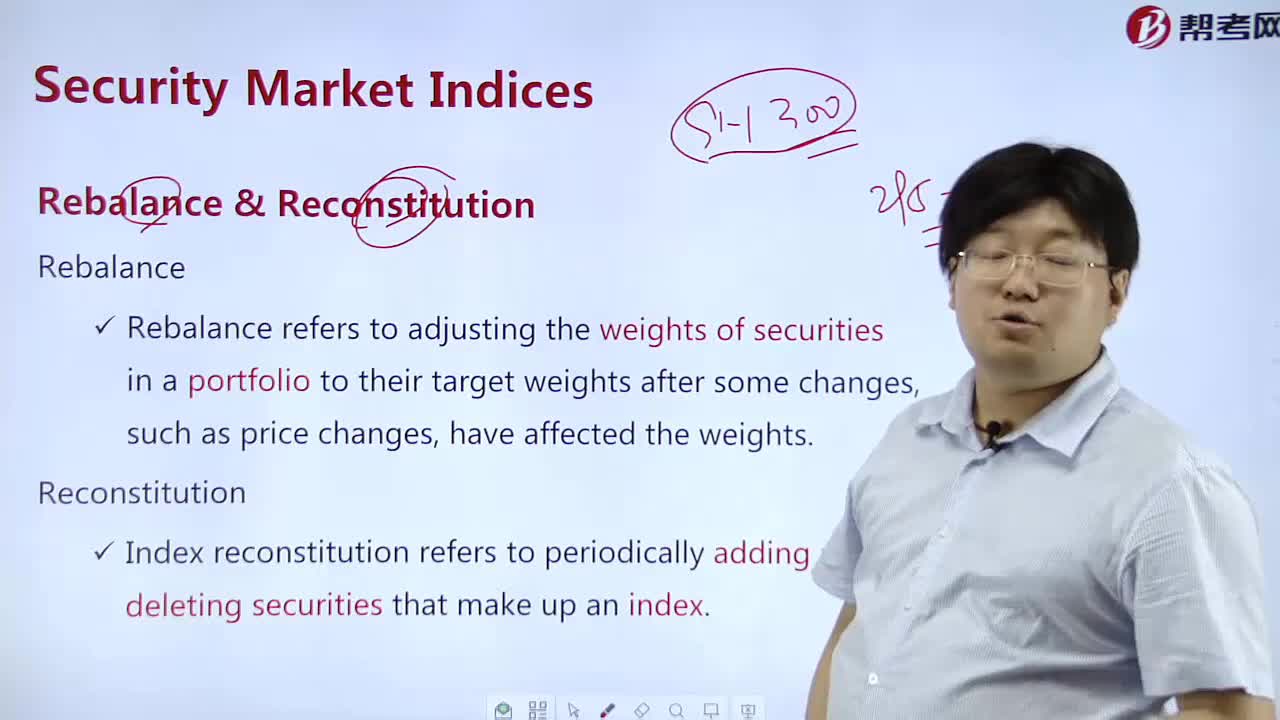

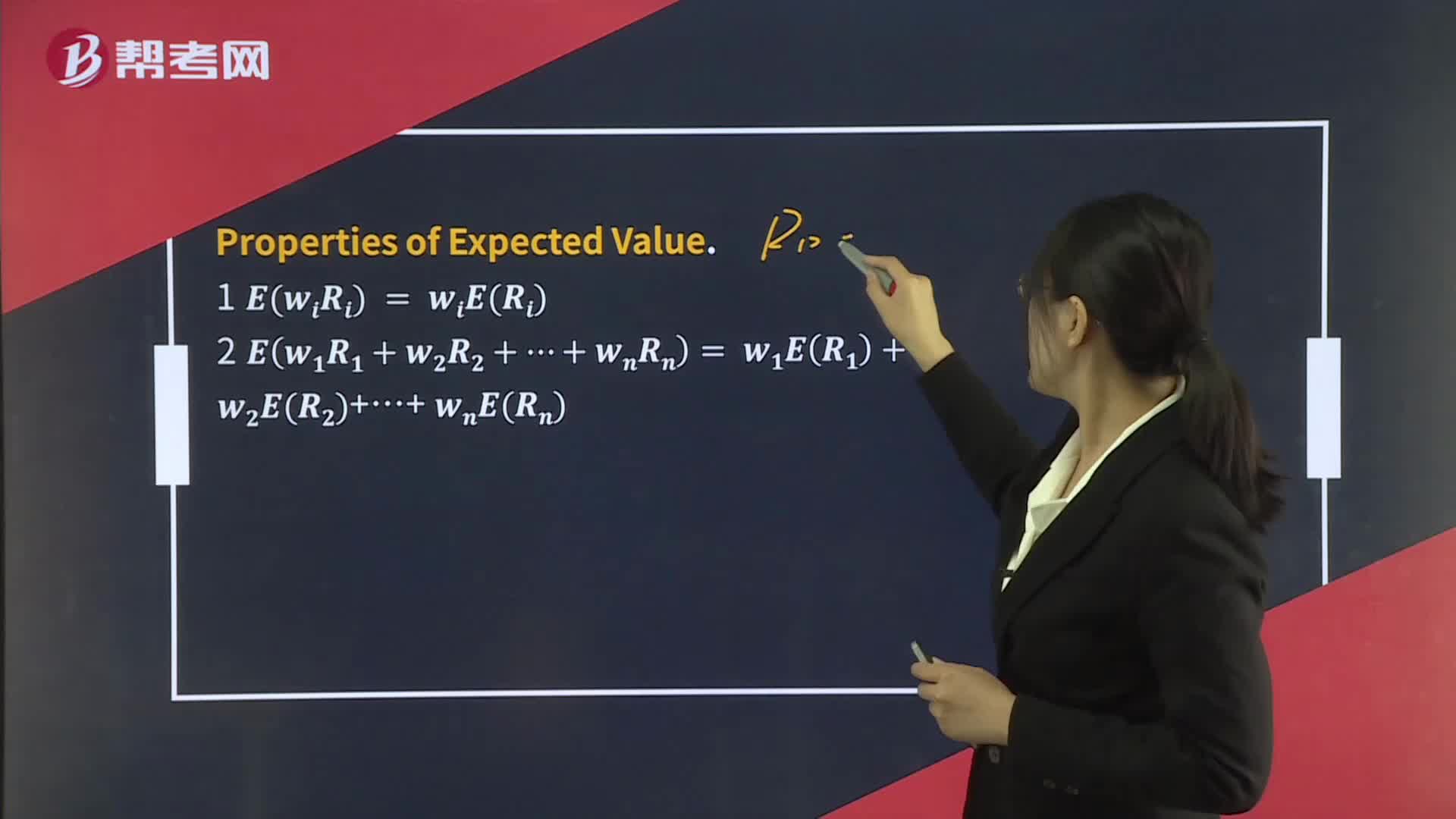

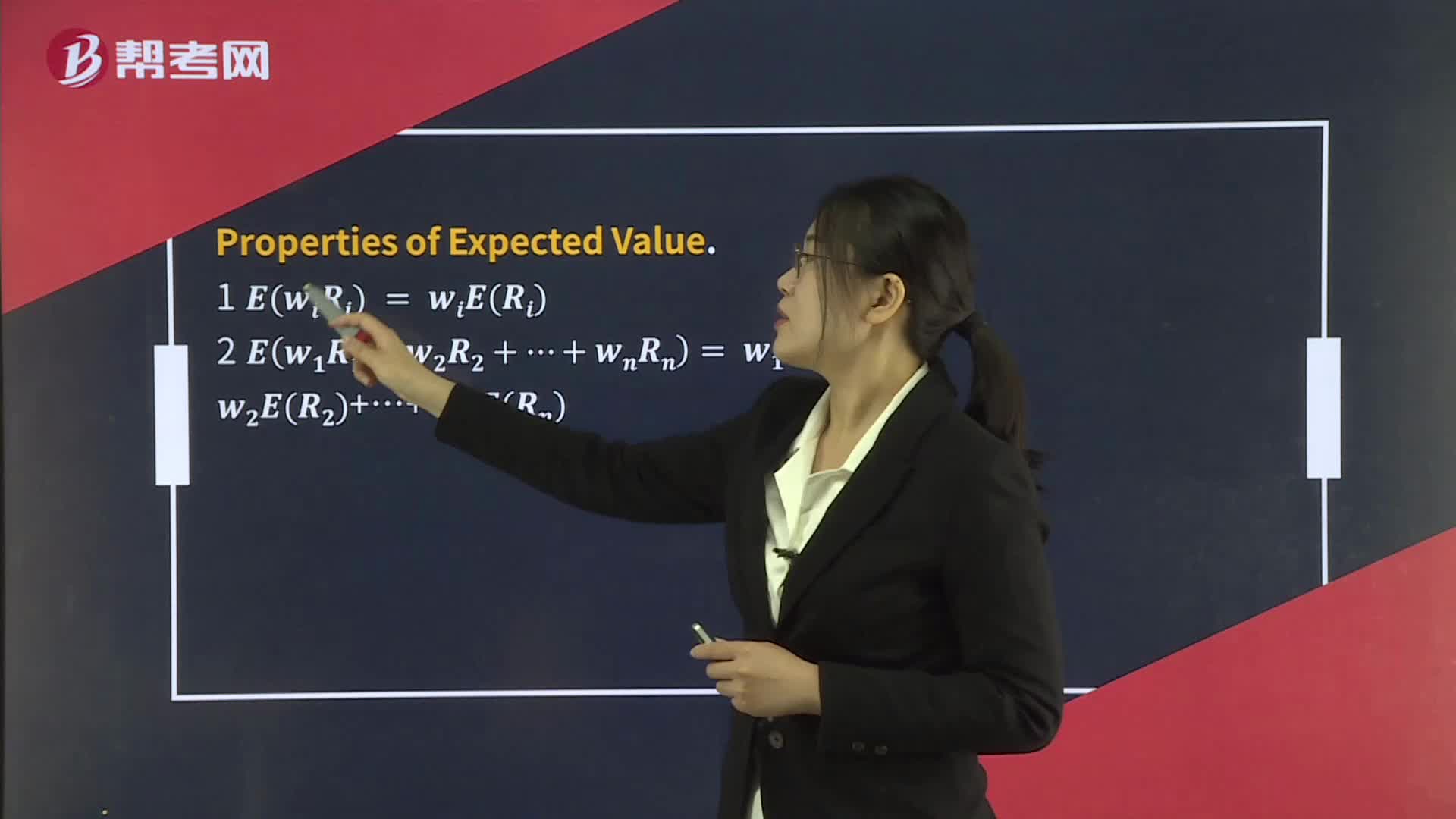

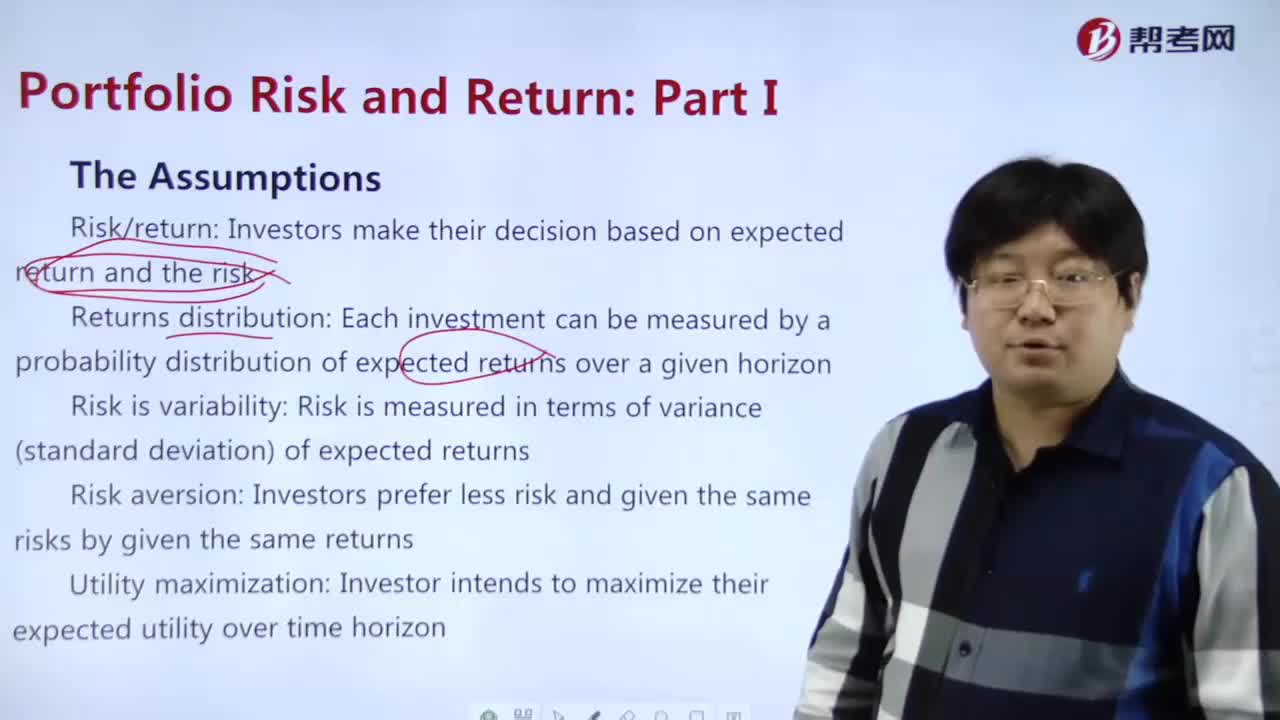

What is the assumptions in portfolio risk?

What are the return measures in portfolio management?

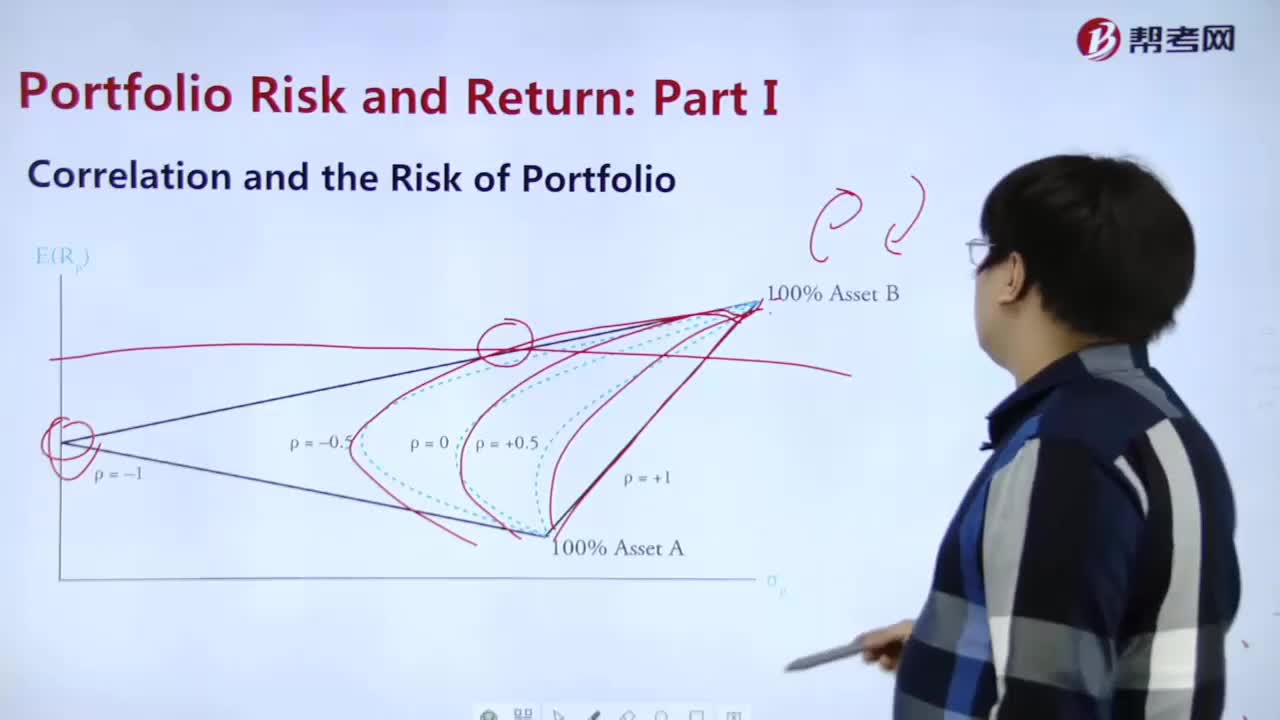

What are the correlations and risks of portfolio?

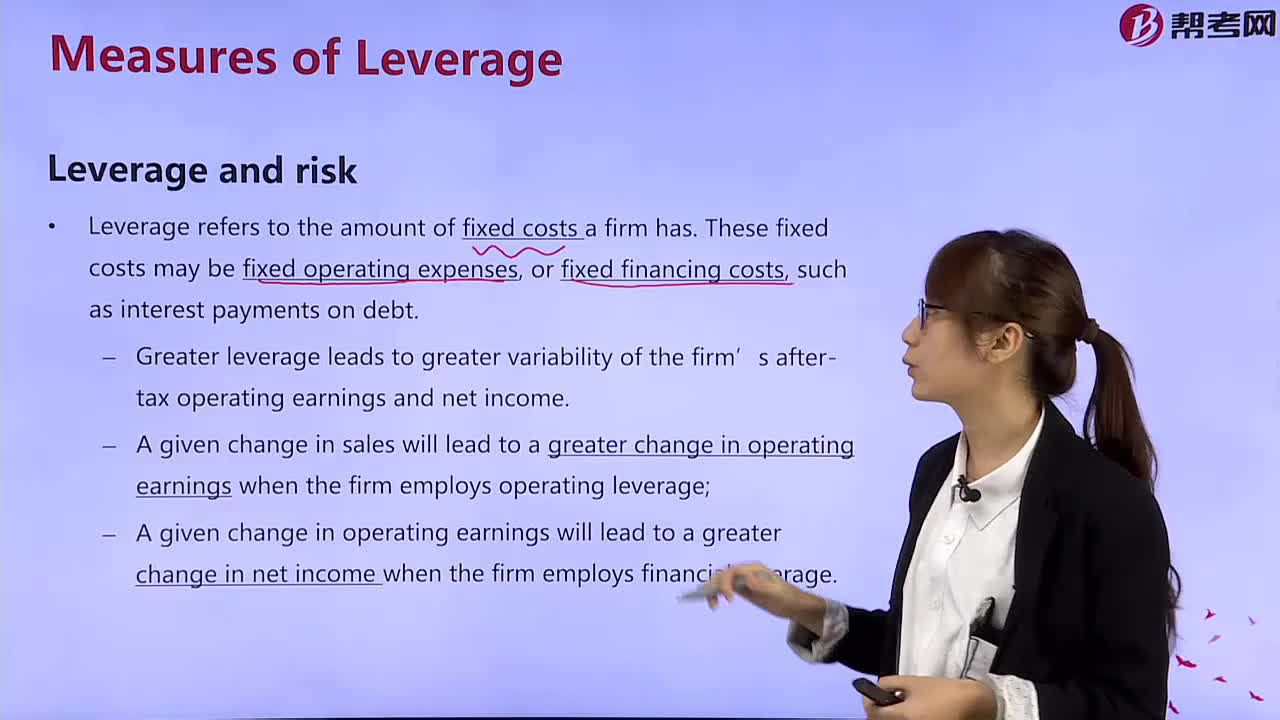

What does leverage and risk mean?

How to control risk and return?

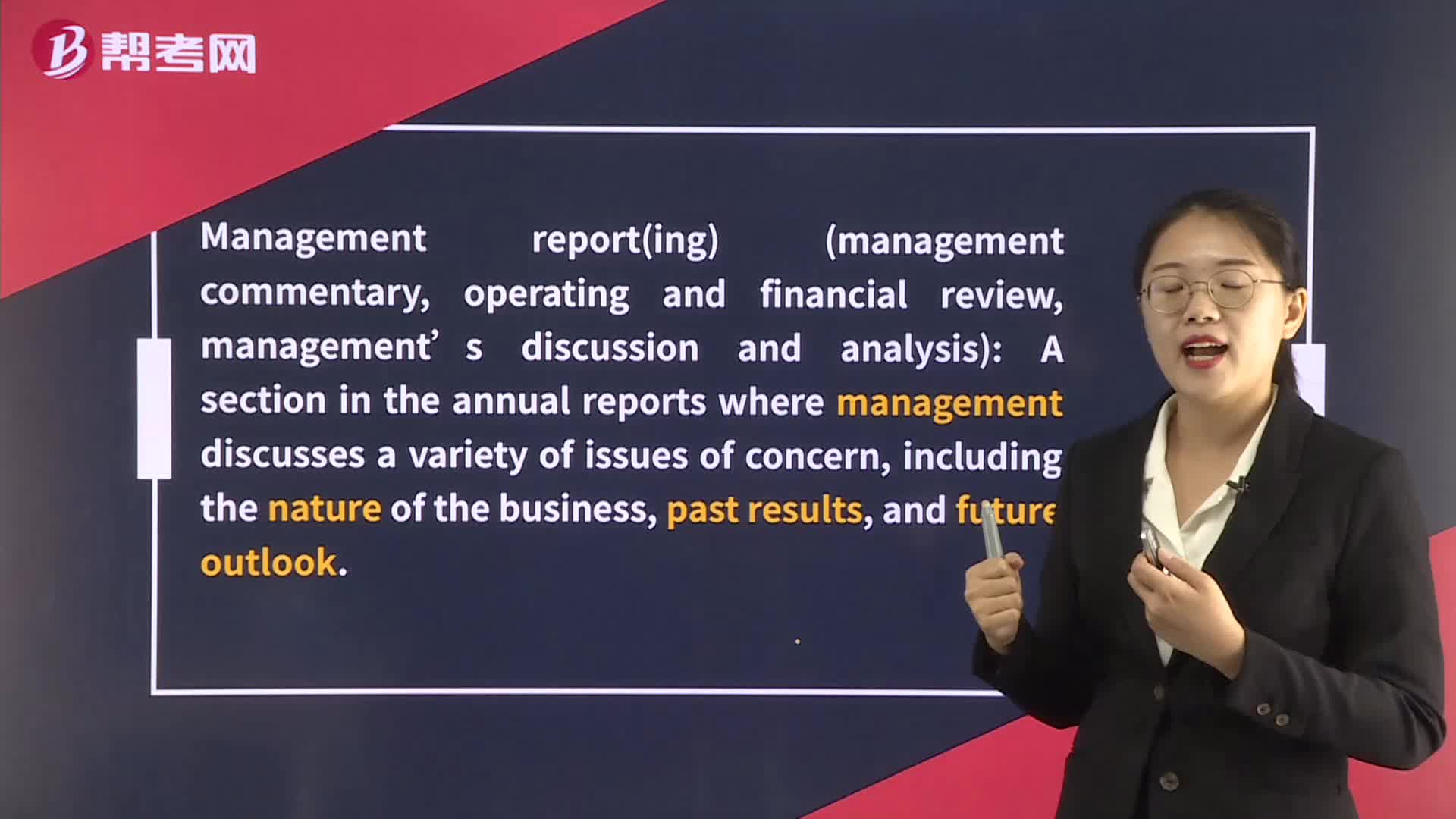

What is the definition of risk management?

What's the meaning of Prepayment risk?

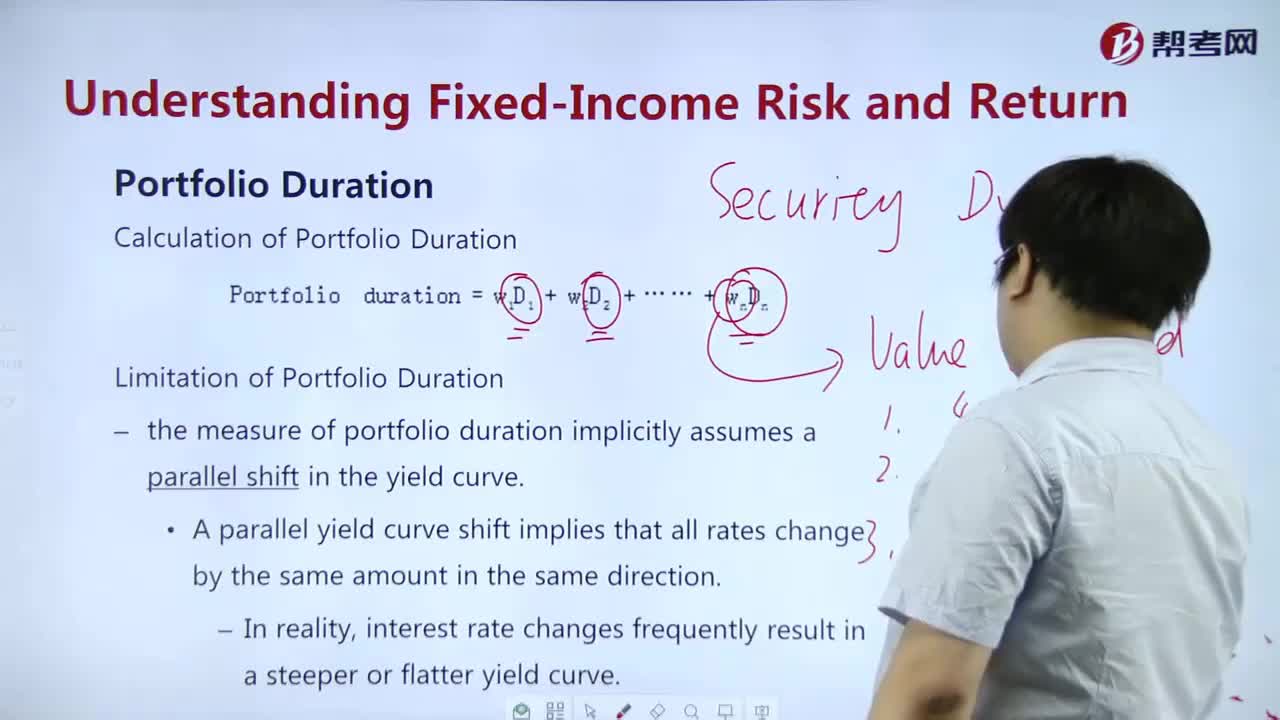

How to understand Portfolio Duration?

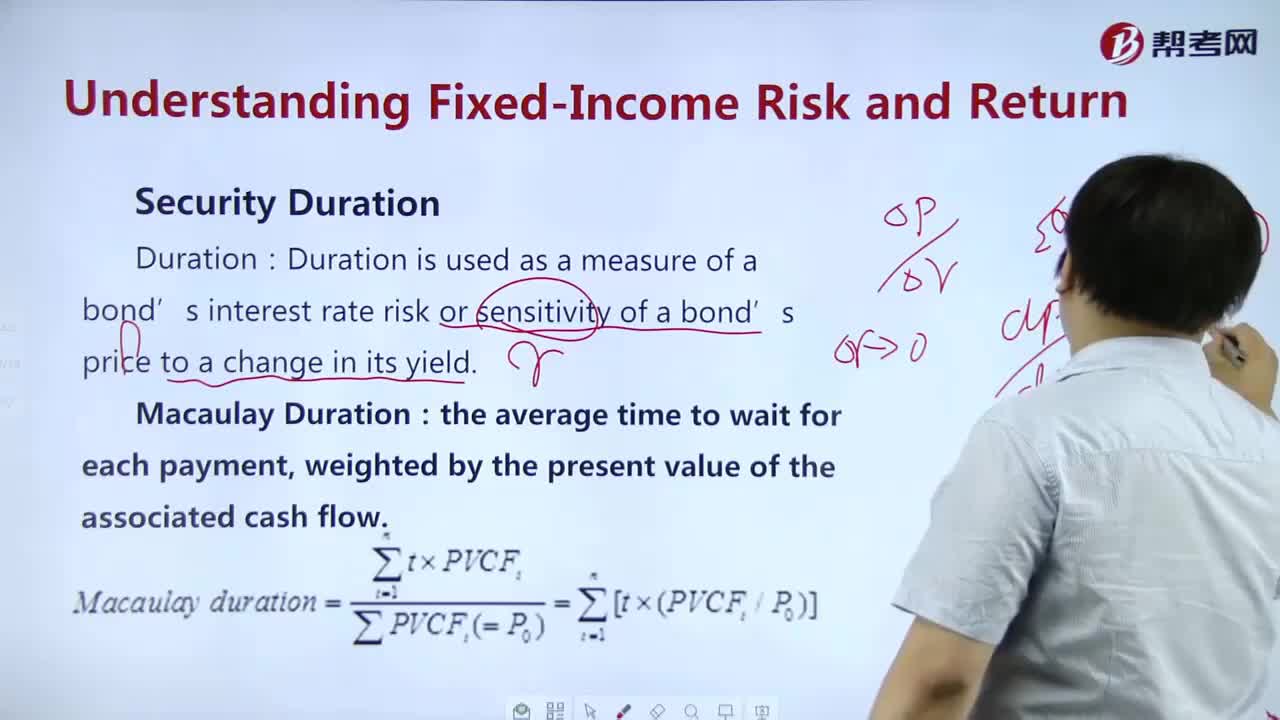

How to master Income Risk and Return-Security Duration?

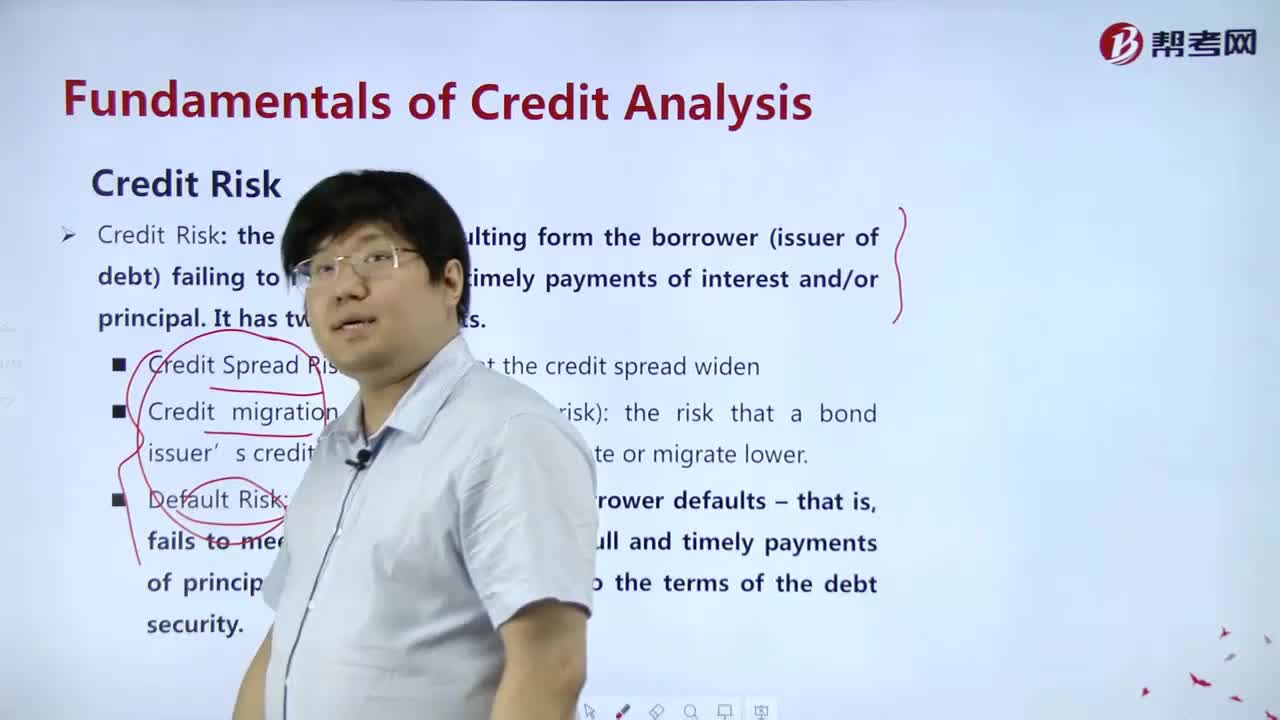

What's the meaning of Credit Risk?

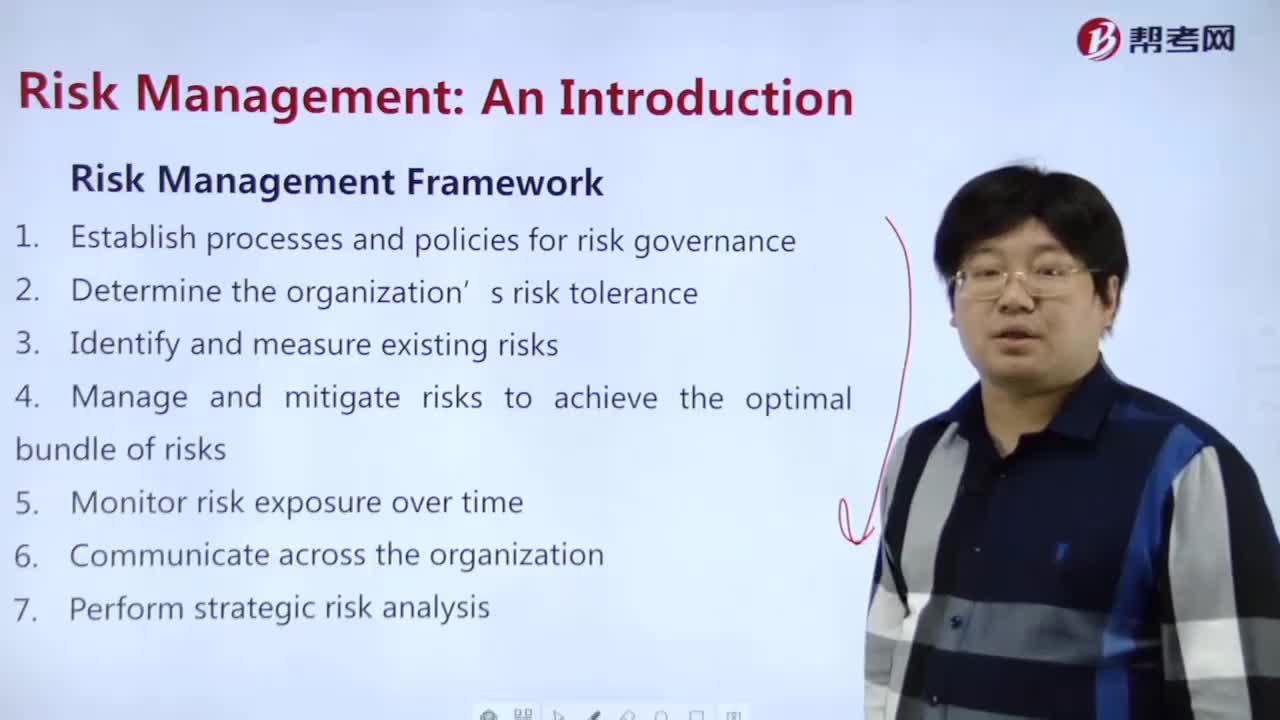

How to understand Risk Management Framework?

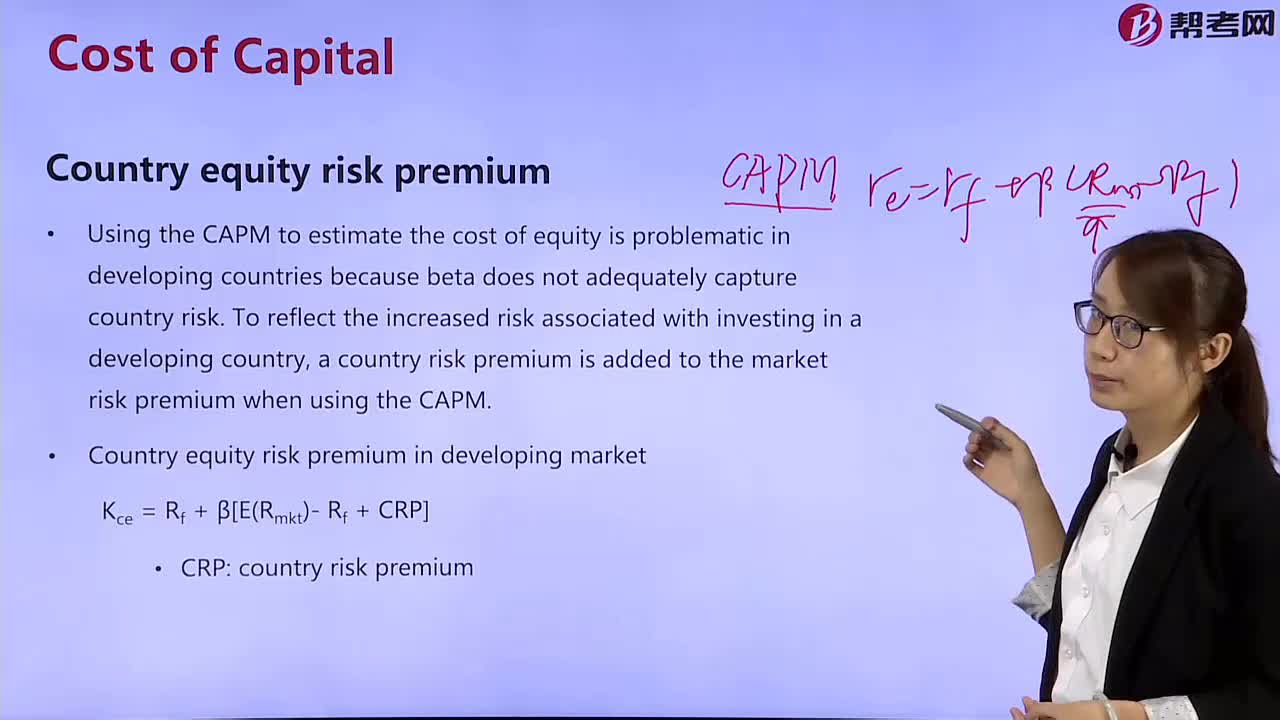

What is the National Equity Risk Premium?

下载亿题库APP

联系电话:400-660-1360