下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

The Production Function and Potential GDP

The neoclassical or Solow growth model is the framework used to determine the underlying sources of growth for an economy.

The model shows that the economy’s productive capacity and potential GDP increase because:

1 accumulation of such inputs as capital, labor, and raw materials used in production, and

2 discovery and application of new technologies that make the inputs in the production process more productive.

Two-factor production function

Y = AF(L,K)

A represents technological knowledge or total factor productivity (TFP).

TFP is a scale factor that reflects the portion of growth that is not accounted for by the capital and labor inputs. The main factor influencing TFP is technological change.

Two assumptions about the production function.

The production function has constant returnsto scale.

The production function exhibits diminishingmarginal productivity with respect to any individual input.

Diminishing marginal productivity of labor argued that as the population and labor force grew, the additional output produced by an additional worker would decline essentially to zero and there would be no long-term economic growth.

Diminishing marginal productivity of capital has two major implications for potential GDP:

1 Long-term sustainable growth cannot rely solely on capital deepening investment that increases the stock of capital relative to labor.

2 Given the relative scarcity and hence high productivity of capital in developing countries, the growth rates of developing countries should exceed those of developed countries. As a result, there should be a convergence of incomes between developed and developing countries over time.

Because of diminishing returns to capital, the only way to sustain growth in potential GDP per capita is through technological change or growth in total factor productivity.

The growth accounting equation

Growth in potential GDP = Growth in technology + WL (Growth in labor) + WC (Growth in capital)

Where WC and WL are the relative shares of capital and labor in national income.

The capital share is the sum of corporate profits, net interest income, net rental income, and depreciation divided by GDP.

The labor share is employee compensation divided by GDP.

For the US, WL and WC are roughly 0.7 and 0.3, respectively.

The growth accounting equation in per capita terms

Growth in per capita potential GDP = Growth in technology + WC (Growth in capital-to-labor ratio)

The capital-to-labor ratio measures the amount of capital available per worker and is weighted by the share of capital in national income.

89

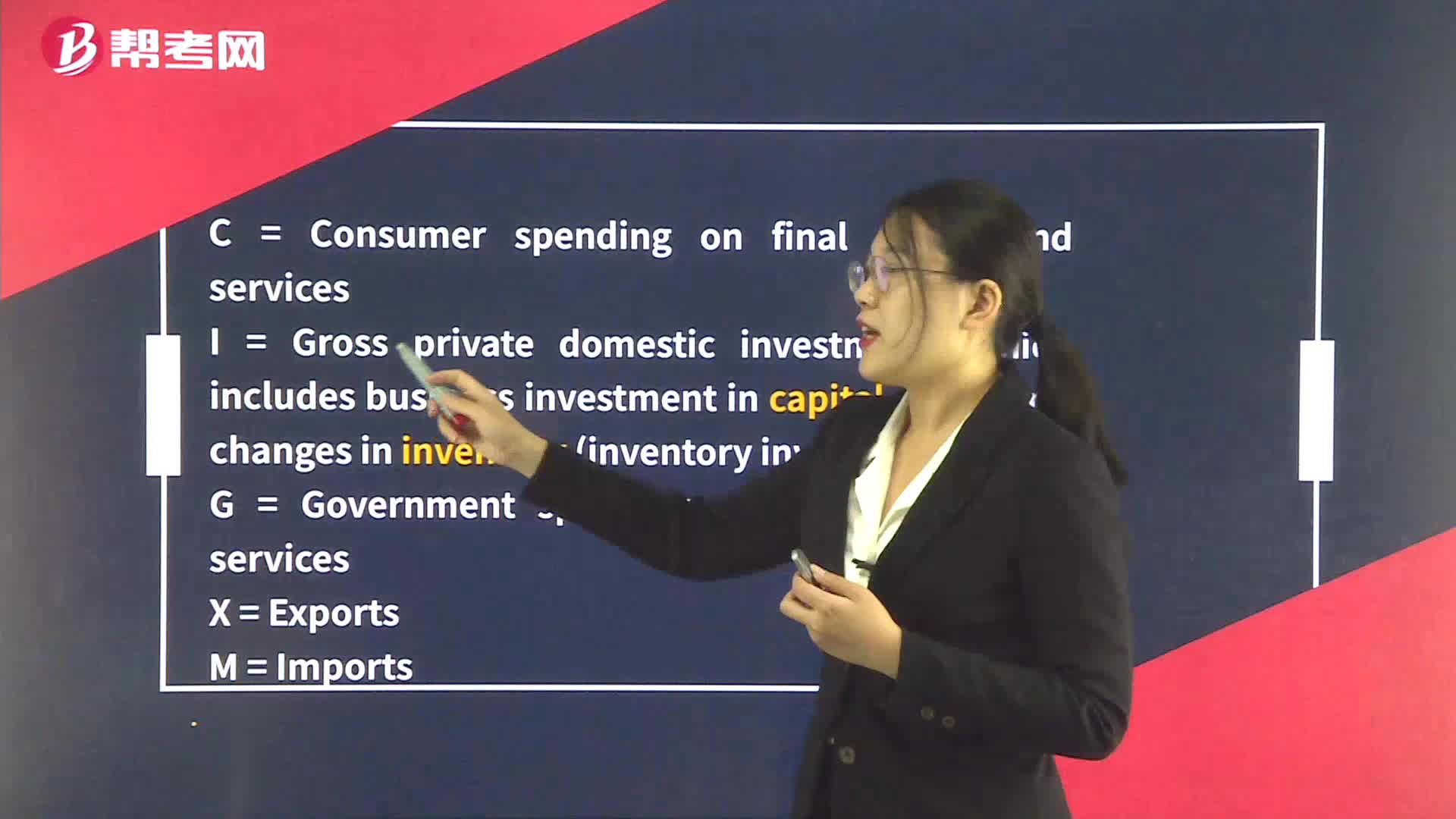

89The Components of GDP:The Components of GDP:servicesM = Imports

355

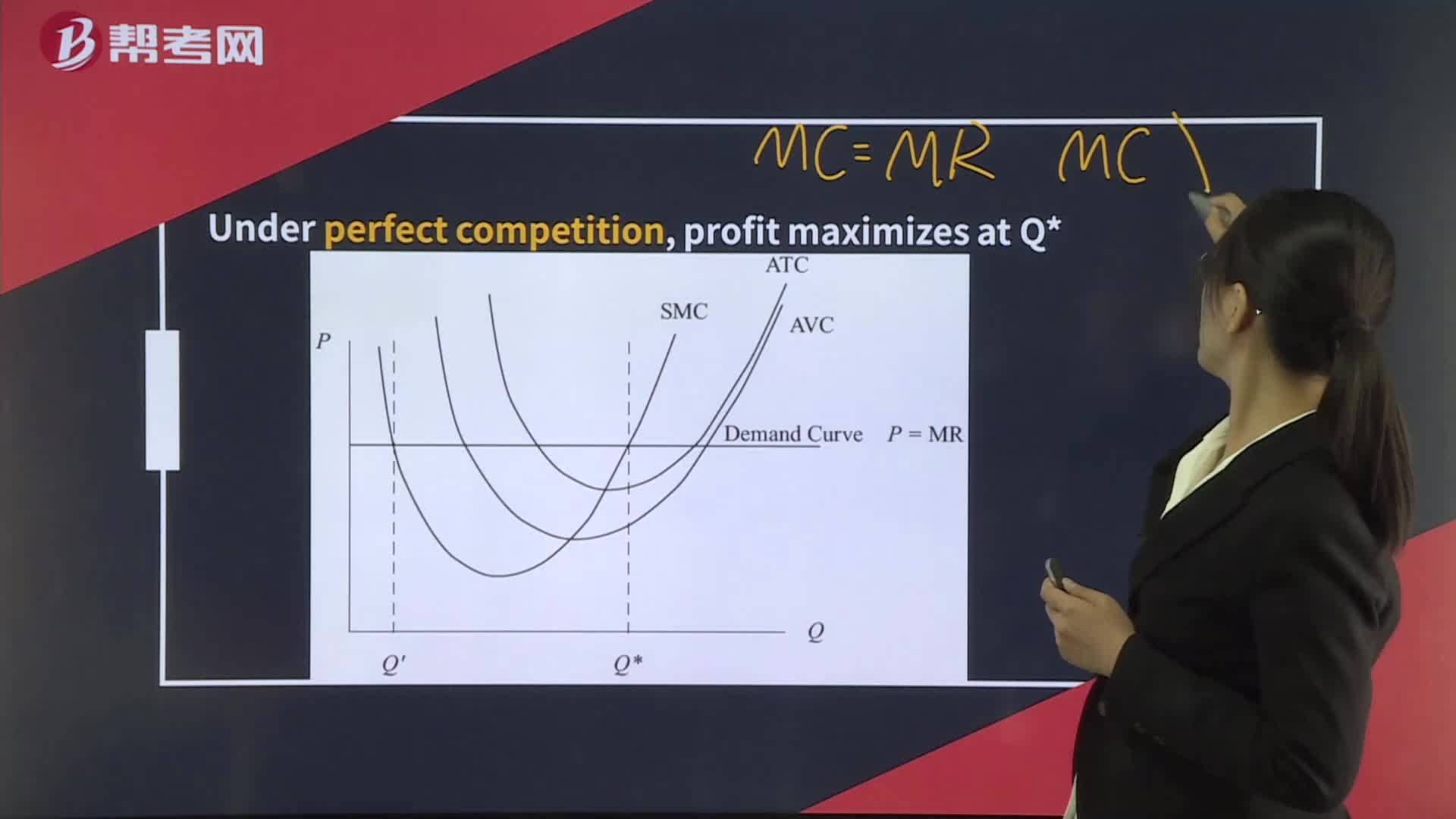

355Profit-Maximization, Breakeven, and Shutdown Points of Production:Points of Production:competition[Practiceminimized does not necessarily correspond to a profit maximum.

87

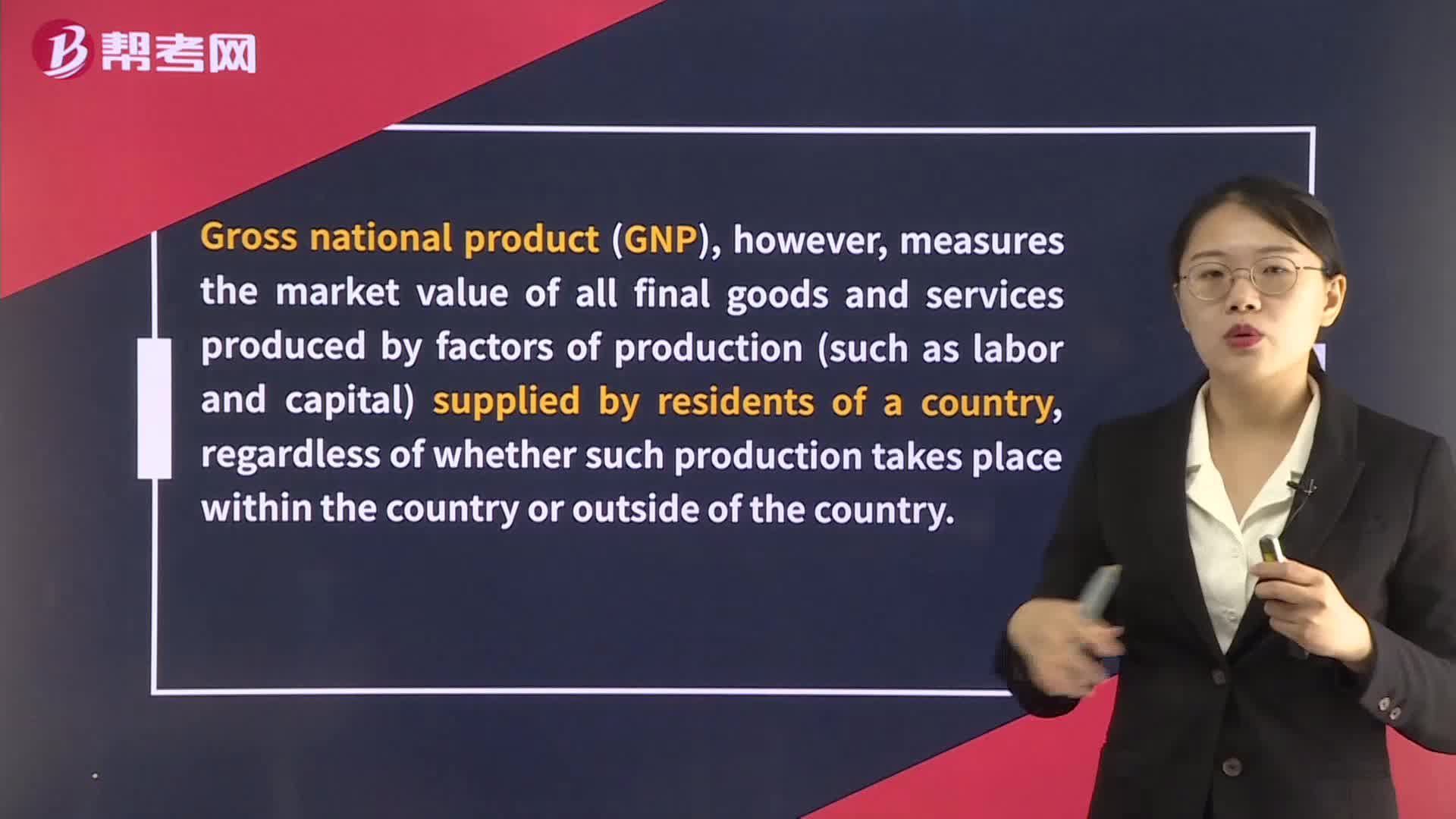

87GDP and GNP:quarter.,Gross,outside of the country.

微信扫码关注公众号

获取更多考试热门资料