下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Derivative Investments5道练习题,附答案解析,供您备考练习。

1、When valuing a call option using the binomial model, an increase in the probability that theunderlying will go up, most likely implies that the current price of the call option:【单选题】

A.remains unchanged.

B.decreases.

C.increases.

正确答案:A

答案解析:The probability that the underlying will go up is not part of the binomial model for pricing options. Thisprobability is irrelevant, since the options are priced using risk-neutral probabilities. These are derivedby constructing a hedged portfolio in the absence of arbitrage opportunities.

CFA Level I

"Basics of Derivative Pricing and Valuation," Don M. Chance

Section 4.2

1、Compared with a futures contract, a forward contract is most likely to be more:【单选题】

A.publicized.

B.customized.

C.liquid.

正确答案:B

答案解析:The terms of a forward contract are customized to meet the needs of both parties. A futures contract is not customized. Instead, the exchange establishes the terms.

2014 CFA Level I

"Futures Markets and Contracts," by Don M. Chance

Sections 1.2–1.3

1、An investor purchases 100 shares of common stock at €50 each and simultaneously sells calloptions on 100 shares of the stock with a strike price of €55 at a premium of €1 per option. At theexpiration date of the options, the share price is €58. The investor's profit is closest to:【单选题】

A.€900.

B.€600.

C.€400.

正确答案:B

答案解析:Because the share price  is greater than the strike price (X), the investor collects the premiumplus the difference between the strike price and purchase price:

is greater than the strike price (X), the investor collects the premiumplus the difference between the strike price and purchase price:  In this case, 100 × (€55-€50+€1)=€600.

In this case, 100 × (€55-€50+€1)=€600.

CFA Level I

"Risk Management Applications of Option Strategies," Don M. Chance

Section 2.2.1

1、An analyst does research about an forward rate agreement (FRA).FRA 3 × 12means the maturity is:【单选题】

A.3 month and is based on a 6-month underlying rate.

B.3 month and is based on a 9-month underlying rate.

C.9 month and is based on a 3-month underlying rate.

正确答案:B

答案解析:FRA 3 × 12是指远期利率合约的期限是3个月,针对的是9个月(12个月-3个月)的贷款利率。

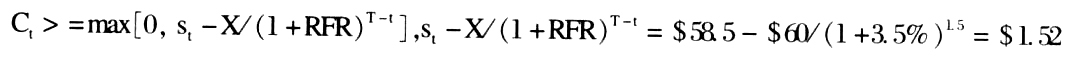

1、An American call has a strike price of $60 and expires in 1.5 years.The currentprice of the underlying is $58.5 and the risk-free rate is 3.5%.The minimumvalue of this call is:【单选题】

A.$0

B.$0.53

C.$1.52

正确答案:C

答案解析:

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料