下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Portfolio Management5道练习题,附答案解析,供您备考练习。

1、Which of the following is least likely an assumption of the capital asset pricing model (CAPM)?【单选题】

A.Security prices are not affected by investor trades.

B.An investor can invest as much as he or she desires in any asset.

C.Investors are different only with respect to their unique holding periods.

正确答案:C

答案解析:One of the assumptions of the CAPM is that investors plan for the same single holding period.

CFA Level I

"Portfolio Risk and Return: Part II," Vijay Singal

Section 4.1

2、A client exhibits an above-average willingness to take risk but a below-averageability to take risk.The investment adviser is most likely to assess the client'soverall risk tolerance as:【单选题】

A.above average.

B.average.

C.below average.

正确答案:C

答案解析:虽然客户有较强意愿去接受风险,但其风险承受能力较低,所以咨询师只能将此客户列为较低风险承受者。

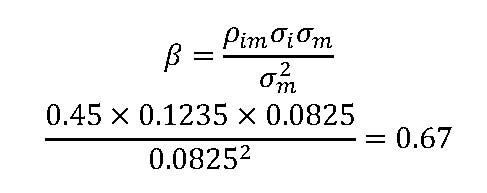

3、A stock has a correlation of 0.45 with the market and a standard deviation of returns of 12.35%. If the market has a standard deviation of returns of 8.25%, then the beta of the stock is closest to:【单选题】

A.0.30.

B.0.67.

C.1.50.

正确答案:B

答案解析:“Portfolio Risk and Return Part II,” Vijay Singal

2012 Modular Level I, Vol. 4, pp. 415–417

Study Session 12-45-eCalculate and interpret beta.

B is correct.

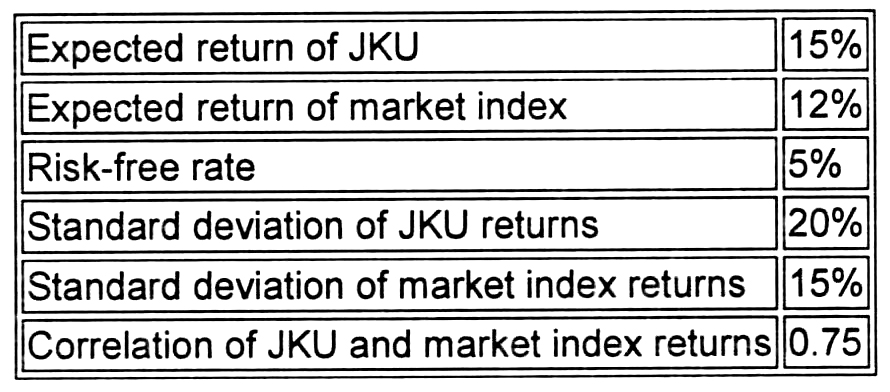

4、The following table shows data for the stock of JKU and a market index.

Based on the capital asset pricing model (CAPM), JKU is most likely:【单选题】

A.overvalued.

B.fairly valued.

C.undervalued.

正确答案:C

答案解析: =0.75 × 0.2/0.15=1.0 and

=0.75 × 0.2/0.15=1.0 and  =RFR+

=RFR+ =0.05+1 ×(0.12-0.05)=0.12. The required rate of return of JKU is 12%, and the expected return of JKU is15%. Therefore, JKU is undervalued relative to the security market line (SML); the risk-returnrelationship lies above the SML.

=0.05+1 ×(0.12-0.05)=0.12. The required rate of return of JKU is 12%, and the expected return of JKU is15%. Therefore, JKU is undervalued relative to the security market line (SML); the risk-returnrelationship lies above the SML.

CFA Level I

"Portfolio Risk and Return: Part II," Vijay Singal

Section 4

5、A correlation matrix of the returns for securities A, B, and C is reported below:

Assuming that the expected return and the standard deviation of each security are the same, a portfolio consisting of an equal allocation of which two securities will be most effective for portfolio diversification? Securities:【单选题】

A.A and B.

B.A and C.

C.B and C.

正确答案:C

答案解析:“Portfolio Risk and Return Part I,” Vijay Singal

2012 Modular Level I, Vol. 4, pp. 364–365

Study Session 12-44-f

Describe the effect on a portfolio’s risk of investing in assets that are less than perfectly correlated.

C is correct. The negative correlation of –0.5 between investment instruments B and C is lowest and therefore is most effective for portfolio diversification.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料