下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

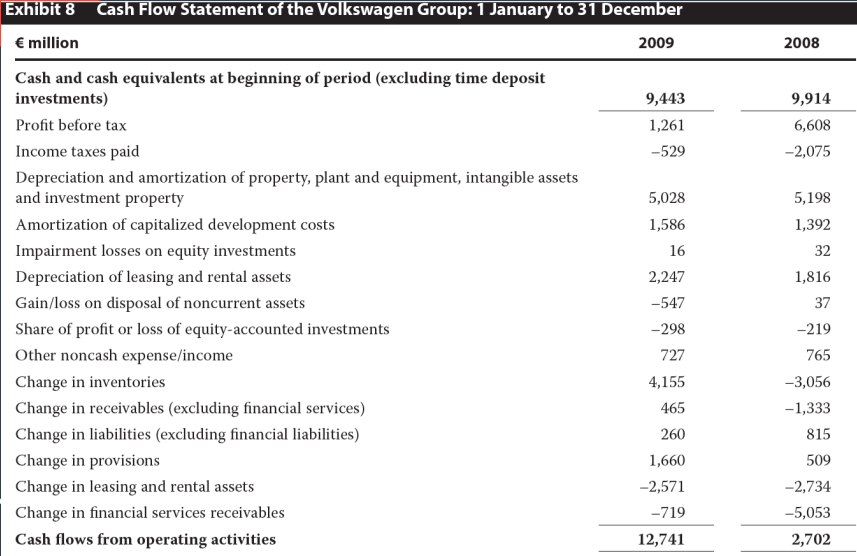

Cash Flow Statement

Financial flexibility is the ability of the company to react and adapt to financial adversities and opportunities.

The cash flow statement classifies all cash flows of the company into three categories: operating, investing, and financing.

20200806101610745.jpg)

Cash flows from operating activities are those cash flows not classified as investing or financing and generally involve the cash effects of transactions that enter into the determination of net income and, hence, comprise the day-to-day operations of the company.

Cash flows from investing activities are those cash flows from activities associated with the acquisition and disposal of long-term assets, such as property and equipment.

Cash flows from financing activities are those cash flows from activities related to obtaining or repaying capital to be used in the business.

20200806101822950.jpg)

20200806101823791.jpg)

The indirect method emphasizes the different perspectives of the income statement and cash flow statement.

On the income statement, income is reported when earned, not necessarily when cash is received, and expenses are reported when incurred, not necessarily when paid.

The cash flow statement presents another aspect of performance: the ability of a company to generate cash flow from running its business.

The sum of the net cash flows from operating, investing, and financing activities and the effect of exchange rates on cash equals the net change in cash during the fiscal year.

264

264Technical Indicators— Flow-of-Funds Indicators:Flow-of-Funds;NewSecondaryof shares have the potential to change the supply-and-demand equation as muchas IPOs do.

108

108Scope of Financial Statement Analysis:creditorder to form expectations about its future performance and financial position.

54

54Statement of Comprehensive Income:begins with profit or loss from the income statement.

微信扫码关注公众号

获取更多考试热门资料