下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

各位小伙伴大家好,美国CPA考试共有三种题型:选择题,案例分析题和写作题,不同科目题型分配不同,为了帮助大家更好地备考,帮考网带来了练习题供大家练习,帮助大家熟悉题型和积累答题经验,具体内容如下:

1.Capital assets include:

a. A corporation\\\'s accounts receivable from the sale of its inventory.

b. A corporate real estate developer\\\'s unimproved land that is to be subdivided to build homes, which will be sold to customers.

c. A manufacturing company\\\'s investment in U.S. Treasury bonds.

d. Seven-year MACRS property used in a corporation\\\'s trade orbusiness.

答案:C

Explanation

Choice "c" is correct. Investment assets of a taxpayer that are not inventory are capital assets. The manufacturing company would have capital assets including an investment in U.S. Treasury bonds.

Choice "a" is incorrect. Accounts receivable generated from the sale of inventory are excluded from the statutory definition of capital assets.

Choice "d" is incorrect. Depreciable property used in a trade orbusiness is excluded from the statutory definition of capital assets.

Choice "b" is incorrect. Land is usually a capital asset, but when it is effectively inventory, as when it is used by a developer to be subdivided, it is excluded from the statutory definition of capital assets.

2.If the executorof a decedent\\\'s estate elects the alternate valuation date and none of the property included in the gross estate has been sold ordistributed, the estate assets must be valued as of how many months after the decedent\\\'s death?

a. 6

b. 9

c. 3

d. 12

答案:A

Explanation

Choice "a" is correct.

Rule: The executorcan elect to use an alternate valuation date rather than the decedent\\\'s date of death to value the property included in the gross estate. The alternate date is generally six months after the decedent\\\'s death orthe earlier date of sale ordistribution.

Note: The valuation of the assets in an estate impacts the recipient as basis of the inherited assets.

Choices "d", "b", and "c" are incorrect, per the above rule.

3.In a "like-kind" exchange of an investment assetfora similar assetthat will also be held as an investment, no taxable gain orloss will be recognized on the transaction if both assets consist of:

a. Convertible debentures.

b. Convertible preferred stock.

c. Rental real estate located in different states.

d. Partnership interests.

答案:C

Explanation

Choice "c" is correct. No taxable gain orloss will be recognized on a like-kind exchange if both assets are tangible property. Rental real estate located in different states qualifies fora like-kind exchange.

Choices "a", "b", and "d" are incorrect. In orcerto meet the "like-kind exchange" requirements fornonrecognition of gain orloss, the property exchanged must be tangible property. Convertible debentures, convertible preferred stock, and partnership interests are not considered tangible property.

Exception: If the same class of stock of the same corporation is exchanged, it will qualify for"substituted basis."

以上就是今天分享的全部内容了,希望本文对各位有所帮助,预祝各位取得满意的成绩,如需了解更多相关内容,请关注帮考网!

86

862020年AICPA考试用什么教材学习?:2020年AICPA考试用什么教材学习?在美国有数百种AICPA考试的辅导书籍或资料,Becker's CPA Review 教材和学习系统在美国已有50年以上历史,使用Becker教材通过美国注册会计师考试的人数是未使用该教材人数的两倍;75%的考试通过者、90%的一次通过者以及95%的高分区学员皆选用Becker教材。美国各地超过70多所大学院校选择Becker教材作为他们的课程。

22

222020年美国CPA考哪些科目?:2020年美国CPA考哪些科目?2020年美国CPA考试科目有:FAR财务会计与报告,AUD审计与鉴证,REG法规,BEC商业环境与理论。共有3种考试题型:分别是选择题,案例分析题,写作题。不同科目题型分配不同,FAR,AUD,REG都是有50%的选择题和50%的案例分析题组成,另外BEC还有个写作题,其BEC题型是由50%的选择+35%的案例分析+15%的写作题组成。

42

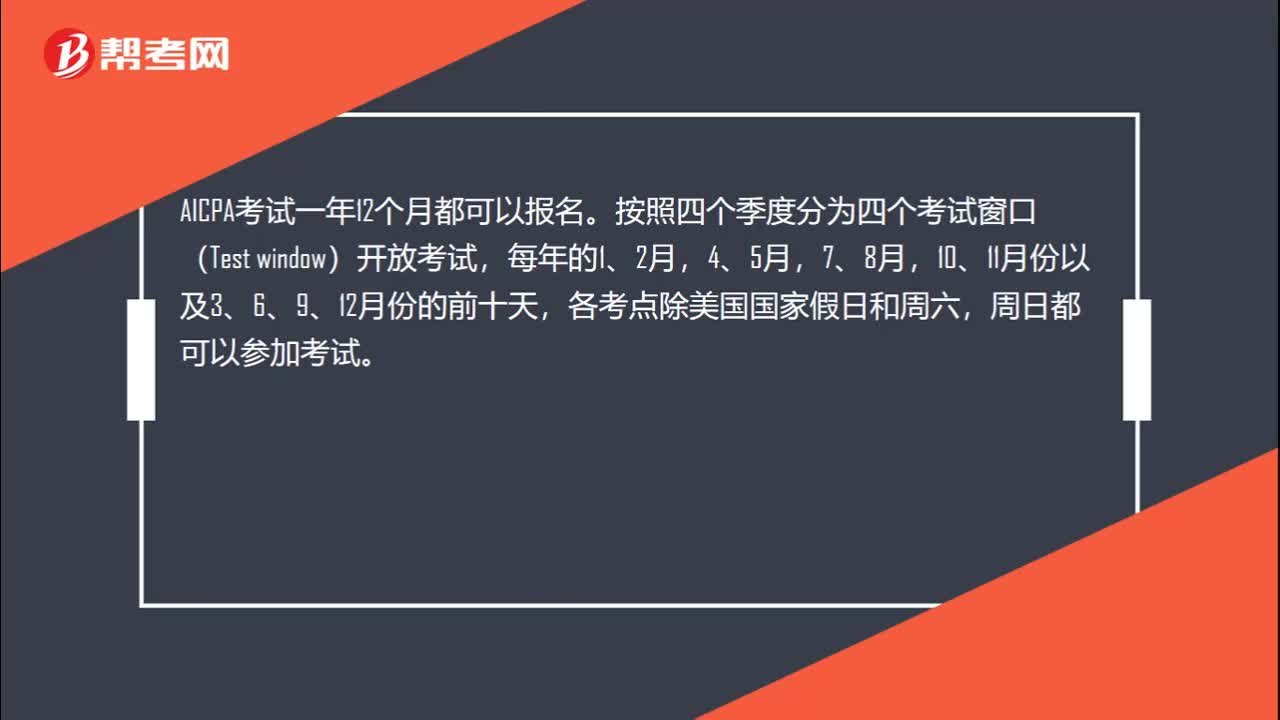

422020年AICPA考试预约考试后多久收到NTS准考证?:2020年AICPA考试预约考试后多久收到NTS准考证?NTS大约需要二到八周才能到达。在大多数州,一旦你收到NTS,它的有效期为六个月,你可以一次申请多个考试科目部分。当你重新申请时,收到你的NTS通常只需要1-2周时间。中国考生申请考试一般需要2-3个月的时间,取得NTS后,建议考生在考前45天去预约考试日期,以确保能参加考试。

00:22

00:222020-05-21

01:20

01:202020-05-21

00:25

00:252020-05-21

01:01

01:012020-05-21

00:45

00:452020-05-21

微信扫码关注公众号

获取更多考试热门资料