-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

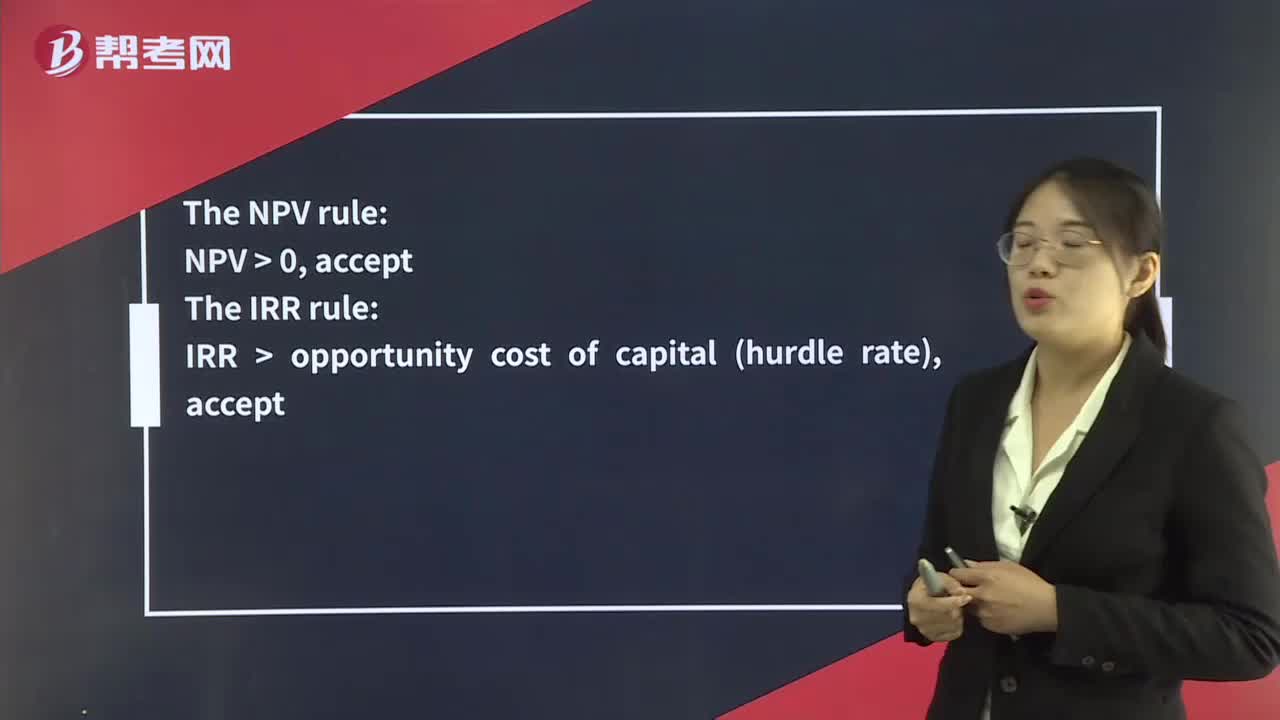

The NPV Rule & The IRR Rule

The NPV rule:

NPV > 0, accept

The IRR rule:

IRR > opportunity cost of capital (hurdle rate), accept

For mutually exclusive projects:

NPV rule: Choose the candidate with the higher positive NPV.

IRR rule: Choose the candidate with the higher IRR.

When the IRR and NPV rules conflict in ranking projects (due to size of projects, timing of cash flows), we should take directions from the NPV rule.

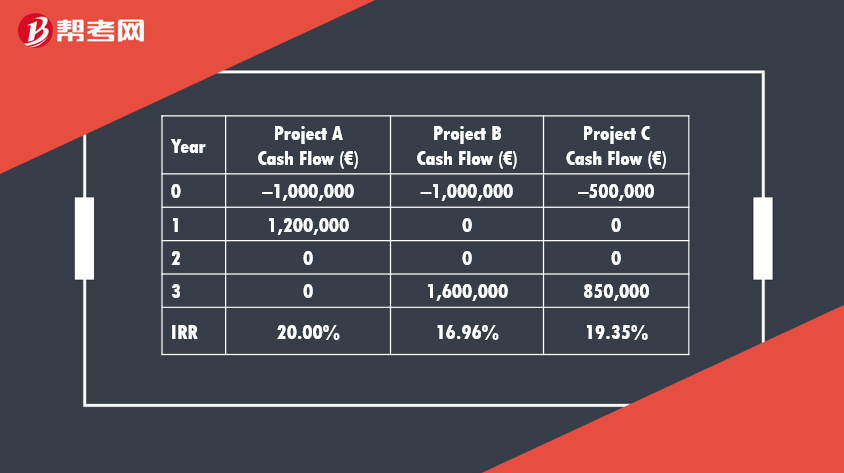

[Practice Problems] Suppose a company has only €1,000,000 available to invest. The three projects available are described in the table. If the opportunity cost of capital is 12%, which project should be accepted?

[Solutions] The projects are mutually exclusive because the amount to invest is constrained to €1,000,000. The NPV rule should be used.

Project A NPV = –€1,000,000 + €1,200,000/(1.12) = €71,429

Project B NPV = –€1,000,000 + €1,600,000/(1.12)3 = €138,848

Project C NPV = –€500,000 + €850,000/(1.12)3 = €105,013

208

208

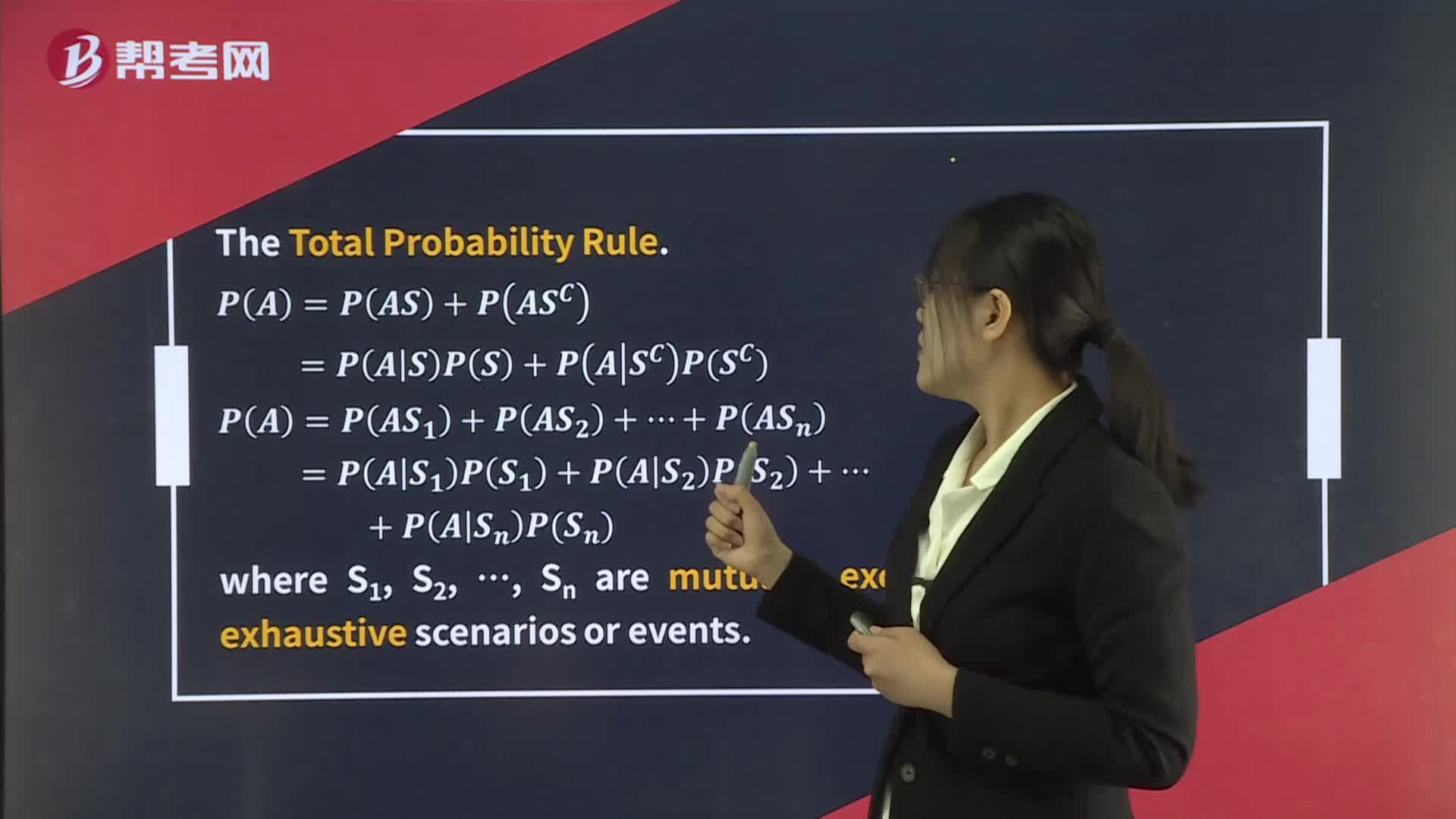

The Total Probability Rule:not-S,the two-quarter period in total.rulejoint probability of both A and B occurring is PAB = PAPB.

68

68

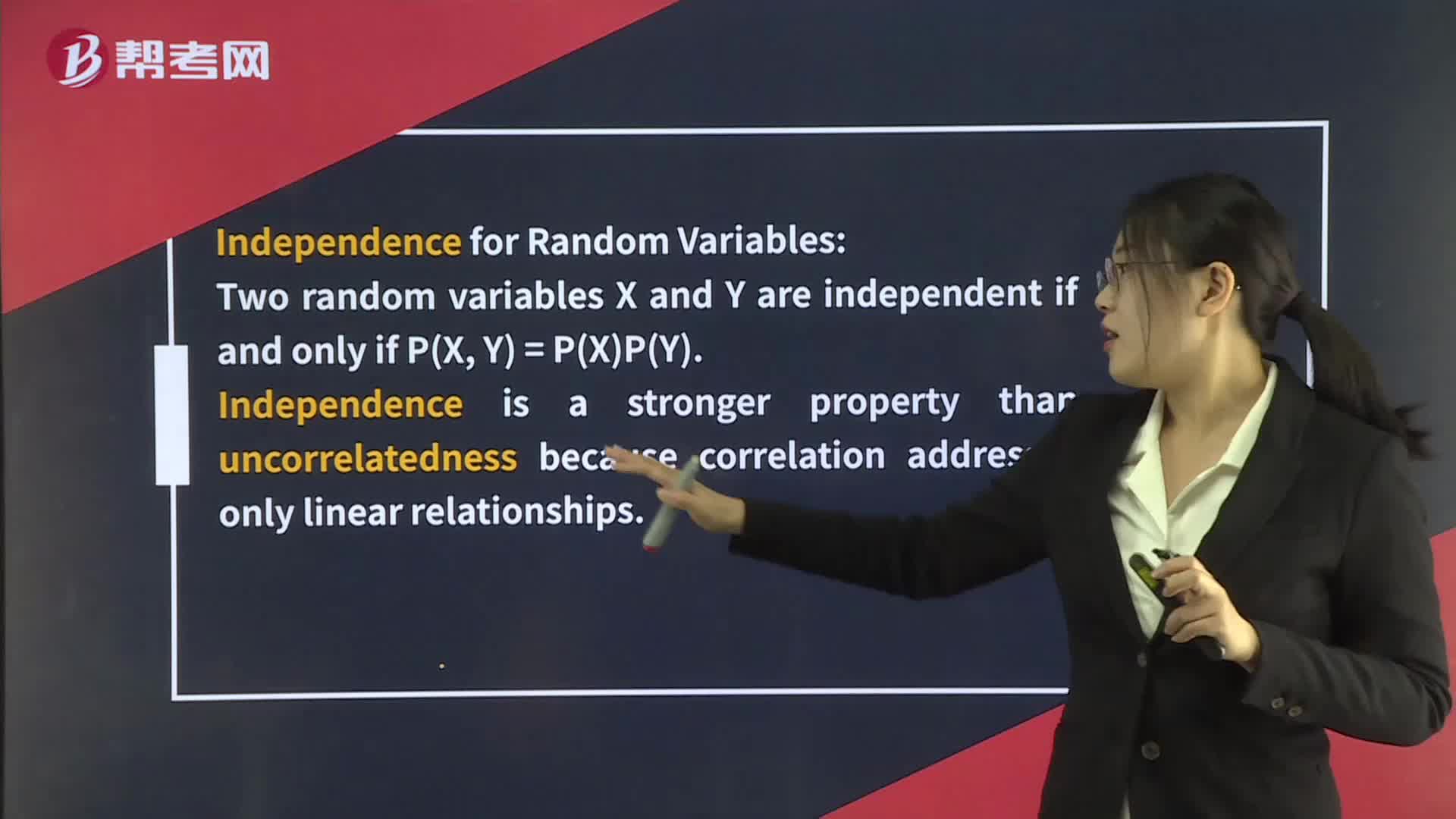

Multiplication Rule For Expected Value:Two random variables X and Y are independent:EXY = EXEY

312

312

The NPV Rule & The IRR Rule:IRR opportunity cost of capital hurdle:rate:accept,IRR.,[Practice,013

08:39

08:39

2020-05-18

04:30

04:30

13:18

13:18

13:11

13:11

06:13

06:13

2020-05-15

微信扫码关注公众号

获取更多考试热门资料