下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

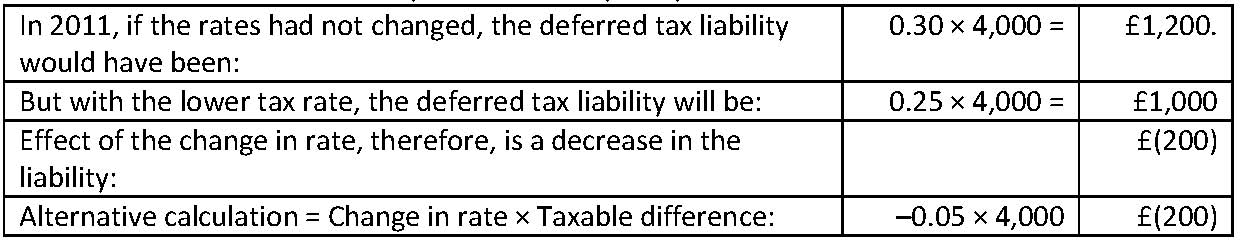

1、A company purchased equipment in 2010 for £25,000. The year-end values of the equipment for accounting purposes and tax purposes are as follows:Which of the following statements best describes the effect of the change in the tax rate on the company’s 2011 financial statements? The deferred tax liability:【单选题】

A.increases by £250.

B.decreases by £200.

C.decreases by £800.

正确答案:B

答案解析:“Income Taxes,” Elbie Antonites, CFA and Michael A. Broihahn, CFA

2、Which action is most likely considered a secondary source of liquidity?【单选题】

A.Increasing the availability of bank lines of credit

B.Increasing the efficiency of cash flow management

C.Renegotiating current debt contracts to lower interest payments

正确答案:C

答案解析:“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFAC is correct. Renegotiating debt contracts is a secondary source of liquidity because it may affect the company’s operating and/or financial positions.

3、The null hypothesis is most likely to be rejected when the p-value of the test statistic:【单选题】

A.exceeds a specified level of significance.

B.is negative.

C.falls below a specified level of significance.

正确答案:C

答案解析:If the p-value is less than the specified level of significance, the null hypothesis is rejected.Section 2

4、All else being equal, a decrease in volatility of the underlying is most likely toresult in a(n):【单选题】

A.increase in call price and a decrease in put price.

B.decrease in call price and a decrease in put price.

C.increase in call price and a increase in put price.

正确答案:B

答案解析:所针对的标的资产波动性增加会同时增加看涨期权和看跌期权的价值,此时标的资产的价格高于看涨期权行权价或者低于看跌期权行权价的可能性都增加,而所针对的标的资产的波动性若降低,则结论正好相反。

5、An analyst does research about impact to option due to interest rate and volatilityof the underlying.Which of the following statements best describes the effect ofthe level of interest rates and volatility of the underlying on the price of options?All else being equal, prices for:【单选题】

A.put options are positively related to the level of interest rates.

B.call options are positively related to the level of interest rates.

C.put options are negatively related to the volatility of the underlying.

正确答案:B

答案解析:当利率越高时,更多的人会选择投资看涨期权,因为可以延后购买资产的时间,即现在只要付一部分期权费就可以买入将来购买这项资产的权利,所以看涨期权与利率正相关。相反地,当利率越高时,更多的人会选择卖出看跌期权,导致看跌期权价格下跌,所以看跌期权与利率负相关。资产的波动性与看涨期权及看跌期权的价格都是正相关。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料