下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

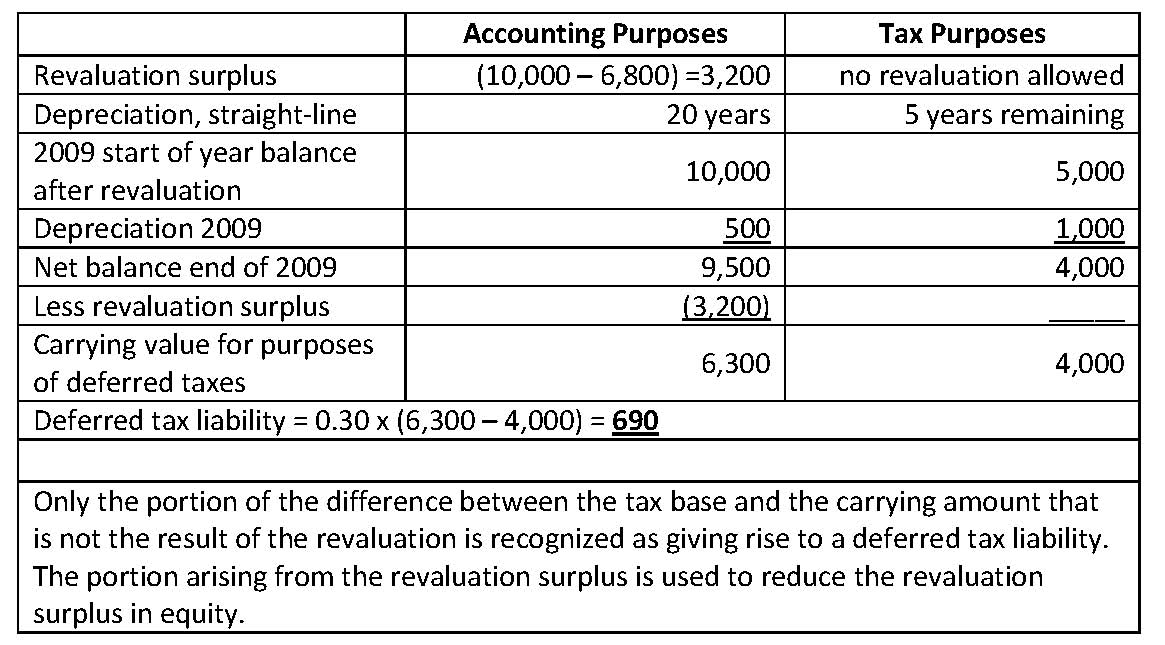

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、The most relevant definition for duration is:【单选题】

A.a security’s price sensitivity to changes in yield.

B.the first derivative of the security’s price with respect to yield.

C.the weighted-average time until receipt of the present value of cash flows.

正确答案:A

答案解析:“Introduction to the measurement of interest rate risk,” Frank J. Fabozzi, CFA

2010 Modular Level I, Vol. 5, pp. 542-543

Study Session 16-66-e

Distinguish among the alternative definitions of duration and explain why

effective duration is the most appropriate measure of interest rate risk for bonds

with embedded options.

This is the most relevant definition because users of duration are interested in a

security’s price sensitivity to changes in yield.

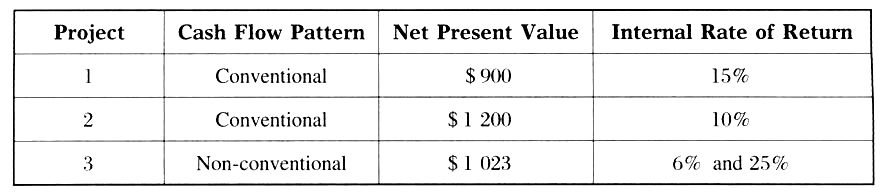

2、Using the following information about three mutually exclusive capital projects tomake an investment decision.

Assumed each project has the same initial outlay and required return, the mostappropriate investment is :【单选题】

A.Project 1.

B.Project 2.

C.Project 3.

正确答案:B

答案解析:当选择互斥项目(mutually exclusive projects)时,如果使用净现值(NPO)与内部收益率作决策有冲突的话,选择有最高的NPV的项目。非传统项目(non-conventional projects)可能会给出不同的内部收益率,如项目开始后,仍然有负的现金流。

3、Which of the following is the most appropriate reason for using a free-cash-flow-to-equity (FCFE) model to value equity of a company?【单选题】

A.FCFE is a measure of the firm’s dividend paying capacity.

B.FCFE models provide more accurate valuations than the dividend discount models.

C.A firm’s borrowing activities could influence dividend decisions but they would not impact FCFE.

正确答案:B

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA and Stephen E. Wilcox, CFA

2013 Modular Level I, Vol. 5, Reading 51, Section 4

Study Session 14-51-c

Explain the rationale for using present-value of cash flow models to value equity and describe the dividend discount and free-cash-flow-to-equity models.

A is correct. FCFE is a measure of the firm’s dividend paying capacity.

4、Holding all other factors constant, an increase in expected yield volatility will cause the price of a:【单选题】

A.putable bond to increase.

B.callable bond to increase.

C.putable bond to decrease.

正确答案:A

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi

2010 Modular Level I, Vol. 5, p. 284

Study Session 15-61-n

Explain how yield volatility affects the price of a bond with an embedded option and how changes in volatility affect the value of a callable bond and a putable bond.

Increasing yield volatility increases the value of both put options and call options, which increases the value of a putable bond (which is long the put option) but decreases the value of a callable bond (which is short the call option.)

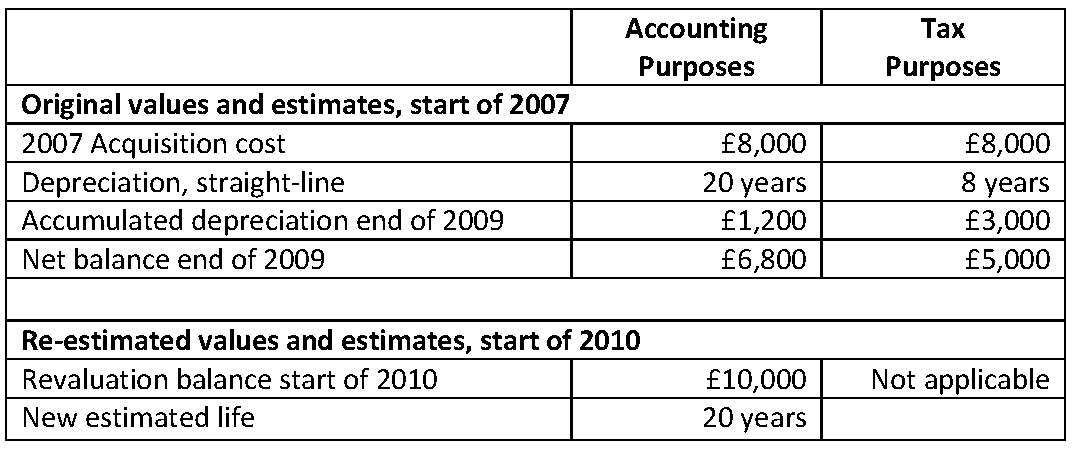

5、A company has recently revalued one of its depreciable properties and estimated that its remaining useful life would be another 20 years. The applicable tax rate for all years is 30% and the revaluation of the property is not recognized for tax purposes. Details related to this asset are provided in the table below, with all £-values in millions.

The deferred tax liability (in millions) as at the end of 2010 is closest to:【单选题】

A.£690.

B.£960.

C.£1,650.

正确答案:A

答案解析:“Income Taxes,” Elbie Antonites, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol. 3, pp. 477-480

Study Session: 9-38-c, d, h

Determine the tax base of a company’s assets and liabilities.

Calculate income tax expense, income tax payable, deferred tax assets, and deferred tax liabilities, and calculate and interpret the adjustment to the financial statements related to a change in the income tax rate.

Compare and contrast a company’s deferred tax items.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料