下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、David Bravoria, CFA, is an independent financial advisor for a high net worth client with whom he had not had contact in over two years. During a recent brief telephone conversation, the client states he wants to increase his risk exposure. Bravoria subsequently recommends and invests in several high-risk funds on behalf of the client. Bravoria continues, as he has done in the past, to send to his client monthly, detailed itemized investment statements. Did Bravoria most likely violate any CFA Standards?【单选题】

A.No.

B.Yes, with regard to investment statements.

C.Yes, with regard to purchasing venture capital funds.

正确答案:C

答案解析:“Guidance for Standards I-VII,” CFA Institute

2011 Modular Level I, Vol. 1, pp. 65-67

Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

C is correct because Bravoria violated Standard III – Duties to Clients in not exercising Loyalty, Prudence and Care. Bravoria had not updated his client’s profile in over two years thus should not have made further investments, particularly in high risk investments until such time as he updated the client’s risk and return objectives, financial constraints and financial position. Bravoria provided his client with investment statements more frequently than that which is required; i.e. quarterly so was not in violation of regular account information.

2、If a regulatory agency sets prices equal to a monopoly’s long-run average cost (LRAC), the monopoly will most likely have economic profit that is:【单选题】

A.zero.

B.positive.

C.negative.

正确答案:A

答案解析:“Monopoly,” Michael ParkinIf regulators set the price to equal long-run average cost, the monopolist will earn zero economic profits (Figure 11, p. 210).

3、Which of the following is a constraint as defined in the International Financial Reporting Standards (IFRS) Framework for the Preparation and Presentation of Financial Statements?【单选题】

A.Neutrality

B.Timeliness

C.Going concern

正确答案:B

答案解析:“Financial Reporting Standards,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O’Connor Rubsam, CFA, R. Elaine Henry, CFA, and Michael A. Broihahn, CFATimeliness is a constraint in the IFRS Framework. Neutrality is a factor that contributes to reliability and going concern is an assumption of the Framework.

4、An equity analyst is forecasting the next year’s net profit margin of a heavy equipment manufacturing firm, by using the average net profit margin over the past three years. In making his profit projection, he is concerned about the following three items:The analyst would:【单选题】

A.use the most recent tax rate because that is the best predictor of future tax rates.

B.exclude the gains on the sale from investments because the company is a manufacturing firm.

C.include the discontinued operations because they appear to be an on-going feature for this company.

正确答案:B

答案解析:“Understanding the Income Statement,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFAThe company is a heavy equipment manufacturer - since gains on investments is not a core part of its business, they should not be viewed as an ongoing source of earnings. Discontinued operations are considered to be nonrecurring items (even though they have occurred in the past three years); they are normally treated as random and unsustainable and should not be included in a short-term forecast; the change in the current tax rate is best viewed as temporary (in the absence) of additional information and should not be the basis of the calculation of the average tax rate.

5、Which method of calculating the firm’s cost of equity is most likely to incorporate the long-run return relationship between the firm's stock and the market portfolio?【单选题】

A.Dividend discount model

B.Capital asset pricing model

C.Bond-yield-plus risk-premium

正确答案:B

答案解析:“Cost of Capital” Yves Courtois, CFA, Gene C. Lai, and Pamela Peterson Drake, CFAThe capital asset pricing model uses the firm’s equity beta, which is computed from a market model regression of the company's stock returns against market returns.

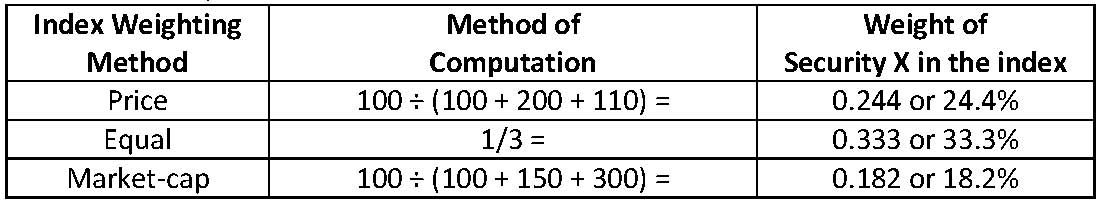

6、A market index only contains the following three securities:Which approach to indexing will most likely give Security X a weight of 18%?【单选题】

A.Price

B.Equal

C.Market-capitalization

正确答案:C

答案解析:“Security Market Indices,” Paul D. Kaplan, CFA, and Dorothy C. Kelly, CFA.

7、The tenor of a swap is best described as the:【单选题】

A.size of the contract.

B.original time to maturity.

C.net amount owed by one party to the other.

正确答案:B

答案解析:“Swap Markets and Contracts,” Don M. Chance, CFAB is correct. The original time to maturity is referred to as the tenor of the swap.

8、Eldora Ltd. recently issued deferred-coupon bonds for which no coupon payments will be paid in the first two years of the bond's life. Regular annual coupon payments at a rate of 9% will then be made until the bonds mature at the end of six years. The spot rates for various maturities are given in the following table.On the basis of these spot rates, the price of the bond today is closest to:【单选题】

A.100.12.

B.108.20.

C.116.24.

正确答案:A

答案解析:The bond price is computed as:Section 2.4

9、Compliance with the Global Investment Performance Standards (GAPS?) canleast likely be claimed by firms that:【单选题】

A.manage a variety of clients' assets.

B.consult with investors to select external asset managers.

C.is defined as investment firm, subsidiary or division held out to clients andprospective clients as a distinct business entity.

正确答案:B

答案解析:本题考查的是GAPS?中对可宣称遵守其标准的公司的基本定义。只有管理资产的公司才能宣称遵守GAPS?规定,而为客户推荐外部管理人的机构并不直接管理资产,因而不可宣称遵守GAPS?规定。选项C是GAPS?中关于公司的标准定义。

10、An analyst does research about survivorship bias and its impact to measurementratios.Hedge fund data bases and indexes that suffer from survivorship bias becauseof a failure to comply with performance presentation standards are mostlikely to overstate :【单选题】

A.Sharpe ratios.

B.standard deviation of returns.

C.correlations with returns from common stocks.

正确答案:A

答案解析:对冲基金有生存偏差,统计的历史业绩中只包含那些生存下来的基金的业绩,而那些由于业绩不佳而被清盘的基金的业绩不包括在内,这就高估了对冲基金的平均收益率,低估了对冲基金收益率的标准差,所以导致高估了夏普比率。同时,由于对冲基金的业绩看上去很稳定,但并不能反映市场的情况,这就低估了与普通股收益率之间的相关系数。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料