What are the effects of share repurchase on stock price volatility?

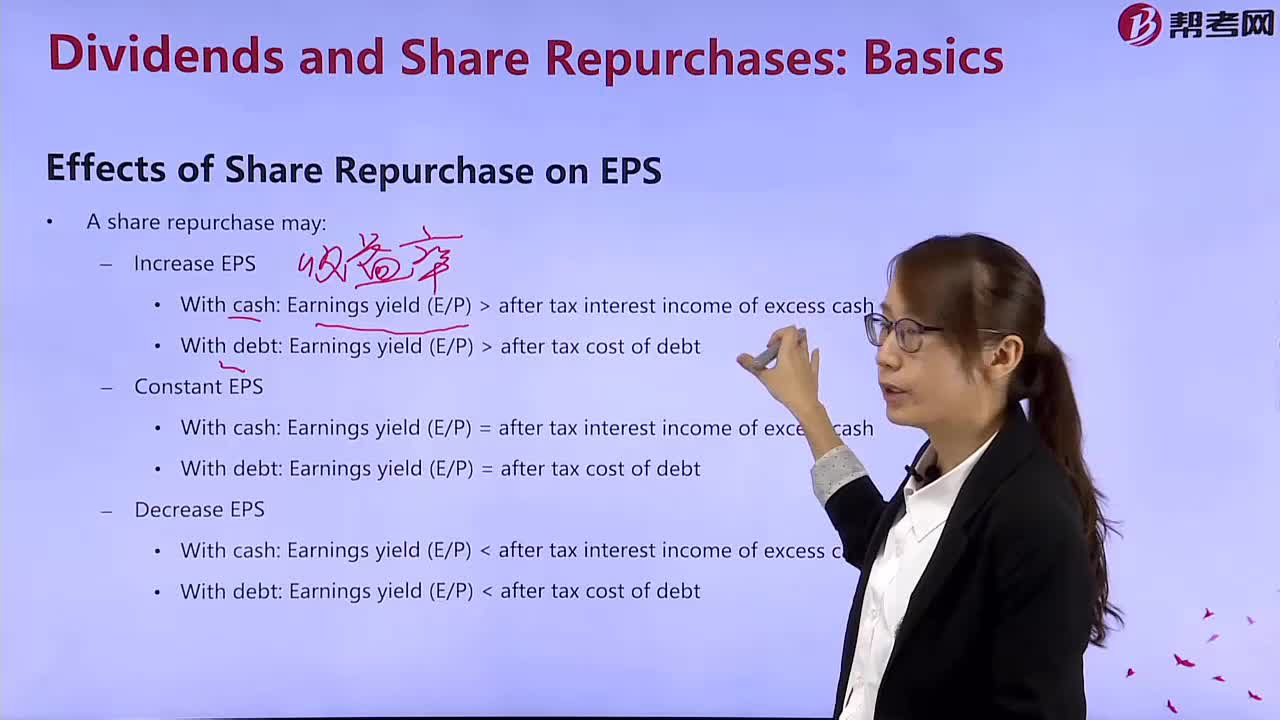

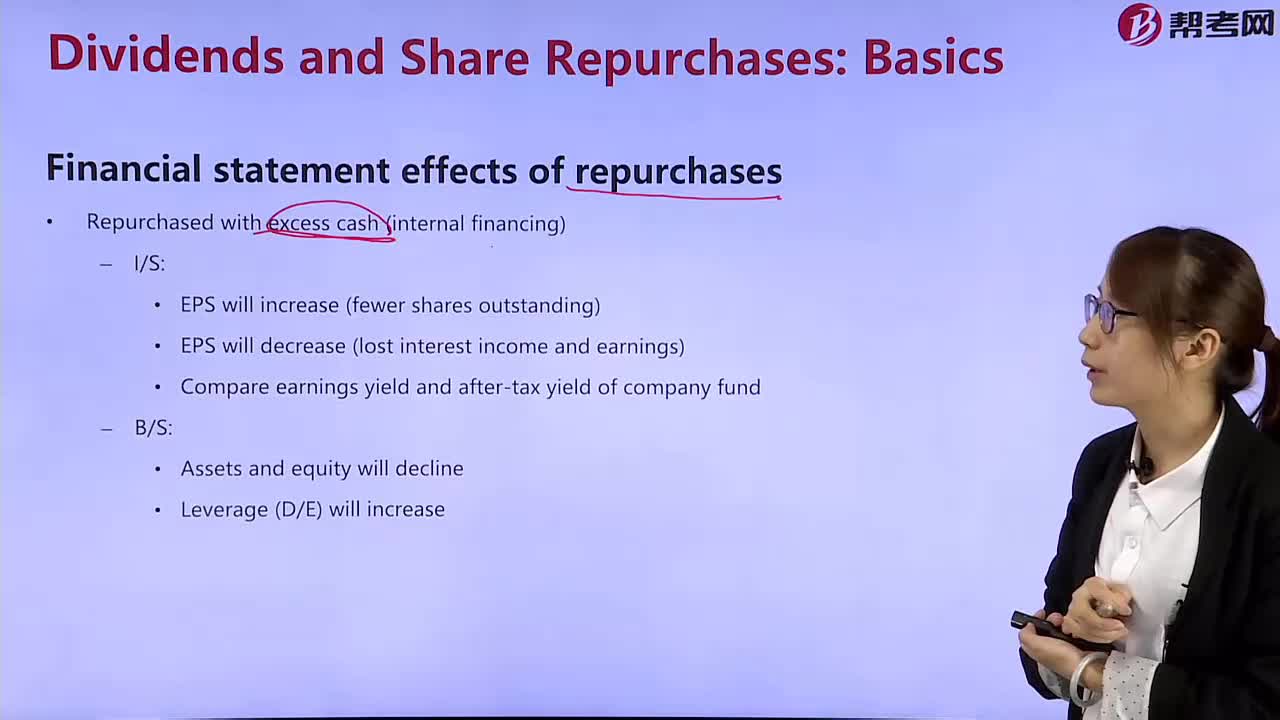

What effect does stock repurchase have on earnings per share?

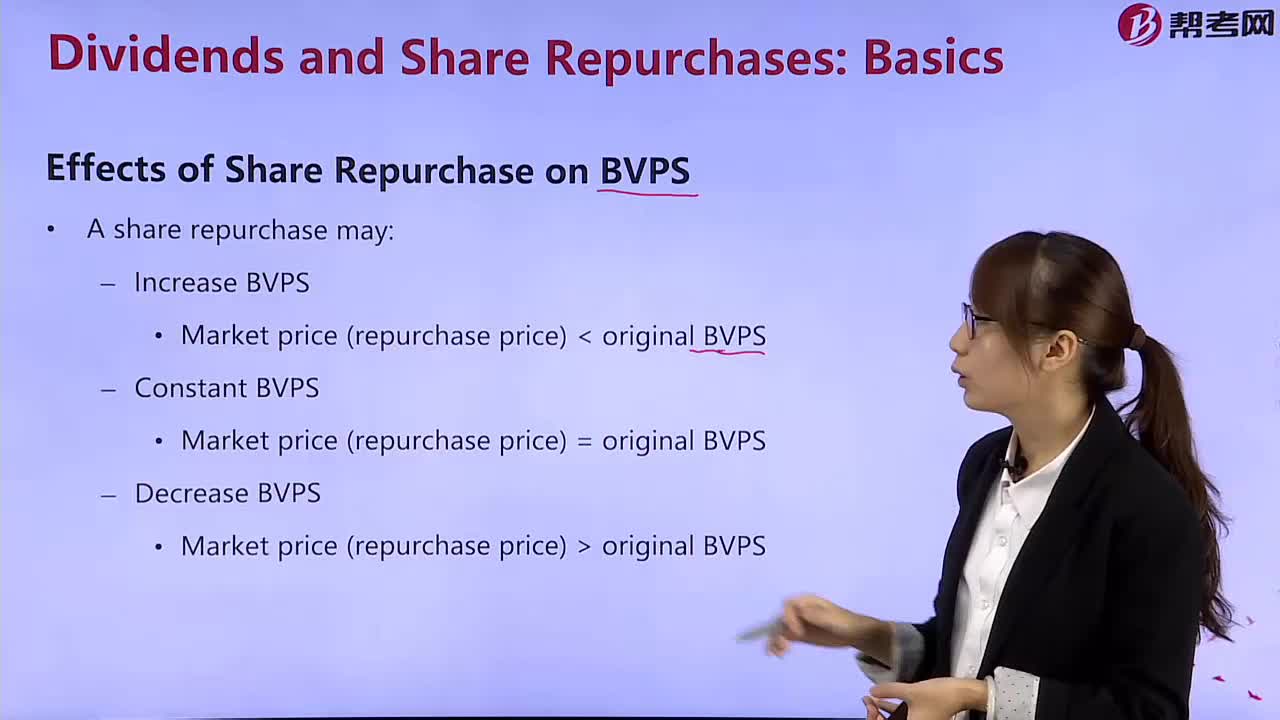

What is the effect of the repurchase on the financial statements?

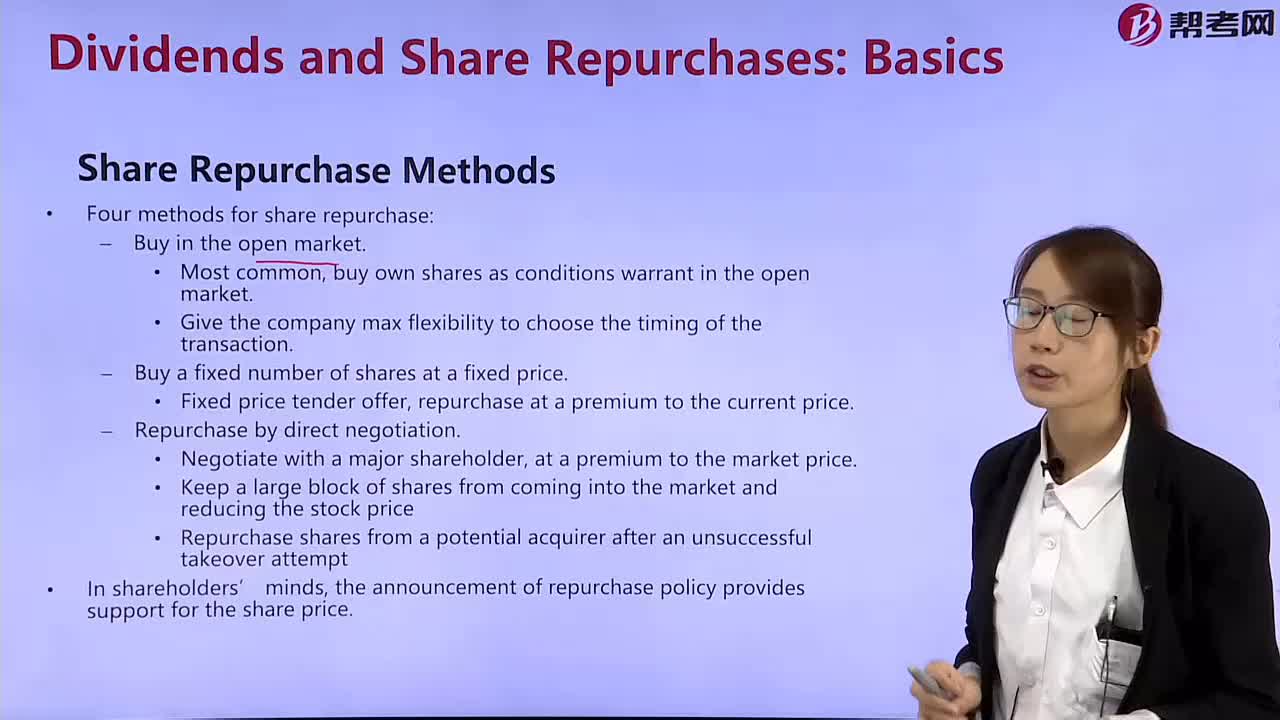

What are the methods of share repurchase?

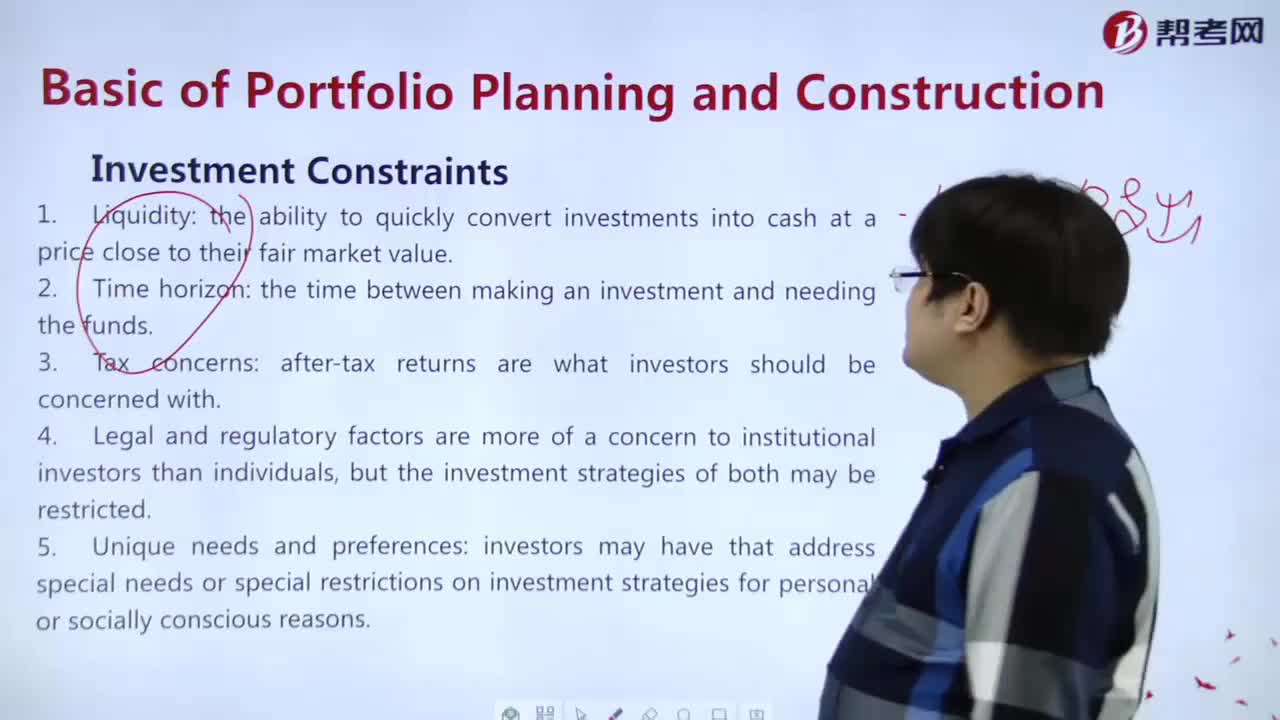

What are the constraints of investment?

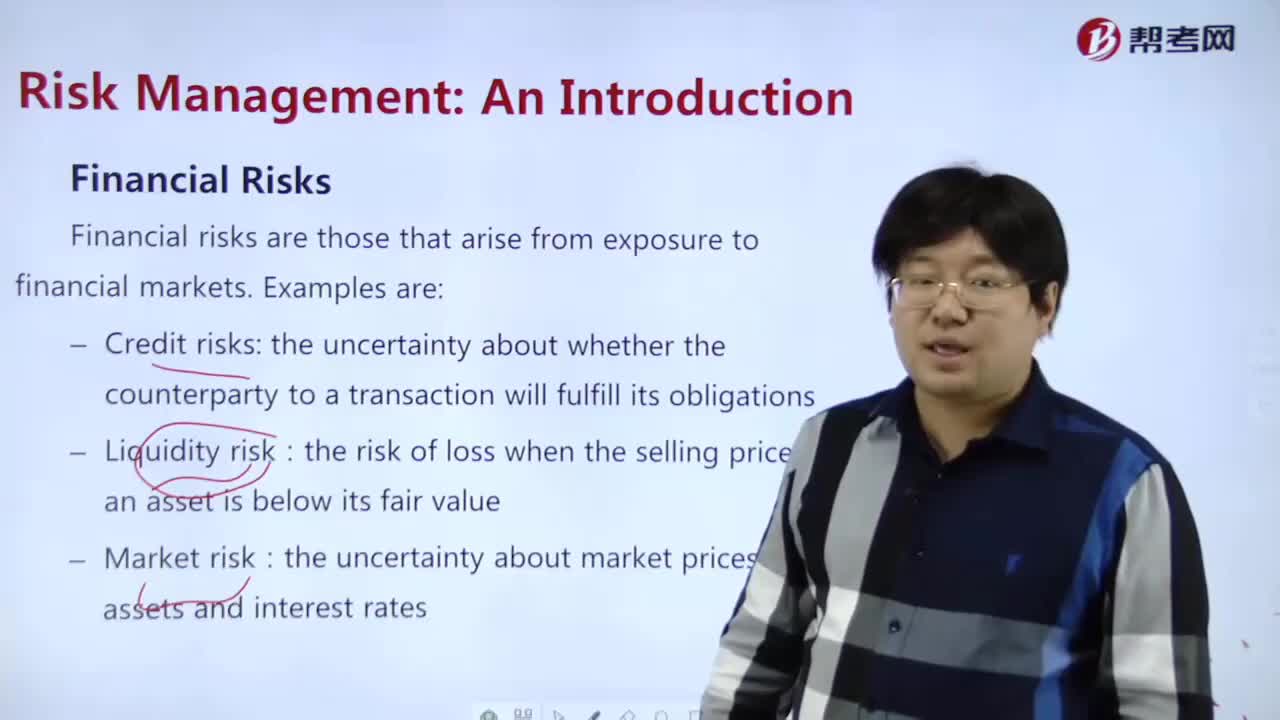

What are the types of financial risks?

What are the methods of dividend discount model?

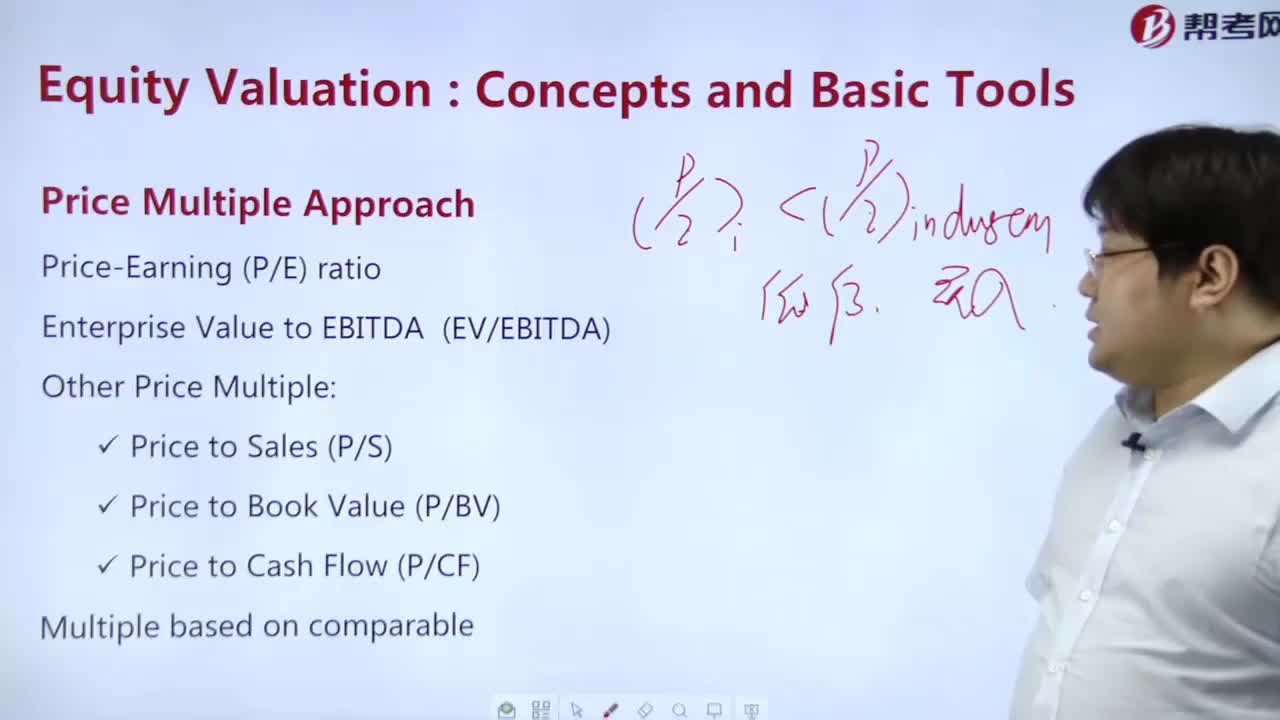

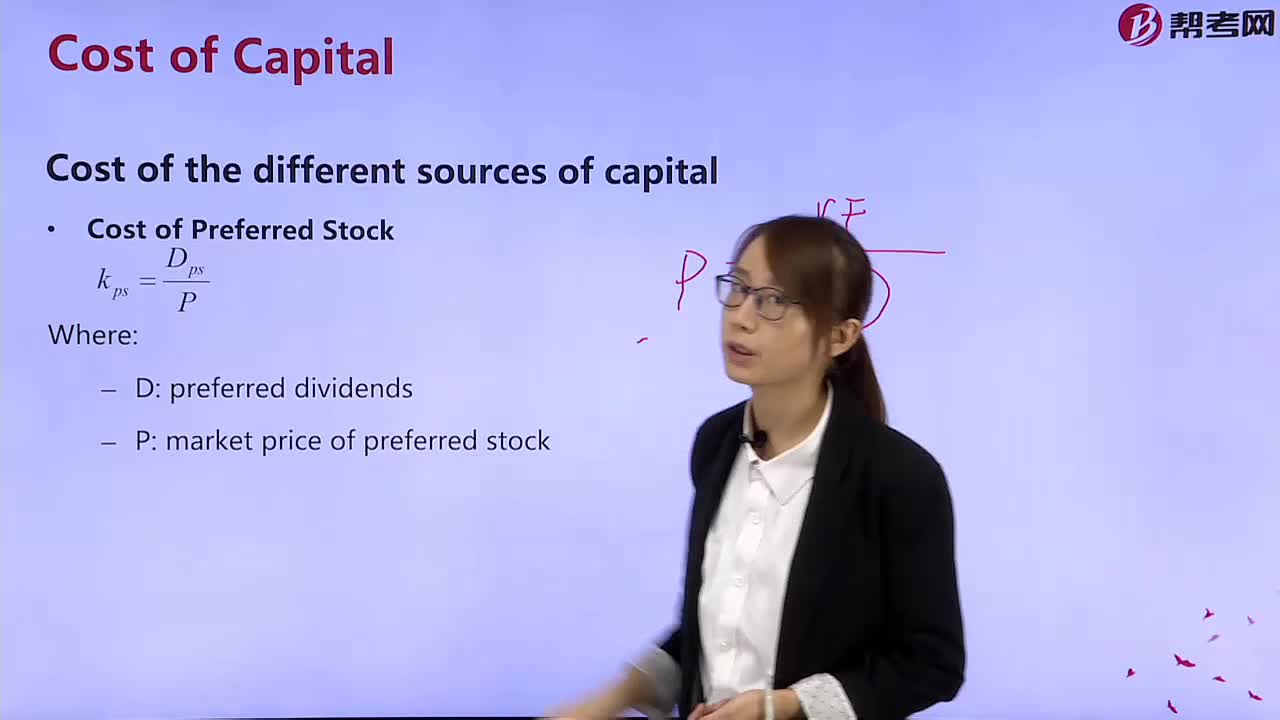

What are the costs of different sources of funding?

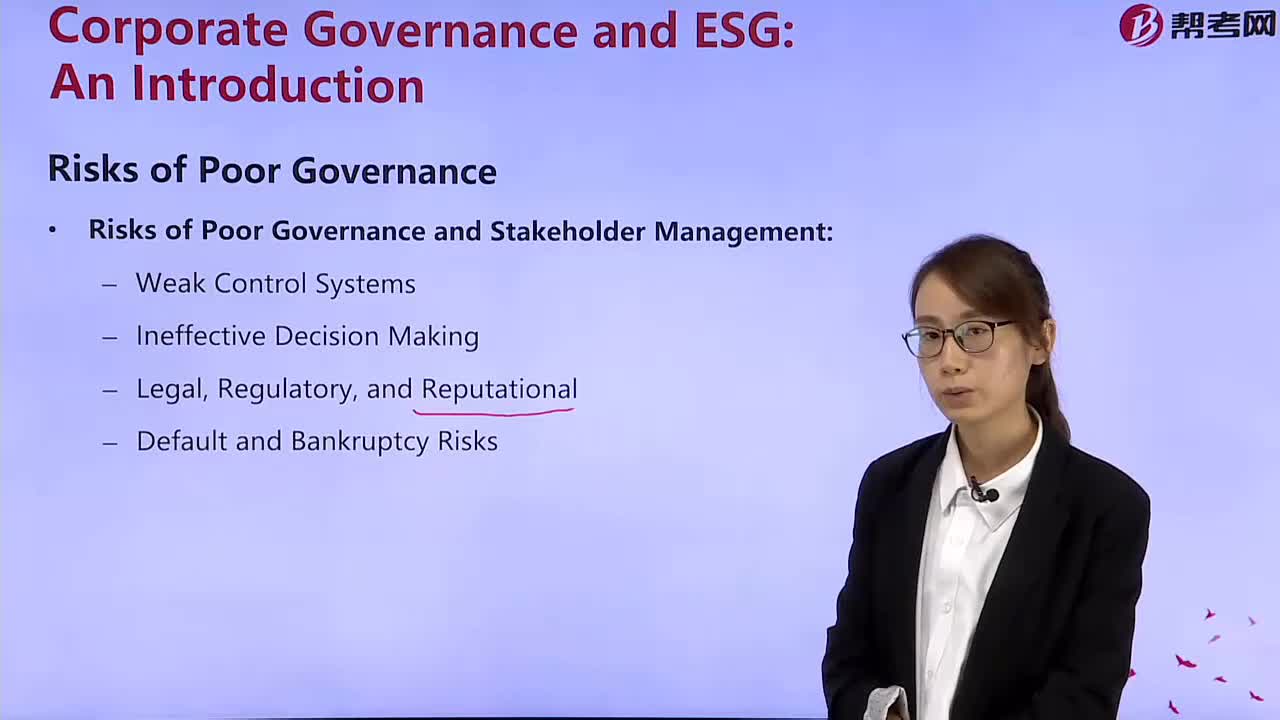

What are the risks of poor governance?

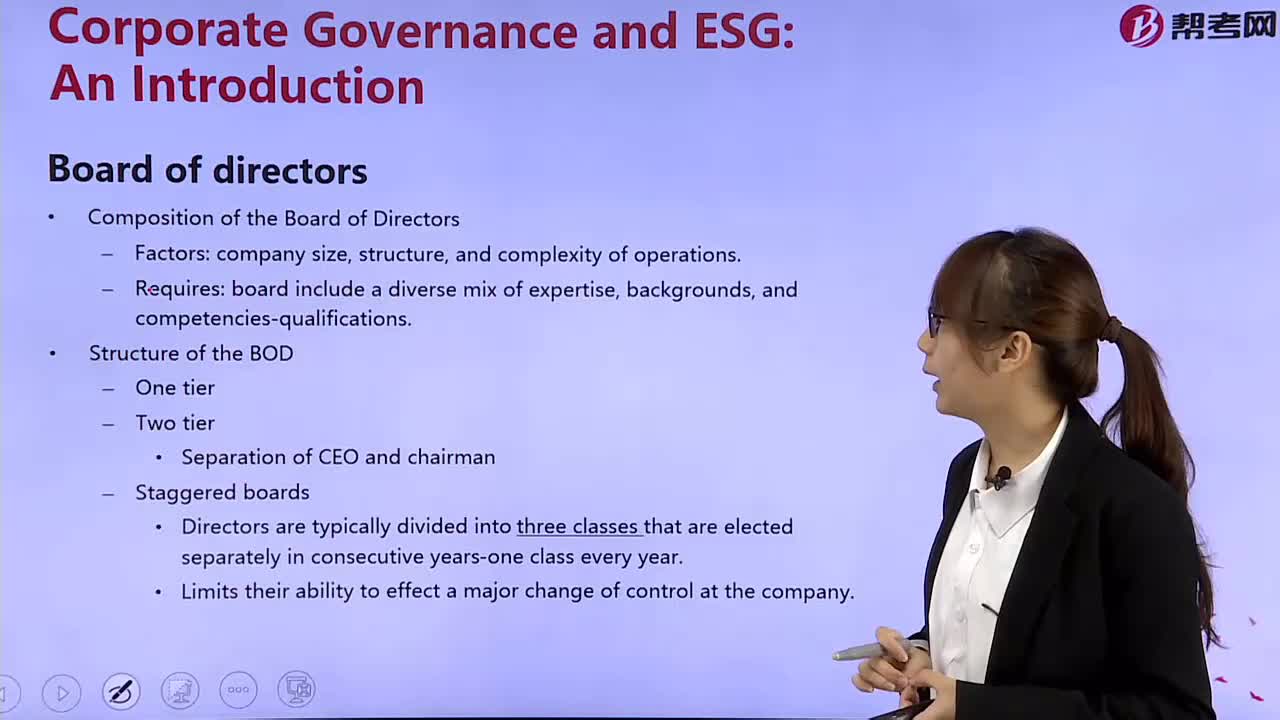

What are the requirements of the board members?

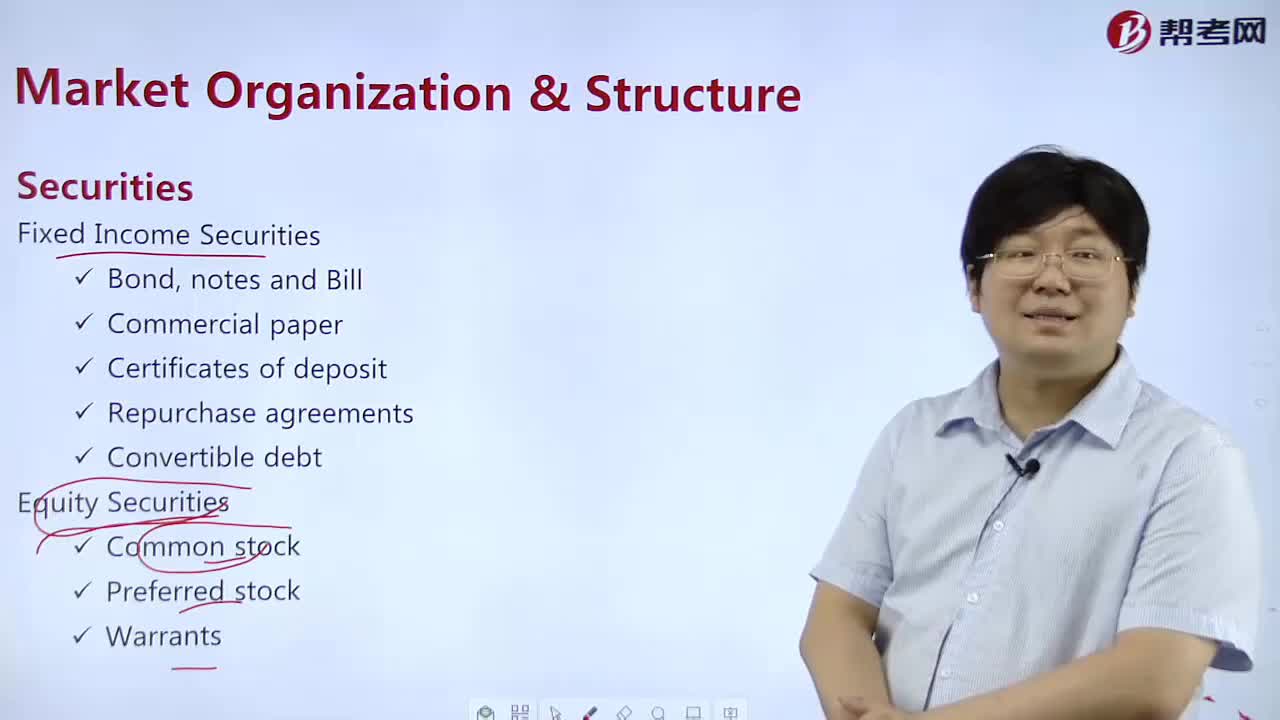

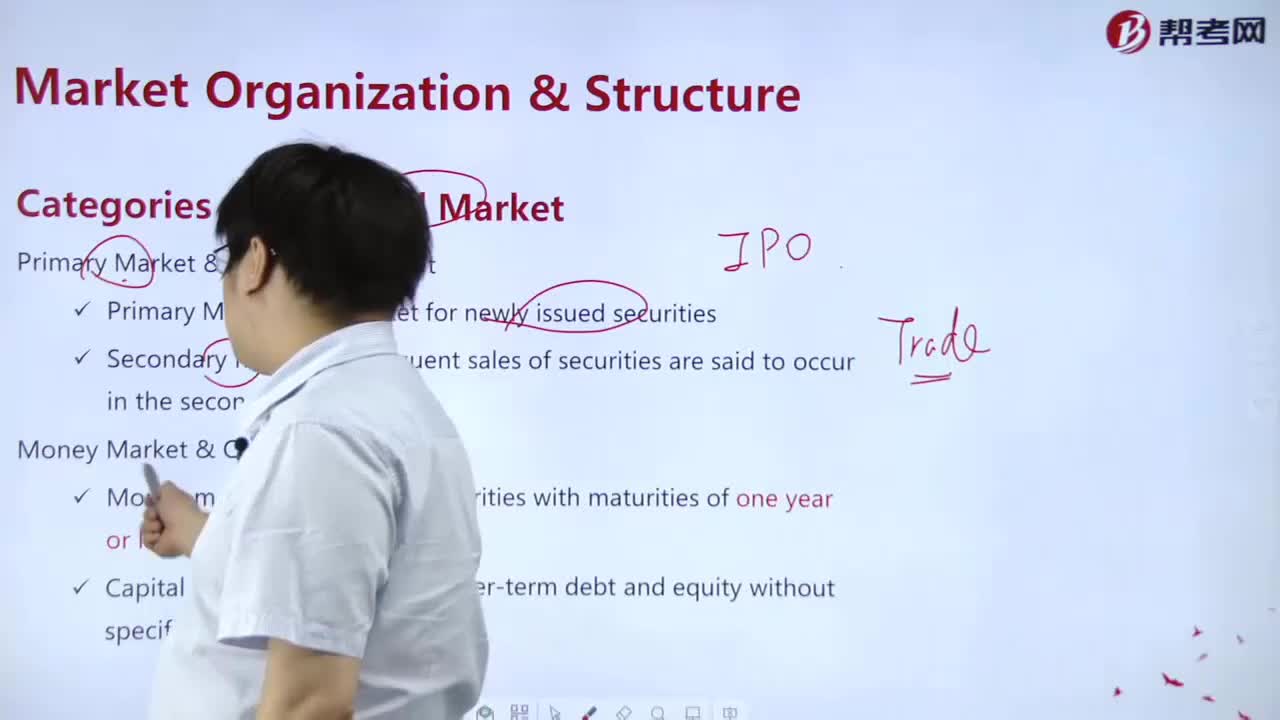

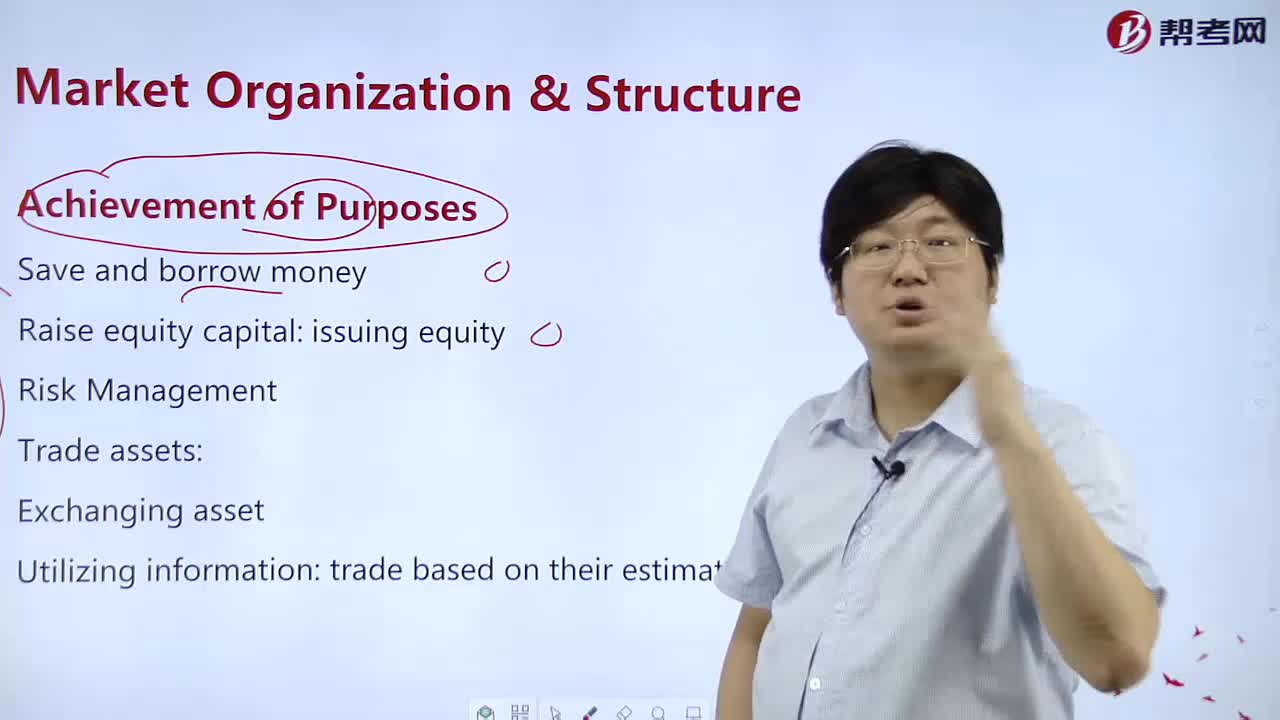

What are the objectives of the Marketing Organization?

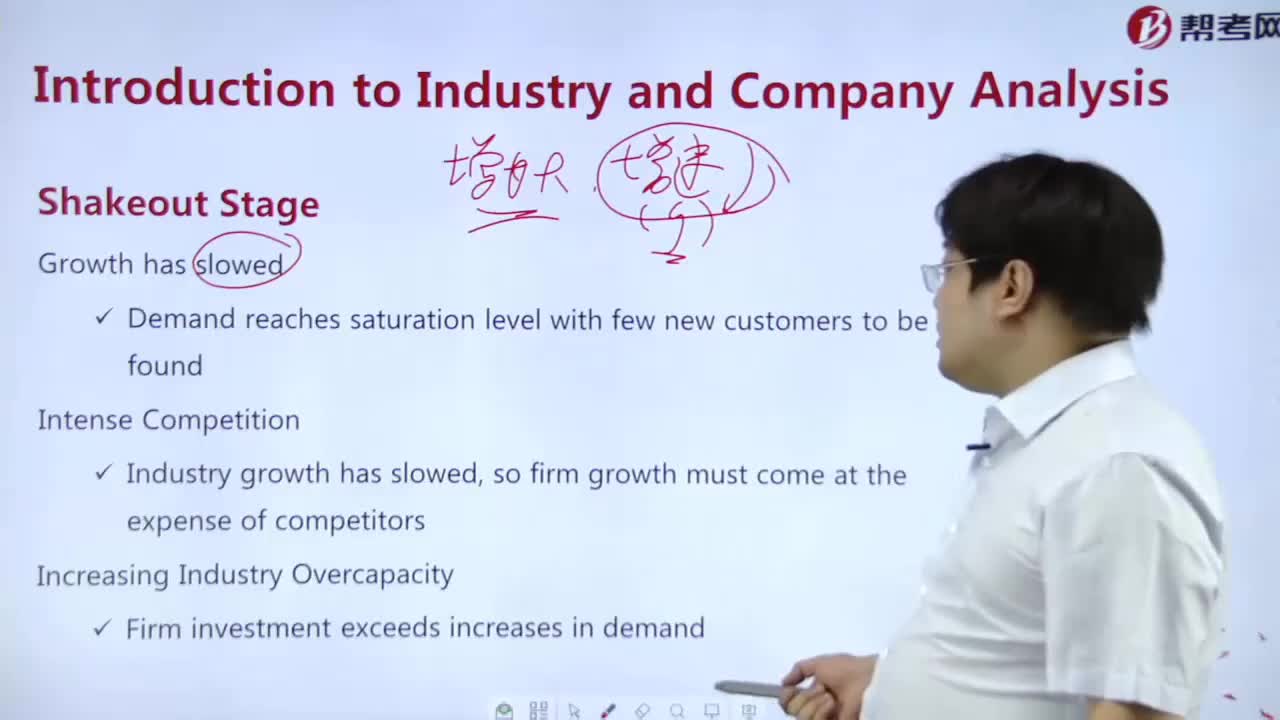

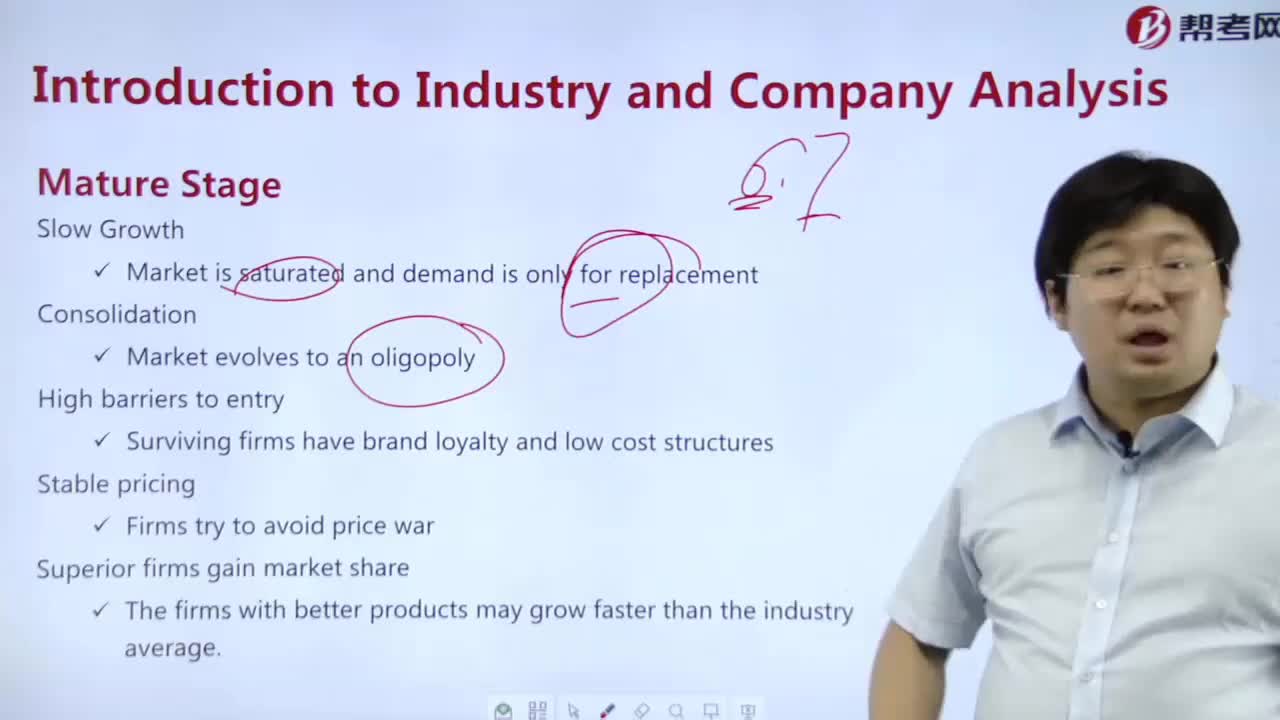

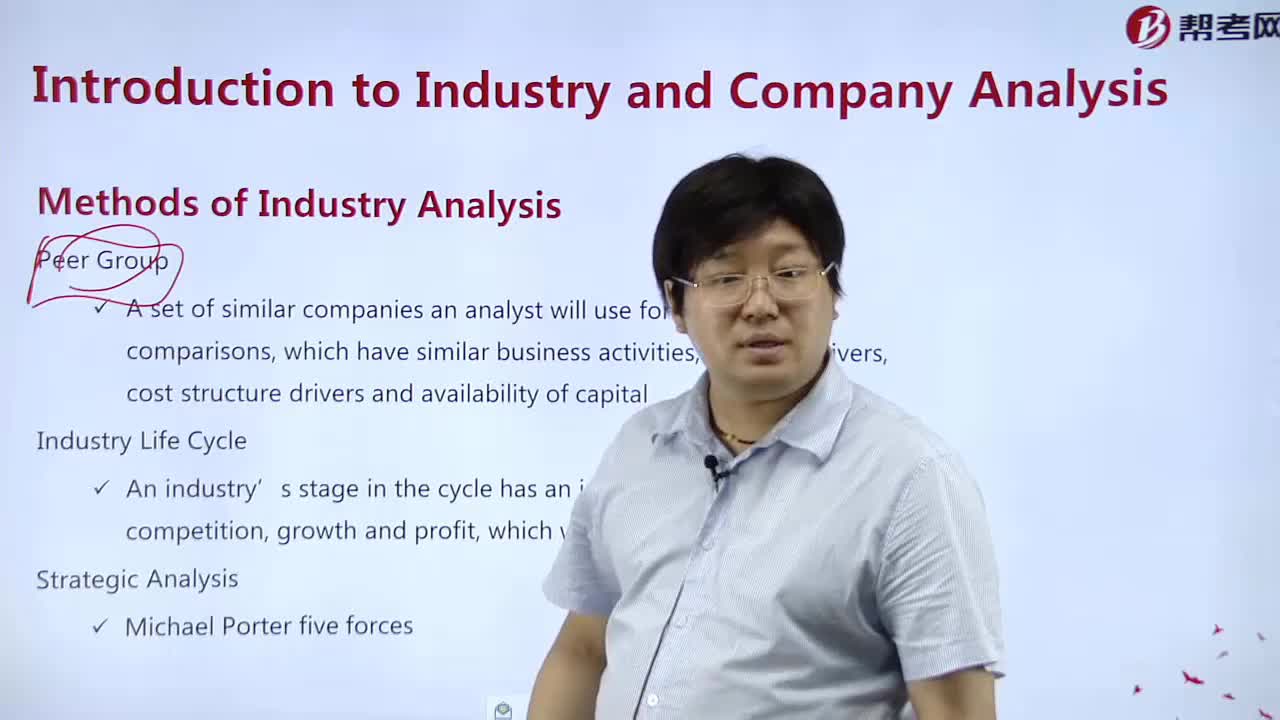

What are the methods of industrial analysis?

下载亿题库APP

联系电话:400-660-1360