What are the hedging strategies for stocks?

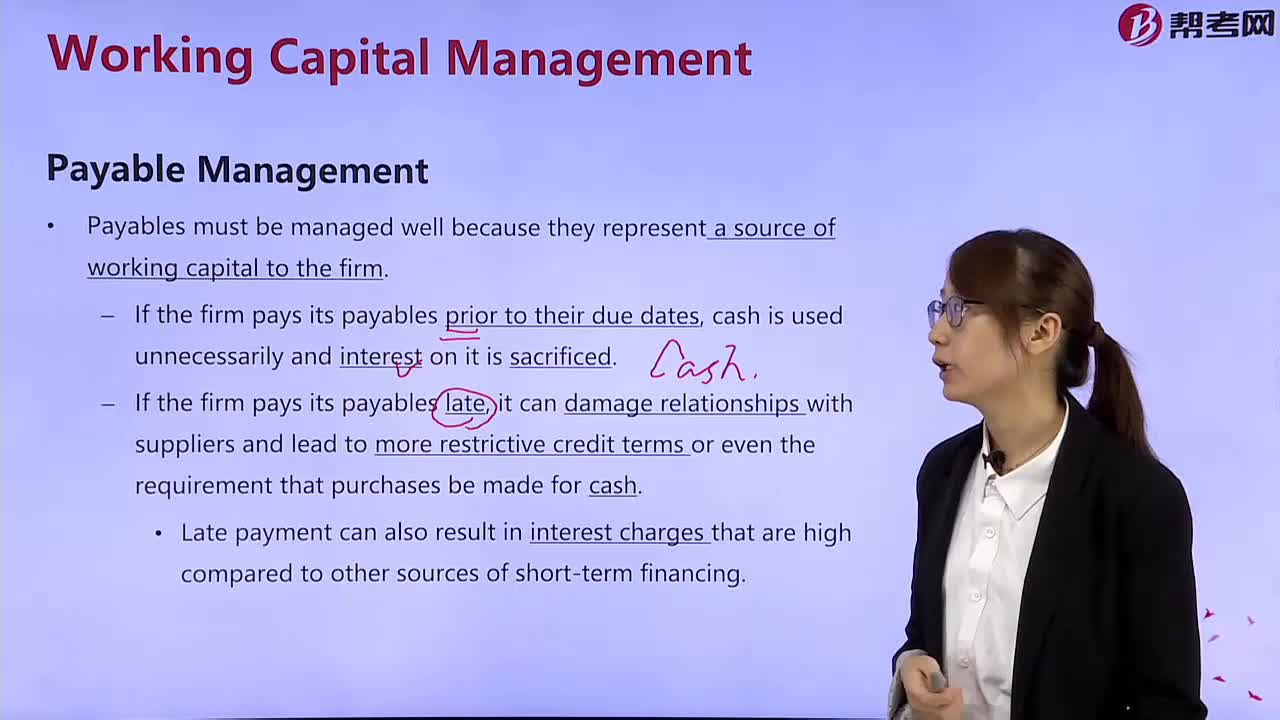

What are the accounts payable?

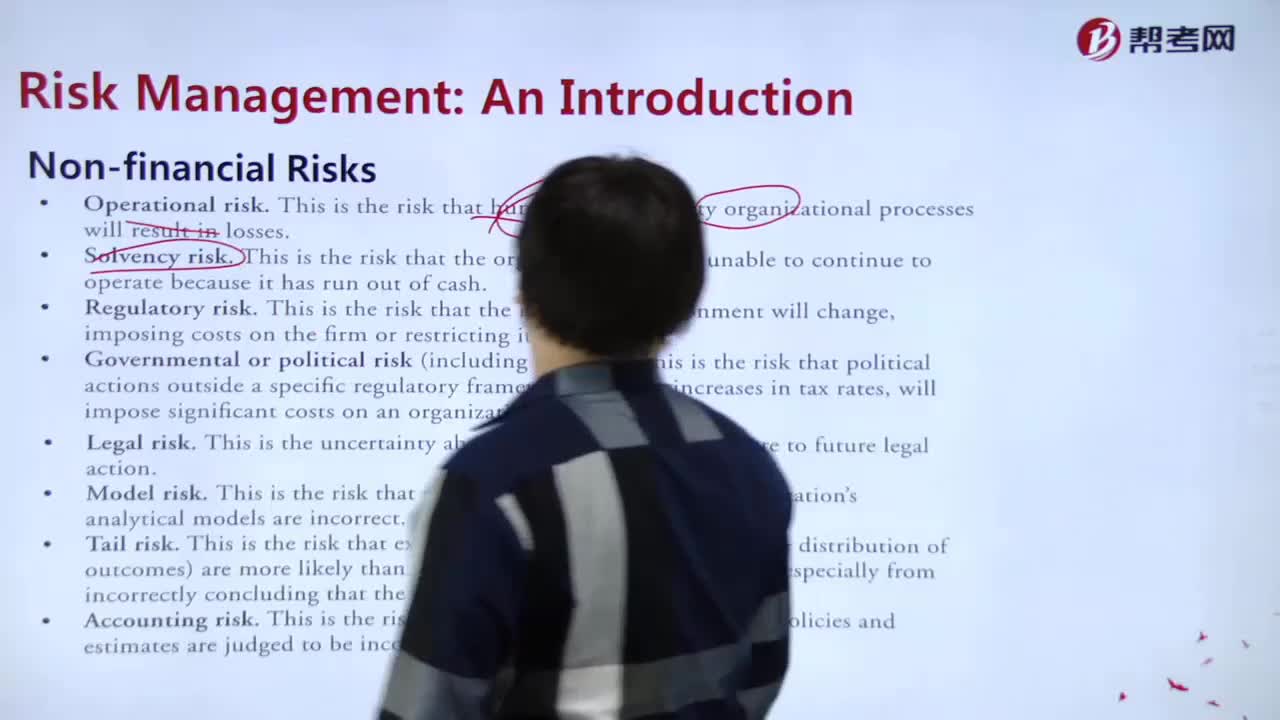

What are the non-financial risks?

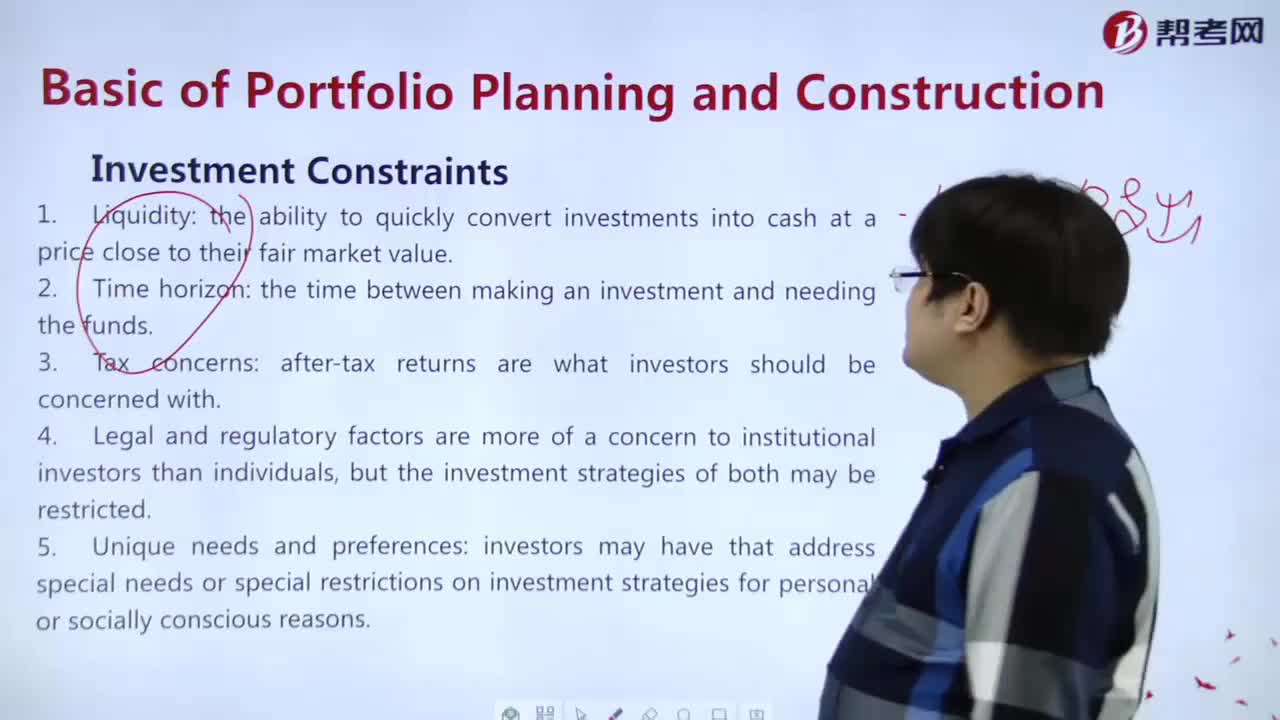

What are the constraints of investment?

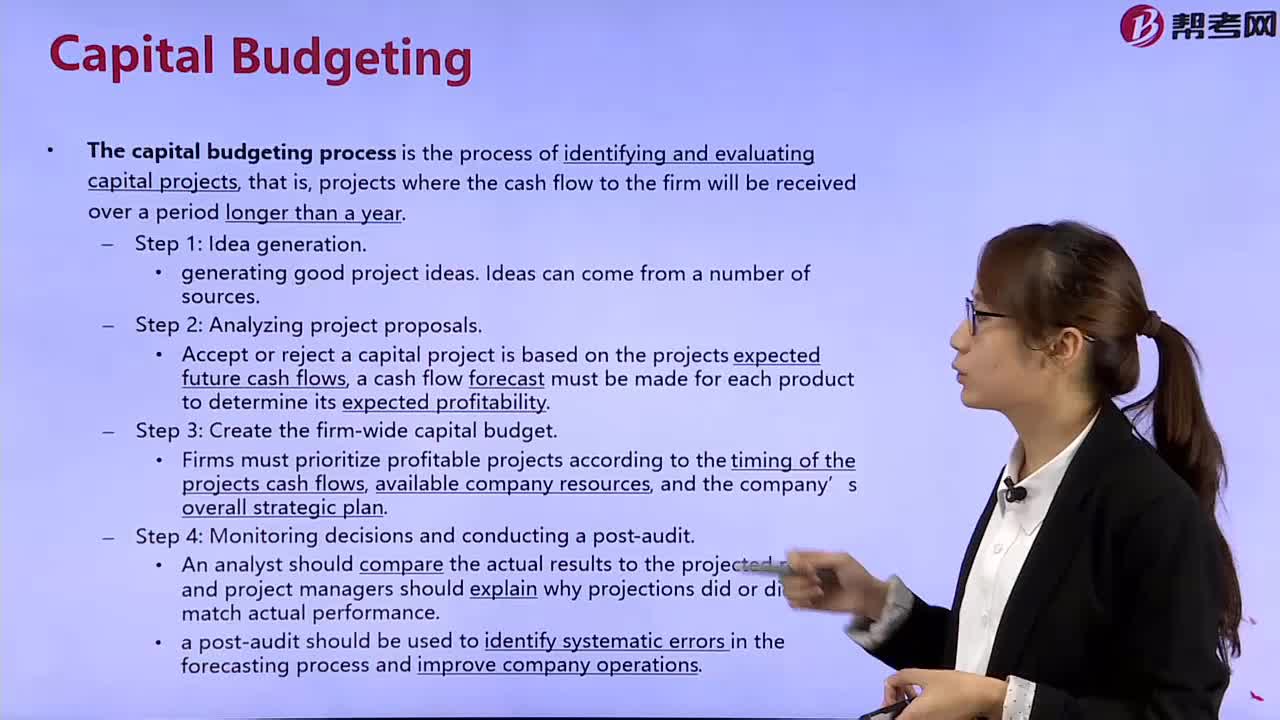

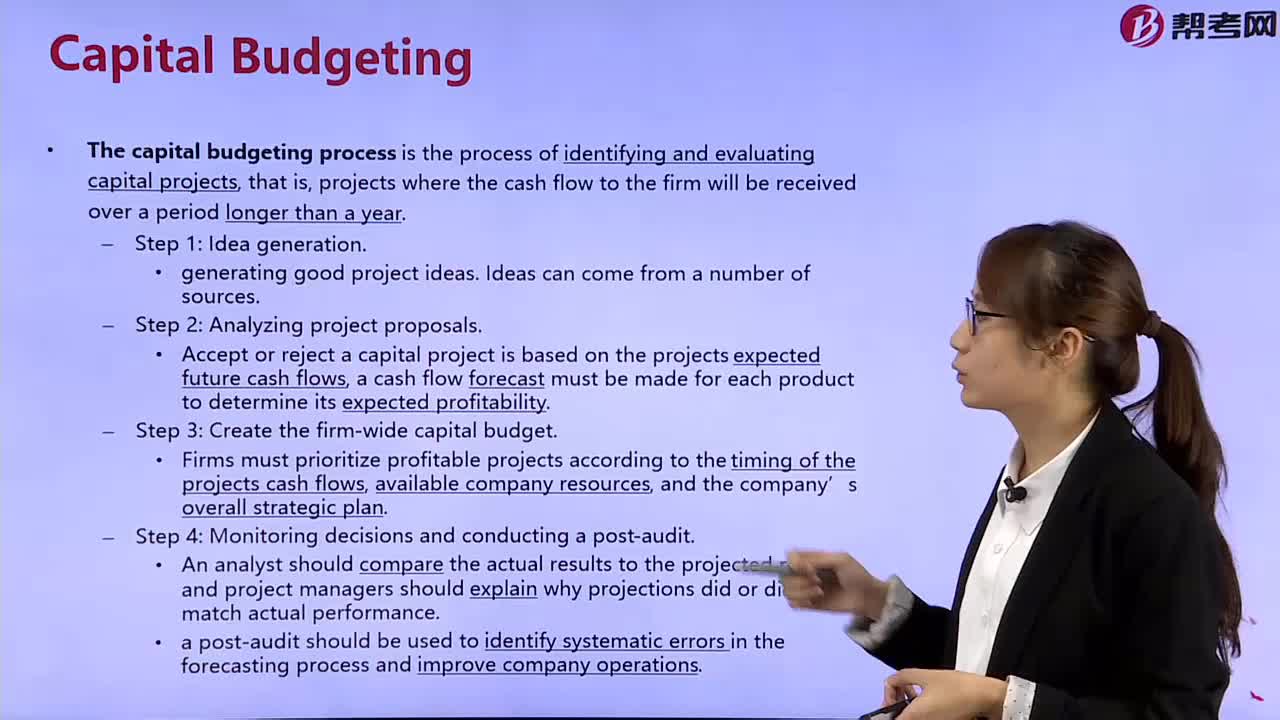

What are the steps for a capital budget?

What are the steps for a capital budget?

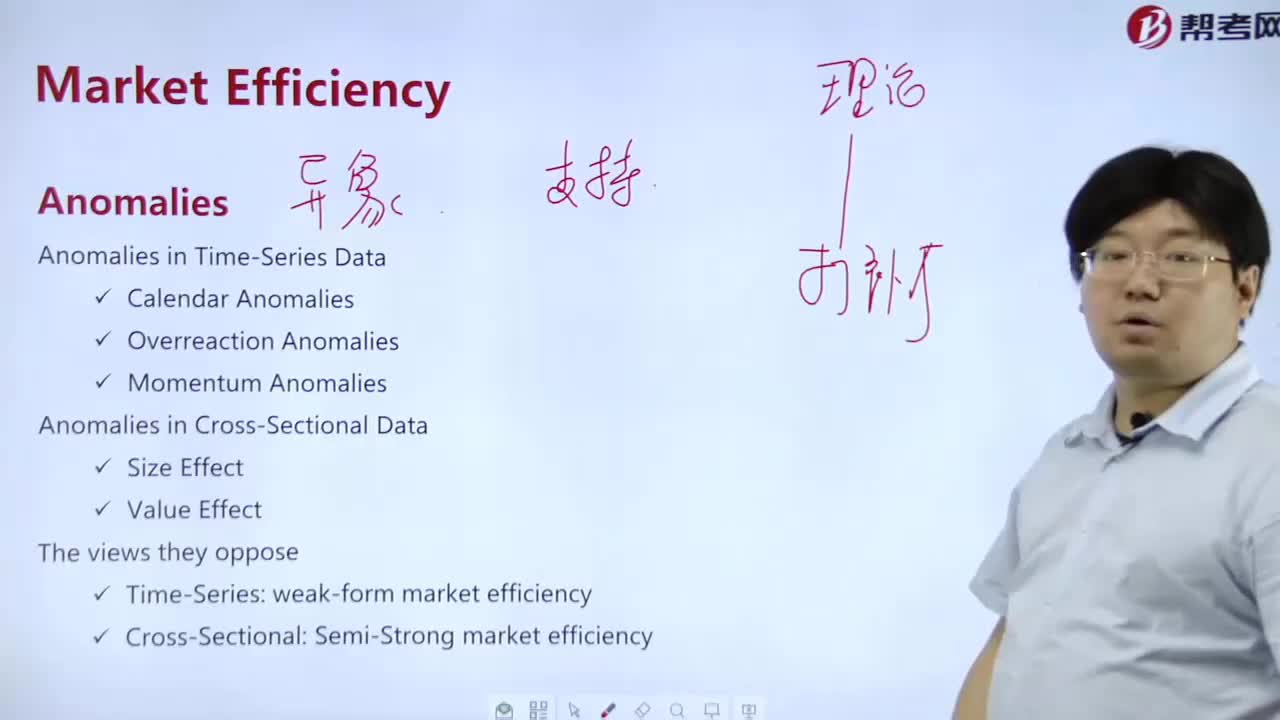

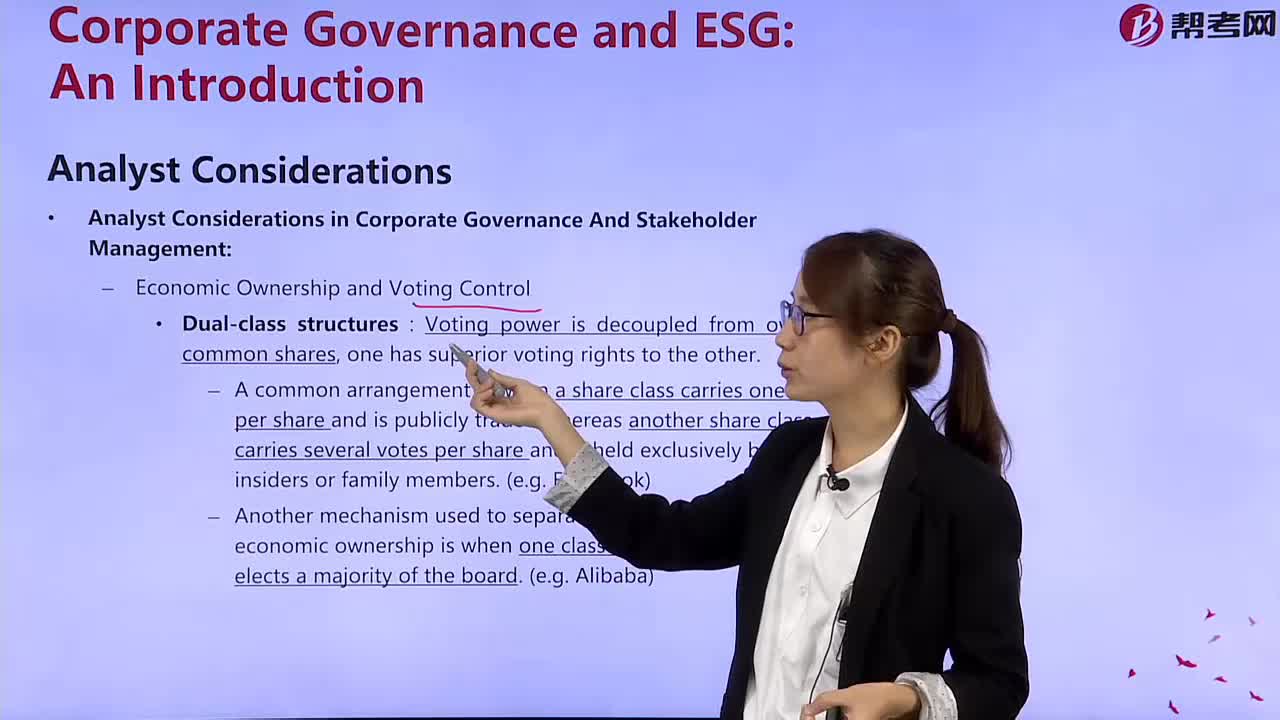

What are the issues that analysts are considering?

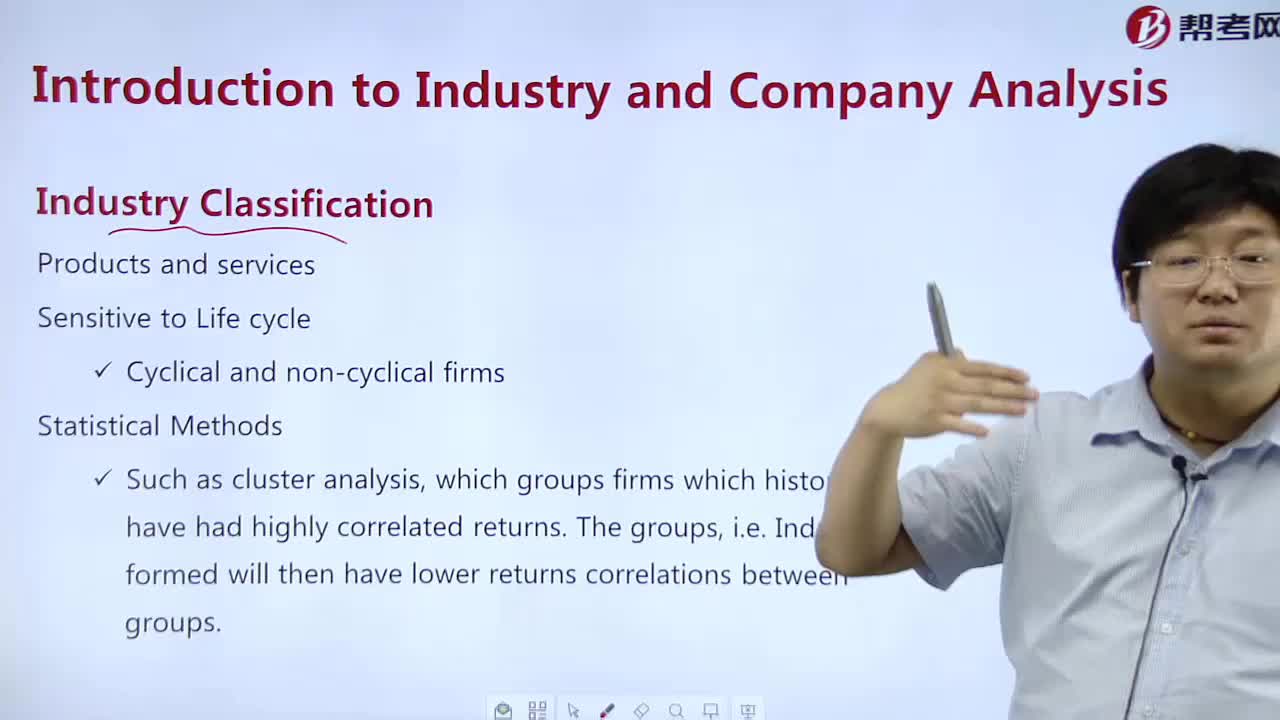

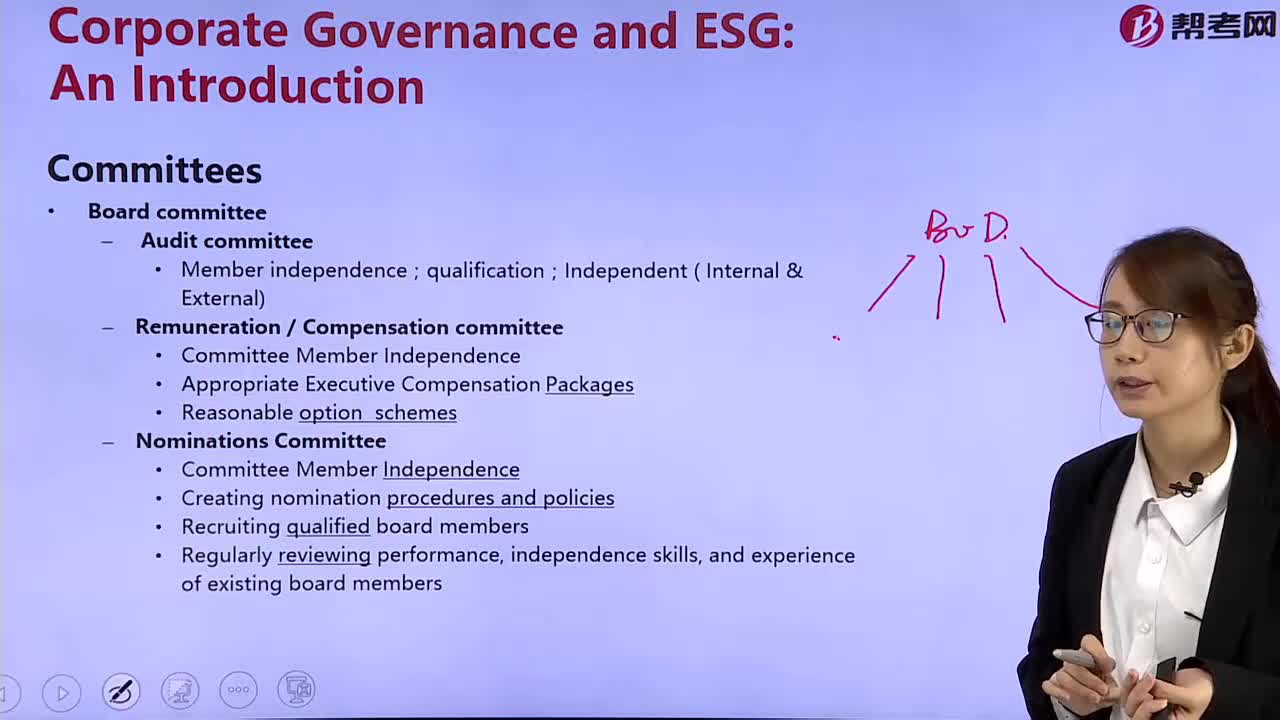

What are the committee's classifications?

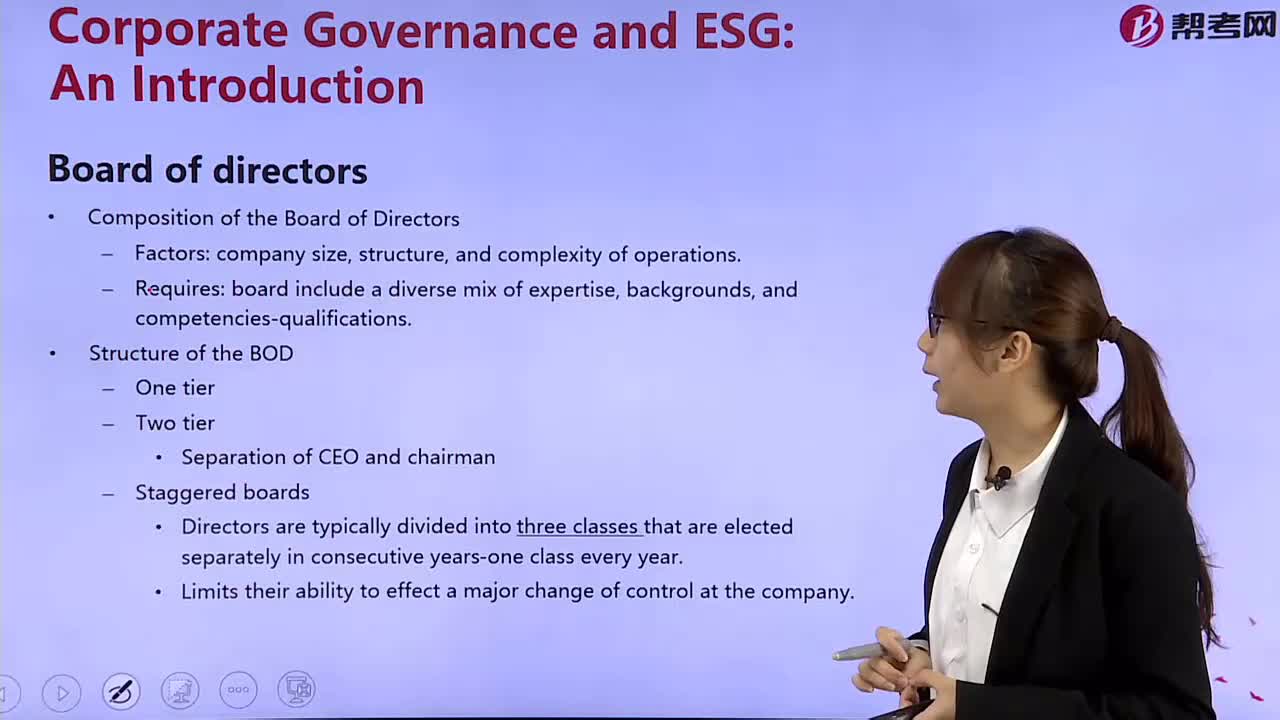

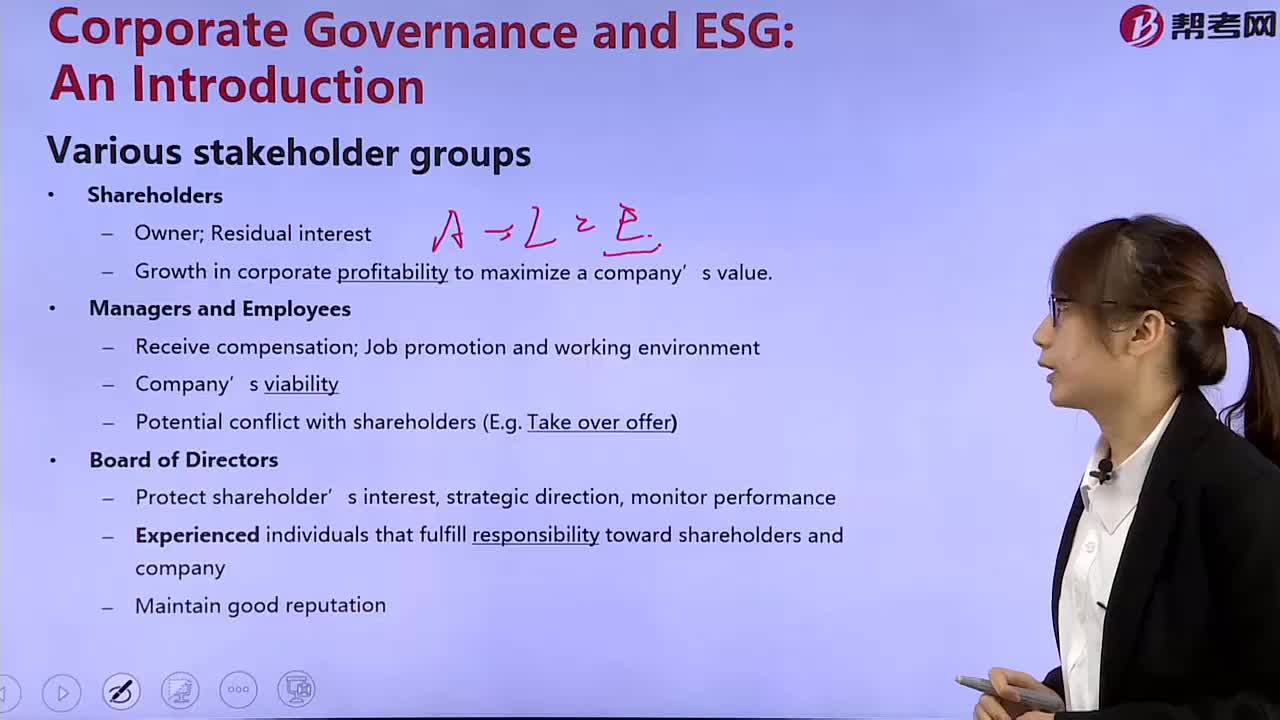

What are the requirements of the board members?

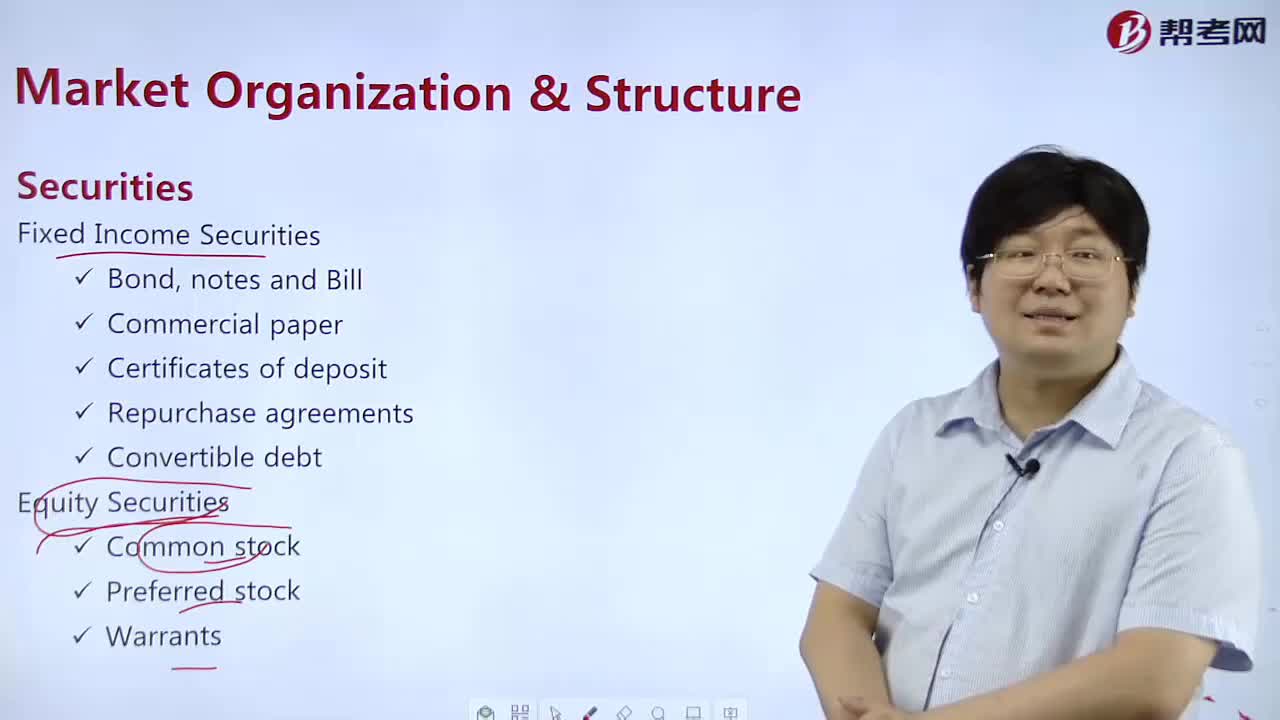

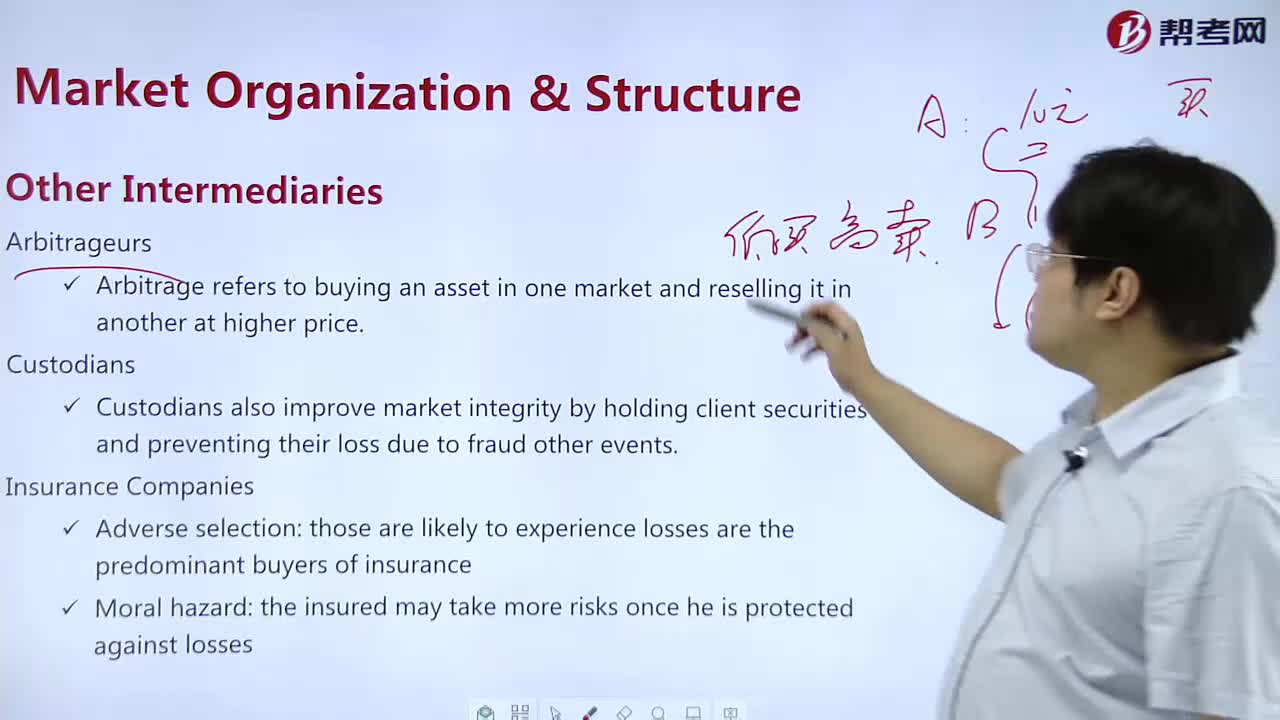

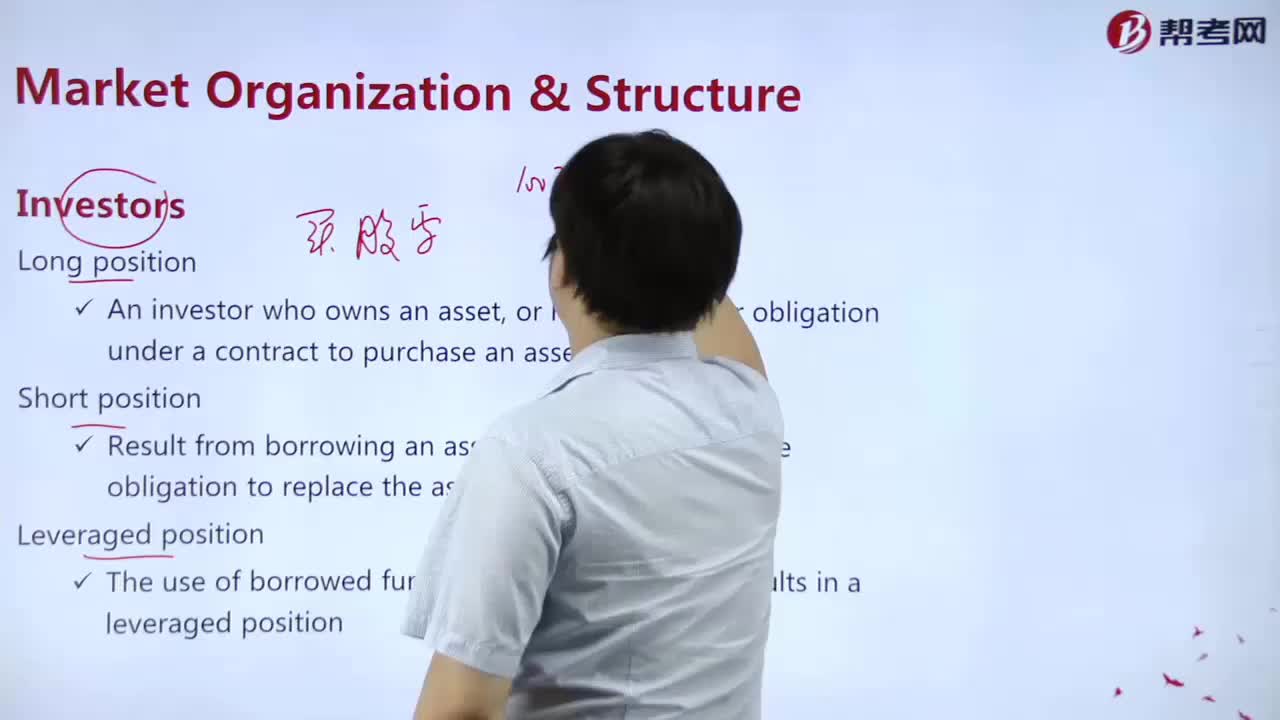

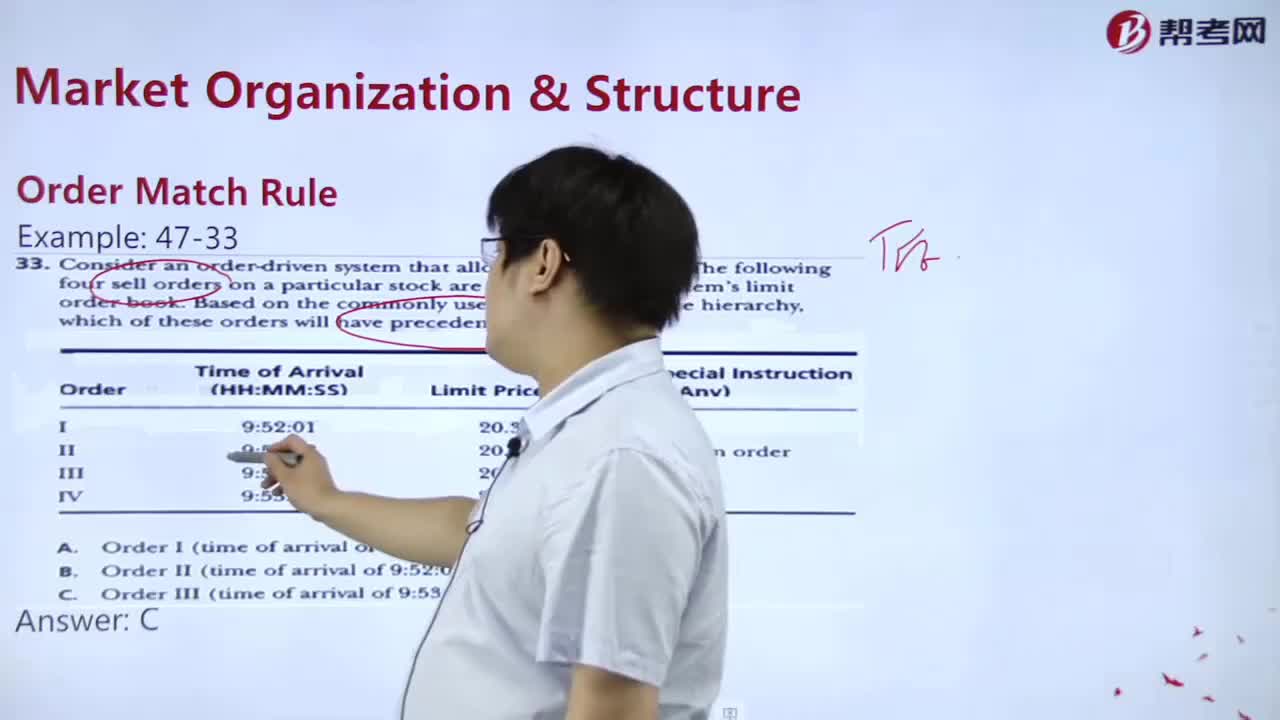

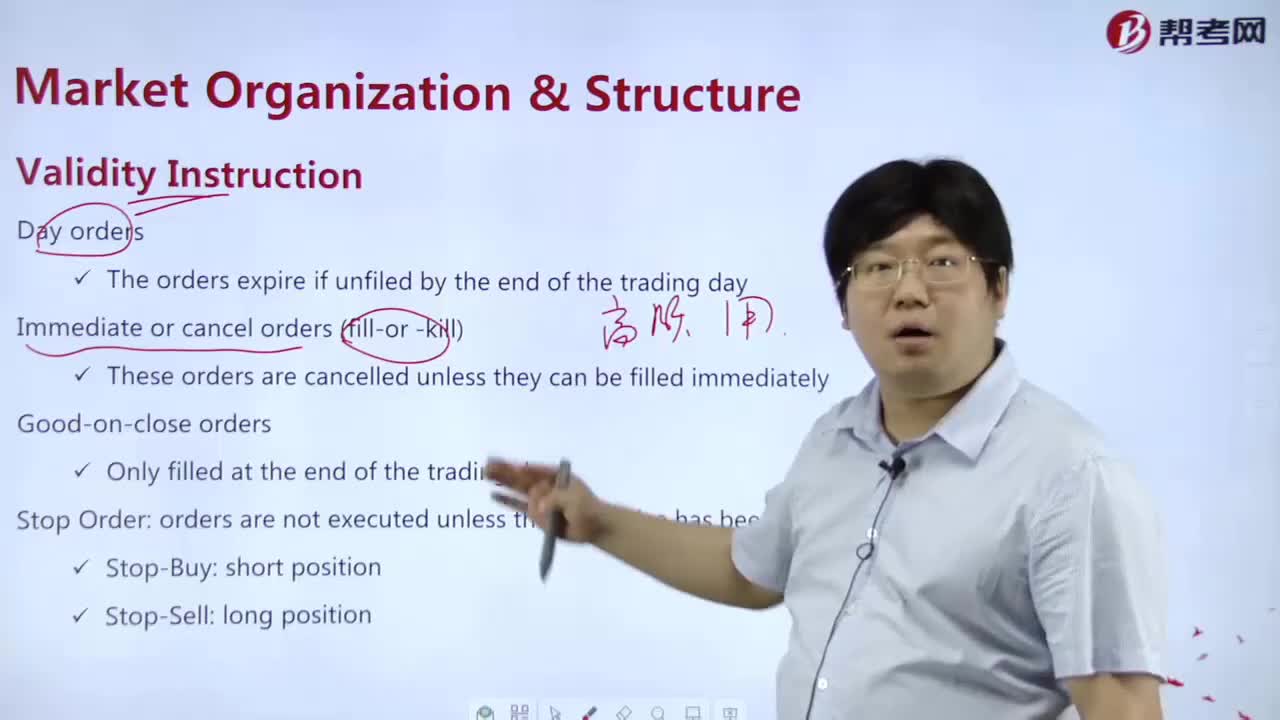

What are the objectives of the Marketing Organization?

What are the different stakeholders in the company?

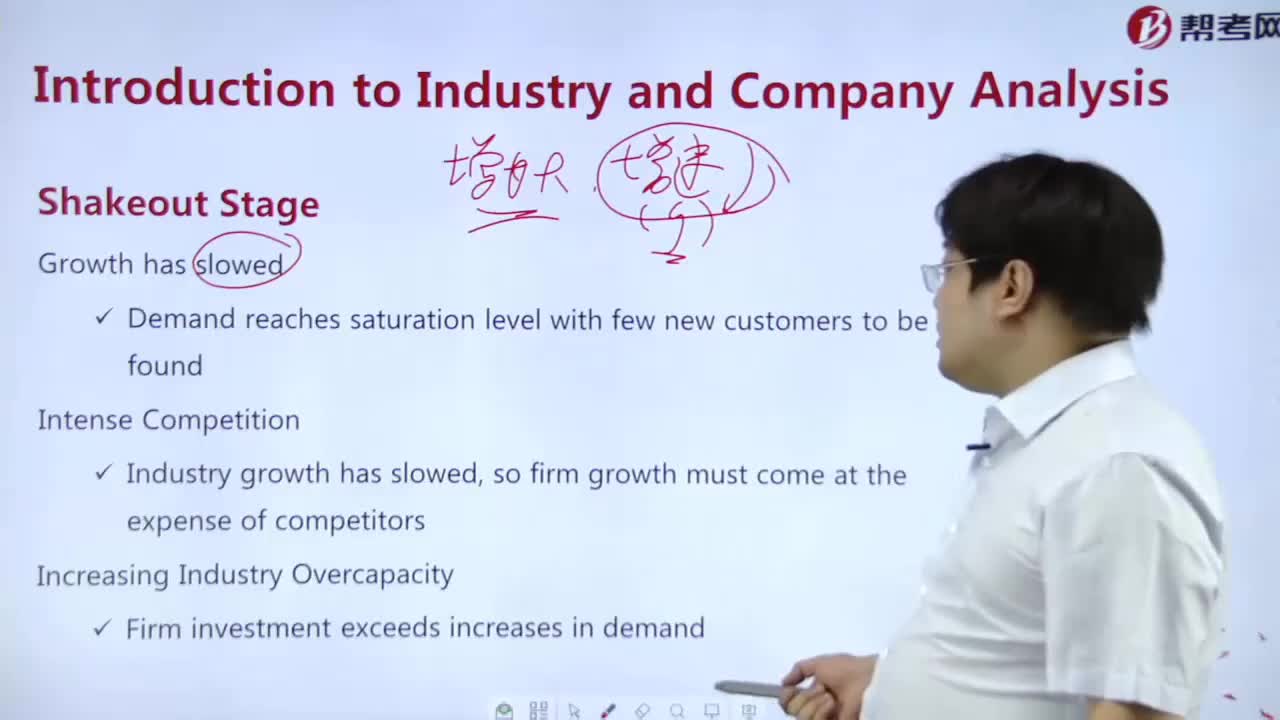

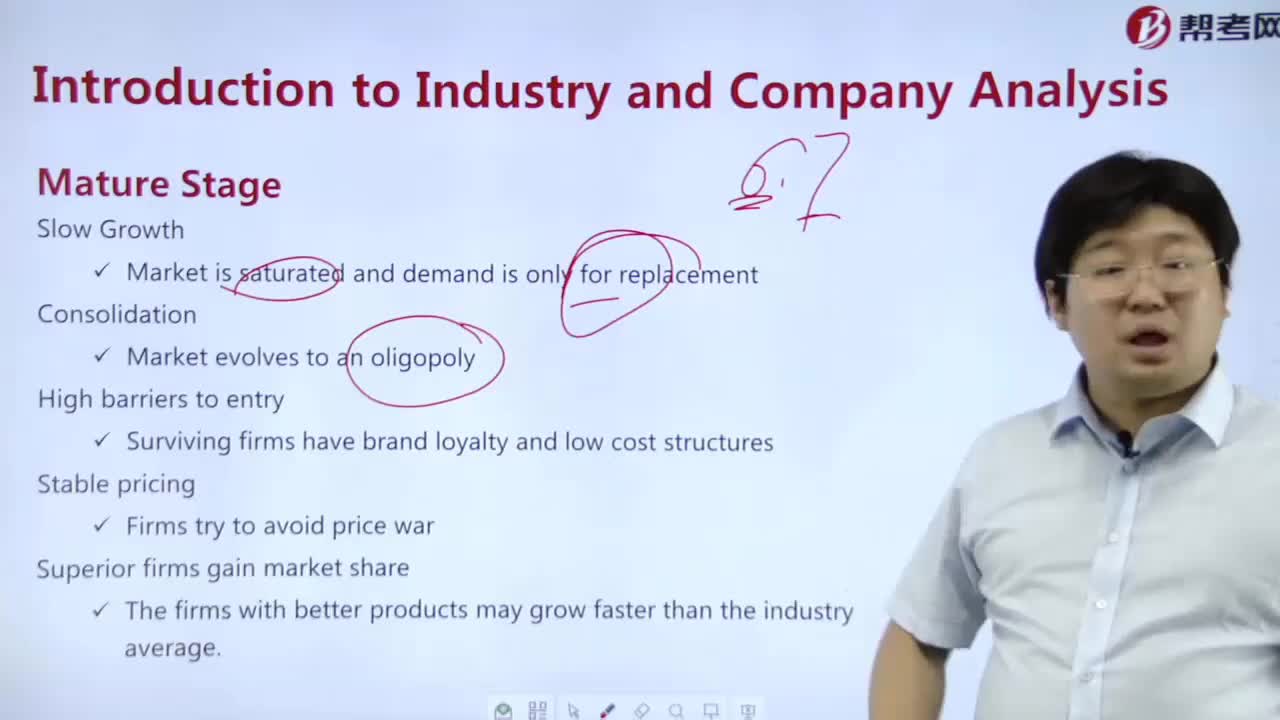

What are the characteristics of the growth period?

下载亿题库APP

联系电话:400-660-1360