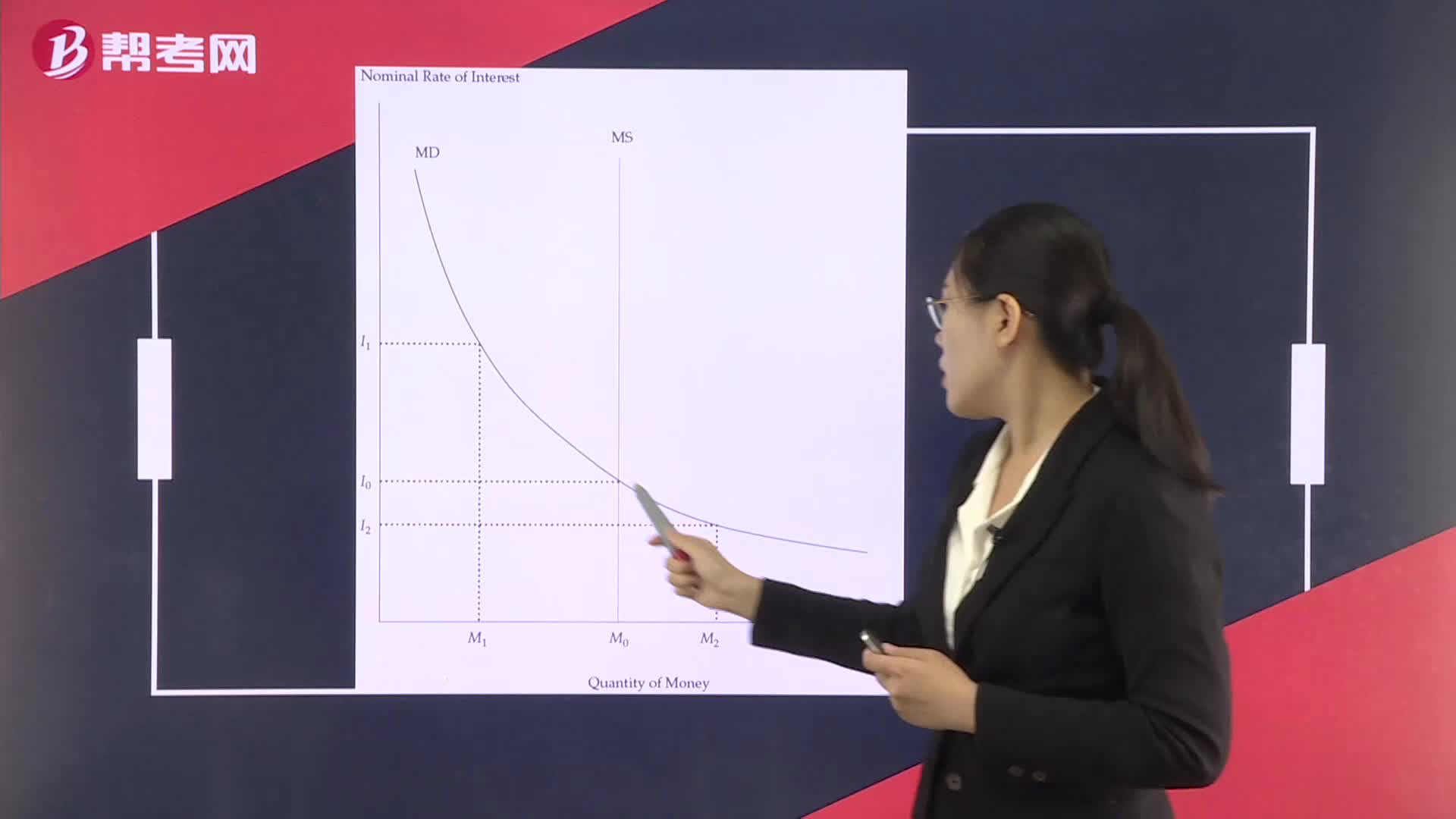

The Supply and Demand for Money

The Quantity Theory of Money

Shifts in the AD and AS curves and Equilibriums

The Money Creation Process

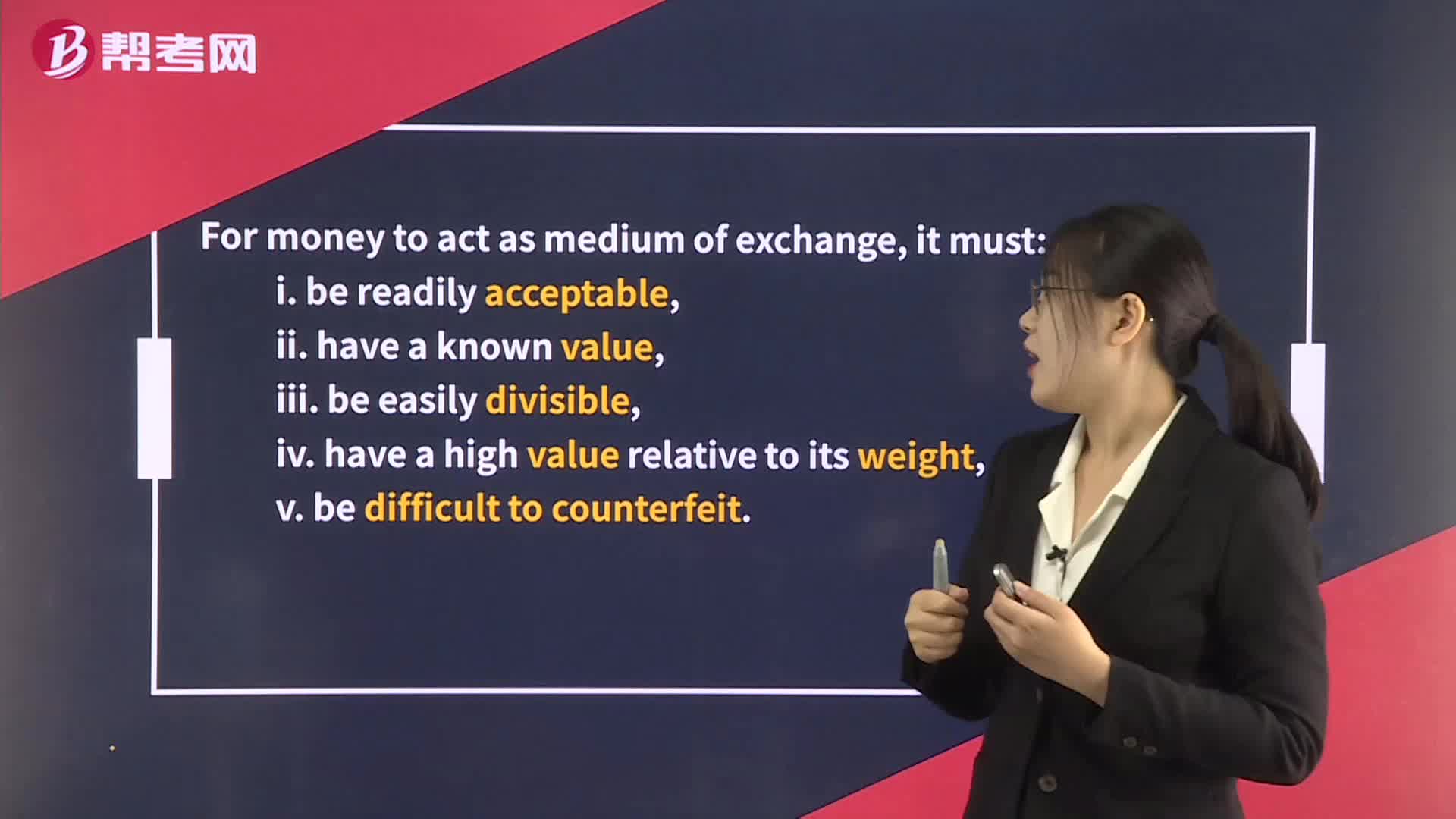

The Functions of Money

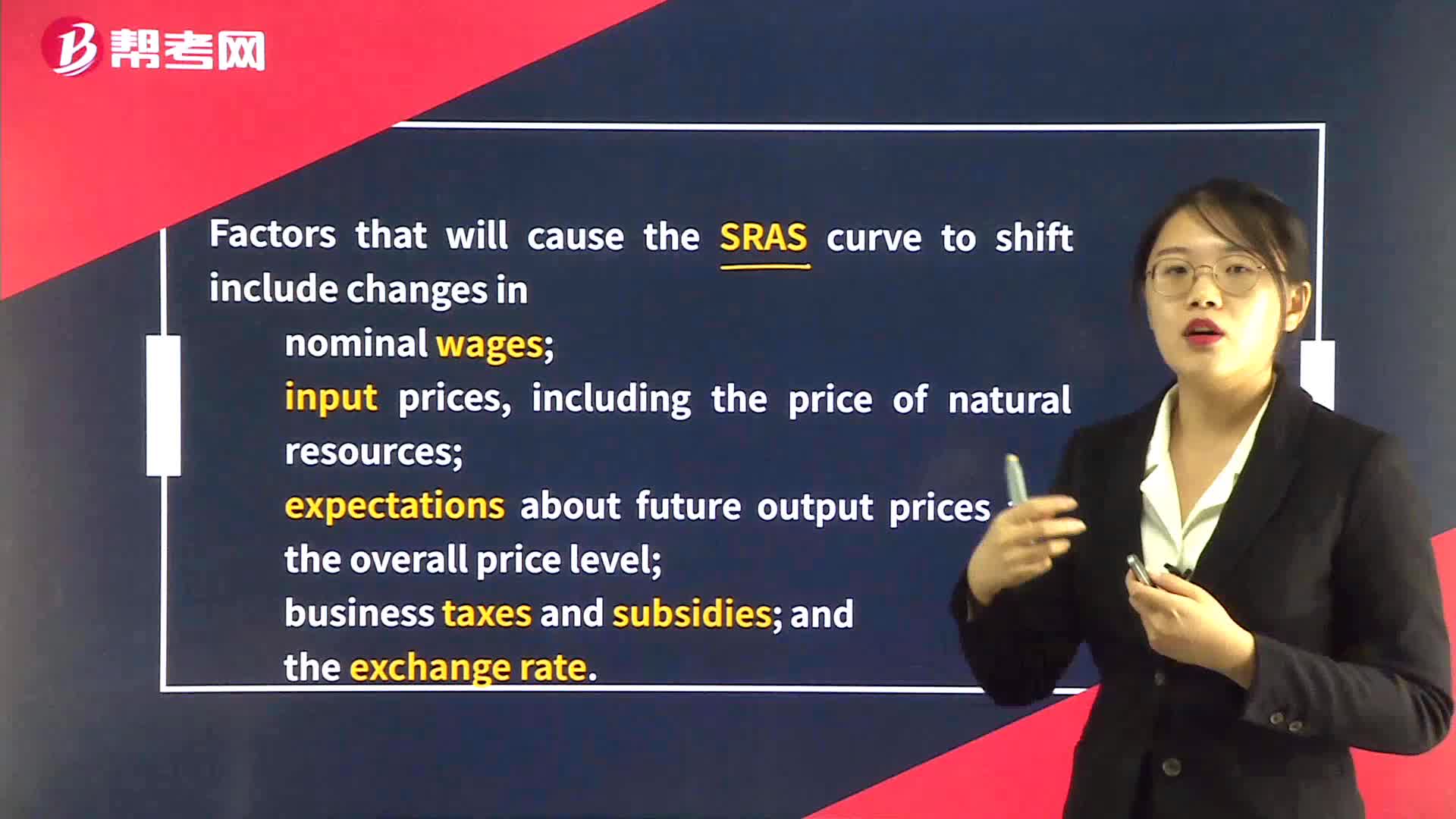

Shifts in Aggregate Supply

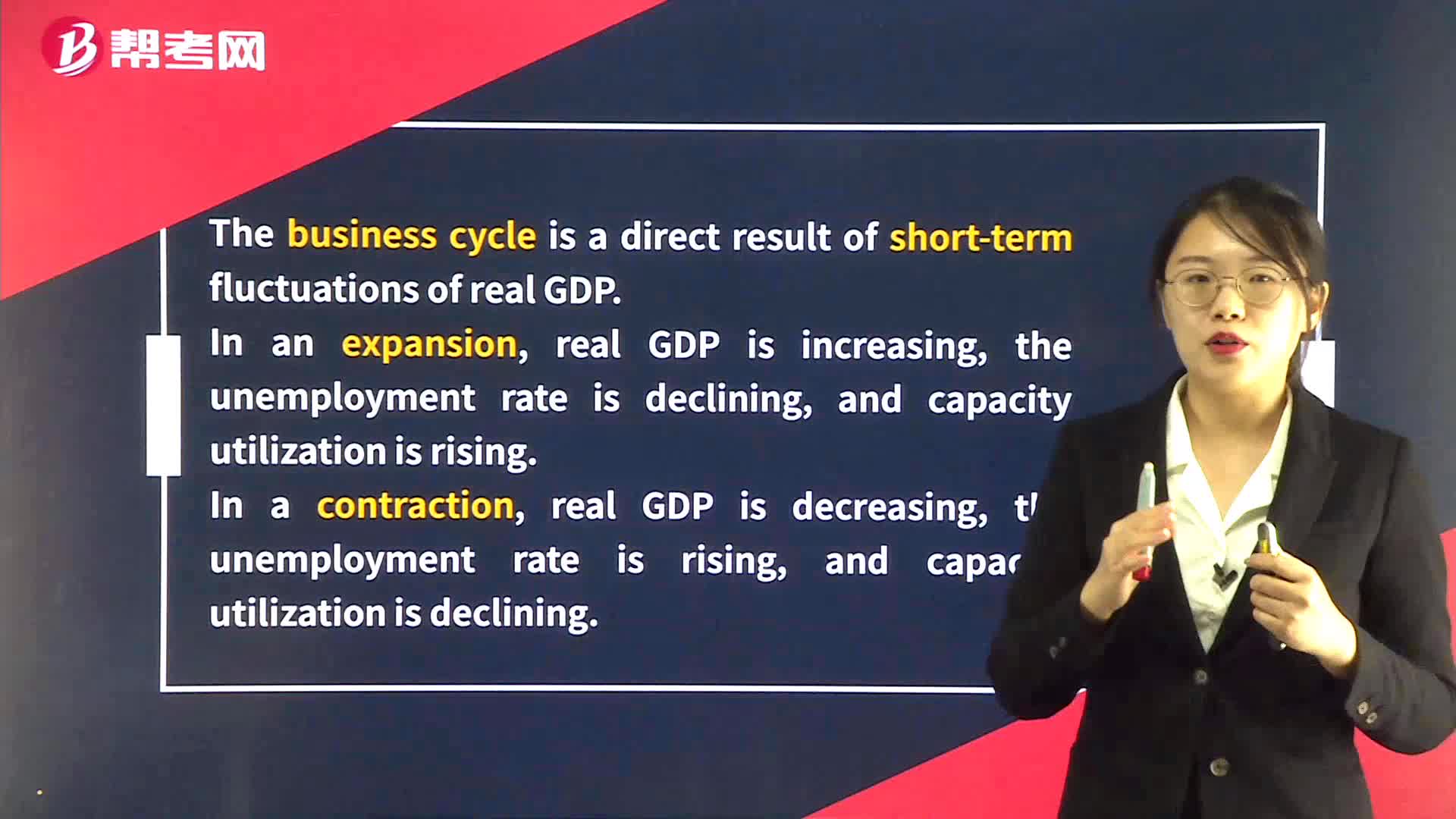

Shifts in Aggregate Demand and Supply

The Demand for Money

The Relationship Between Fiscal and Monetary Policy

Demand Analysis:The Consumer

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

Factors Influencing the Mix of Fiscal and Monetary Policy

下载亿题库APP

联系电话:400-660-1360