下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Fixed Income Investments5道练习题,附答案解析,供您备考练习。

1、A moral obligation bond is also known as:【单选题】

A.a prerefunded bond.

B.a general obligation debt.

C.an appropriation-backed obligation

正确答案:C

答案解析:“Overview of Bond Sectors and Instruments,” Frank J. FabozziSome municipal bonds include a nonbinding pledge of additional tax revenue to make up any shortfalls; however legislative approval is required for the additional appropriation. These are known as moral obligation bonds. They are a form of general obligation debt, but most general obligation debt does not include such a pledge. In contrast, a prerefunded bond is backed by a trust of riskless securities that provide cash flows sufficient to pay the interest and principal payments of the bond.

2、The bond-equivalent yield (BEY) spot rates for U.S. Treasury yields are provided below.On a BEY basis, the 6-month forward rate one year from now is closest to:【单选题】

A.2.10%.

B.3.64%.

C.4.21%.

正确答案:C

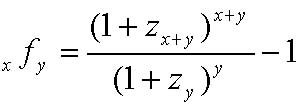

答案解析:“Yield Measures, Spot Rates, and Forward Rates,” Frank J. Fabozzi, CFAC is correct because, the x-year forward rate y-years from now . All spot rates are given on a BEY basis and must be divided by 2 in this calculation, or

. All spot rates are given on a BEY basis and must be divided by 2 in this calculation, or  . On a BEY basis, the forward rate is 0.021036×2=4.21%

. On a BEY basis, the forward rate is 0.021036×2=4.21%

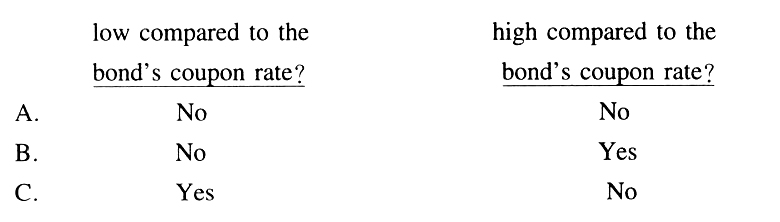

3、An analyst does research about a callable bond.All else being equal, is a callablebond most likely to exhibit negative convexity when the prevailing market yieldfor that bond is relatively:【单选题】

A.

B.

C.

正确答案:C

答案解析:当市场利率低于息票率时,更有可能触及到可赎回价格,这时体现价格和收益率的相互关系的曲线显示出负凸性。

4、An analyst does research about a floating-rate security.All else being equal, thecap on a floating-rate security is most likely to benefit the:【单选题】

A.issuer if interest rates fall.

B.issuer if interest rates rise.

C.bondholder if interest rates rise.

正确答案:B

答案解析:浮动利率的利率顶对于债券的发行人有利,它限制了票面利率上涨的最高幅度,锁定了发行人的利息支出。

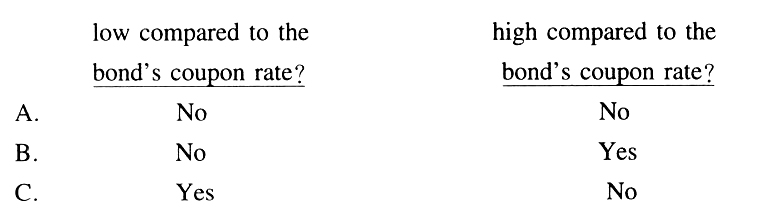

5、An analyst does research about bond valuation and gave her supervisor the followinginformation about two $1 000 par value option-free bonds:The analyst's supervisor reviewed the information and stated that the informationgiven is consistent with the expected relationships for the bond 1 but is not consistentwith the expected relationships for the bond 2.Is the supervisor correctwith respect to the:【单选题】

A.

B.

C.

正确答案:C

答案解析:当到期收益率(YTM)大于息票率时,债券价格低于面值,是折价债券。当到期收益率小于息票率时,债券价格高于面值,是溢价债券。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料