下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理历年真题10道,附答案解析,供您考前自测提升!

1、Given the following portfolio data, the portfolio return is closest to:【单选题】

A.8.2%.

B.10.0%.

C.10.8%.

正确答案:C

答案解析:“Statistical Concepts and Market Returns,” Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle0.45 × 16 + 0.25 × 12 + 0.30 × 2 = 10.80.

2、The following table represents the history of an investment in a company:The investor does not reinvest the dividends that he receives. Assuming no taxes on dividends, the time-weighted rate of return on this investment is closest to:【单选题】

A.1.93%.

B.2.40%.

C.2.57%.

正确答案:B

答案解析:“Discounted Cash Flow Applications”, Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA2013 Modular Level I, Vol. 1, Reading 6, Section 3, 3.2Study Session 2-6-c, dCalculate and interpret a holding period return (total return).Calculate and compare the money-weighted and time-weighted rates of return of a portfolio and evaluate the performance of portfolios based on these measures.B is correct. First, calculate the portfolio value at the beginning and end of each period and the dividends received over the three years:Then, calculate the holding period return (HPR) for the three years by using the following formula:The time-weighted return (TWR) is found by taking the geometric mean of the three holding period returns:

3、An analyst gathered the following information about a company:Which of the following statements best describes the company’s price-to-earnings ratio (P/E)? Compared with the company’s trailing P/E, the P/E based on the Gordon growth dividend discount model is:【单选题】

A.the same.

B.higher.

C.lower.

正确答案:C

答案解析:The P/E based on the Gordon growth dividend discount model is lower:Section 5

4、Which of the following is the most appropriate reason for using a free-cash-flow-to-equity (FCFE) model to value equity of a company?【单选题】

A.FCFE is a measure of the firm’s dividend paying capacity.

B.FCFE models provide more accurate valuations than the dividend discount models.

C.A firm’s borrowing activities could influence dividend decisions but they would not impact FCFE.

正确答案:B

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFAA is correct. FCFE is a measure of the firm’s dividend paying capacity.

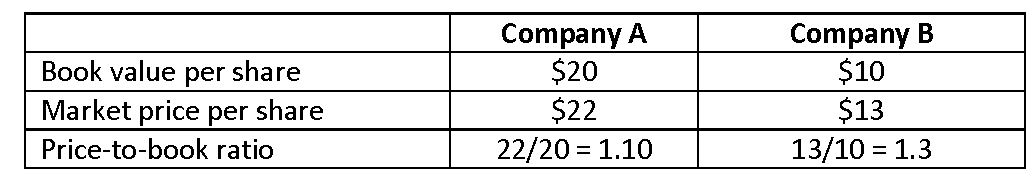

5、An analyst gathers the following information about two companies in the same industry:What is the most appropriate conclusion regarding investors’ expectations? Compared to Company B, Company A has:【单选题】

A.higher intrinsic value as reflected by its higher market price.

B.higher sustainable growth as reflected by its higher return on equity.

C.lower future investment opportunities due to its lower price-to-book ratio.

正确答案:C

答案解析:“Overview of Equity Securities” Ryan C. Fuhrmann, CFA, and Asjeet S. Lamba, CFA

6、The following table shows changes to the number of common shares outstanding for a company during 2012:To calculate earnings per share for 2012, the company’s weighted average number of shares outstanding is closest to:【单选题】

A.215,000.

B.315,000.

C.430,000.

正确答案:C

答案解析:The weighted average number of shares outstanding is time weighted:Section 6.2

7、The yield on a U.S. Treasury STRIPS security is also known as the Treasury:【单选题】

A.spot rate.

B.yield spread.

C.forward rate.

正确答案:A

答案解析:“Understanding Yield Spreads”, Frank J. Fabozzi, CFAA is correct because a STRIPS security is a zero-coupon bond with no default risk and therefore represents the appropriate discount rate for a cash flow certain to be received at the maturity date for the STRIPS.

8、The most likely impact of adding commodities to a portfolio of equities and bonds is to:【单选题】

A.increase risk

B.enhance return.

C.reduce exposure to inflation.

正确答案:C

答案解析:“Investing in Commodities,” Ronald G. Layard-LieschingC is correct. Over the long term, commodity prices are closely related to inflation and, therefore, including commodities in a portfolio of equities and bonds will reduce its exposure to inflation.

9、An analyst does research about inventory methods.A company with no initialinventory on hand made the following purchases of inventory in 2011:At the end of 2011, the company had 5 000 units of inventory on hand.Undera periodic inventory system, ending inventory using the weighted average costmethod is closest to:【单选题】

A.$ 43 000 less than using the FIFO method.

B.$ 32 000 more than using the FIFO method.

C.$ 43 000 more than using the FIFO method.

正确答案:A

答案解析:average price of one unit = (7 000 × $ 76 + 10 100 × $ 80 + 8 000 × $ 91)/(7 000 + 10 100+ 8 000) = $ 82.4。inventory ( weighted average cost ) - inventory ( FIFO ) = $ 412 000 - $ 455 000= - $ 43 000。

10、A decrease in which of the following increases shareholders' equity?【单选题】

A.Retained earnings.

B.Treasury stock.

C.Accumulated comprehensive income.

正确答案:B

答案解析:股东权益中的库藏股(treasury stock)是一个扣减项。库藏股的减少会增加股东权益。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料