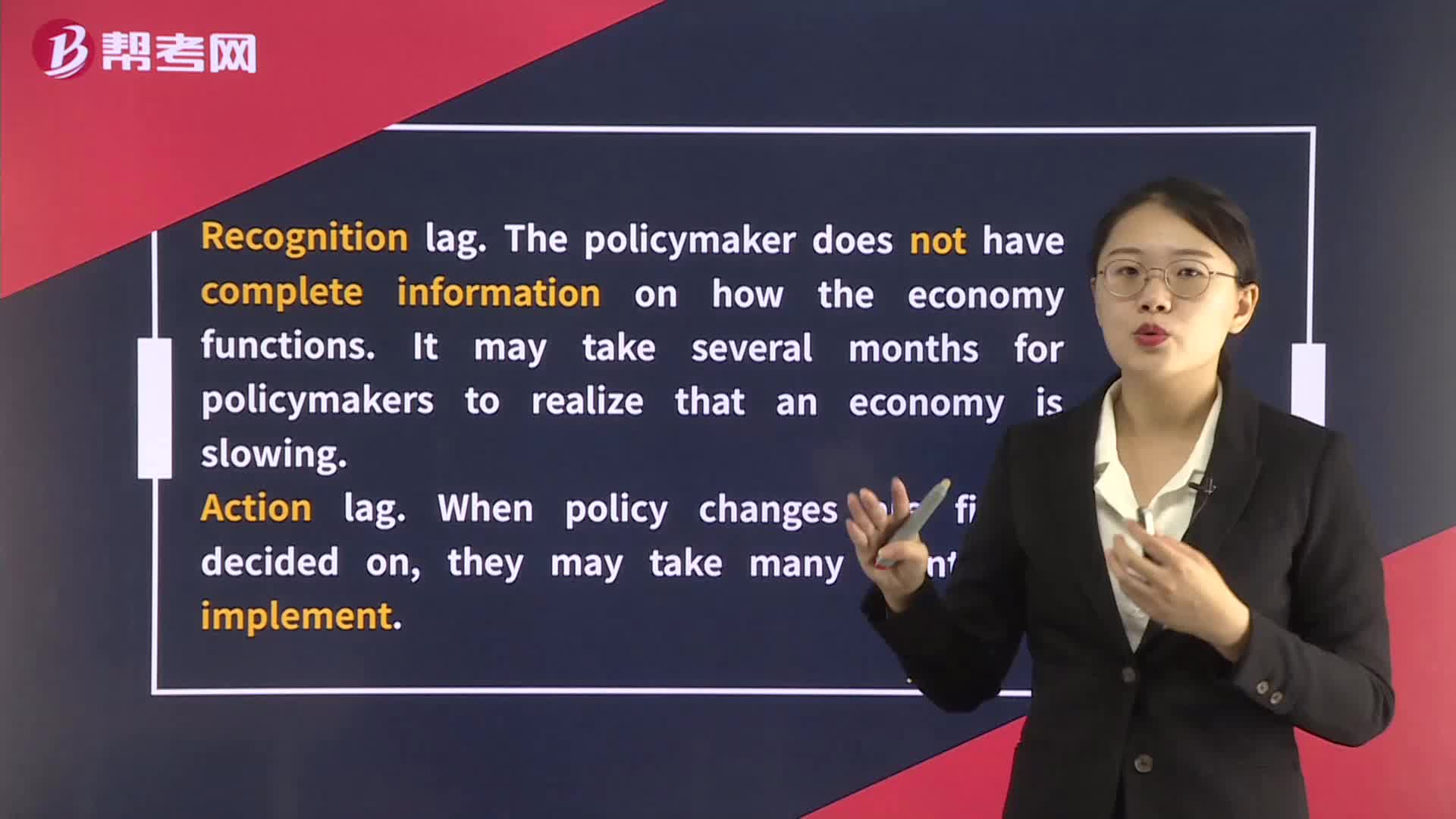

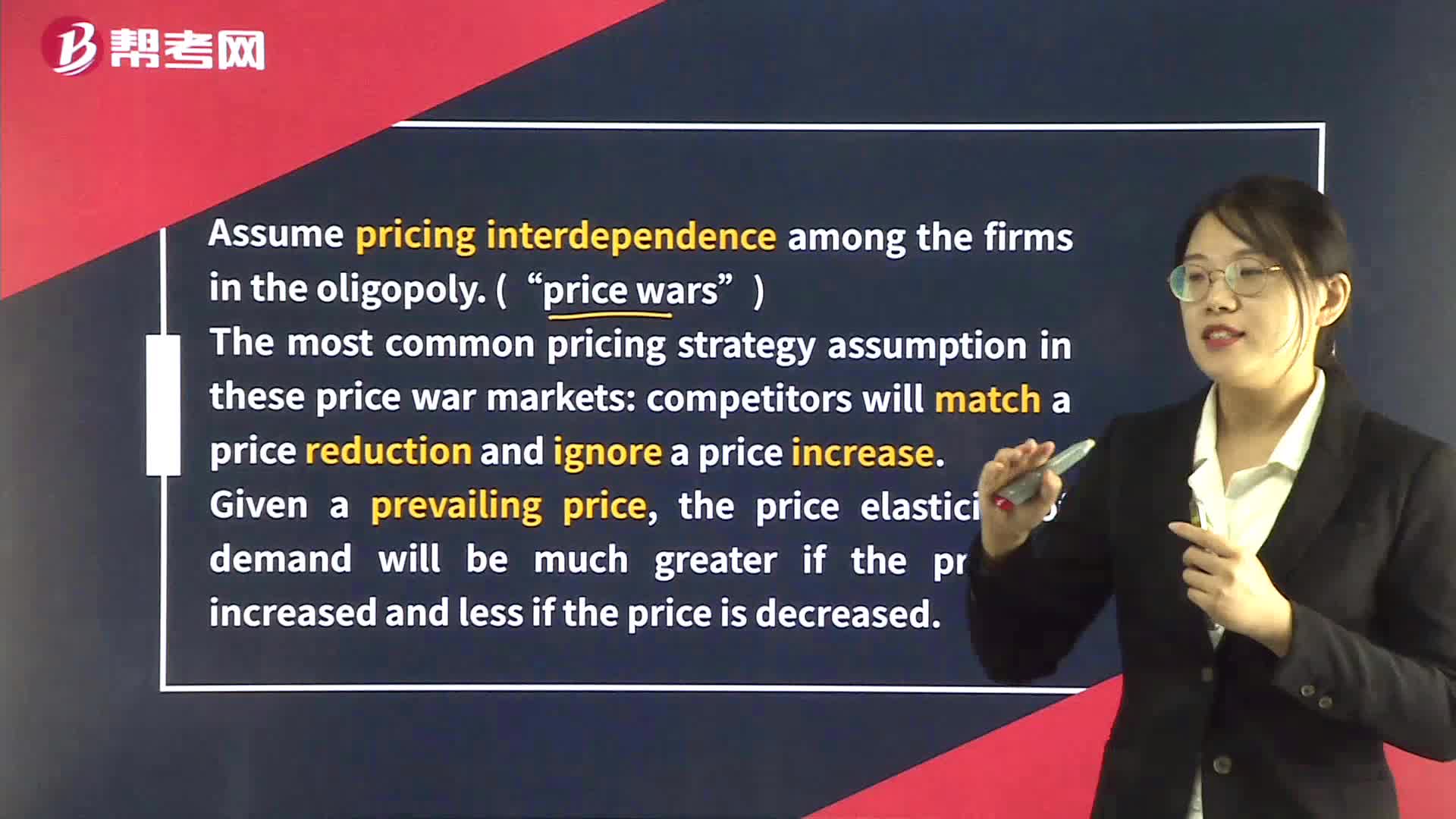

Kinked Demand Curve in Oligopoly Market

Foreign Exchange Market Participants

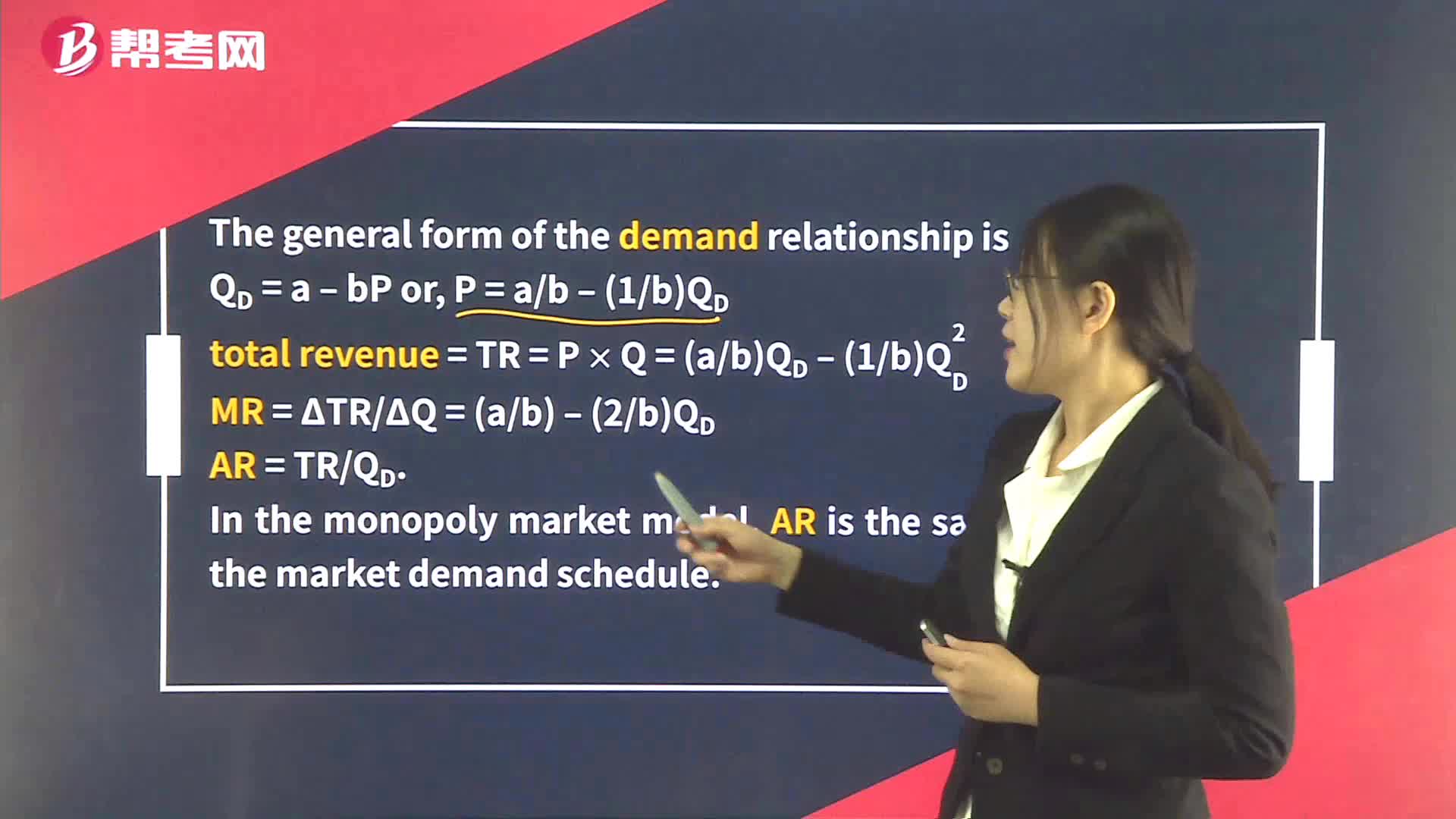

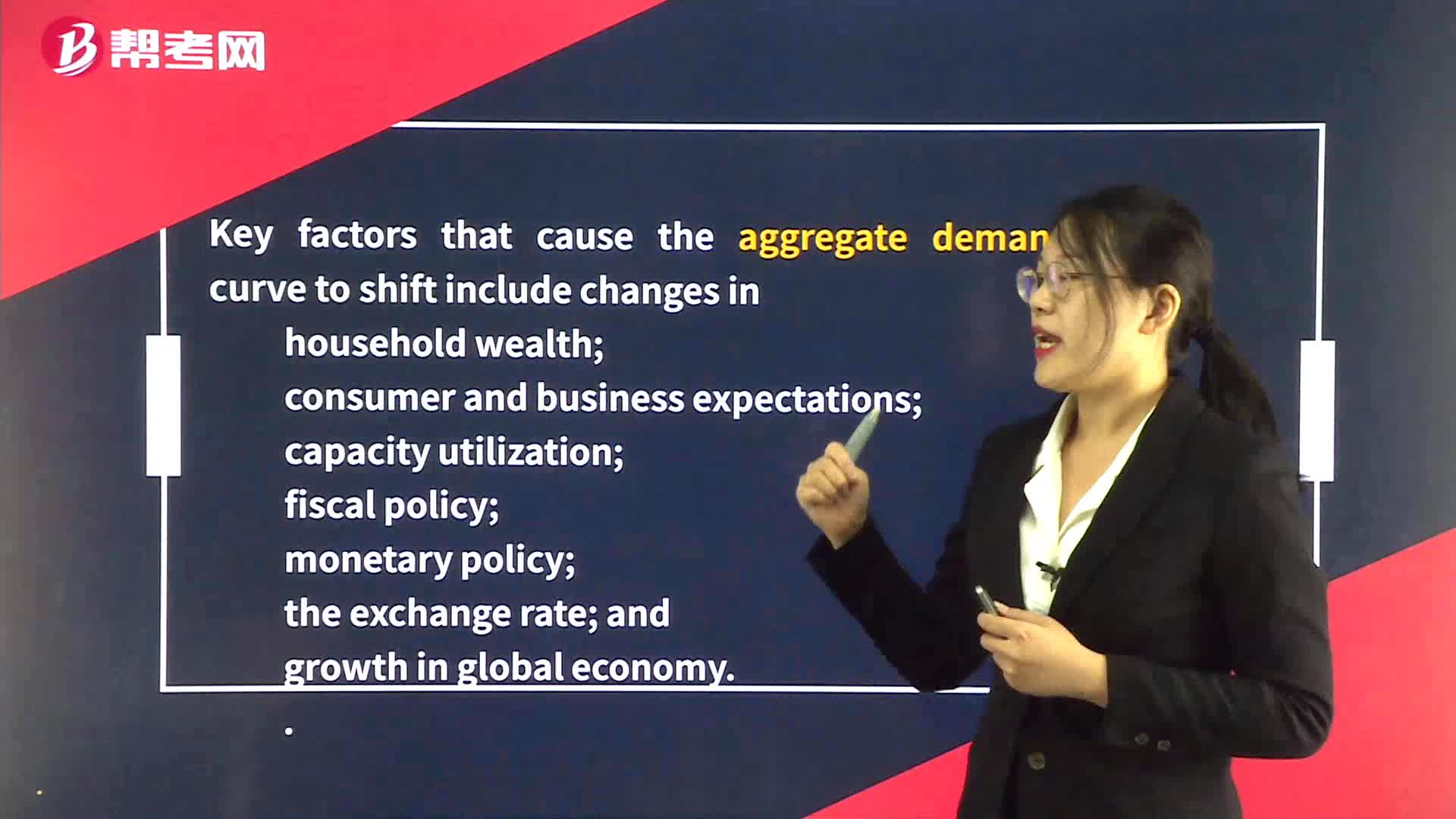

Shifts in Aggregate Demand

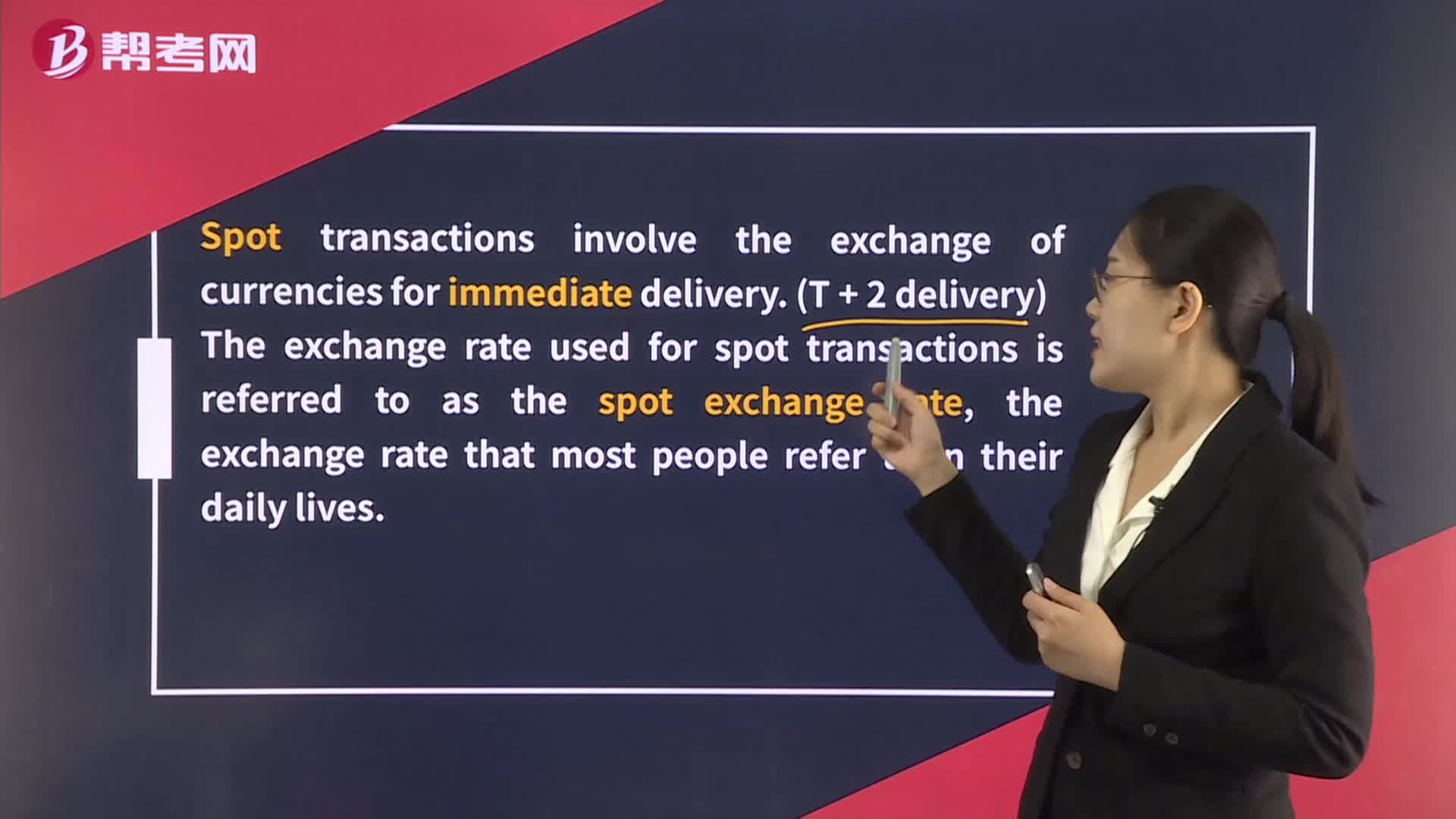

Foreign Exchange Market - Spot Rates and Forward Rates

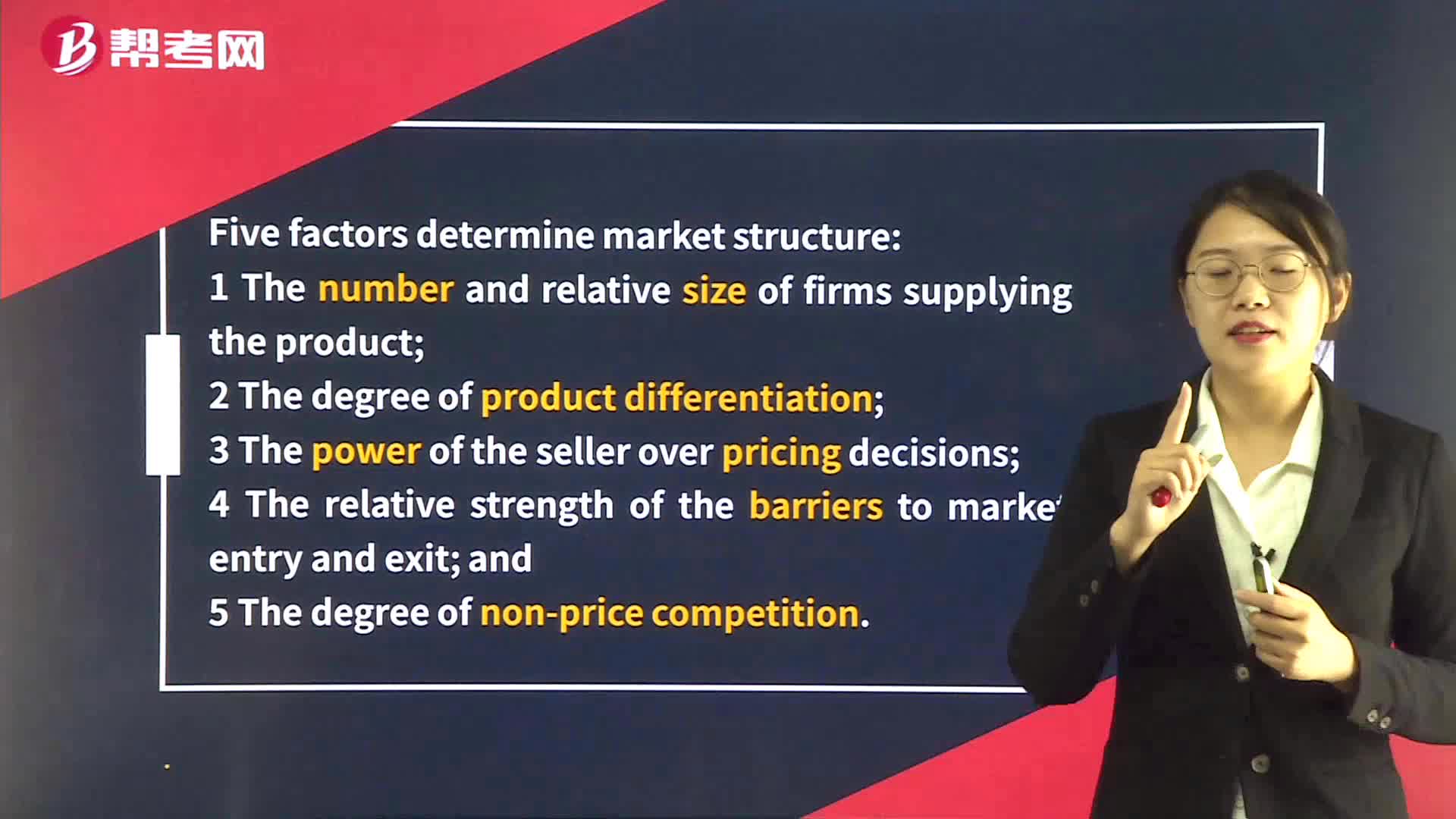

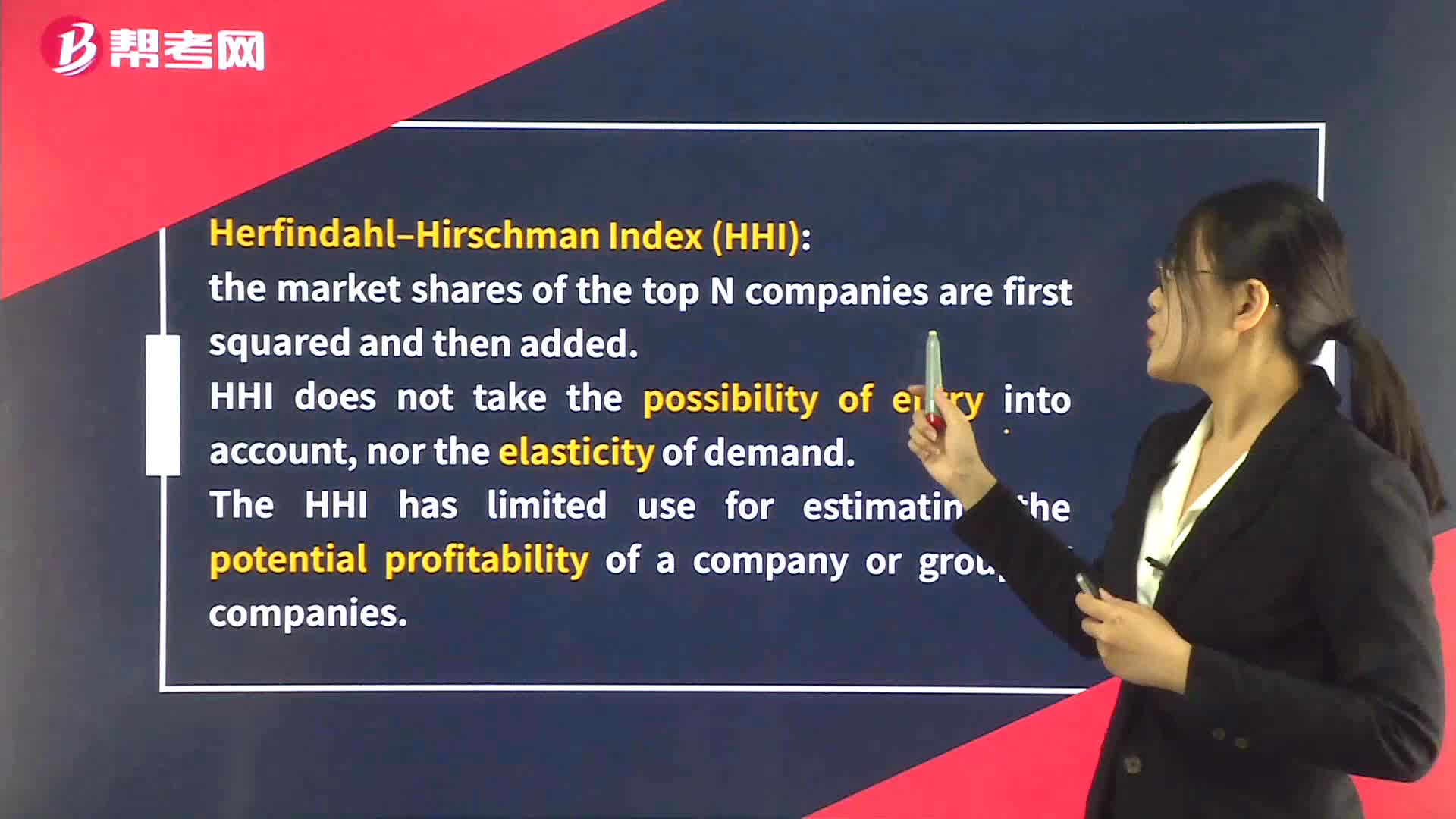

Identification of Market Structure – HHI

Identification of Market Structure – Concentration Ratio

Identification of Market Structure – Econometric Method

Shifts in Aggregate Demand and Supply

The Demand for Money

Factors Affecting Long-Run Equilibrium in Monopoly Markets

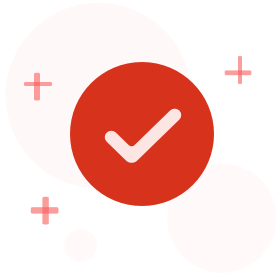

Demand Analysis in Perfect Competition

Demand Analysis:The Consumer

下载亿题库APP

联系电话:400-660-1360