下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

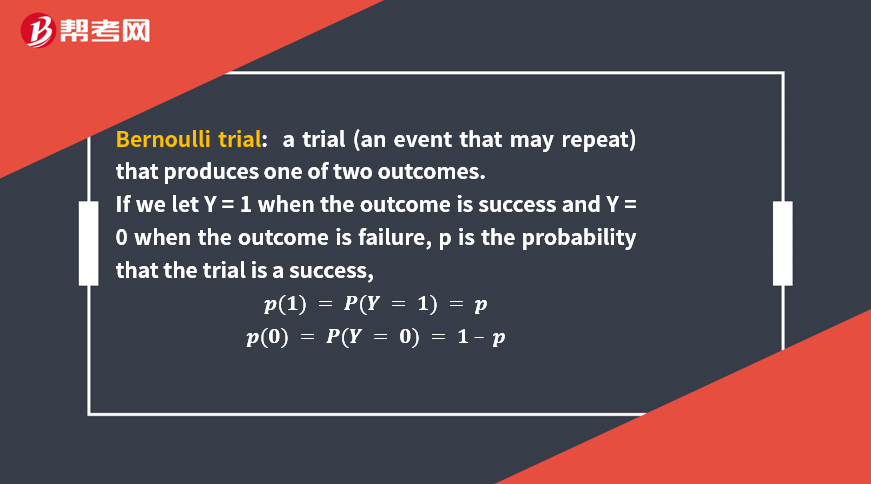

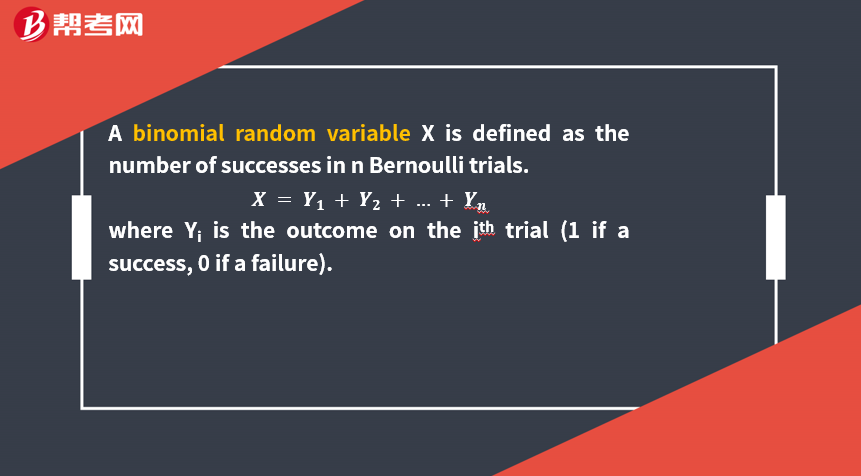

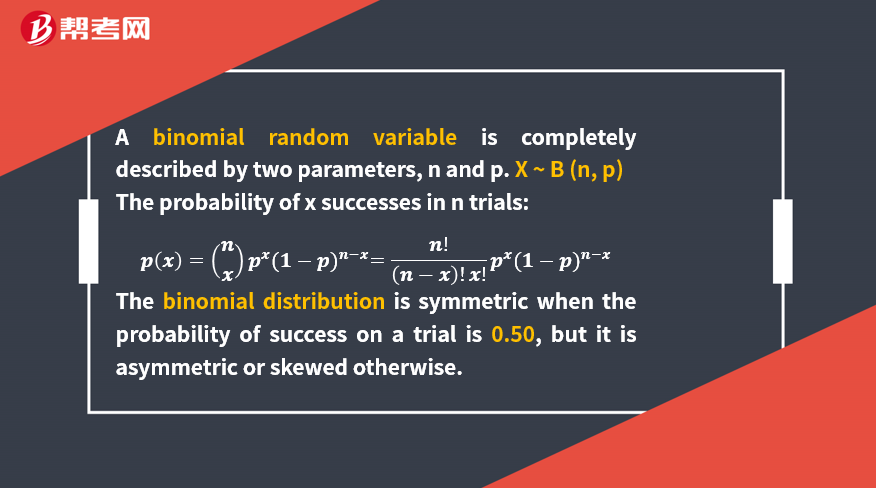

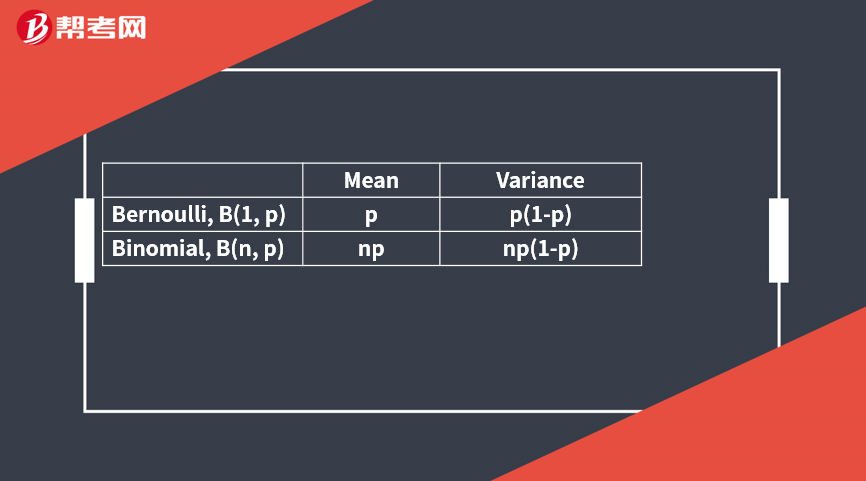

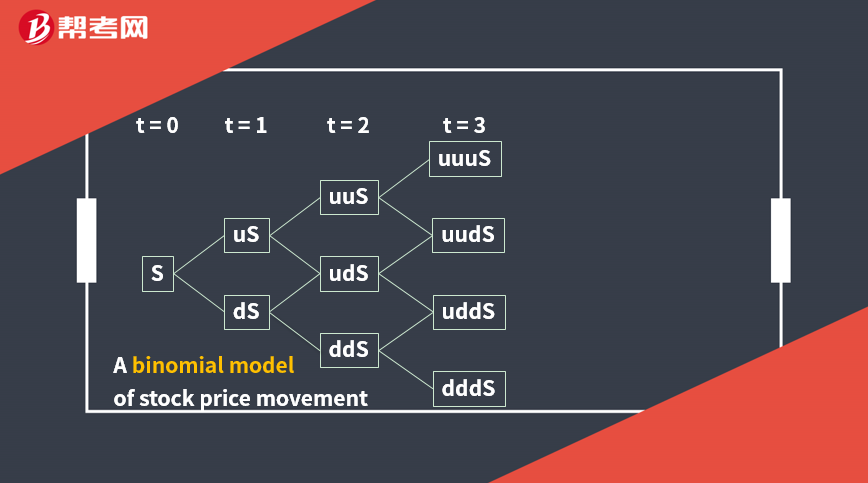

The Binomial Distribution

The binomial distribution makes these assumptions:

The probability, p, of success is constant for all trials.

The trials are independent.

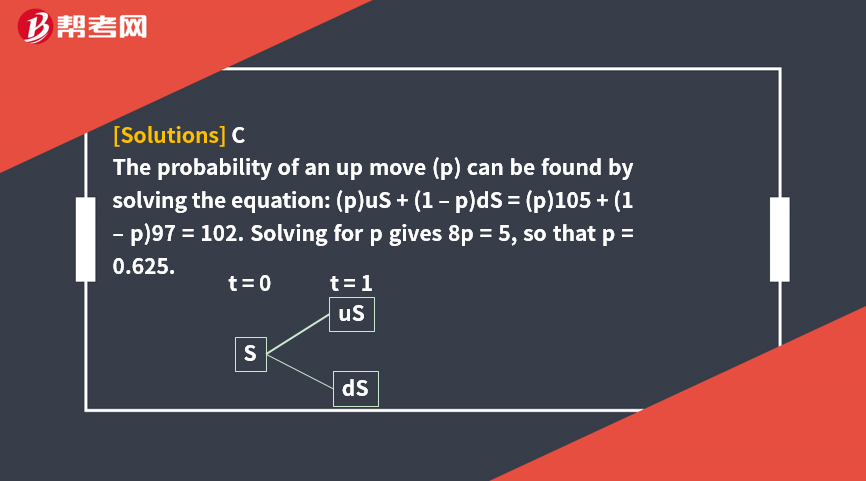

[Practice Problems] A stock is priced at $100.00 and follows a one-period binomial process with an up move that equals 1.05 and a down move 0.97. If 1 million Bernoulli trials are conducted, and the average terminal stock price is $102.00, the probability of an up move (p) is closest to:

A. 0.375.

B. 0.500.

C. 0.625.

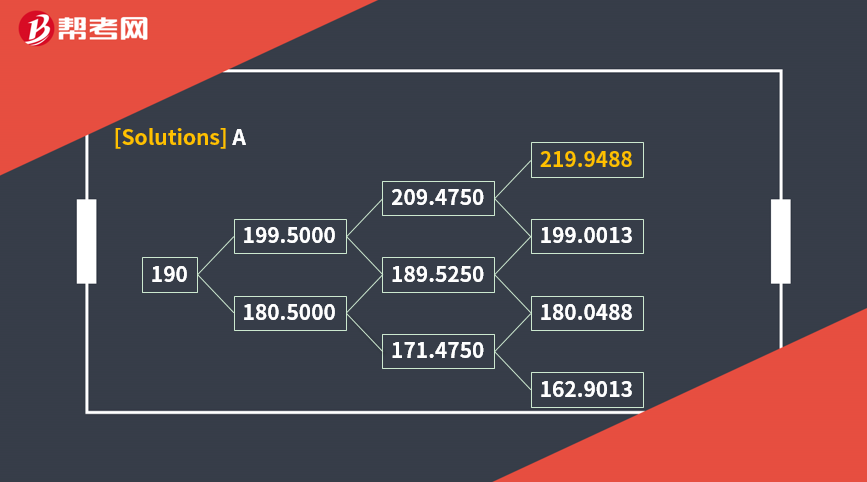

[Practice Problems] A call option on a stock index is valued using a three-step binomial tree with an up move that equals 1.05 and a down move that equals 0.95. The current level of the index is $190, and the option exercise price is $200. If the option value is positive when the stock price exceeds the exercise price at expiration and $0 otherwise, the number of terminal nodes with a positive payoff is:

A. one. B. two. C. three.

191

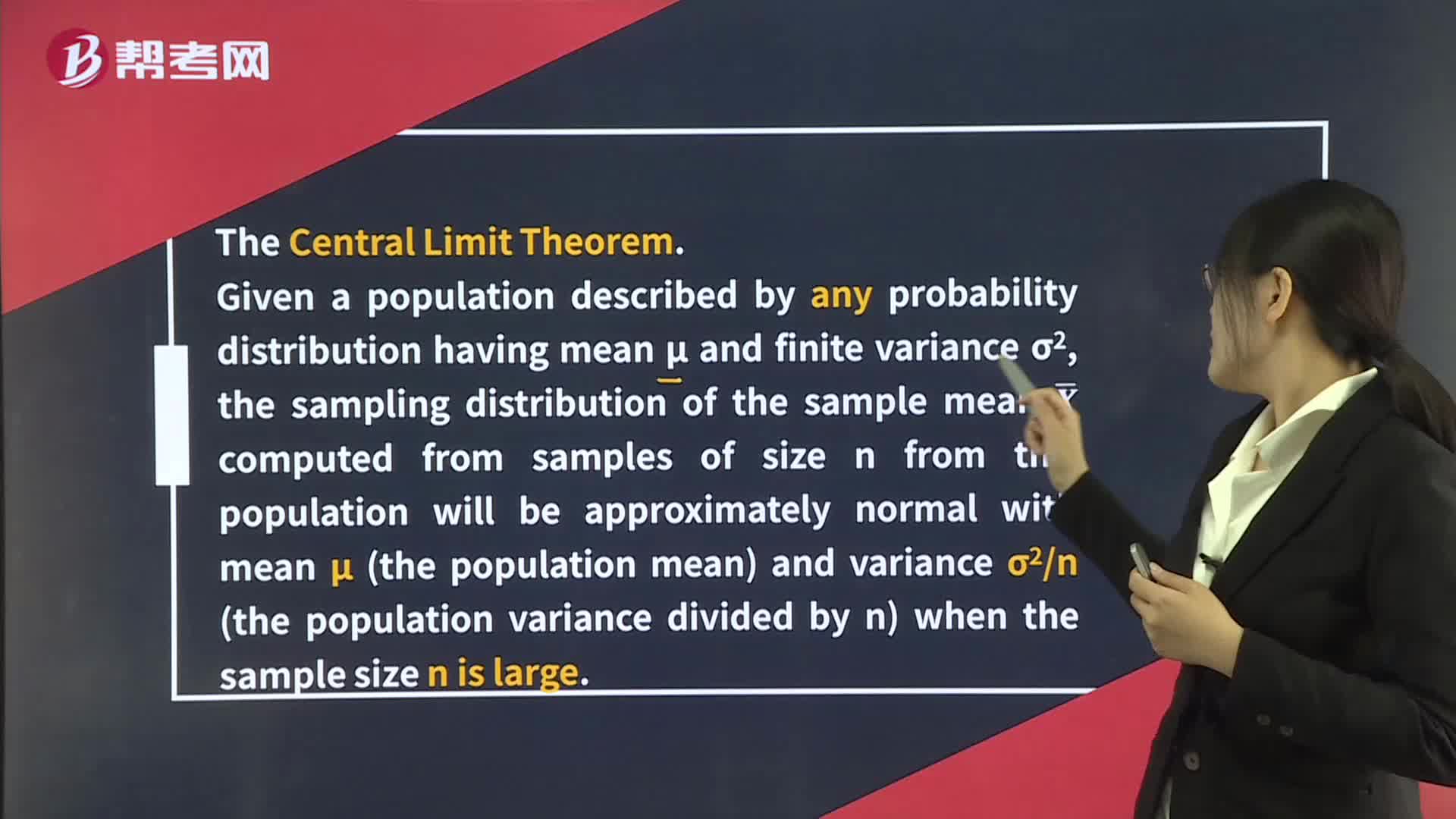

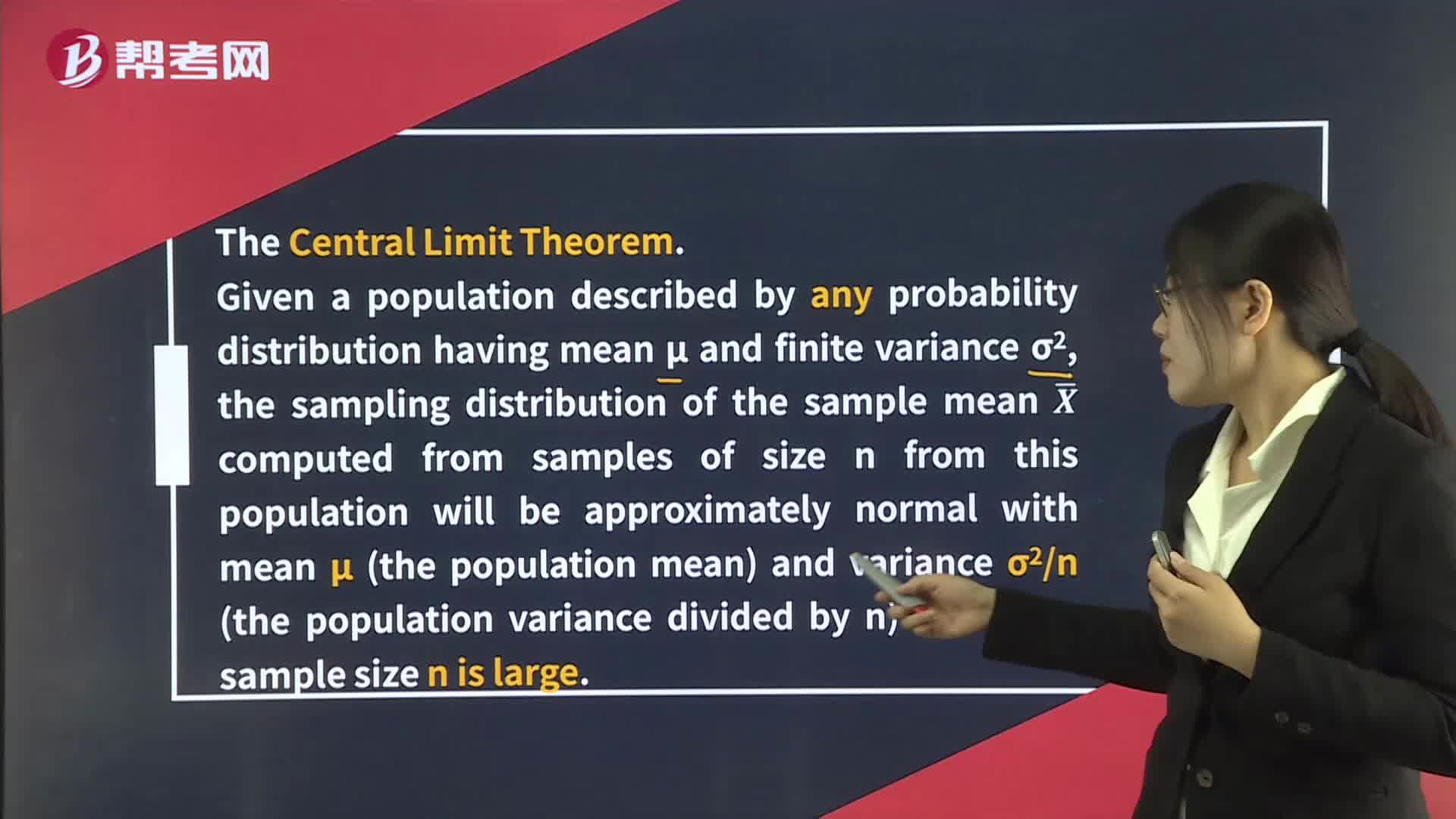

191Distribution of the Sample Mean:[Practicewhen the sample size is large.

168

168Distribution of the Sample Mean:The Central:[PracticeB.C.when the sample size is large.

599

599The Normal Distribution:μ;indicated as X ~ Nμ:Approximately 99% fall in μ ± 2.58σ.[PracticemeanNZ corresponding to 8% must equal 50%. So P8% ≤ Portfolio return ≤ 11% = 0.5832 – 0.50 = 0.0832 or approximately 8.3 percent.

微信扫码关注公众号

获取更多考试热门资料