Limitations of Monetary Policy

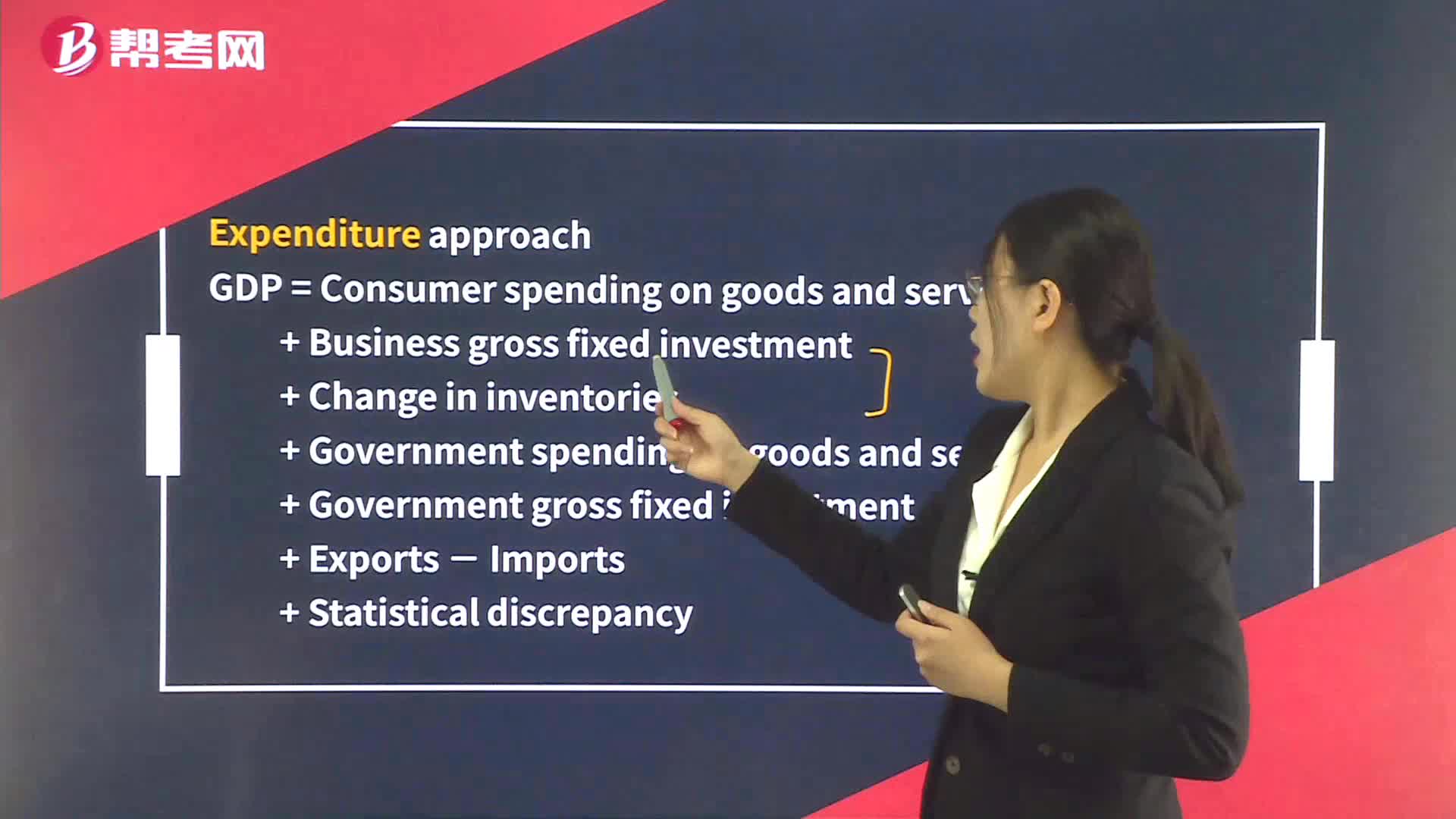

Calculation of GDP – Expenditure Approach

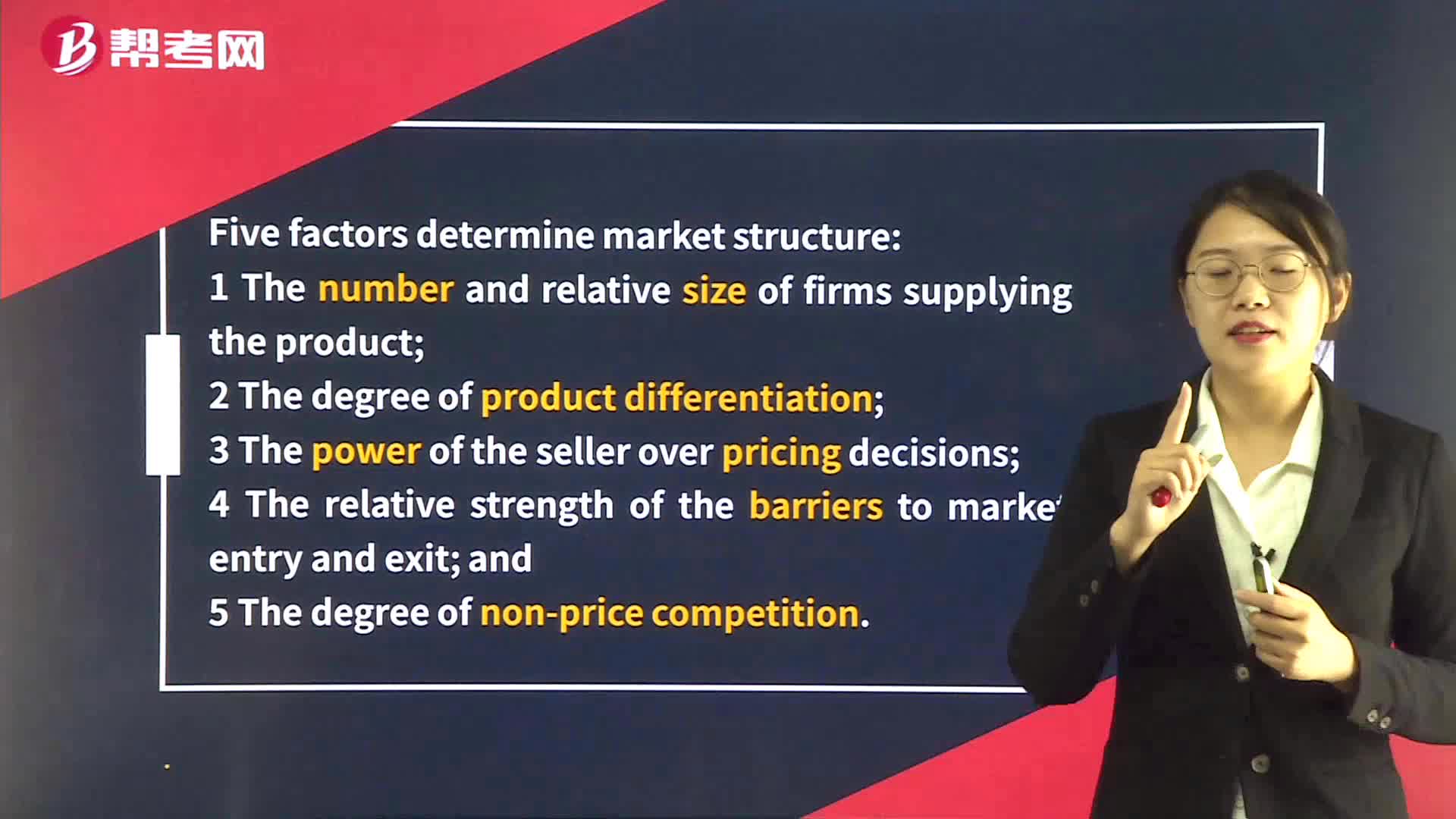

Analysis of Market Structure

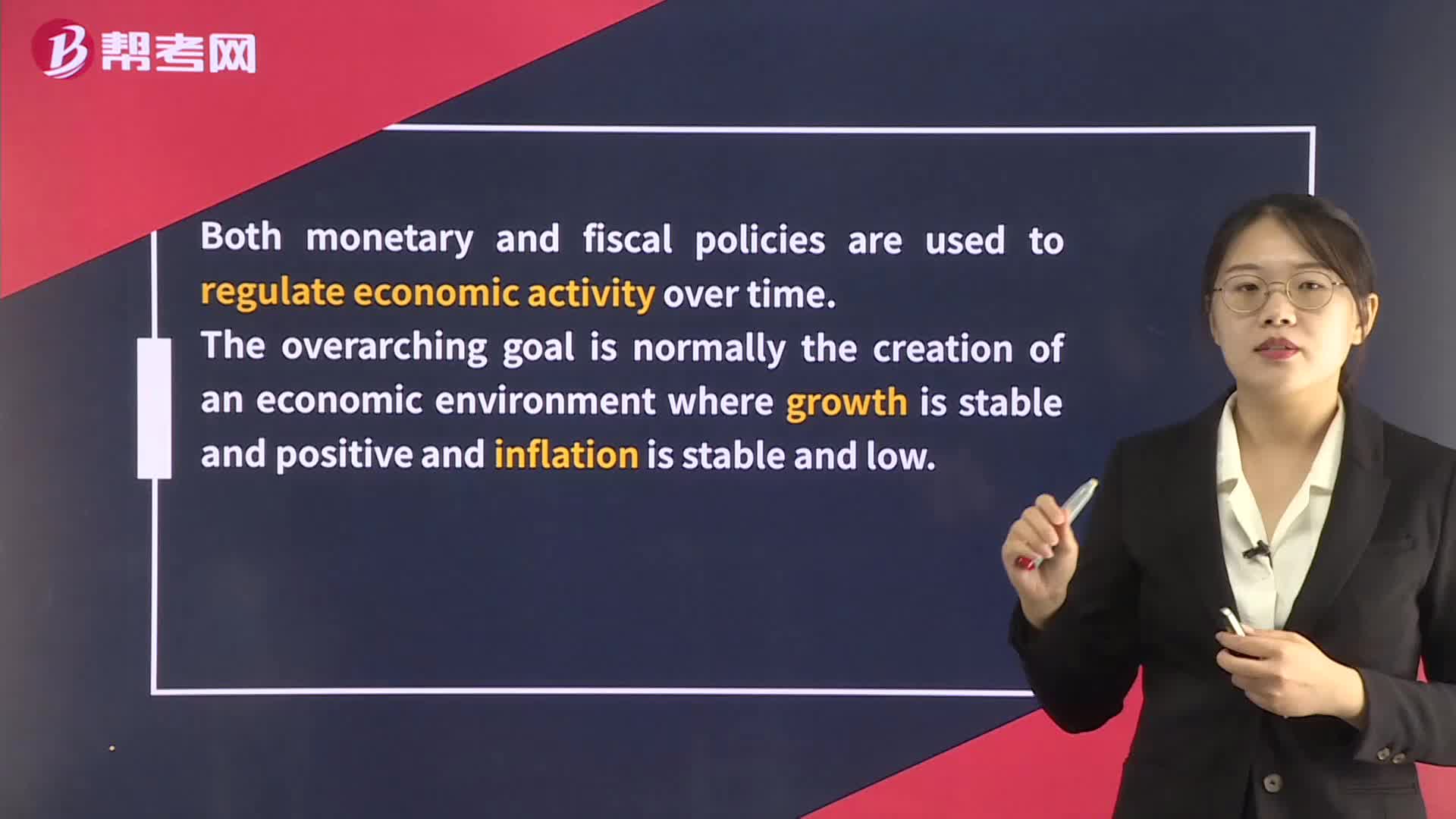

Monetary and Fiscal Policy

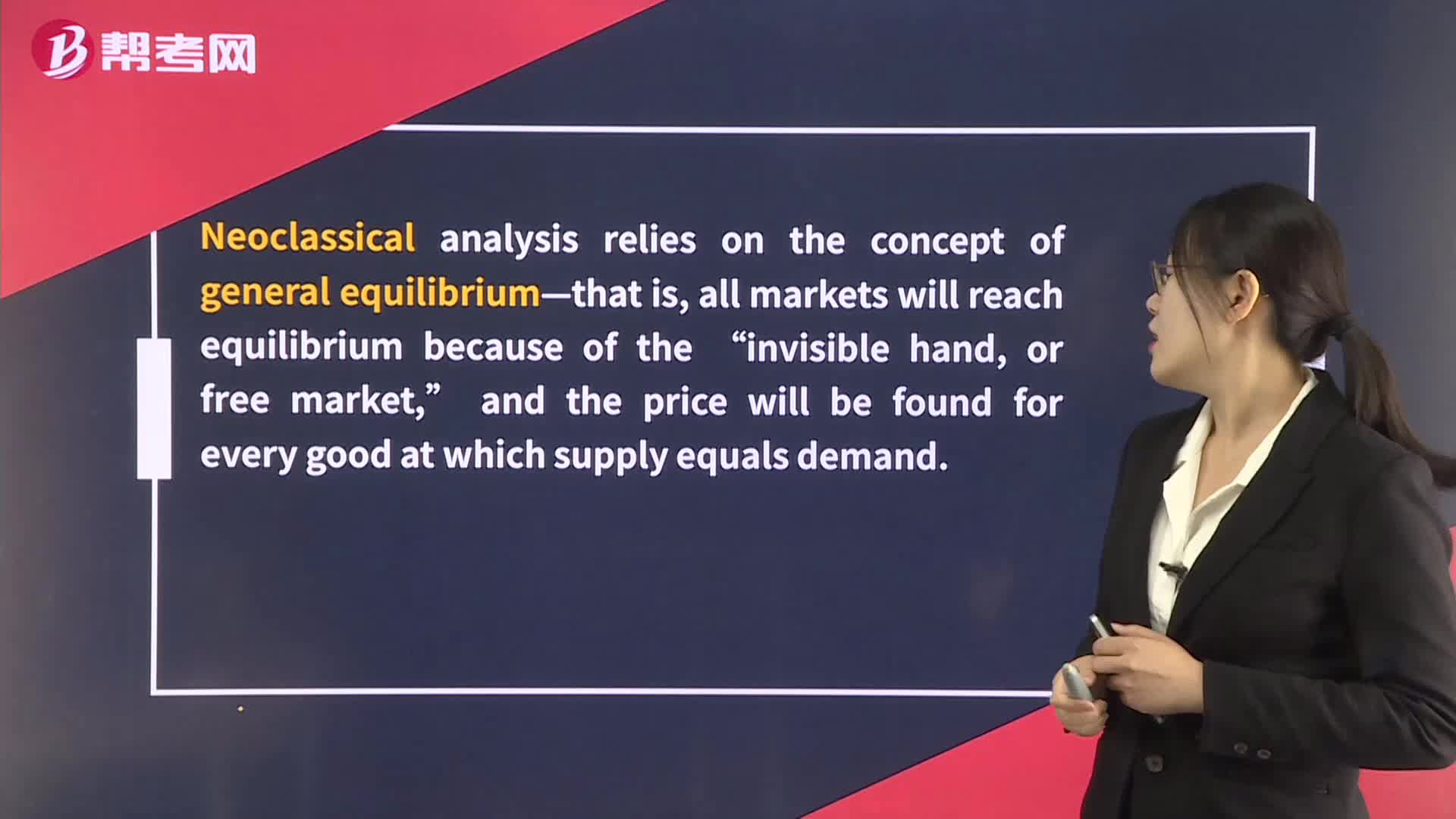

Theories of the Business Cycle - Neoclassical and Austrian Schools

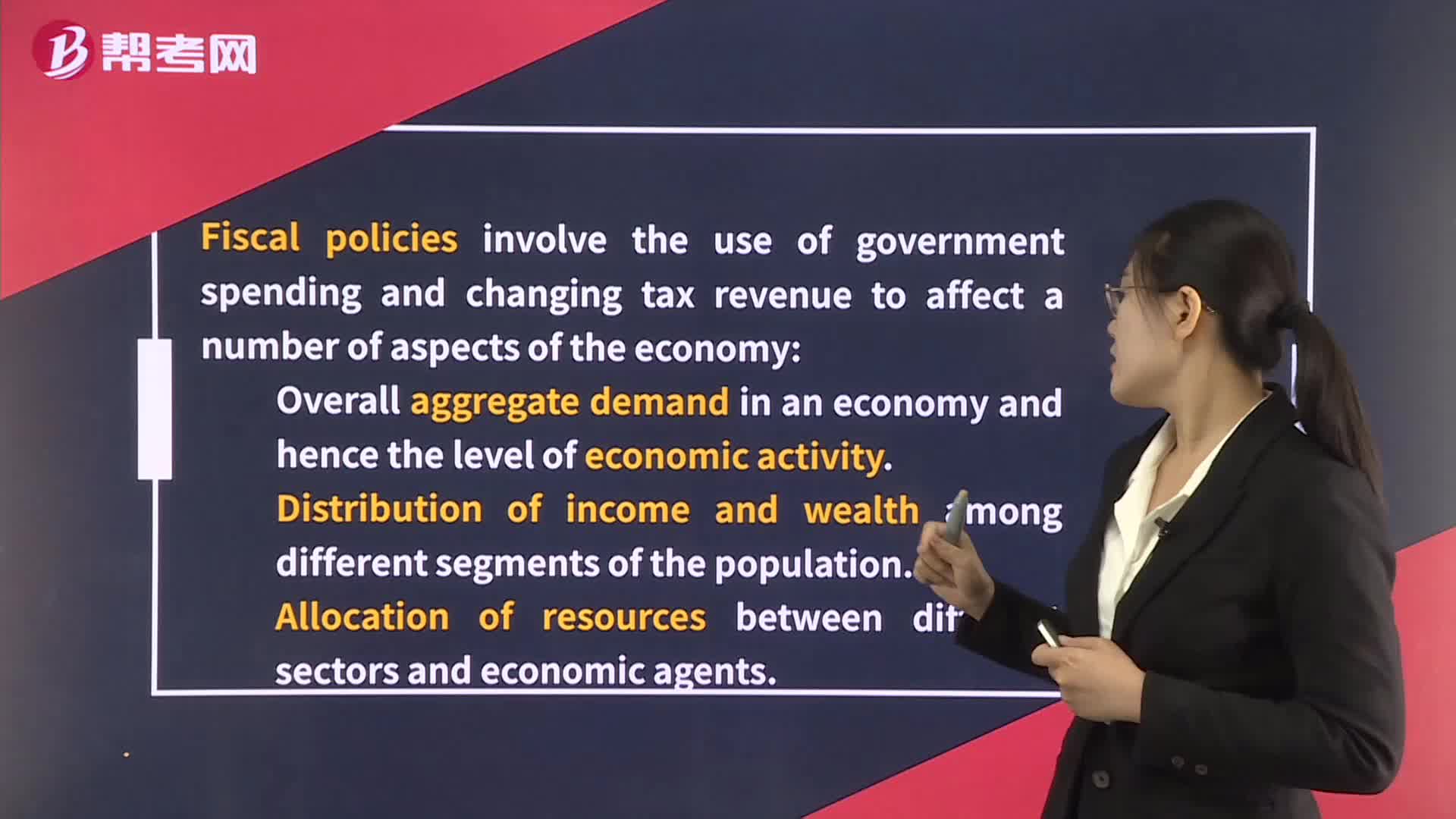

Fiscal Policy

Theories of the Business Cycle - Monetarist School

Theories of the Business Cycle - Keynesian School

Fiscal Policy Tools

Fiscal Policy and Aggregate Demand

Phases Of the Business Cycle

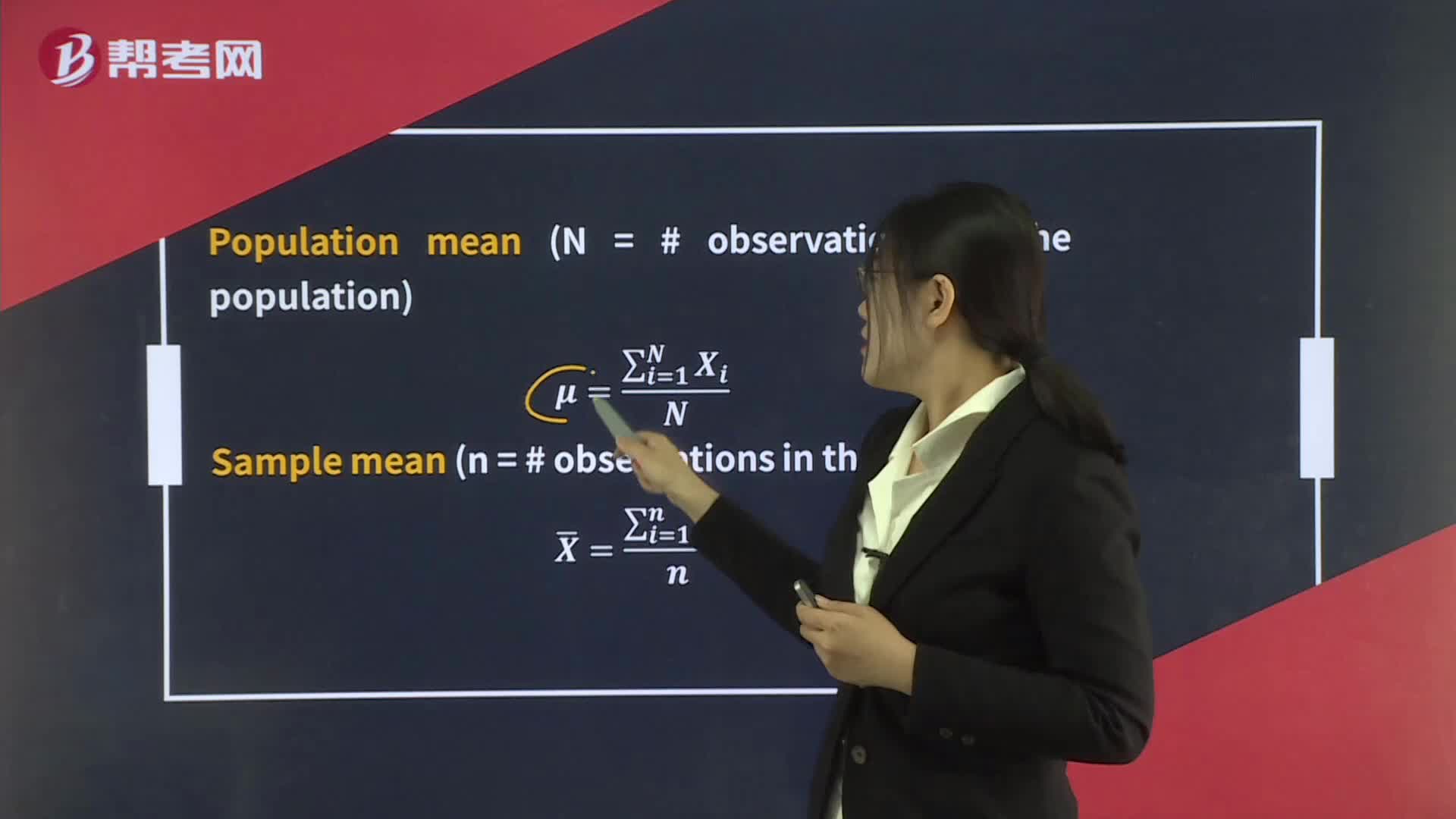

Measures of Central Tendency

下载亿题库APP

联系电话:400-660-1360