下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Danielle Deschutes, CFA, is a portfolio manager who is part of a 10-person team that manages equity portfolios for institutional clients. A competing firm, South West Managers, asks Deschutes to interview for a position within its firm and to bring her performance history to the interview. Deschutes receives written permission from her current employer to bring the performance history of the stock portfolio with her. At the interview, she discloses that the performance numbers represent the work of her team and describes the role of each member. To bolster her credibility, Deschutes also provides the names of institutional clients and related assets constituting the portfolio. During her interview Deschutes most likely violated the CFA Institute Standards of Professional Conduct with regards to:【单选题】

A.the stock portfolio’s performance history.

B.her contribution to the portfolio’s returns.

C.providing details of the institutional clients.

正确答案:C

答案解析:“Guidance for Standards I–VII,” CFA InstituteC is correct because Deschutes most likely violated Standard III (E) Preservation of Confidentiality by failing to preserve the confidentiality of client records when she disclosed specific details about clients in the equity portfolio.

2、If the stated annual interest rate is 9% and the frequency of compounding is daily, the effective annual rate is closest to:【单选题】

A.9.00%.

B.9.42%

C.9.88%.

正确答案:B

答案解析:“Time Value of Money,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA2011 Modular Level I, Vol. 1, pp. 266-267Study Session 2-5-cCalculate and interpret the effective annual rate, given the stated annual interest rate and the frequency of compounding.Solve for effective annual rate using:

3、An analyst does research about equity valuation.A company's current annualdividend ( ) of $0.80 is expected to grow at a 20% rate for the next threeyears and at an 8% rate thereafter.If the required rate of return is 15%, the intrinsicvalue of the equity is closest to:【单选题】

) of $0.80 is expected to grow at a 20% rate for the next threeyears and at an 8% rate thereafter.If the required rate of return is 15%, the intrinsicvalue of the equity is closest to:【单选题】

A.$13.71

B.$16.64

C.$21.33

正确答案:B

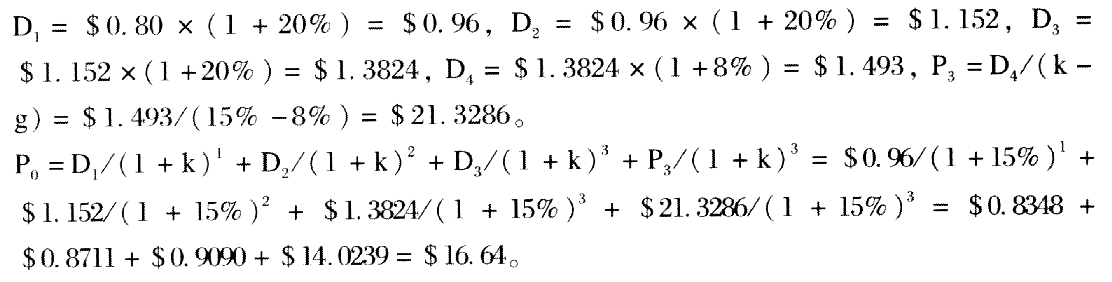

答案解析:根据二阶段戈登股利增长模型(Gordon Dividend Growth Model),价格的计算如下:

4、All else being equal, in a rising interest rate environment, the price of a floating-ratesecurity will most likely decline if:【单选题】

A.there is no cap.

B.the margin required by investors declines.

C.the coupon is reset every six months rather than monthly.

正确答案:C

答案解析:如果没有利率顶(CAP)就会降低利率风险,利率上升,息票率也随之上升,价格不会下跌。如果投资者要求的收益差(margin)减少,会提高浮动利率债券的价格,而不是降低。息票每6个月设定一次而不是每个月设定一次,在利率上升的情况下,浮动利率证券无法反映最新的市场利率,会造成其价格下跌。

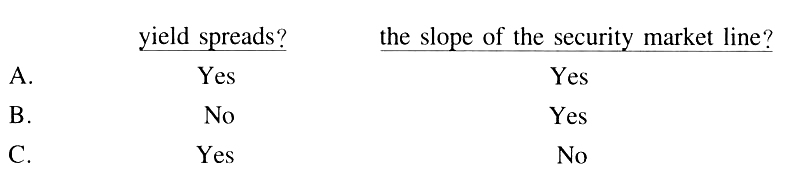

5、An analyst does research about return and risk.Given no major change in assetrisk characteristics, will a decrease in the willingness of investors to accept risktypically result in an increase in:【单选题】

A.

B.

C.

正确答案:A

答案解析:投资者越不愿意承受风险,他们对于风险的补偿要求就越增加,会使得收益率溢价上升。同时,在每个风险水平下(以系统风险衡量),投资者要求的收益率上升,会使得SML线的斜率变大。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料