下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理历年真题10道,附答案解析,供您考前自测提升!

1、William Wong, CFA, is an equity analyst with Hayswick Securities. Based on his fundamental analysis, Wong concludes the stock of a company he follows, Nolvec Inc., is substantially undervalued and will experience a large price increase. He delays revising his recommendation on the stock from “hold” to “buy” to allow his brother to buy shares at a lower price. Wong is least likely to have violated the CFA Institute Standards of Professional Conduct related to:【单选题】

A.duty to clients.

B.reasonable basis.

C.priority of transactions.

正确答案:B

答案解析:“Guidance for Standards I-VII”, CFA InstituteB is correct because there is nothing to suggest that Wong does not have a reasonable basis for his conclusion related to Nolvec. Standard V (A).

2、For an investment portfolio, the coefficient of variation of the returns on the portfolio is best described as measuring:【单选题】

A.risk per unit of mean return.

B.mean return per unit of risk.

C.mean excess return per unit of risk.

正确答案:A

答案解析:“Statistical Concepts and Market Returns,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFAThe coefficient of variation is defined as the standard deviation of the portfolio (a measure of risk) divided by the mean return on the portfolio (i.e., risk per unit of mean return).

3、Regarding a company’s production function, both labor costs and capital costs are best described as:【单选题】

A.fixed in the long run.

B.variable in the long run.

C.variable in the short run.

正确答案:B

答案解析:“Output and Costs,” Michael ParkinIn the short run, a company can vary the quantity of labor but the quantity of capital is fixed. In the long run, a firm can vary both the quantity of labor and the quantity of capital.

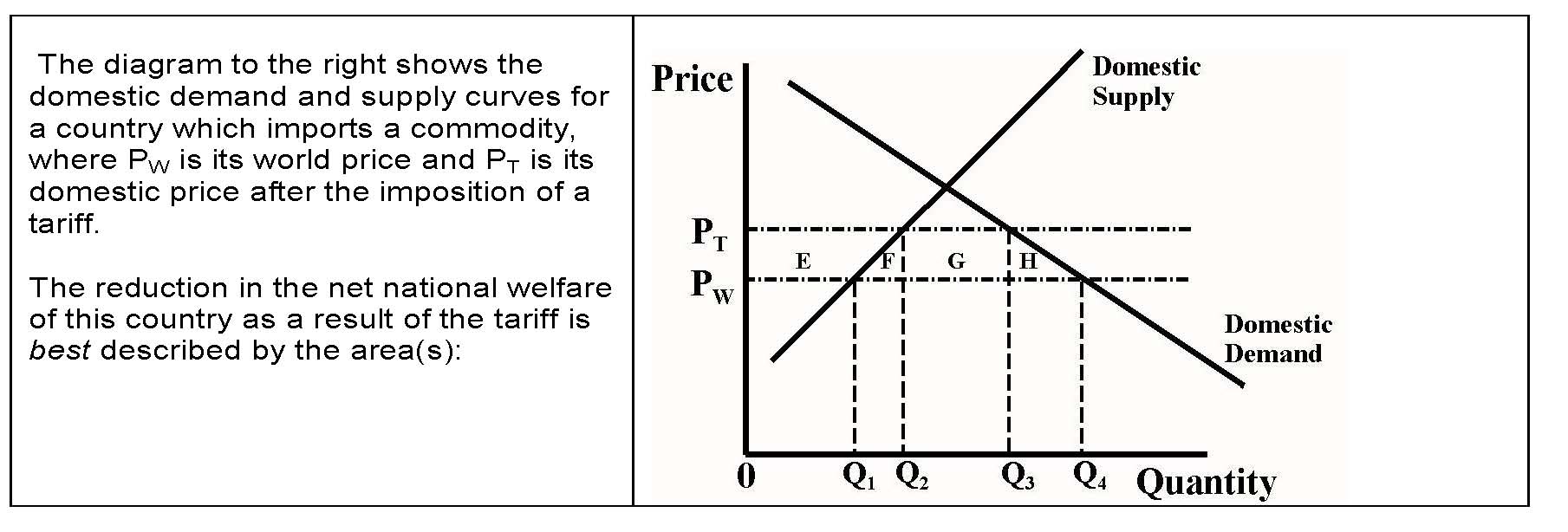

4、 【单选题】

【单选题】

A.E.

B.G.

C.F+H.

正确答案:C

答案解析:The loss in consumer surplus because of higher prices is represented by area e+f+g+h. This exceeds the gains from producer surplus (E) and government revenues on imports (G). Hence the net welfare effect to the country is a deadweight loss of[e+f+g+h] –[E] –[G] = Section 3+.1

Section 3+.1

5、If the yield to maturity on an annual-pay bond is 7.75%, the bond-equivalent yield is closest to:【单选题】

A.7.61%.

B.7.90%.

C.8.05%.

正确答案:A

答案解析:“Yield Measures, Spot Rates, and Forward Rates,” Frank J. Fabozzi, CFA

6、For a hedge fund investor, a benefit of investing in a fund of funds is least likely the:【单选题】

A.multilayered fee structure.

B.higher level of due diligence expertise.

C.ability to negotiate better redemption terms.

正确答案:A

答案解析:“Introduction to Alternative Investments”, Terri Duhon, George Spentzos, CFA, and Scott D. Stewart, CFAA is correct because funds of funds typically have a multilayered fee structure that may dilute the returns to the investor.

7、The following sample of 10 items is selected from a population. The population variance is unknown.The standard error of the sample mean is closest to:【单选题】

A.10.84.

B.3.43.

C.3.60.

正确答案:B

答案解析:When the population variance is unknown, the standard error of the sample mean is calculated as:The standard error of the sample mean is therefore CFA Level I"Sampling and Estimation," Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E.RunkleSection 3.1

8、The following 10 observations are a sample drawn from an approximately normal population:The sample standard deviation is closest to:【单选题】

A.13.18.

B.12.50.

C.11.92.

正确答案:A

答案解析:The sample variance is:The sample standard deviation is the (positive) square root of the sample variance.CFA Level I"Statistical Concepts and Market Returns," Richard A. DeFusco, Dennis W. McLeavey, Jerald E.Pinto, and David E. RunkleSection 7.4

9、An analyst does research about difference between forward market and futuremarket.Compared with contracts in the forward market, contracts in the futuresmarket are least likely to be appropriately described as transactions that are:【单选题】

A.public.

B.customized according to the counterparts' requests.

C.based on an agreement to buy or sell an underlying asset at a future date at aprice agreed on today.

正确答案:B

答案解析:期货市场是公开交易标准化的远期合约的,它与远期市场一样,都是约定在未来的某个时点按约定的价格买卖一项资产,但是期货市场是不能像远期市场那样,根据交易对手的要求来进行定制化。

10、An analyst does research about assumption behind the Markowitz Portfolio Theory.A basic assumption behind the Markowitz Portfolio Theory is that utilitycurves for an investor:【单选题】

A.demonstrate increasing marginal utility of wealth.

B.are a function of expected returns and expected variance of returns only.

C.are a function of expected returns on the risk-free asset and the marketportfolio.

正确答案:B

答案解析:根据马柯威茨投资组合理论(Markowitz Portfolio Theory),假设财富的边际效用是递减的,而不是递增的,风险加大后需要更高的收益进行补偿。效用曲线是预期收益和方差的方程。选项C是资本市场线(CML)。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料