下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

各位小伙伴大家好,美国CPA考试共有三种题型:选择题,案例分析题和写作题,不同科目题型分配不同,为了帮助大家更好地备考,帮考网带来了练习题供大家练习,帮助大家熟悉题型和积累答题经验,具体内容如下:

1.Kale Co. purchased bonds at a discount on the open market as an investment and intends to hold these bonds to maturity. Kale should account forthese bonds at:

a. Fair value.

b. Lower of cost ormarket.

c. Amortized cost.

d. Cost.

答案:C

Explanation

Choice "c" is correct. Bond investments which are intended to be held until the maturity date are classified as held-to-maturity securities and are reported at their amortized cost.

Choice "d" is incorrect. Investments in marketable securities are reported at fair value orat their amortized cost, depending on their classification.

Choice "a" is incorrect. Trading securities and available-for-sale securities are reported at their fair value.

Choice "b" is incorrect. The lower of cost ormarket method is no longer used to account formarketable securities.

2.On both December 31, Year 1, and December 31, Year 2, Kopp Co.\\\'s only marketable equity security had the same market value, which was below cost. Kopp considered the decline in value to be temporary in Year 1 but other than temporary in Year 2. At the end of both years the security was classified as an available-for-sale asset. Kopp could not exercise significant influence over the investee. What should be the effects of the determination that the decline was other than temporary on Kopp\\\'s Year 2 net available-for-sale assets and net income?

a. No effect on both net available-for-sale assets and net income.

b. No effect on net available-for-sale assets and decrease in net income.

c. Decrease in both net available-for-sale assets and net income.

d. Decrease in net available-for-sale assets and no effect on net income.

答案:B

Explanation

Choice "b" is correct. In Year 1, the security would be written down to fair value. The unrealized holding loss would be reported in other comprehensive income. In Year 2, the unrealized holding loss would be removed from accumulated other comprehensive income and recognized in earnings as a realized loss since the decline is classified as other than temporary in Year 2. This Year 2 entry has no effect on available-for-sale assets and decreases net income by the amount of the realized loss.

Choice "a" is incorrect. In Year 2, the unrealized holding loss would be removed from accumulated other comprehensive income and recognized in earnings as a realized loss.

Choice "d" is incorrect. In Year 1, the security would be written down to fair value. The unrealized holding loss would be reported in other comprehensive income. In Year 2, the unrealized loss would be removed from accumulated other comprehensive income and recognized in earnings as a realized loss.

Choice "c" is incorrect. In Year 1, the security would be written down to fair value.

以上就是今天分享的全部内容了,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注帮考网!

86

862020年AICPA考试用什么教材学习?:2020年AICPA考试用什么教材学习?在美国有数百种AICPA考试的辅导书籍或资料,Becker's CPA Review 教材和学习系统在美国已有50年以上历史,使用Becker教材通过美国注册会计师考试的人数是未使用该教材人数的两倍;75%的考试通过者、90%的一次通过者以及95%的高分区学员皆选用Becker教材。美国各地超过70多所大学院校选择Becker教材作为他们的课程。

22

222020年美国CPA考哪些科目?:2020年美国CPA考哪些科目?2020年美国CPA考试科目有:FAR财务会计与报告,AUD审计与鉴证,REG法规,BEC商业环境与理论。共有3种考试题型:分别是选择题,案例分析题,写作题。不同科目题型分配不同,FAR,AUD,REG都是有50%的选择题和50%的案例分析题组成,另外BEC还有个写作题,其BEC题型是由50%的选择+35%的案例分析+15%的写作题组成。

42

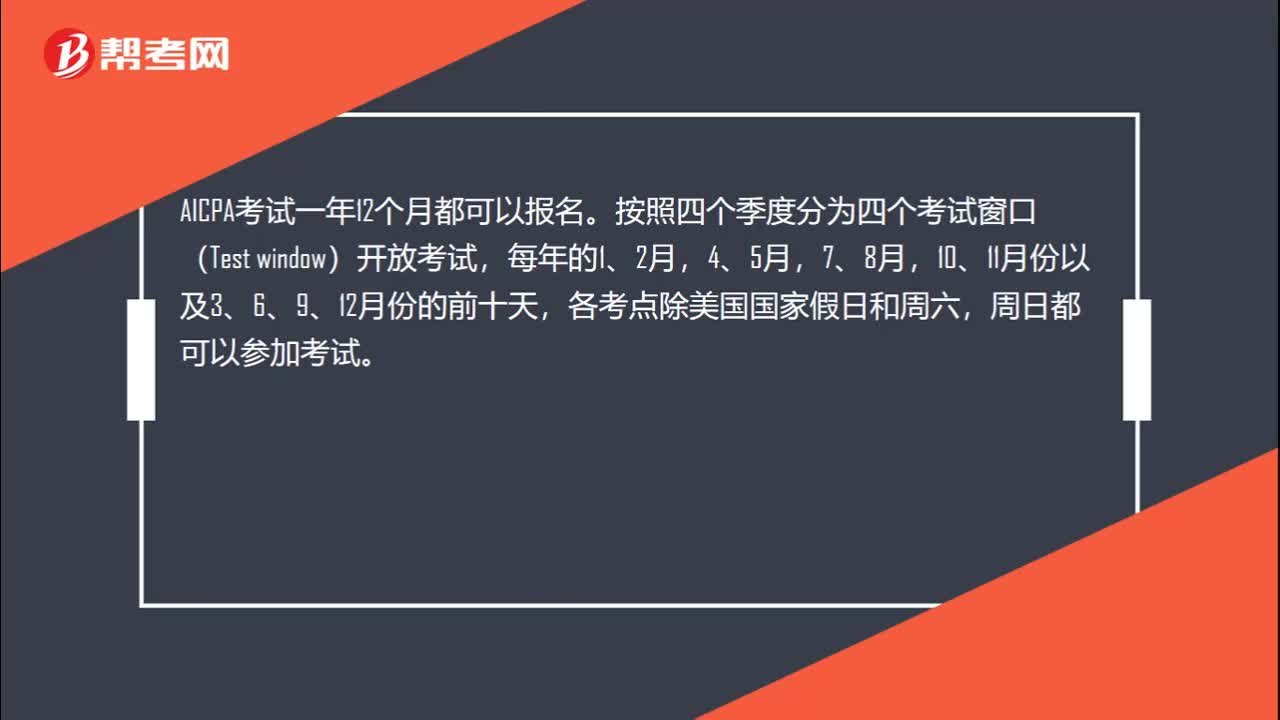

422020年AICPA考试预约考试后多久收到NTS准考证?:2020年AICPA考试预约考试后多久收到NTS准考证?NTS大约需要二到八周才能到达。在大多数州,一旦你收到NTS,它的有效期为六个月,你可以一次申请多个考试科目部分。当你重新申请时,收到你的NTS通常只需要1-2周时间。中国考生申请考试一般需要2-3个月的时间,取得NTS后,建议考生在考前45天去预约考试日期,以确保能参加考试。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料