下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Which of the following factors will most likely drive the repo margin lower?【单选题】

A.Lower quality of the collateral

B.Lower credit quality of the counterparty

C.Shorter supply of the collateral

正确答案:C

答案解析:If the collateral is in short supply or if there is a high demand for it, repo margins are lower. Repo margin is the difference between the market value of the security used as collateral and the value of the loan.

2014 CFA Level I

"Fixed-Income Markets: Issuance, Trading, and Funding," by Moorad Choudhry, Steve V. Mann, and Lavone F. Whitmer

Section 7.3.2

2、Which of the following theories suggests that both aggregate demand and aggregatesupply are primarily driven by changes in technology over time?【单选题】

A.Neoclassical school.

B.Keynesian school.

C.Austrian school.

正确答案:A

答案解析:新古典学派认为,总供给和总需求长期来讲主要由科学水平的变化所主导,而凯恩斯学派认为,总需求的变化是由于市场参与者预期的改变进而引起经济周期,奥地利学派认为,经济周期是由于政府对于经济的干预所引起的。

3、The execution step of the portfolio management process includes:【单选题】

A.finalizing the asset allocation.

B.monitoring the portfolio performance.

C.preparing the investment policy statement.

正确答案:A

答案解析:“Portfolio Management: An Overview,” Robert M. Conroy and Alistair Byrne

2012 Modular Level I, Vol. 4, pp. 296–300

Study Session 12-43-c

Describe the steps in the portfolio management process.

A is correct. Asset allocation occurs in the execution step.

4、Which of the following statements is least likely an advantage of investing in hedge funds through a fund of funds? Funds of funds provide:【单选题】

A.an increase in expected return through diversification.

B.expertise in selecting funds and conducting due diligence.

C.access to successful funds that may otherwise be closed to new investors.

正确答案:A

答案解析:“Alternative Investments,” Bruno Solnik and Dennis McLeavey

2011 Modular Level I, Vol.6, pp. 223-224

Study Session 18-74-j

Explain the benefits and drawbacks to fund of funds investing.

A is correct because diversification results in risk reduction, not return enhancement. Further, the fees charged by the fund of funds manager will likely reduce returns relative to direct hedge fund investment.

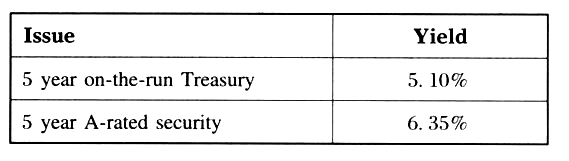

5、An analyst does research about calculating relative yield spread and gathered thefollowing yield information about two bonds:

The relative yield spread between these two bonds is closest to:【单选题】

A.4.5%

B.19.7%

C.24.5%

正确答案:C

答案解析:relative yield spread = (6.35% - 5.10%)/5.10% = 24.5%.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料