How to understand YTM for fixed rate Bond?

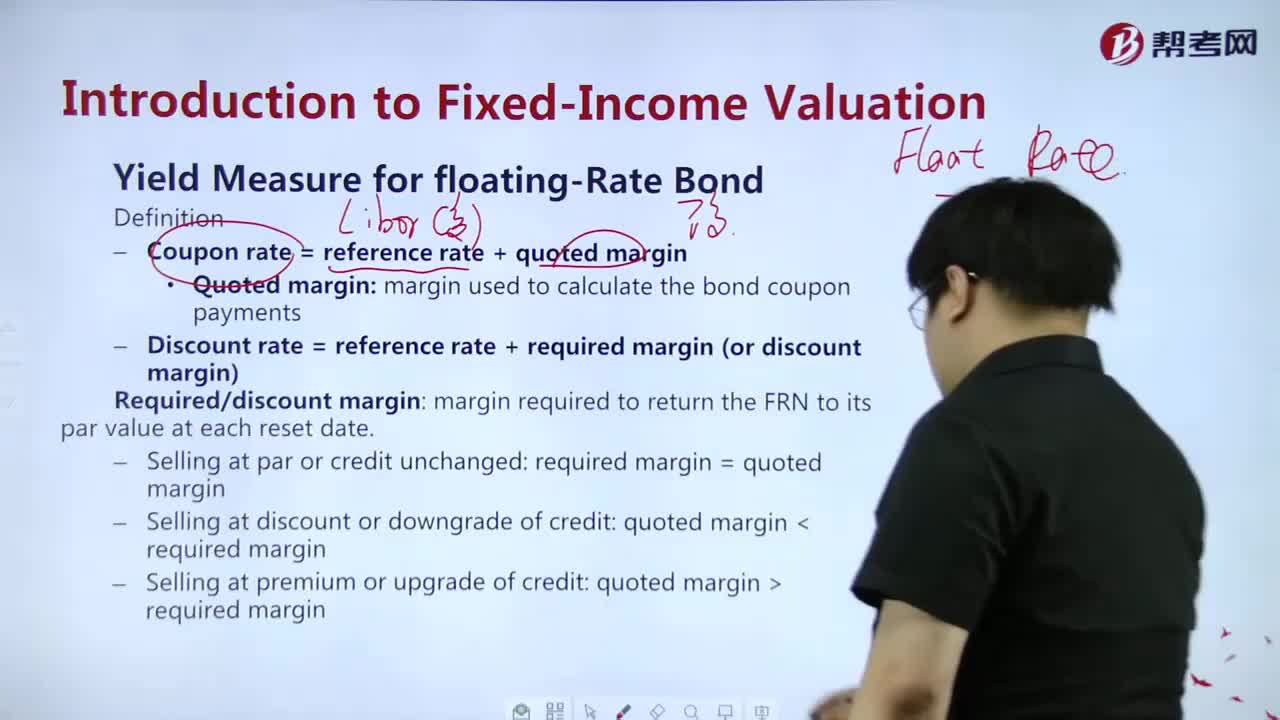

What's the Income Valuation-Yield Measure of Bond?

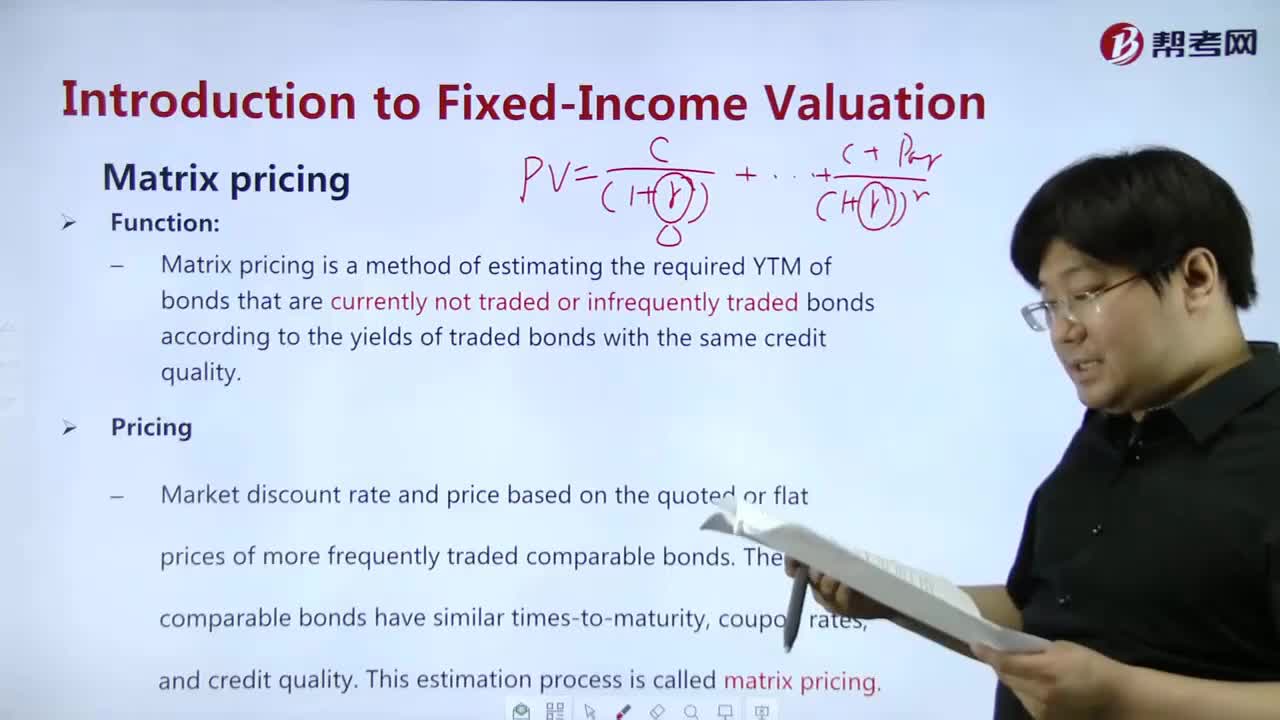

How to explain to you Matrix pricing?

what's the meaning of Bond Pricing with spot rate?

What is the meaning of a Fixed Income Index?

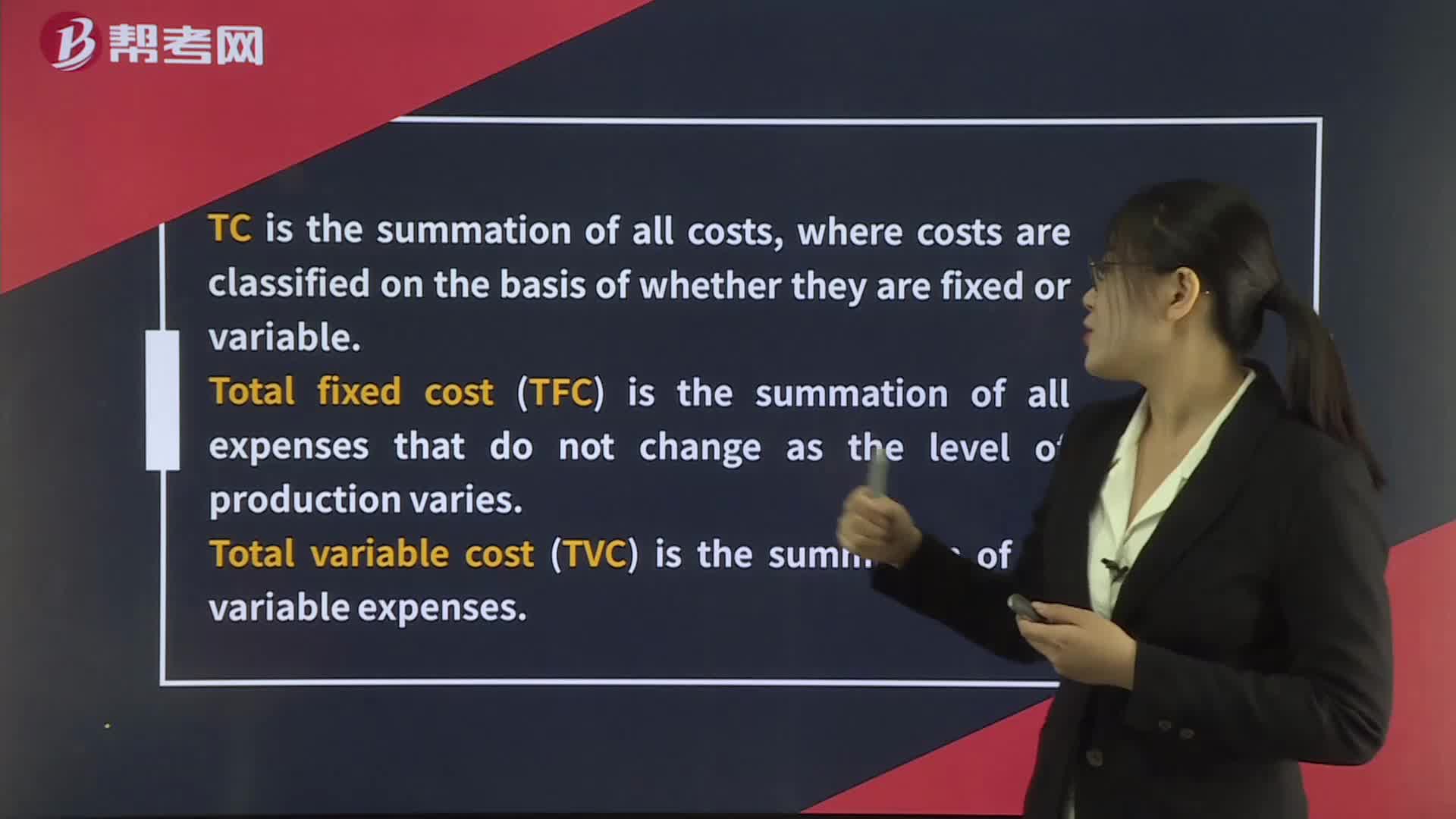

Total, Variable, Fixed, and Marginal Cost and Output

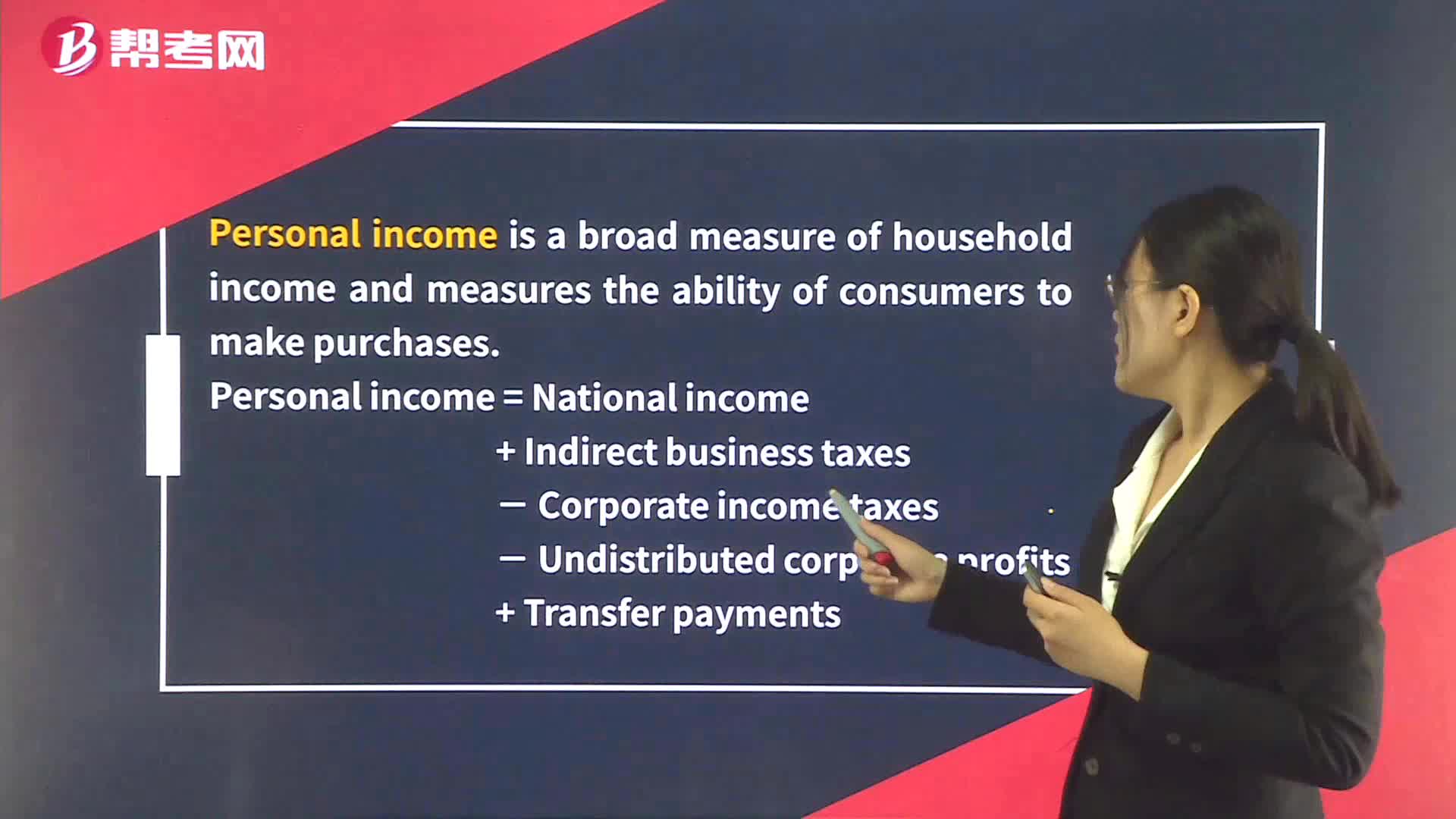

Personal Income & Personal Disposable Income

Substitution and Income Effects

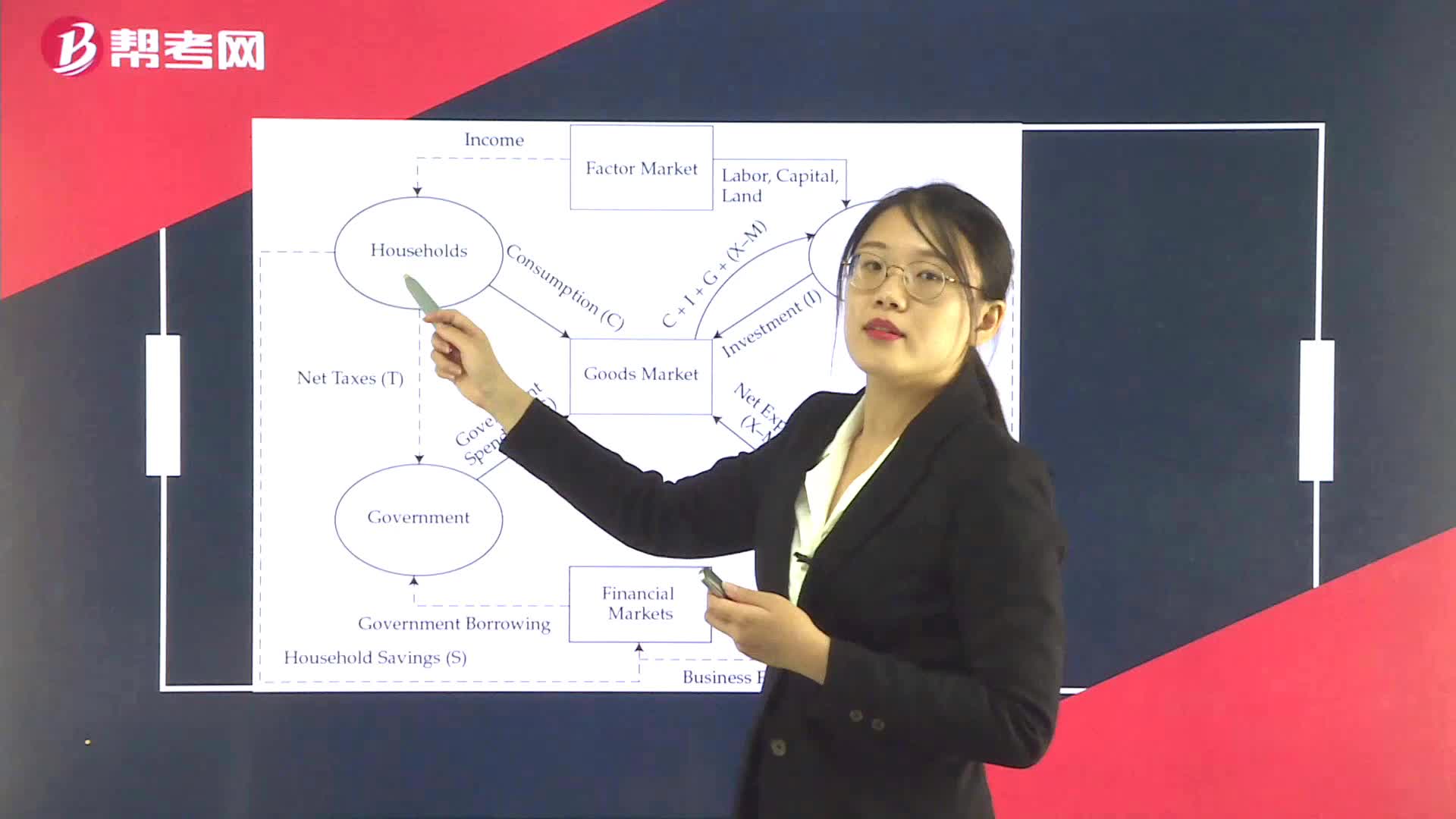

Output, Income, and Expenditure Flows

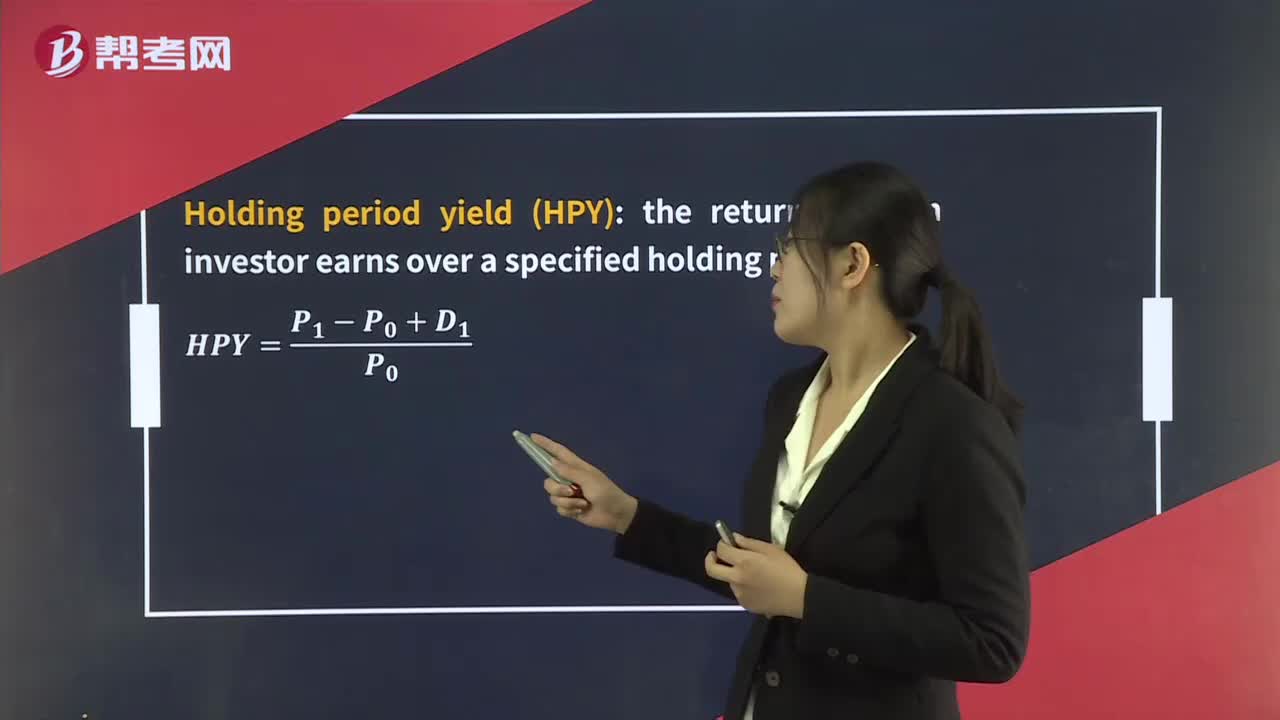

Money-Weighted Rate of Return & Time-Weighted Rate of Return

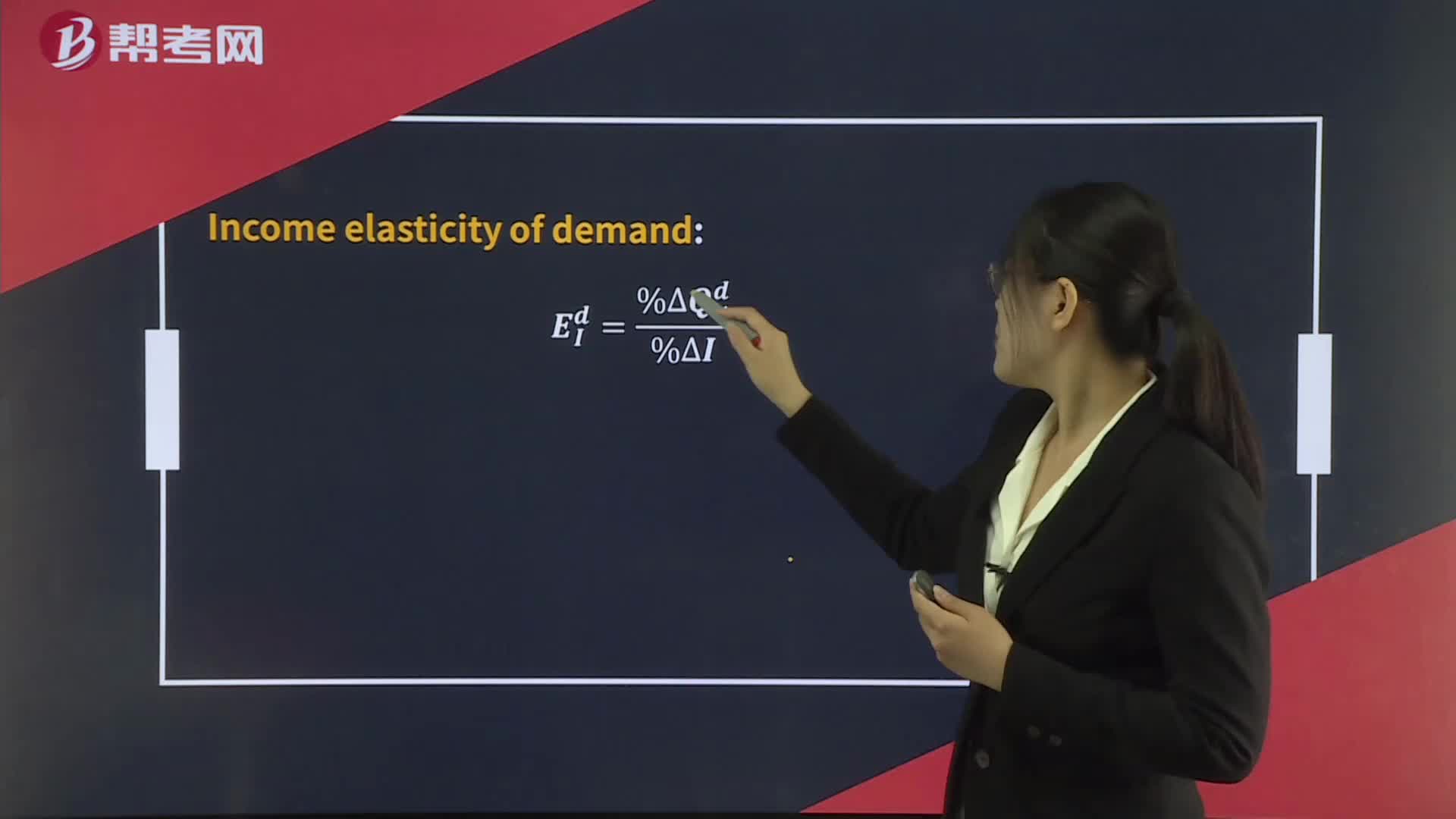

Income Elasticity of Demand

Currency Regimes – Fixed Parity with Crawling Bands

下载亿题库APP

联系电话:400-660-1360