下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

The Demand for Money

There are three basic motives for holding money:

transactions-related

precautionary

speculative

Money balances that are held to finance transactions are referred to as transactions money balances.

The size of the transactions balances will tend to increase with the average value of transactions in an economy.

Precautionary money balances are held to provide a buffer against unforeseen events that might require money.

These balances will tend to be larger for individuals or organizations that enter into a high level of transactions over time.

The speculative demand for money (portfolio demand for money) relates to the demand to hold speculative money balances based on the potential opportunities or risks that are inherent in other financial instruments (e.g., bonds).

Speculative money balances consist of monies held in anticipation that other assets will decline in value.

Speculative balances will tend to be inversely related to the expected return on other financial assets and directly related to the perceived risk of other financial assets.

680

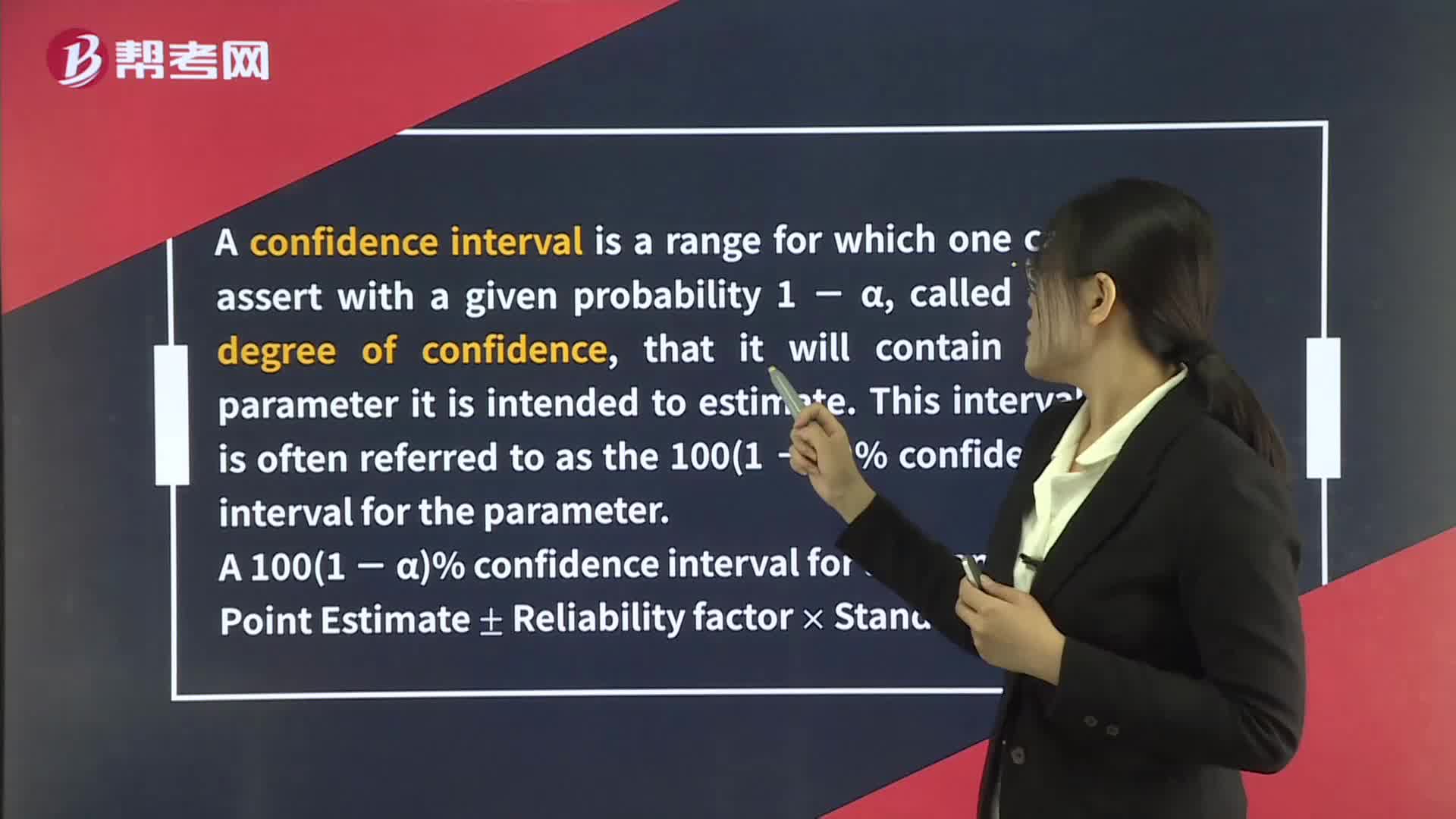

680Confidence Intervals for the Population Mean:error,A confidence:Unknown.normal.Population Variance Unknown—t-Distribution.of freedom for tα2 is n − 1

354

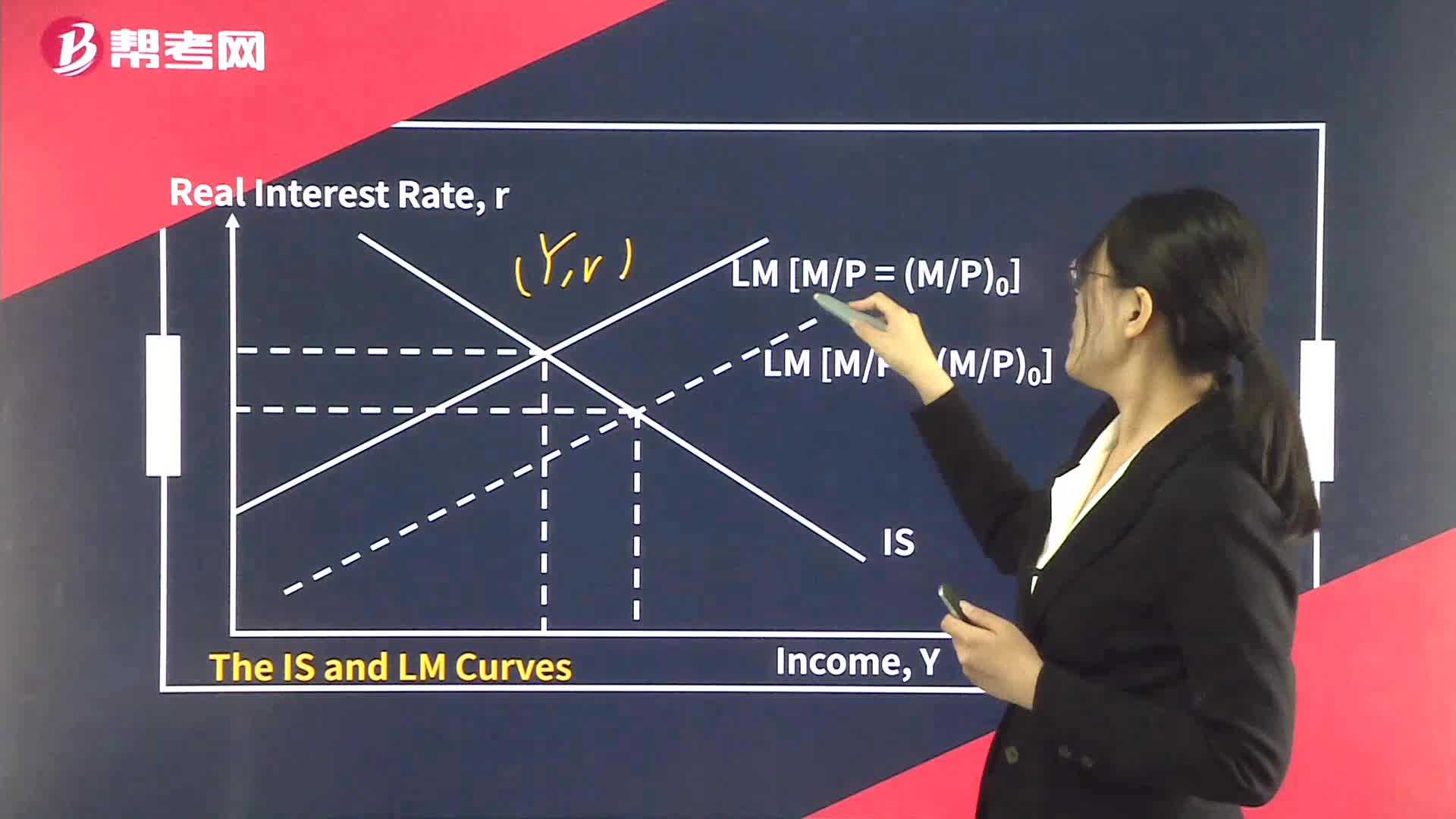

354The Aggregate Demand Curve:changes in private saving S.;money demand is insensitive to Y.

768

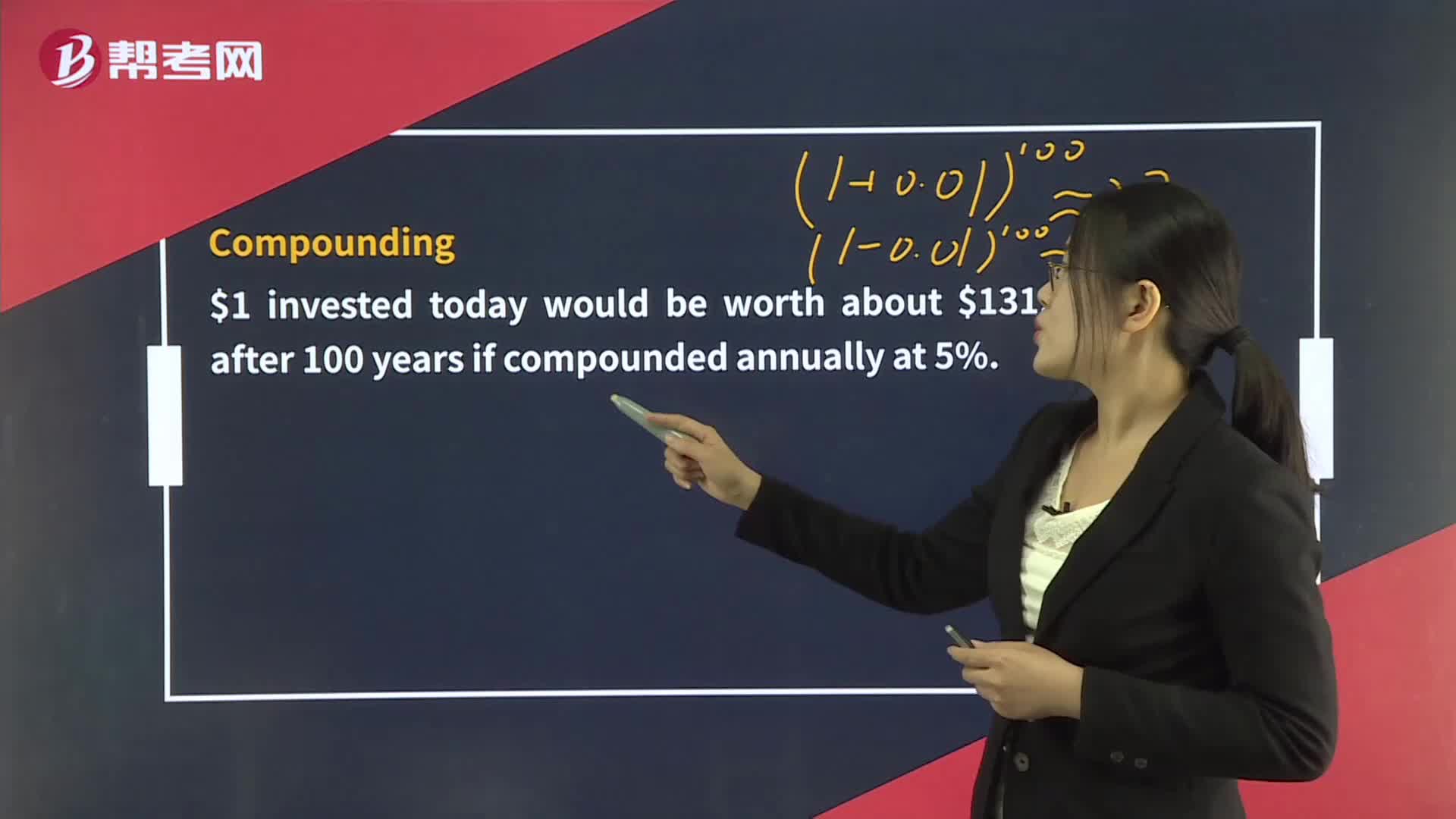

768The Time Value of Money:The,Future Value of a Single Cash Flow – Example:B.C.semiannually.

微信扫码关注公众号

获取更多考试热门资料