下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理历年真题10道,附答案解析,供您考前自测提升!

1、Darden Crux, CFA, a portfolio manager at SWIFT Asset Management Ltd., (SWIFT) calls a friend to join him for dinner. The friend, a financial analyst at Cyber Kinetics (CK) declines the invitation and explains she is performing due diligence on Orca Electronics, a company CK is about to acquire. After the phone call, Crux searches the Internet for any news of the acquisition but finds nothing. Upon verifying Orca is on SWIFT’s approved stock list, Crux purchases Orca’s common stock and call options for selective SWIFT clients. Two weeks later, CK announces its intention to acquire Orca. The next day, Crux sells all of the Orca securities, giving the fund a profit of $3 million. What action should Crux most likely take to avoid violating any CFA Institute Standards of Professional Conduct?【单选题】

A.Refuse to trade based on the information.

B.Purchase the stock and call options for all clients.

C.Trade only after analyzing the stock diligently and thoroughly.

正确答案:A

答案解析:CFA Institute StandardsA is correct as members/candidates who possess material nonpublic information that could affect the value of an investment should not act or cause others to act on the information. Crux traded on the material information that Orca is about to be acquired by Cyber Kinetics. The information is non-public because it is not publicly available, which was verified when Crux researched Orca on the Internet and found nothing about the acquisition. Standard II (A).

2、A 180-day U.S. Treasury bill has a holding period yield (HPY) of 2.375%. The bank discount yield (in %) is closest to :【单选题】

A.4.640.

B.4.750.

C.4.875.

正确答案:A

答案解析:“Discounted Cash Flow Applications,” Richard A. Defusco CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA2010 Modular Level I, Vol. 1, pp. 253-257Study Session 2-6-d, eCalculate and interpret the bank discount yield, holding period yield, effective annual yield, and money market yield for a U.S. treasury billConvert among holding period yields, money market yields, effective annual yields, and bond equivalent yields.

3、Which of the following statements is most accurate? For a country to gain from trade it must have:【单选题】

A.an absolute advantage.

B.a comparative advantage.

C.economies of scale or lower labor costs.

正确答案:B

答案解析:“International Trade and Capital Flows,” Usha Nair-Reichert and Daniel Robert WitschiB is correct. A comparative advantage arises if one entity can produce an item at a lower opportunity cost than another. An absolute advantage in producing a good (or service) arises if one entity can produce that good at a lower cost or use fewer resources in its production than its trading partner. Even if a country does not have an absolute advantage in producing any of its goods, it can still gain from trade by exporting the goods in which it has a comparative advantage. The country with the lower opportunity cost (with the comparative advantage) should specialize and produce its low opportunity cost item, and the other country should produce the high opportunity cost item, trading the goods between each other to make both better off.

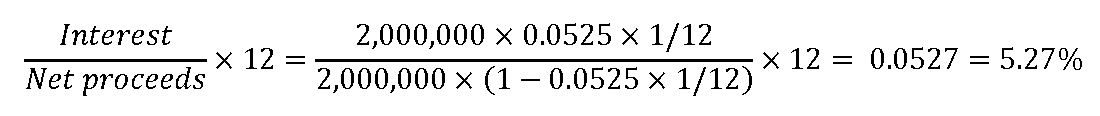

4、The effective annualized cost (%) of a banker’s acceptance that has an all-inclusive annual rate of 5.25% for a one-month loan of $2,000,000 is closest to:【单选题】

A.5.27.

B.5.38.

C.5.54.

正确答案:A

答案解析:“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFA 2013 Modular Level I, Vol. 4, Reading 40, Section 8.4., Example 7

5、Marguerite Warrenski, CFA, was a quantitative analyst in McDermott Investments.Warrenski dominated to develop several stock valuation models in McDermottInvestments.Warrenski recently left McDermott Investments and thenjoined Chandler Investments, a competitor of McDermott Investments.AtChandler Investments, Warrenski employs skills and experiences she learned atMcDermott Investments to develop a number of new stock valuation models,some of which are similar to those Warrenski developed at McDermott Investments.Has Warrenski most likely violated the Standards of Professional Conduct?【单选题】

A.No.

B.Yes, relating to loyalty to employer.

C.Yes, relating to record retention.

正确答案:A

答案解析:一旦员工离开了原来的公司,其技能和经验还是完全可以使用的,题目中也说明了Warrenski用了在原先公司中学到的技能研制了许多新的股票估值模型,虽然有些模型与原先公司的模型类似,但并不是一模一样的,所以也不违反对于雇主忠诚的行业行为标准。同时,Warrenski也没有带走原来公司的资料,也没有违反记录保存的行为标准。

6、A 3-year old investment firm plans to adopt Global Investment PerformanceStandards (GAPS?).To claim compliance with the GAPS?, the firm is initiallyrequired to present GAPS?-compliant performance history for at least:【单选题】

A.three years.

B.five years.

C.ten years.

正确答案:A

答案解析:遵守GAPS?最少的年限是5年,或自开业之日起计算年限。因为公司成立年限是3年,所以最初提交符合GAPS?要求的年限是3年。

7、An analyst does research about covariance.If the standard deviation of returnsof an asset is 0.8367%, the covariance of the asset's returns with themselves(in unit of percent squared) is closest to:【单选题】

A.0.70

B.0.91

C.1.00

正确答案:A

答案解析:变量与自身的协方差是其标准差的平方,即=0.70。

8、An analyst does research about accrual accounting.A retail store in a shoppingmall often pays its rent in advance.The originating entry to account for the rentmost likely reduces cash and records a(n):【单选题】

A.asset.

B.liability.

C.expense.

正确答案:A

答案解析:商场里的零售店提前预付房租,该房租属于待摊费用(prepaid expense)——资产类账户,现金已经支付,但费用不能马上全部确认,而是应该在一定期限内分摊费用。

9、An analyst does research about different inventory valuation methods.Which inventoryvaluation method least likely results in the same cost of sales for bothperiodic and perpetual inventory systems?【单选题】

A.FIFO.

B.LIFO.

C.Specific identification method.

正确答案:B

答案解析:本题考查的是永久性(perpetual)和周期性(periodic)的两种存货系统。需要注意的是,在FIFO和个别鉴别法(specific identification method)之下,两种存货系统产生的期末存货余额(ending inventory)和销货成本(COGS)是一样的;而在LIFO和加权平均成本法(weighted average cost method)之下,两种存货系统产生的期末存货余额和销货成本是不同的。

10、An analyst does research about capital budgeting.Which of the following capitalbudgeting criteria is most directly related to a company's equity value ofshareholders?【单选题】

A.Payback period.

B.Net present value.

C.Internal rate of return.

正确答案:B

答案解析:当投资项目有正的净现值时,会增加股东权益,从而导致股票价格上升。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料