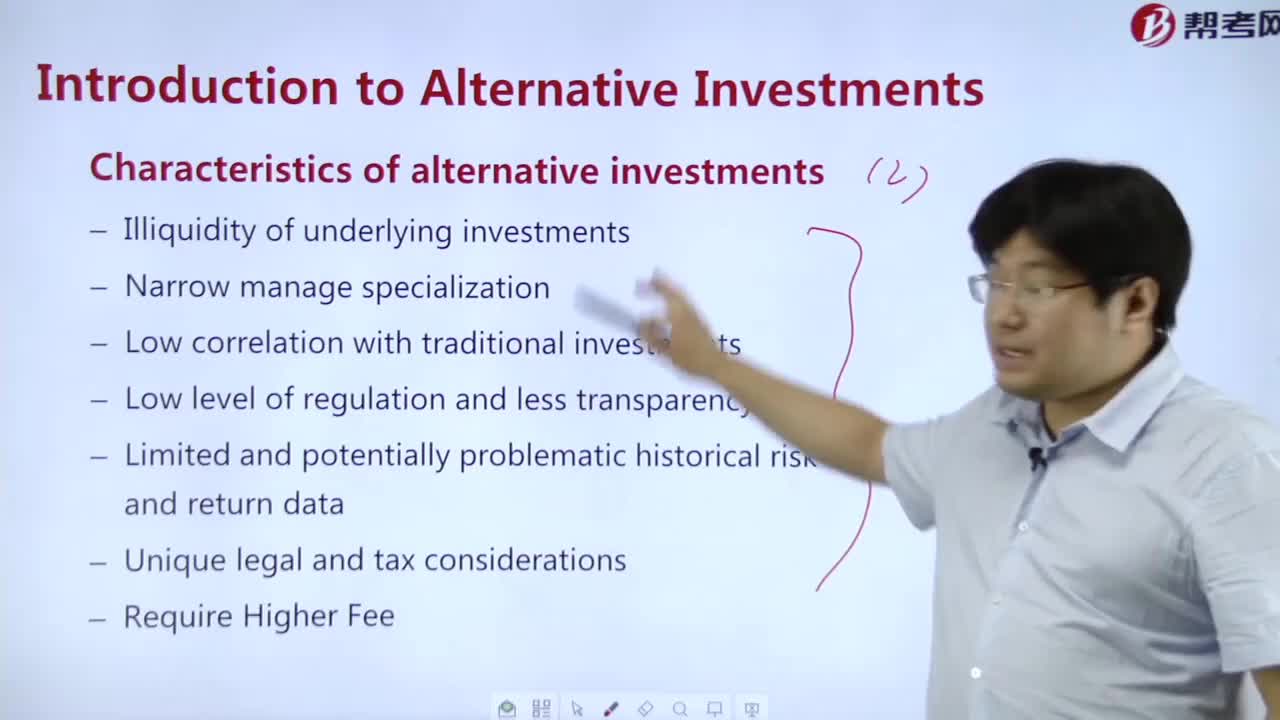

What are the characteristics of alternative investment?

What does alternative investment consist of?

What is the purpose of portfolio construction?

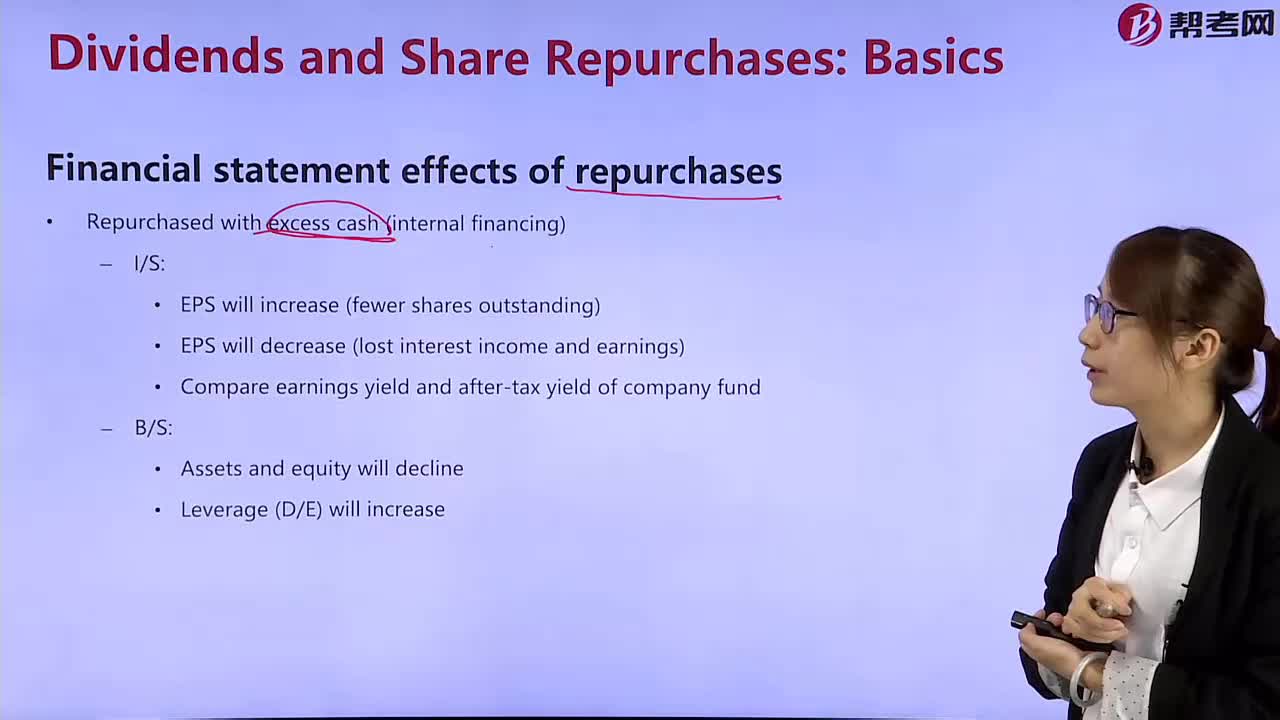

What is the effect of the repurchase on the financial statements?

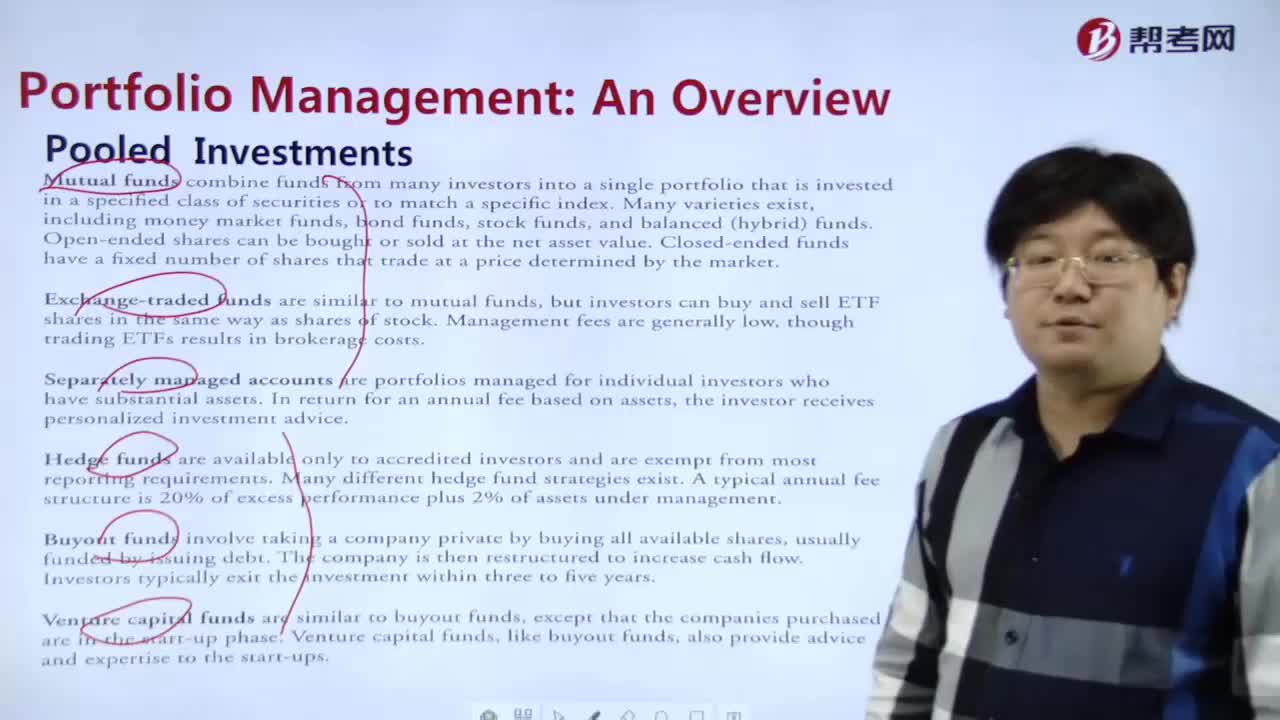

What is pooled investments?

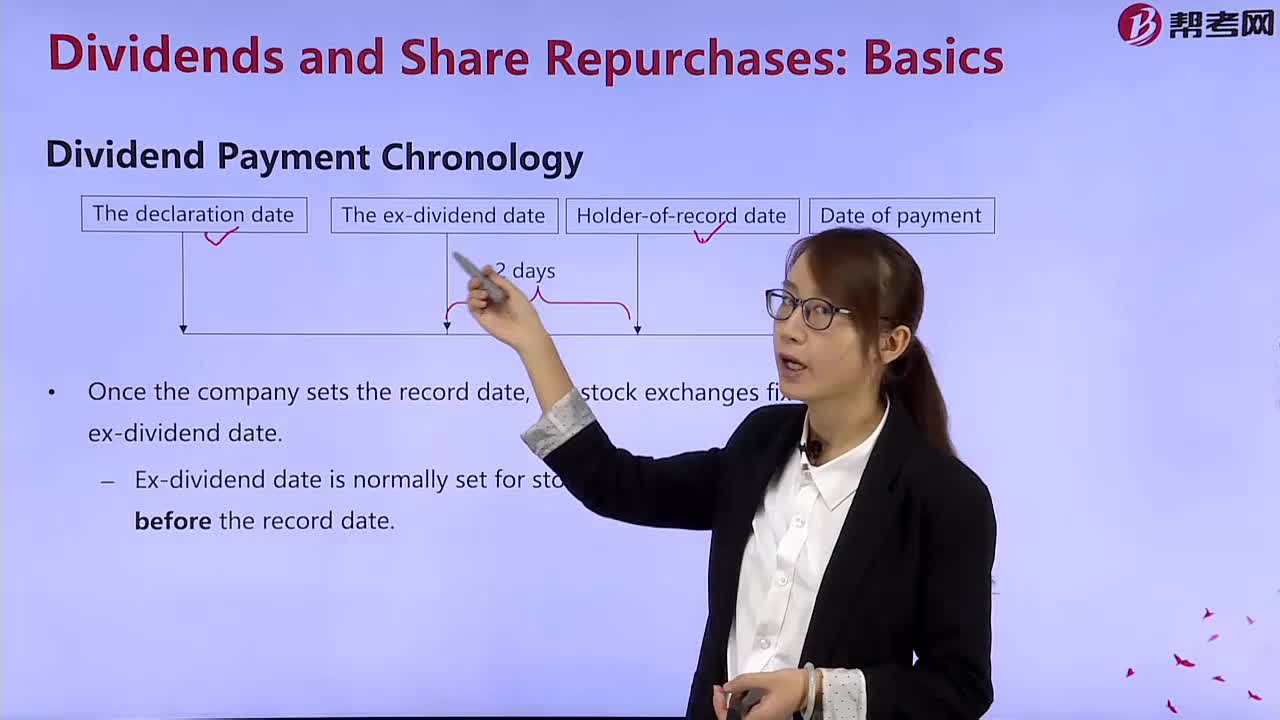

What is included in the annual statement of dividend payment?

What is the definition of risk management?

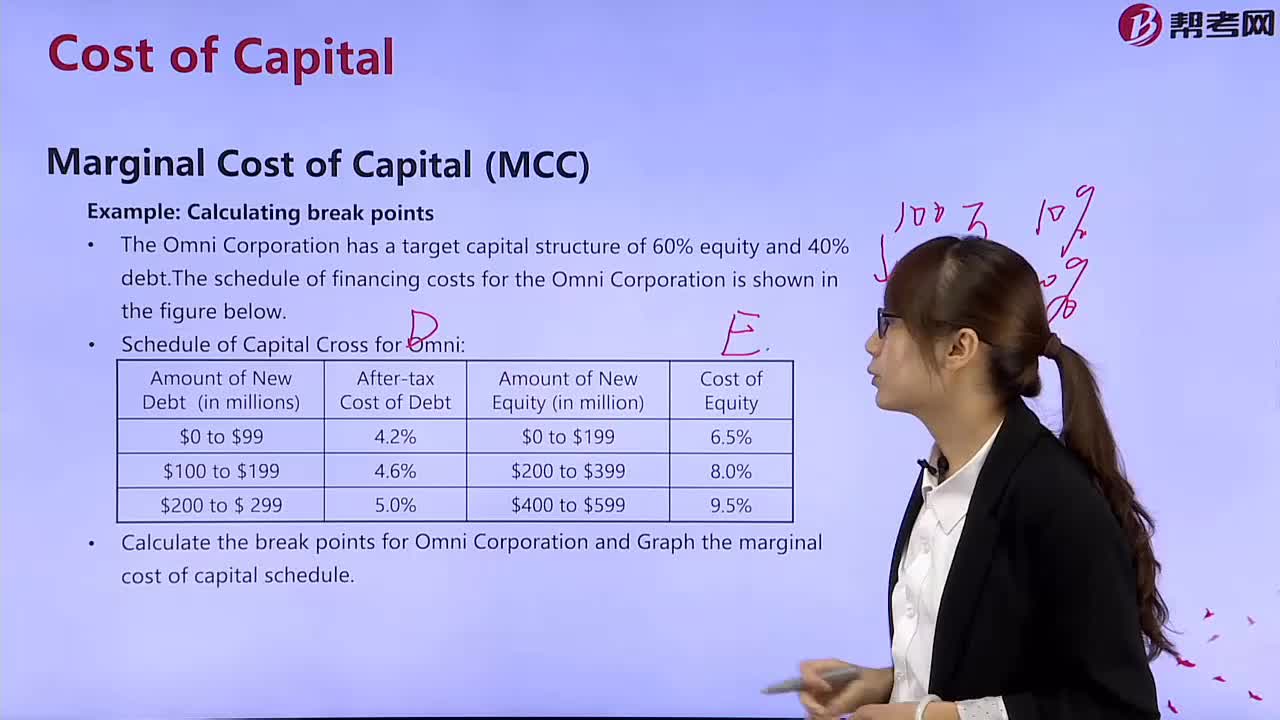

What is the marginal cost of capital?

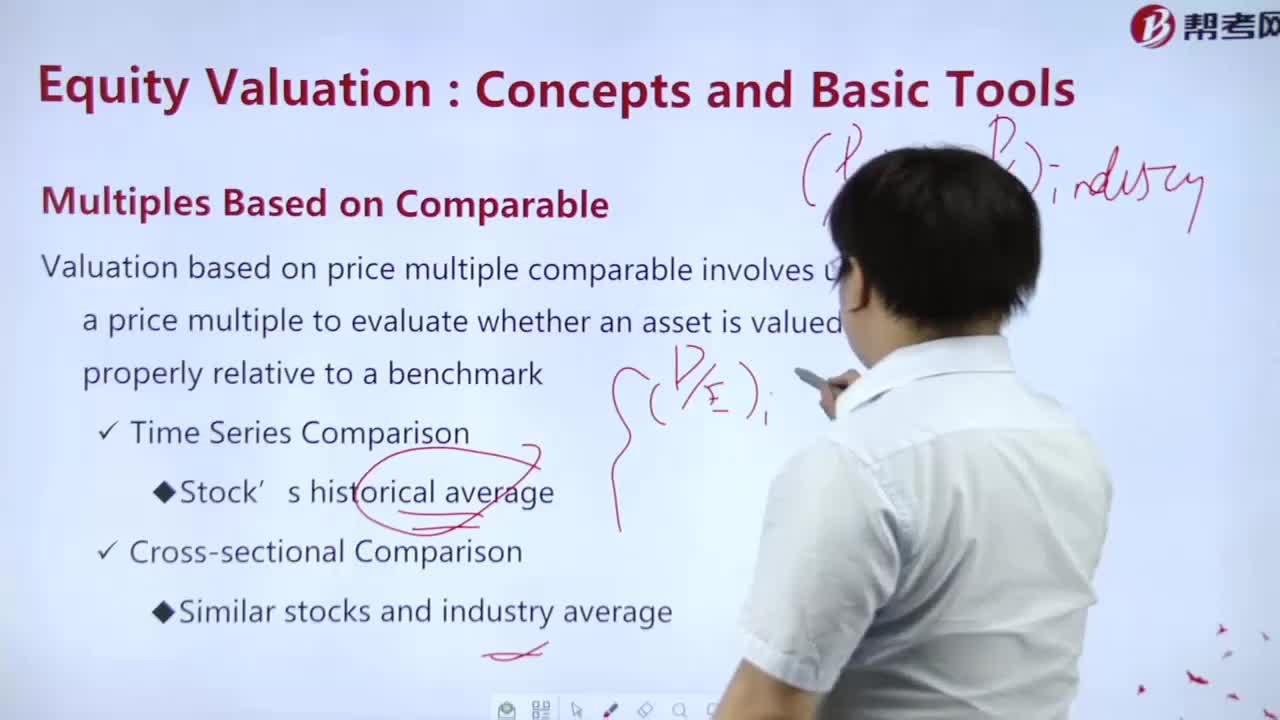

What is the meaning of multiples based on comparable data?

What is the structure of common stock?

08:58

08:58

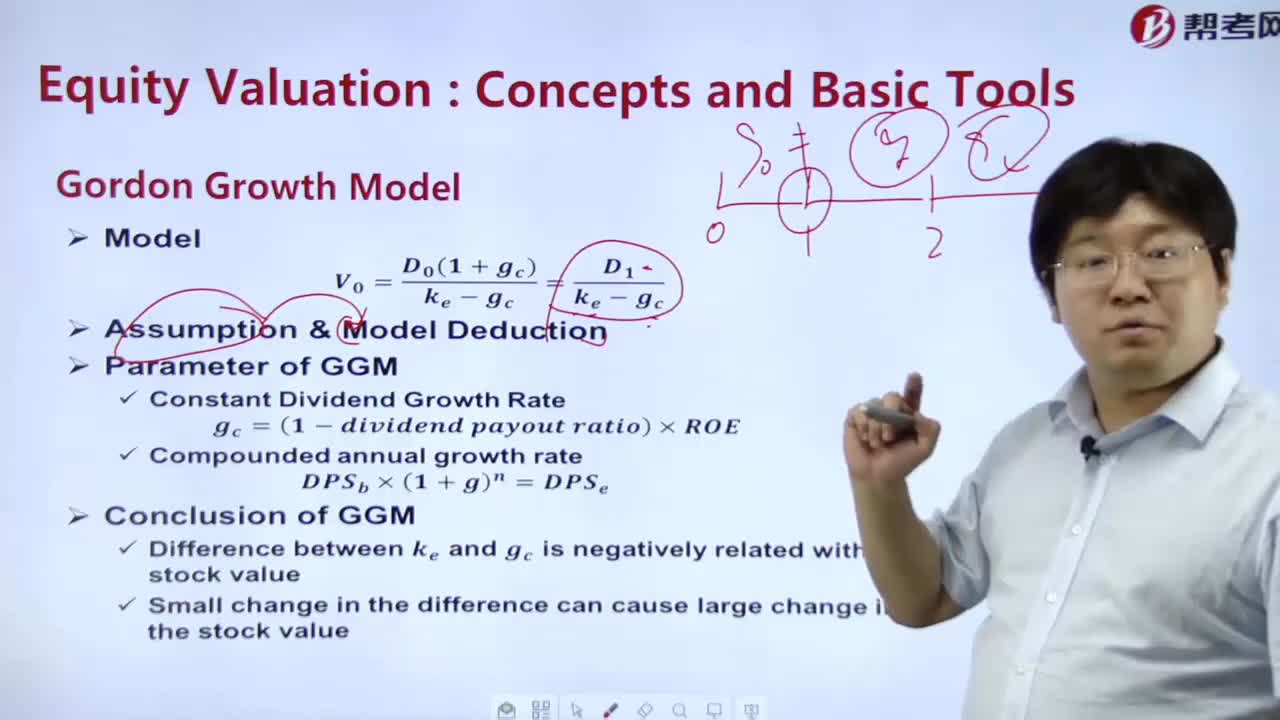

What is the formula of dividend discount model?:What is the formula of dividend discount model?

15:05

15:05

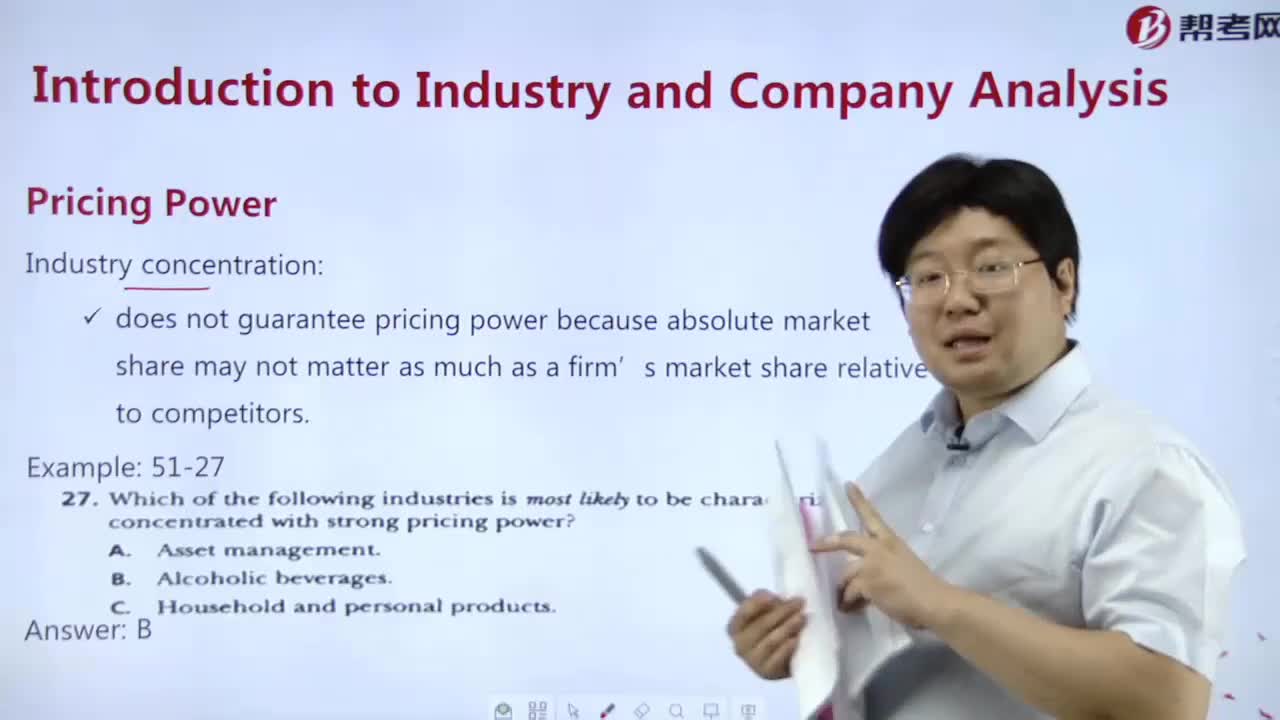

What is the content of pricing power?:What is the content of pricing power?

10:11

10:11

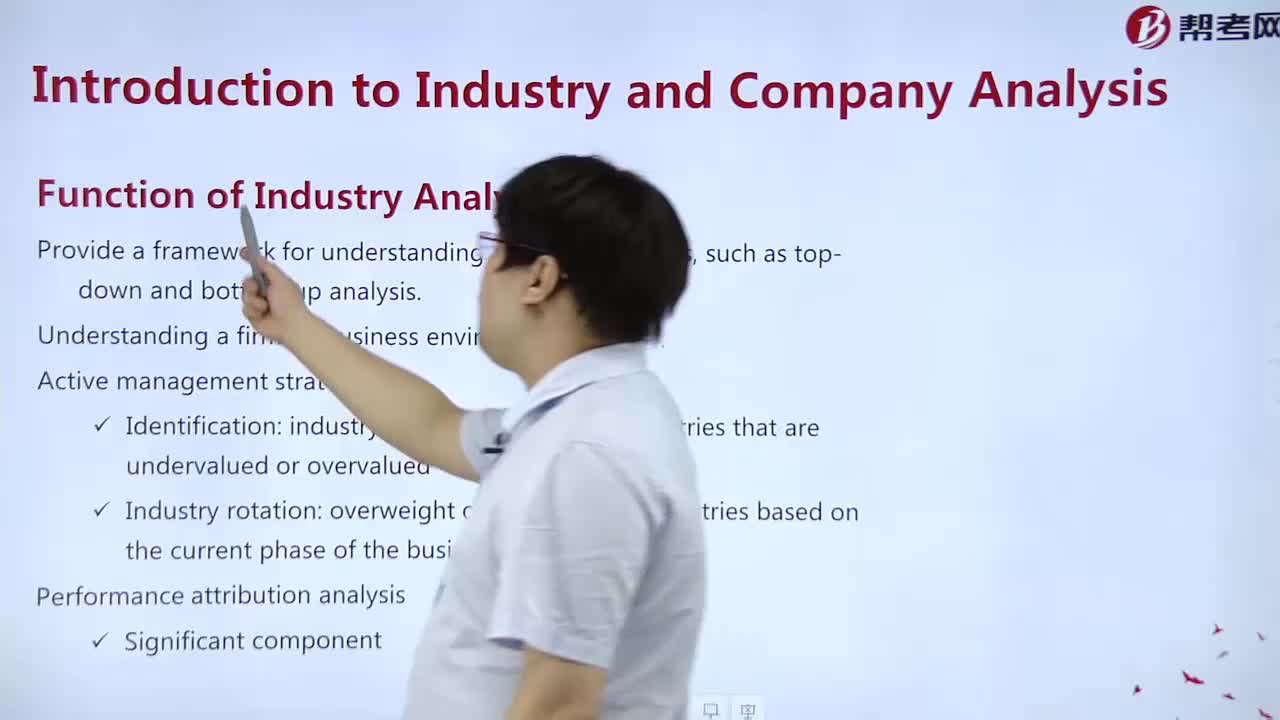

What is the job of industrial analysis?:What is the job of industrial analysis?

03:36

03:36

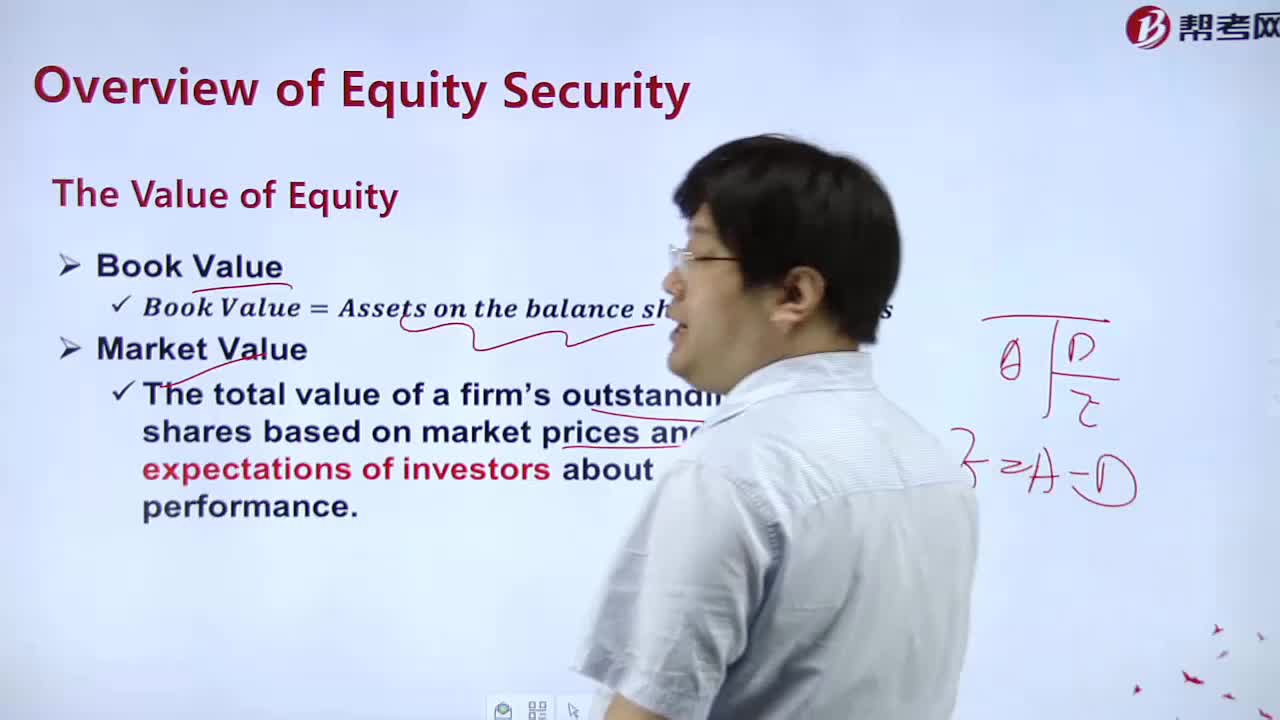

What is the value of the equity?:What is the value of the equity?

09:54

09:54

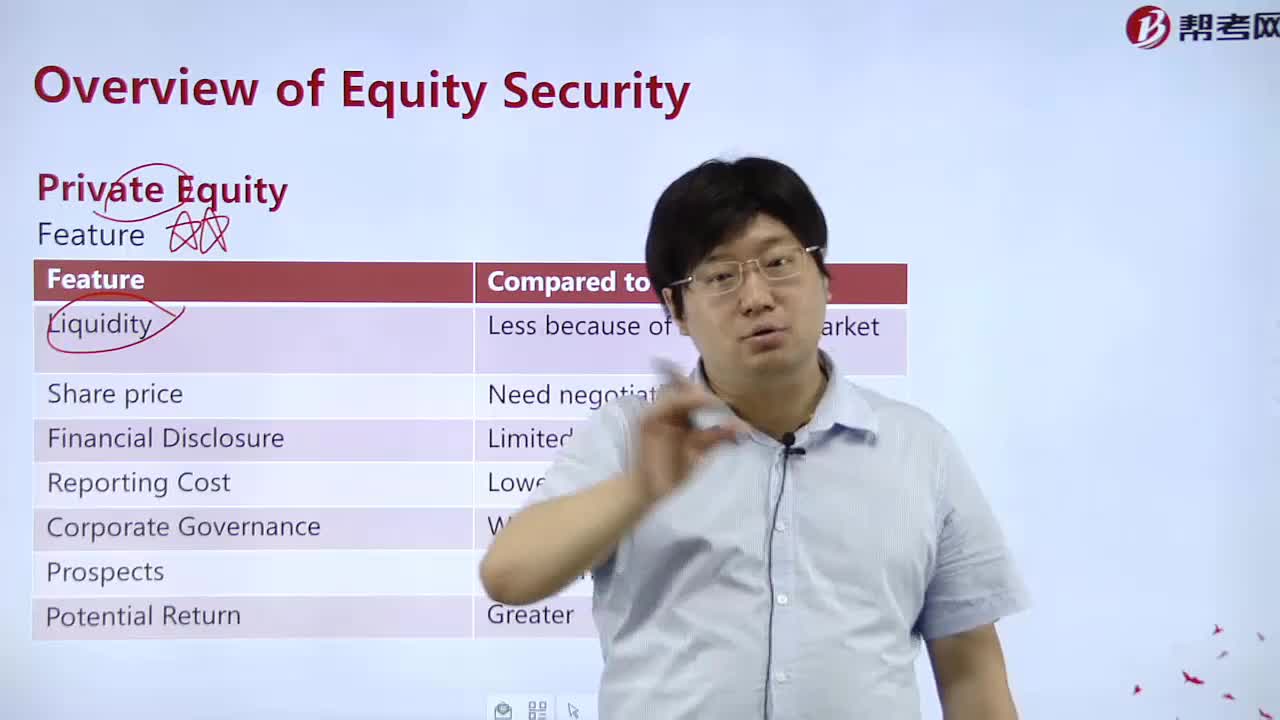

What is the nature of private equity?:What is the nature of private equity?

09:10

09:10

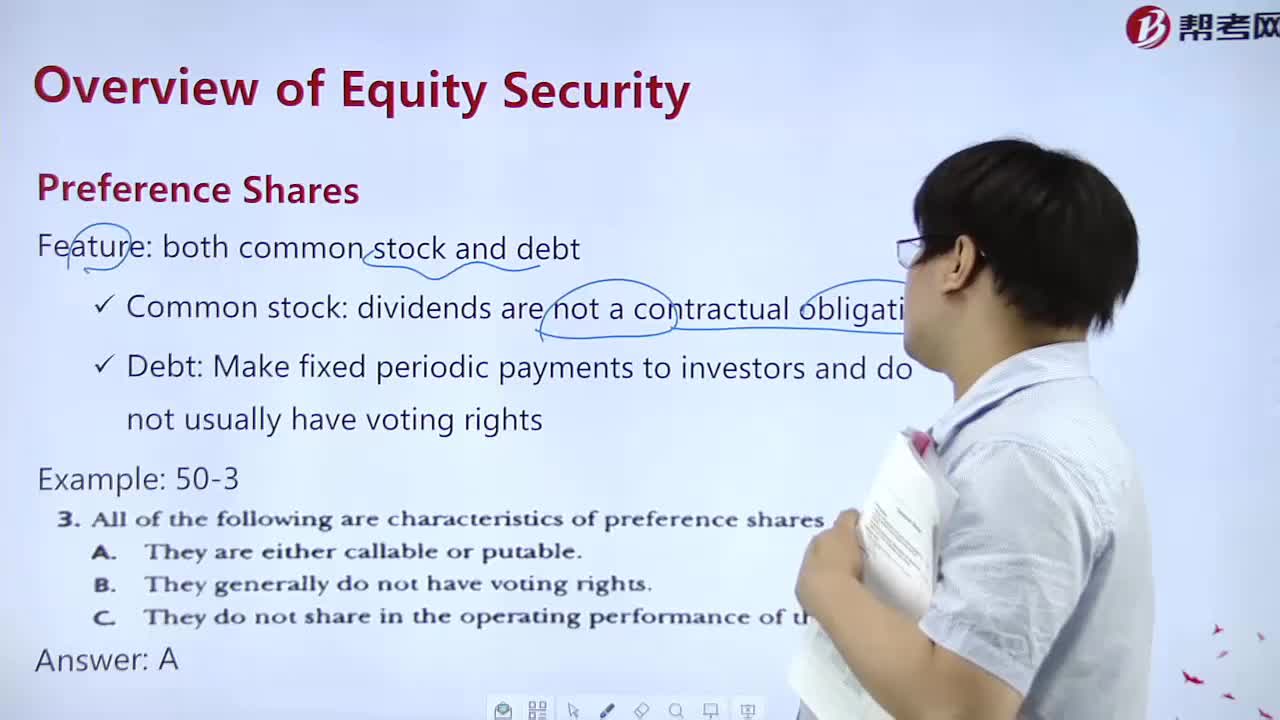

What is the nature of preferred stock?:What is the nature of preferred stock?

11:02

11:02

What is the representativeness of market efficiency?:What is the representativeness of market efficiency?

08:32

08:32

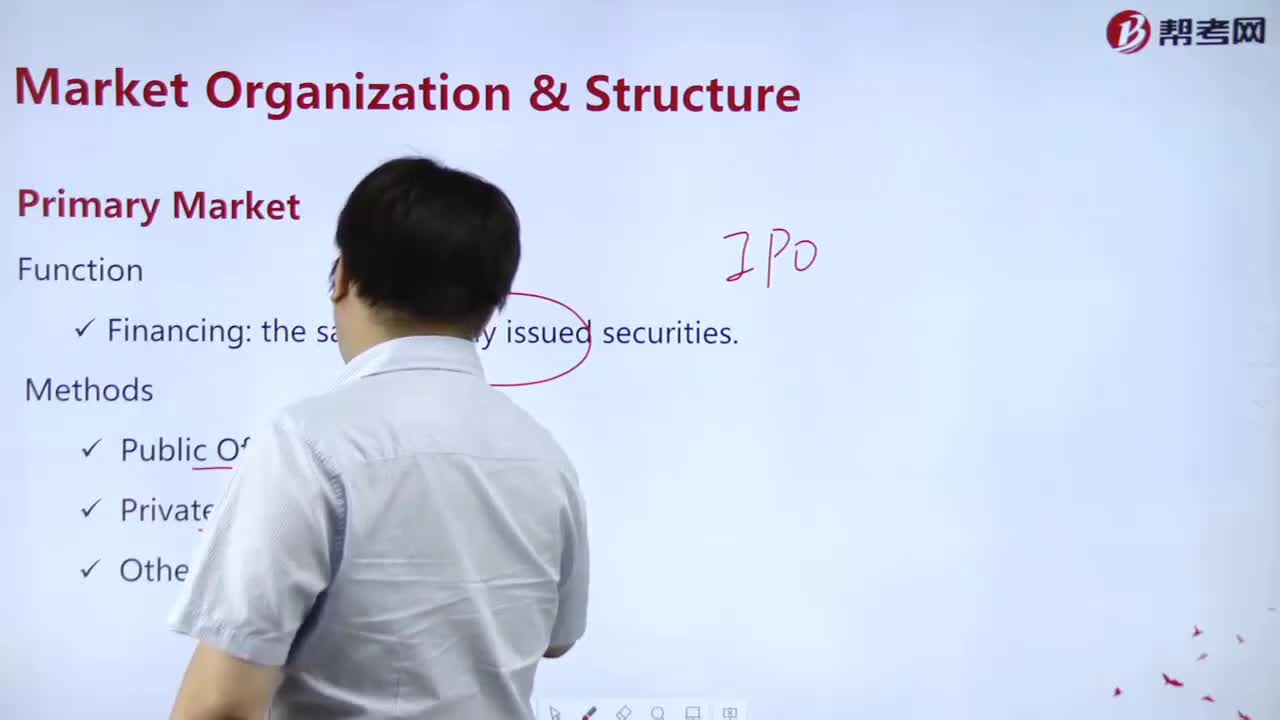

What is the function of the Primary Market?:What is the function of the Primary Market?

05:05

05:05

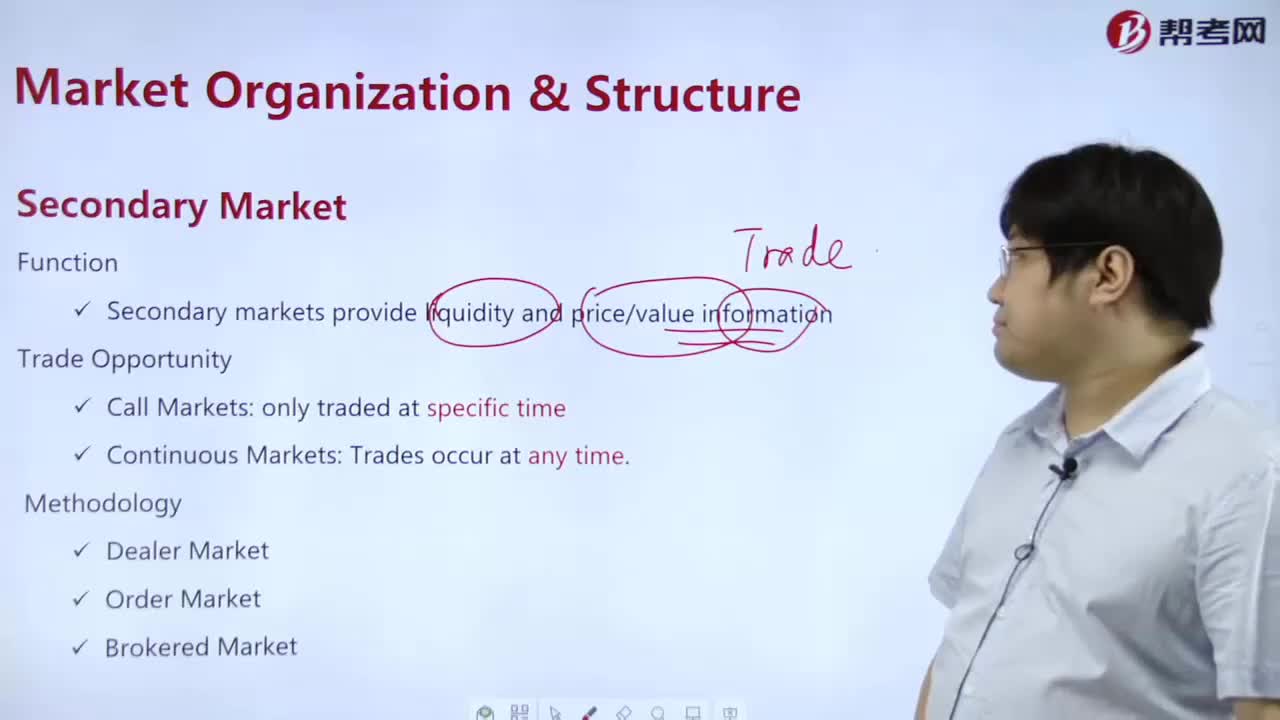

What is the role of the secondary market?:What is the role of the secondary market?

03:57

03:57

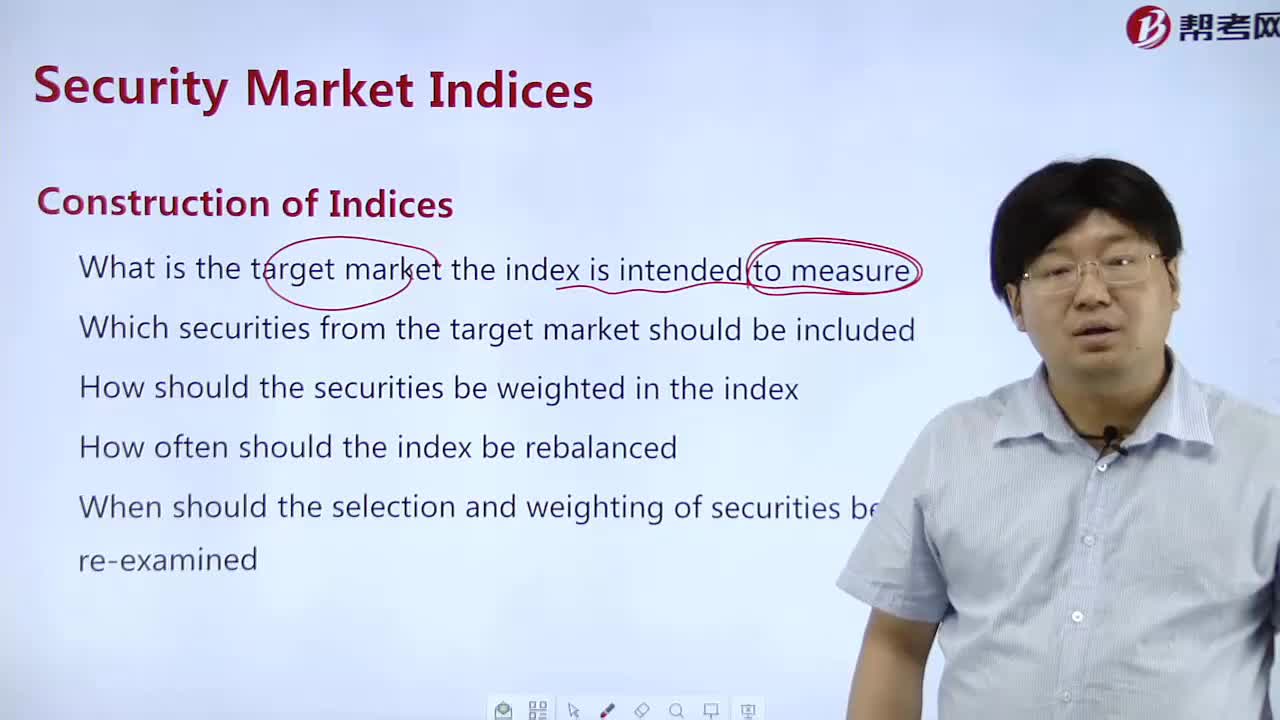

What is the construction of an exponent?:What is the construction of an exponent?

13:02

13:02

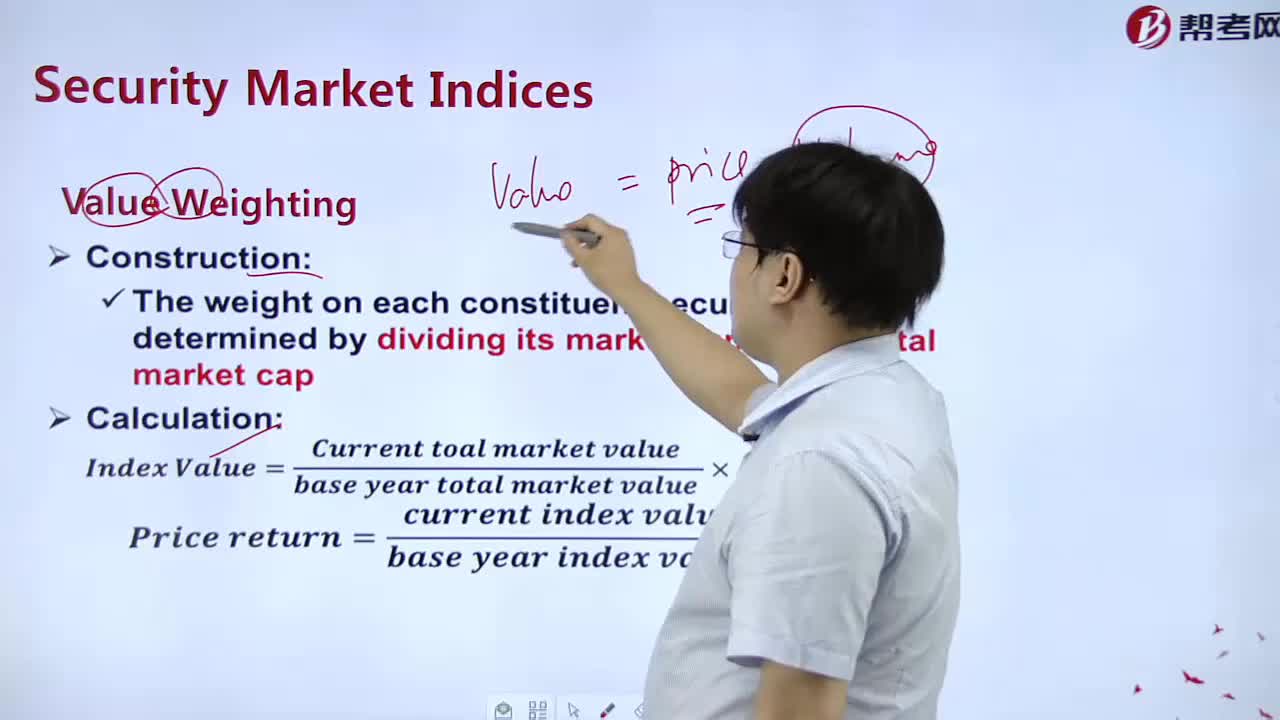

What is the measurement of Value?:What is the measurement of Value?

05:11

05:11

What is the meaning of a Fixed Income Index?:What is the meaning of a Fixed Income Index?