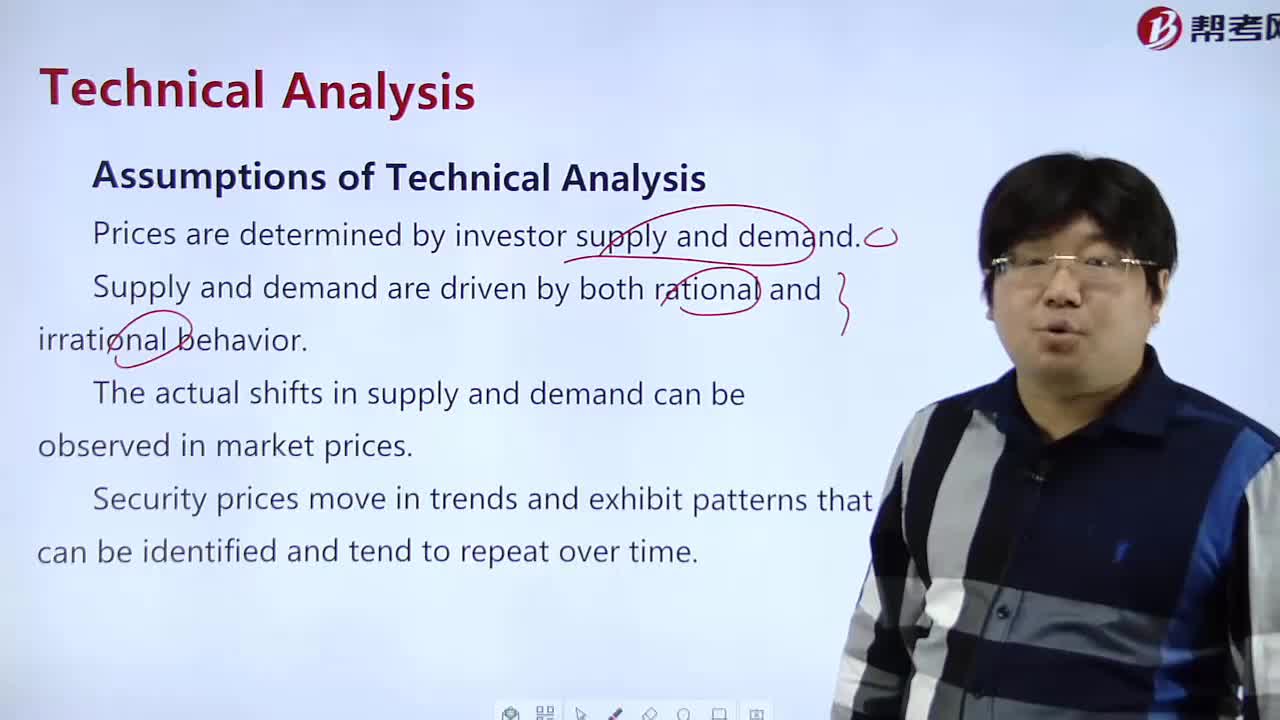

What are the assumptions of technical analysis?

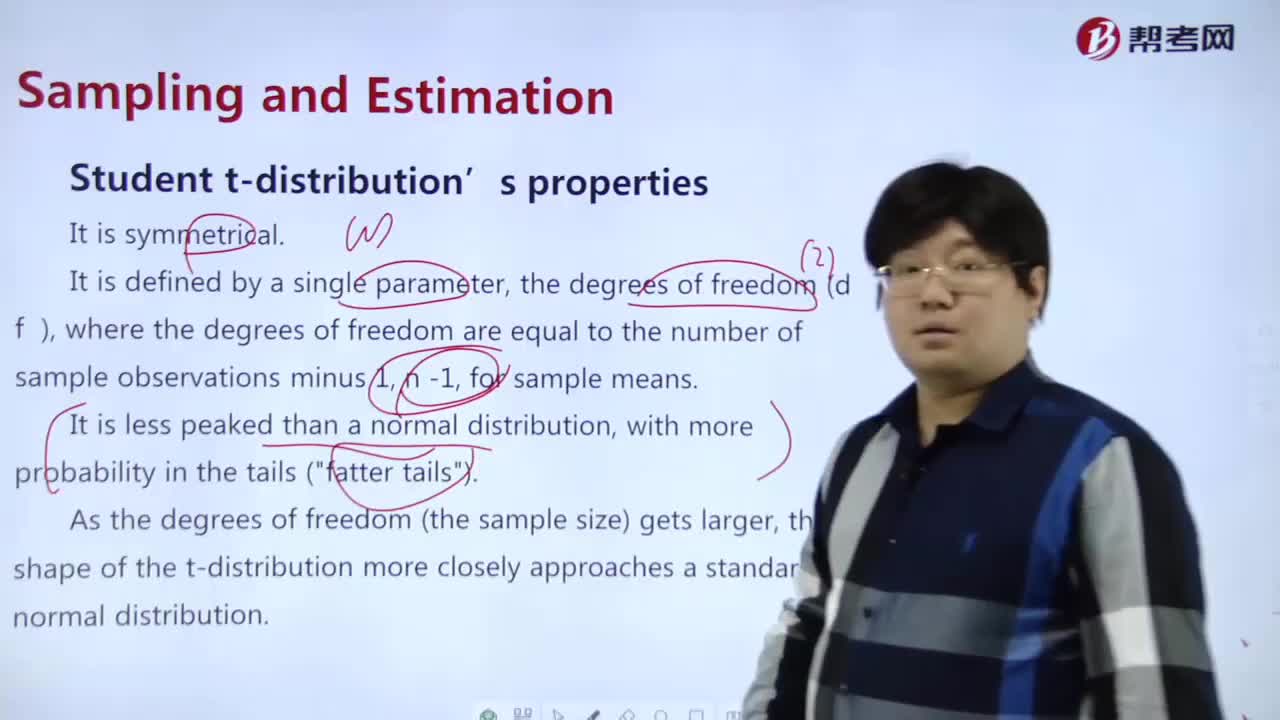

What are the attributes of the student distribution?

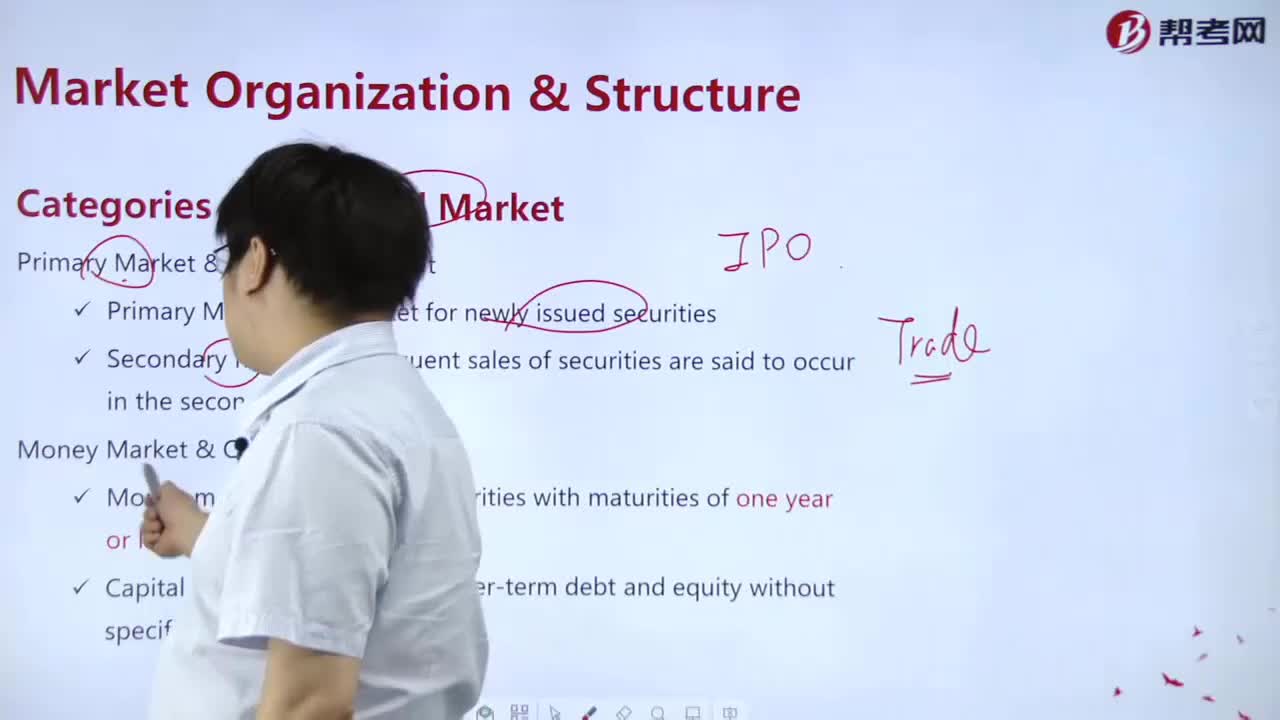

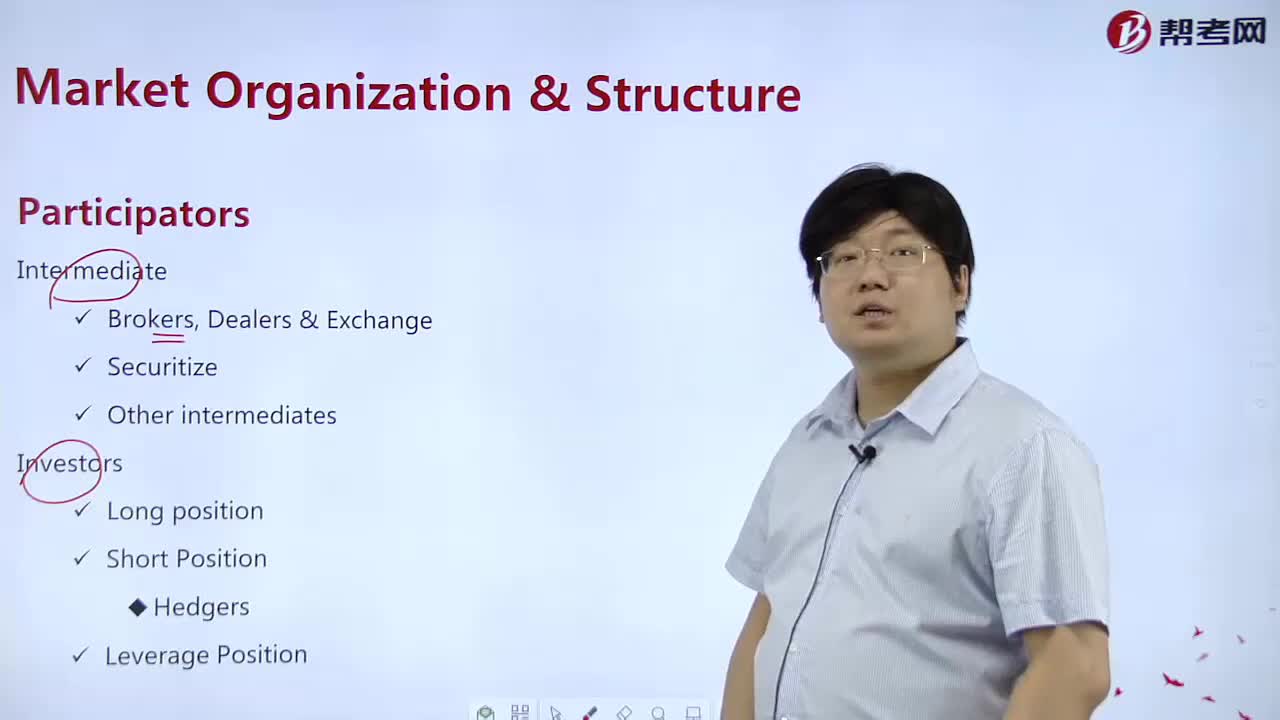

What are the types of contracts?

What are the advantages of derivatives?

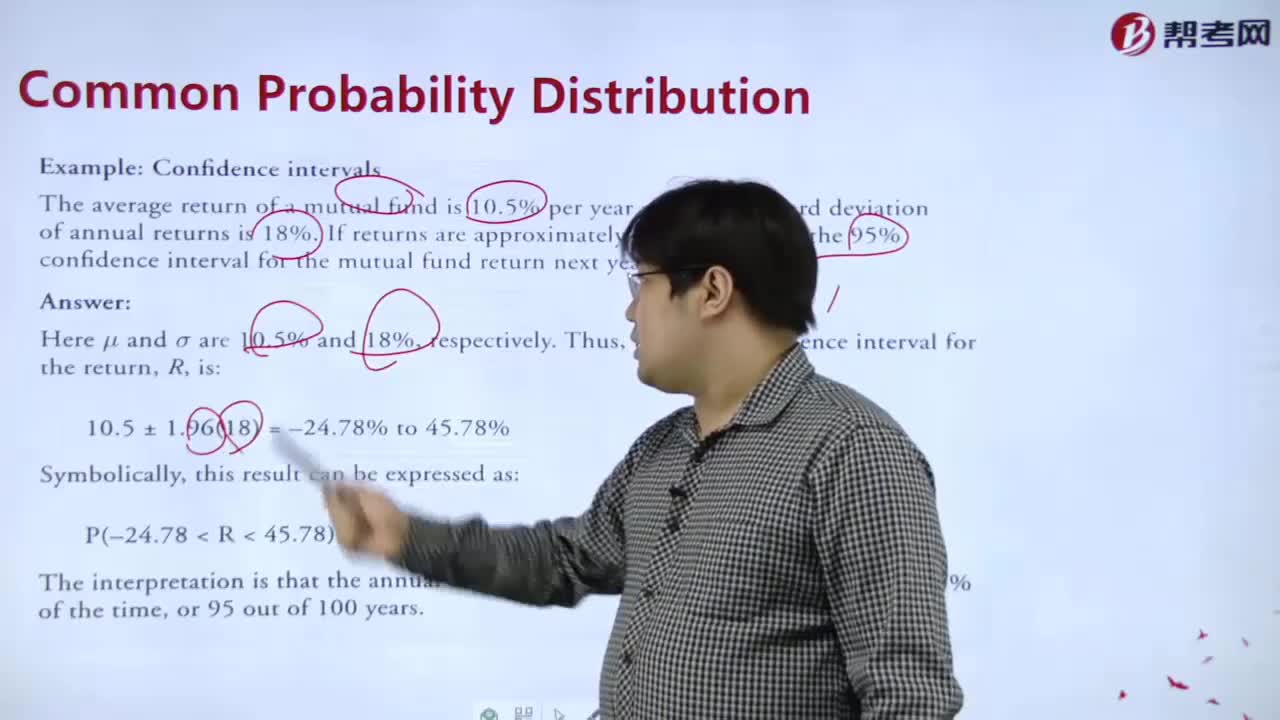

What are the properties of normal distribution?

What are the types of derivatives?

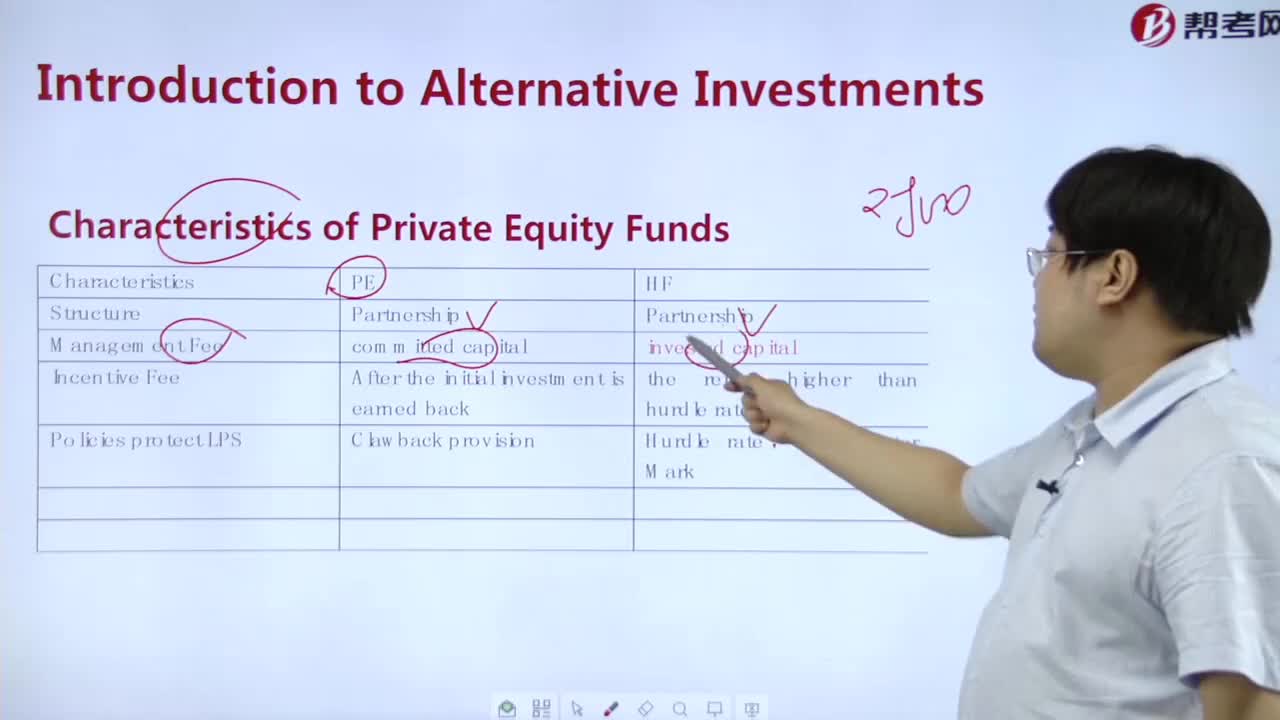

What are the characteristics of private equity?

What are the characteristics of hedge funds?

What are the types of alternative investments?

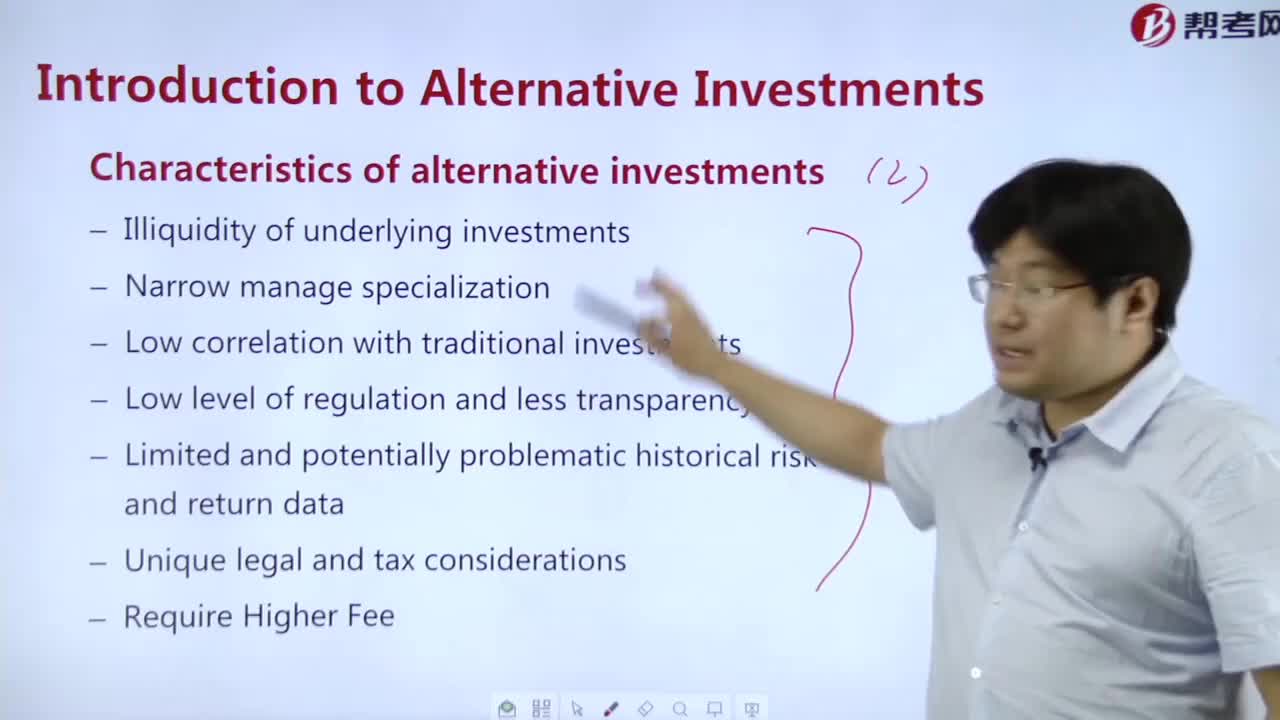

What are the characteristics of alternative investment?

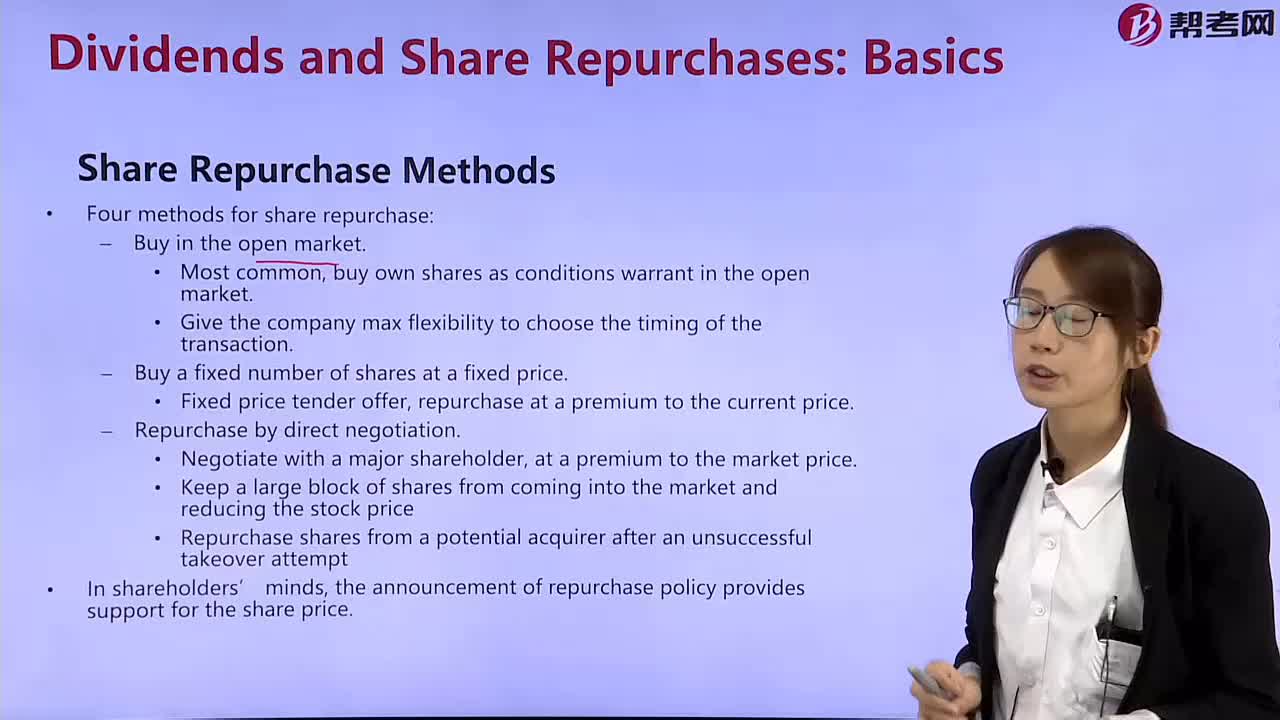

What are the methods of share repurchase?

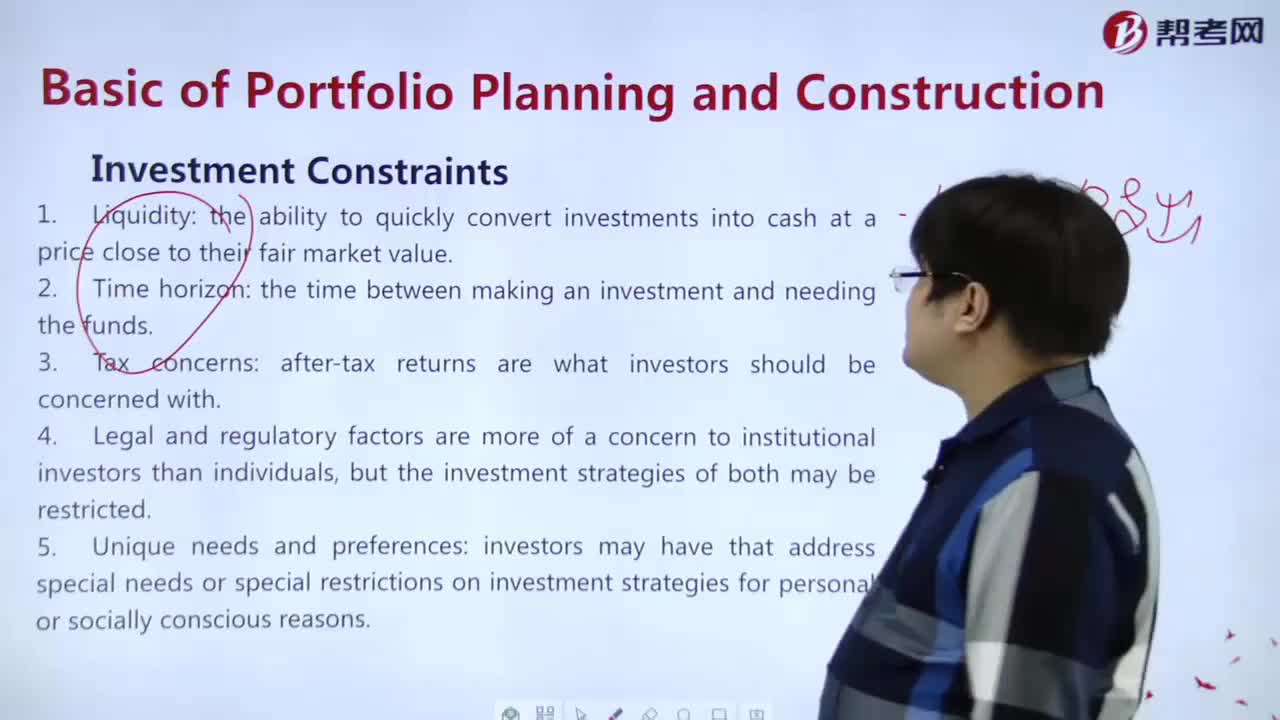

What are the constraints of investment?

下载亿题库APP

联系电话:400-660-1360