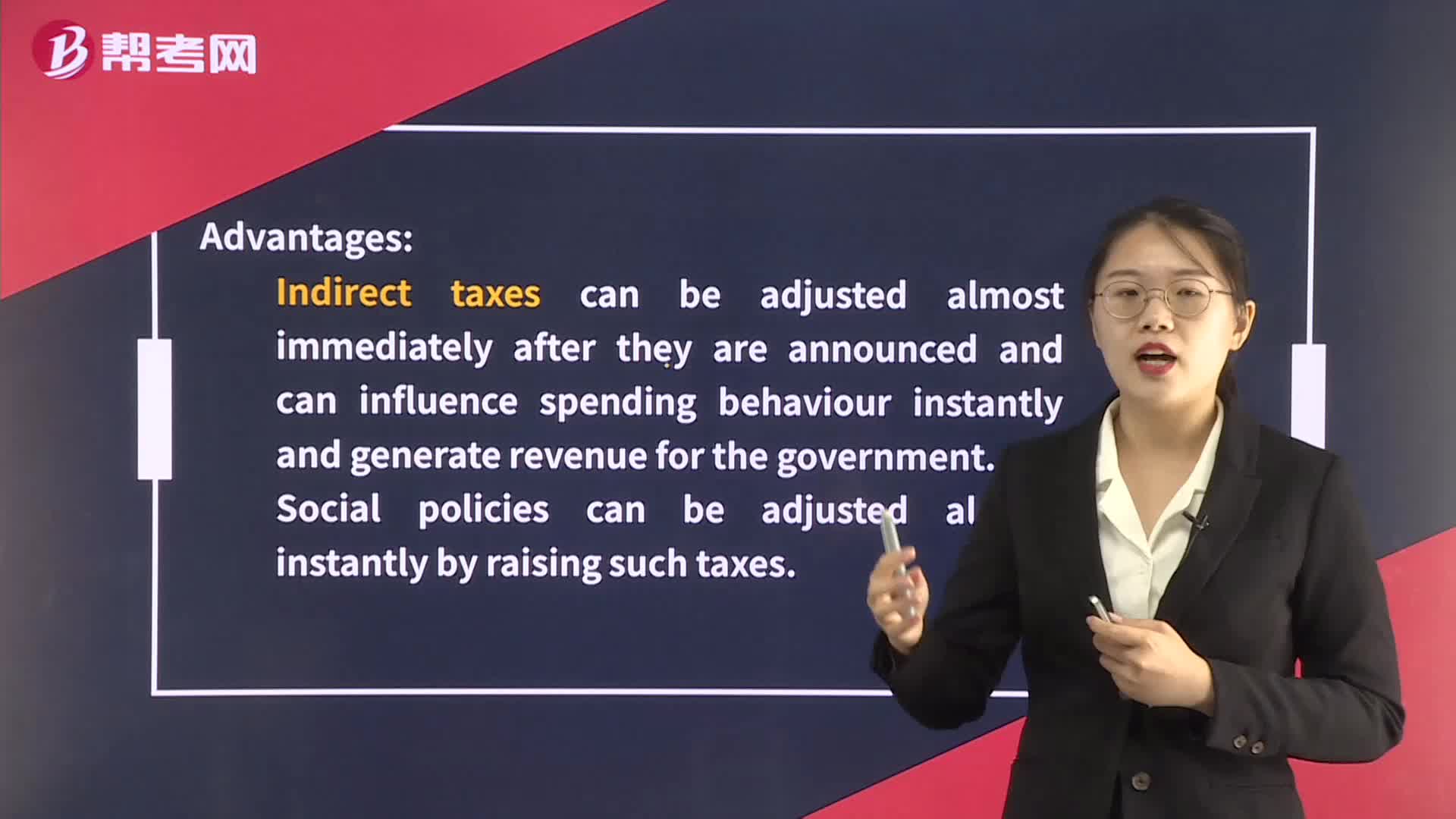

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

Factors Influencing the Mix of Fiscal and Monetary Policy

Deficits and the Fiscal Stance

The Production Function and Potential GDP

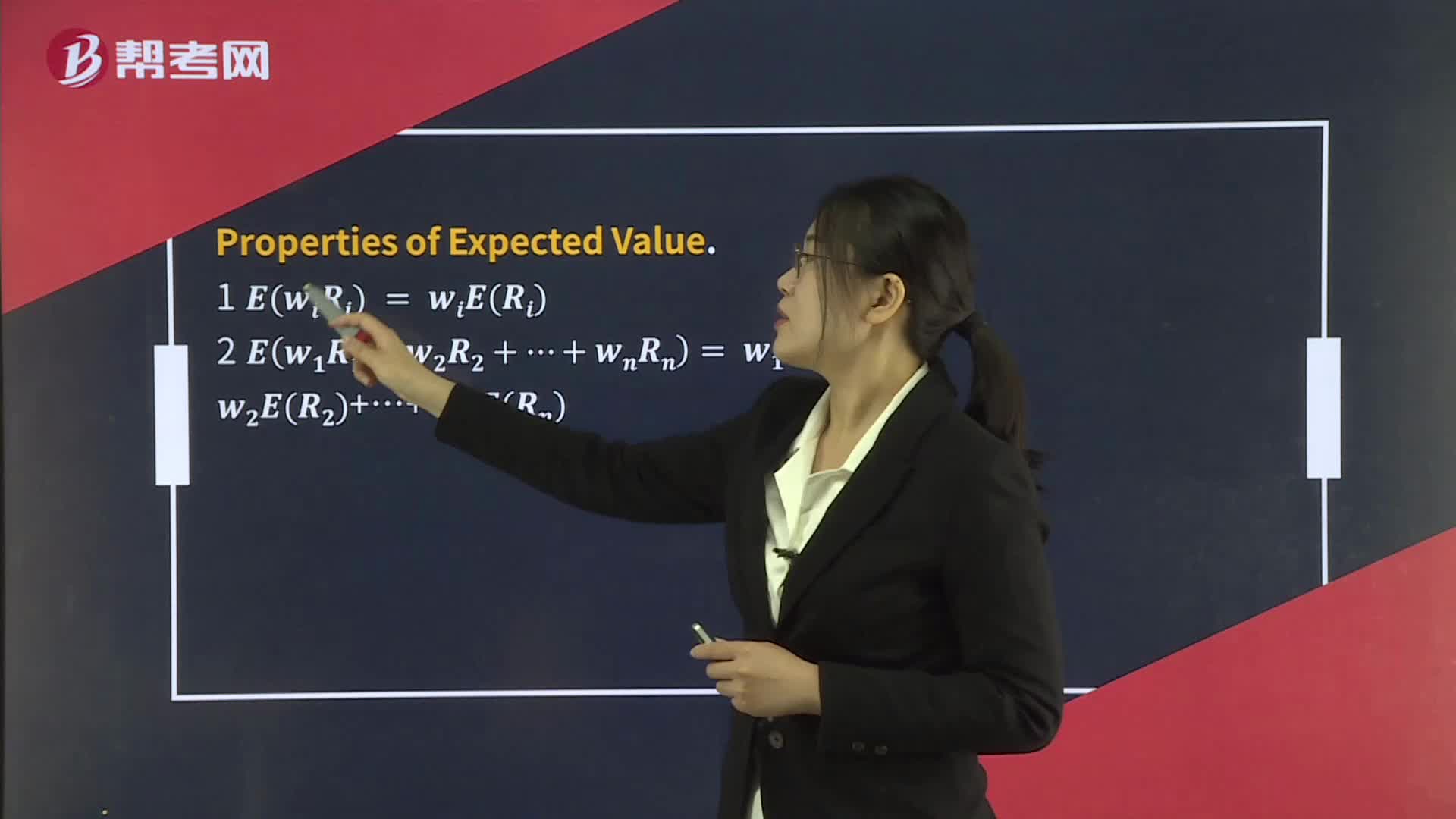

Portfolio Expected Return and Variance of Return

Limitations of Monetary Policy

Monetary and Fiscal Policy

Theories of the Business Cycle - Neoclassical and Austrian Schools

Theories of the Business Cycle - Monetarist School

Theories of the Business Cycle - Keynesian School

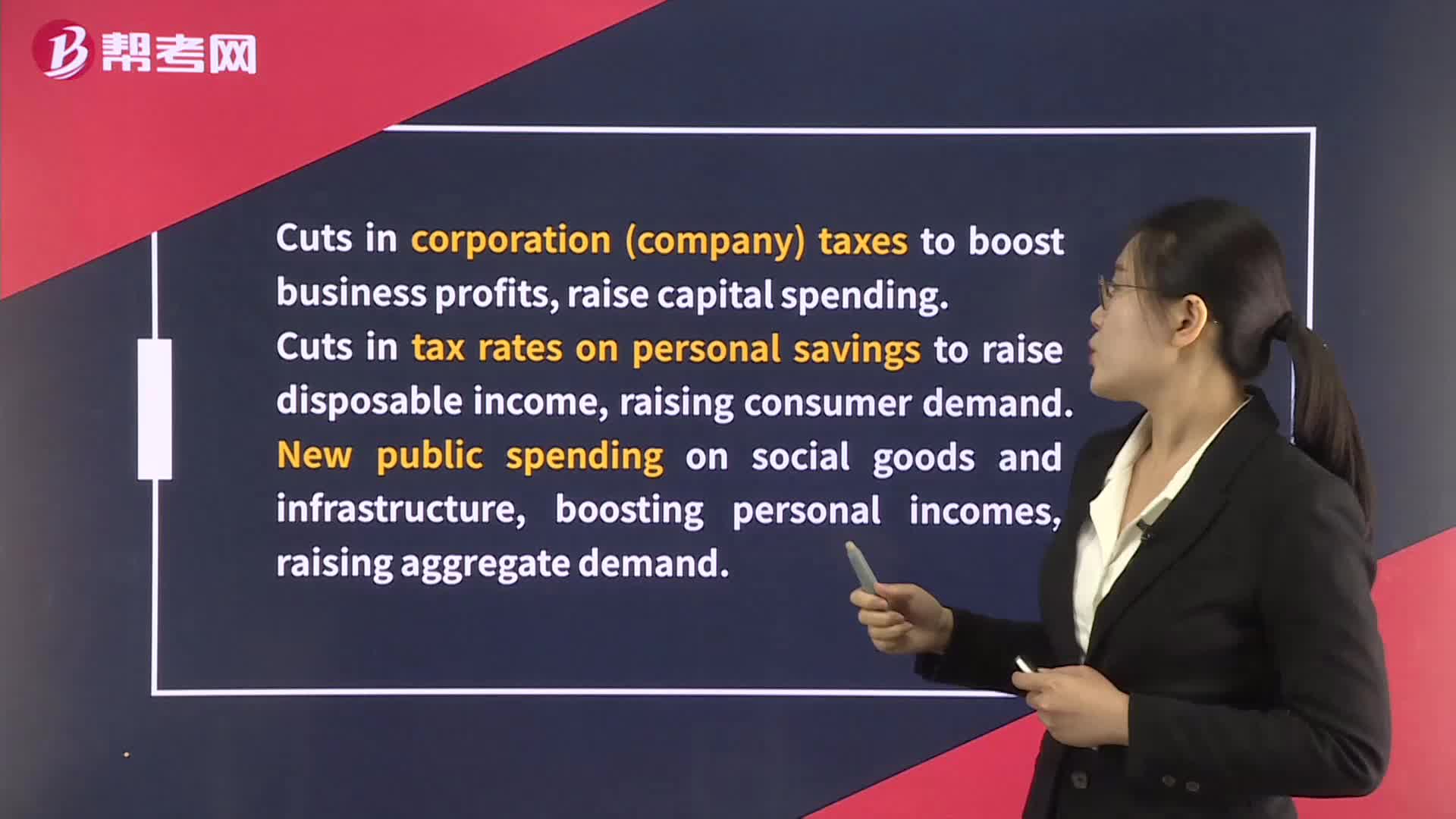

Fiscal Policy Tools

Fiscal Policy and Aggregate Demand

下载亿题库APP

联系电话:400-660-1360