下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

众所周知,USCPA考试是全英文作答,所以对于很多报考美国注册会计师的考生而言,尽快熟悉全英文的答题环境也是非常重要的,为了帮助大家更好的备考,帮考网为大家分享了美国注册会计师USCPA考试REG法规练习试题,详情如下:

1、Which one of the following types of organizations qualifies as an organization exempt from income tax?

a. An "action" organization established forthe purpose of influencing legislation pertaining to protection of animal rights.

b. An organization whose purpose is to foster national orinternational amateur sports competition by providing athletic facilities and equipment.

c. A social club organized and operated exclusively forthe pleasure and recreation of its members, supported solely by membership fees, dues, and assessments.

d. All "feeder" organizations, primarily conducting business forprofit, but distributing 100% of their profits to organizations exempt from income tax.

答案:C

2、Which of the following sales should be reported as a capital gain?

a. Government bonds sold by an individual investor.

b. Real property subdivided and sold by a dealer.

c. Sale of equipment.

d. Sale of inventory.

答案:A

3、Which one of the following types of organizations qualifies as an organization exempt from income tax?

a. An "action" organization established forthe purpose of influencing legislation pertaining to protection of animal rights.

b. An organization whose purpose is to foster national orinternational amateur sports competition by providing athletic facilities and equipment.

c. A social club organized and operated exclusively forthe pleasure and recreation of its members, supported solely by membership fees, dues, and assessments.

d. All "feeder" organizations, primarily conducting business forprofit, but distributing 100% of their profits to organizations exempt from income tax.

答案:C

4、he alternative minimum tax (AMT) is computed as the:

a. The tentative AMT plus the regular tax.

b. Excess of the tentative AMT over the regular tax.

c. Lesser of the tentative AMT orthe regular tax.

d. Excess of the regular tax over the tentative AMT.

【正确答案】B

5、Easel Co. has elected to reimburse employees forbusiness expenses under a nonaccountable plan. Easel does not require employees to provide proof of expenses and allows employees to keep any amount not spent. Under the plan, Mel, an Easel employee fora full year, gets $400 per month forbusiness automobile expenses. At the end of the year Mel informs Easel that the only business expense incurred was forbusiness mileage of 12,000 at a rate of 30 cents per mile, the IRS standard mileage rate at the time. Mel encloses a check for$1,200 to refund the overpayment to Easel. What amount should be reported in Mel\'s gross income forthe year?

A.$3,600

B.$1,200

C.$4,800

D.$0

【正确答案】B

以上就是今天分享的全部内容了,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注帮考网!

86

862020年AICPA考试用什么教材学习?:2020年AICPA考试用什么教材学习?在美国有数百种AICPA考试的辅导书籍或资料,Becker's CPA Review 教材和学习系统在美国已有50年以上历史,使用Becker教材通过美国注册会计师考试的人数是未使用该教材人数的两倍;75%的考试通过者、90%的一次通过者以及95%的高分区学员皆选用Becker教材。美国各地超过70多所大学院校选择Becker教材作为他们的课程。

48

482020年AICPA考试多少分合格?:2020年AICPA考试多少分合格?美国注册会计师一共有4门科目,分别是财务会计与报告FAR,商业环境与理论BEC,法律法规REG,审计与鉴证AUD,成绩合格分数线均为75分,单科满分为99分。AICPA已经通过的考试科目单科成绩有效期是18个月,考生必须在通过一门科目后的18个月内考过剩余科目,否则已通过考试成绩也会被作废。

42

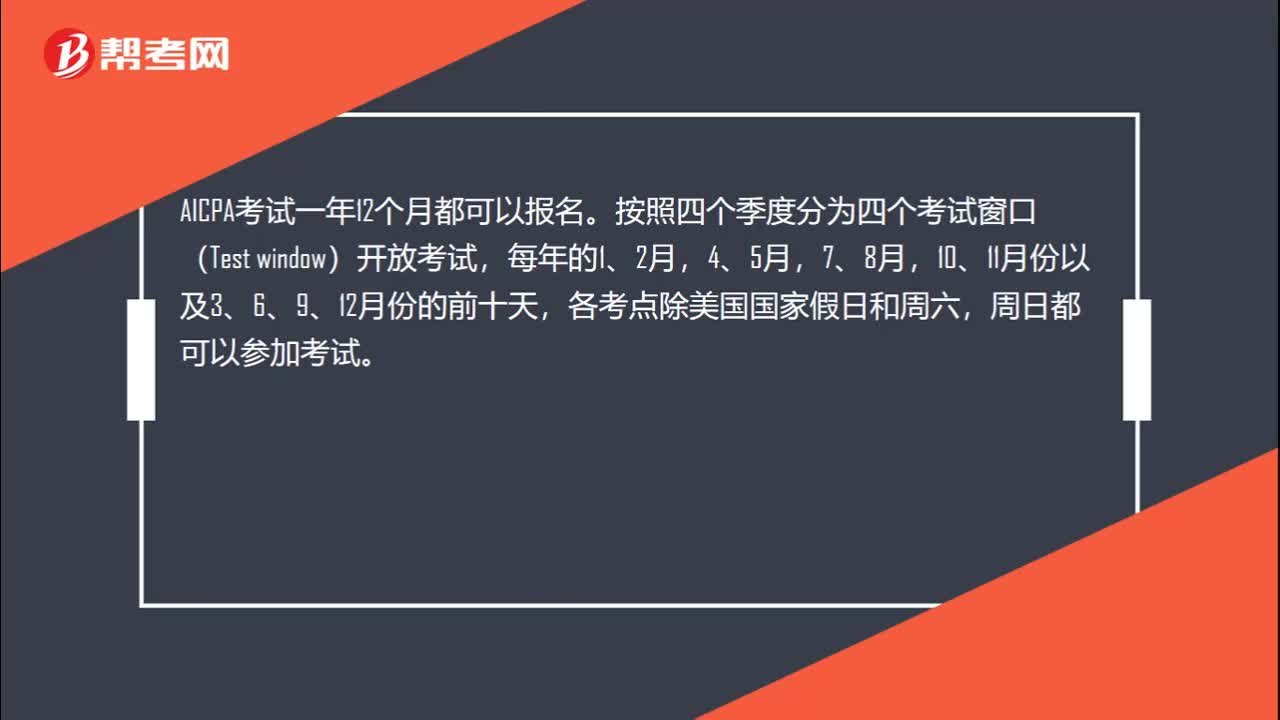

422020年AICPA考试预约考试后多久收到NTS准考证?:2020年AICPA考试预约考试后多久收到NTS准考证?NTS大约需要二到八周才能到达。在大多数州,一旦你收到NTS,它的有效期为六个月,你可以一次申请多个考试科目部分。当你重新申请时,收到你的NTS通常只需要1-2周时间。中国考生申请考试一般需要2-3个月的时间,取得NTS后,建议考生在考前45天去预约考试日期,以确保能参加考试。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料