下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、All else being equal and ignoring tax effects, compared with using the straight-line method of depreciation, the use of an accelerated method of depreciation in the early years of an asset's life would most likely result in a decrease in the firm's:【单选题】

A.cash flow from operations.

B.asset turnover ratio.

C.shareholders' equity.

正确答案:C

答案解析:An accelerated method of deprecation produces greater expenses in the early years and lowers net income, which in turn lowers the retained earnings resulting in a decrease in shareholders' equity.

2014 CFA Level I

"Long-Lived Assets," by Elaine Henry and Elizabeth A. Gordon

Section 3.1

2、An analyst does researchabout lease.When compared to a leasor, which of thefollowing is most appropriate adjustment to the balance sheet of a leasee?【单选题】

A.increasing assets and liabilities by the sum of future lease payments.

B.increasing assets and liabilities by the present value of future leased payments.

C.decreasing assets and liabilities by the present value of future leased payments.

正确答案:B

答案解析:对于经营性租赁(operating lease):资产负债表没有变化,直接产生租赁费用。对于资本性租赁(capital lease):在租期一开始,在资产负债表上的长期资产和负债中分别加上未来租金的现值。

3、An analyst does research about capital structure.The optimal capital structure fora company is best described as the capital structure to maximize that company's:【单选题】

A.stock price.

B.earnings per share.

C.dividends per share.

正确答案:A

答案解析:最优的资本结构能够使公司的价值最大化,即能使股票价格最高。

4、Which of the following activities would an analyst least likely complete as part of the processing data phase of a financial analysis?【单选题】

A.Analyzing the prospects of the industry

B.Preparing common-sized financial statement data

C.Making adjustments for different accounting policies

正确答案:A

答案解析:“Financial Statement Analysis: An Introduction,” Elaine Henry, CFA, and Thomas R. Robinson, CFA

2013 Modular Level I, Vol. 3, Reading 22, Section 4.2, 4.3

Study Session 7–22–f

Describe the steps in the financial statement analysis framework.

A is correct. Analyzing the prospects of the industry would be done in the collect data phase of a financial analysis.

5、An analyst does research about well-function securities markets.In an informationallyefficient securities market, does new information result in price adjustmentthat is:【单选题】

A.

B.

C.

正确答案:A

答案解析:在信息有效市场里,新信息进入后会立刻反映到市场价格中,该种反映是没有偏差的,而且是不可预测的。

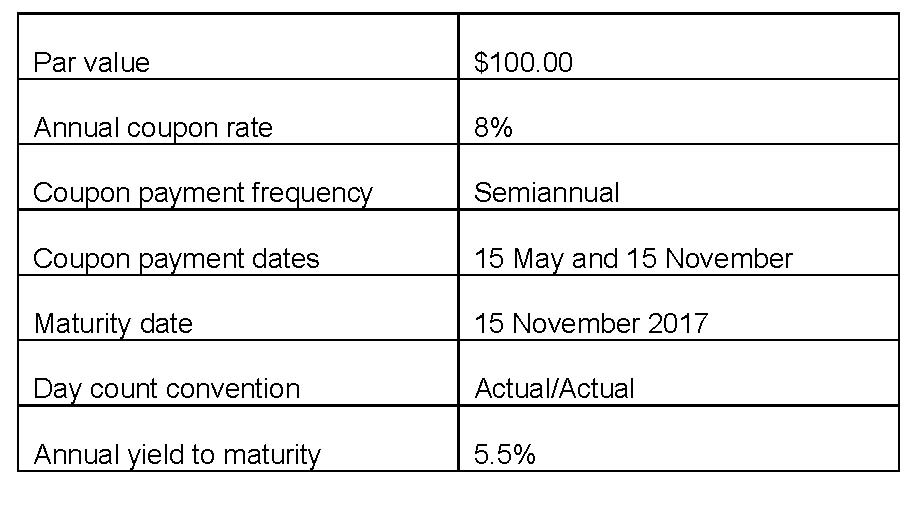

6、The bonds of Whakatane and Co. are priced for settlement on 15 July 2014 and have the following features.

On the basis of this information, the difference between the full and flat prices is closest to:【单选题】

A.1.333.

B.2.667.

C.0.917.

正确答案:A

答案解析:The difference between the full and flat prices is the accrued interest, which is computed as follows. Based on the Actual/Actual day convention, the number of days between the coupon periods is 183 days. Also, using the Actual/Actual day count convention, the number of days between 15 May 2014 and 15 July 2014 is 16 days remaining in May + 30 days in June + 15 days in July = 61 days. Accrued interest (per $100 par value) = (61/183)(8.00/2) = 1.333.

2014 CFA Level I

"Introduction to Fixed-Income Valuation," by James F. Adams and Donald J. Smith

Section 3.1

7、Holding all other characteristics the same, the bond exposed to the greatest level of reinvestmentrisk is most likely the one selling at:【单选题】

A.a premium.

B.a discount.

C.par.

正确答案:A

答案解析:A bond selling at a premium has a higher coupon rate and, all else being equal, bonds with highercoupon rates face higher reinvestment risk. The reason is that the higher the coupon rate, the moredependent the bond's total dollar return will be on the reinvestment of the coupon payments in orderto produce the yield to maturity at the time of purchase.

CFA Level I

"Understanding Fixed-Income Risk and Return," James F. Adams and Donald J. Smith

Section 2

8、An analyst does research about hedge funds.The returns from hedge funds thatcontain infrequently traded assets most likely exhibit a downward bias with respectto correlations with:【单选题】

A.both conventional equity returns and conventional fixed income returns.

B.conventional equity returns but not with conventional fixed income returns.

C.conventional fixed income returns but not with conventional equity returns.

正确答案:A

答案解析:由于对冲基金对业绩披露的要求并不严格,而对冲基金持有交易并不活跃的资产,此时无法得到该资产真实的市场价格,往往需要通过估计得到,而估计会使得资产价格有平滑的趋势,并不能真实反映出最新最真实的市场价格,因此所得出的对冲基金收益率与传统的股票和固定收益产品收益率的相关性降低。

9、A behavioral bias in which an investor assesses probabilities of outcomes depending on how similar they are to the current state is called:【单选题】

A.narrow framing.

B.representativeness.

C.conservatism.

正确答案:B

答案解析:An investor assessing probabilities of outcomes depending on how similar they are to the current state is called representativeness.

2014 CFA Level I

“Market Efficiency,” by W. Sean Cleary, Howard J. Atkinson, and Pamela Peterson Drake

Section 5.3

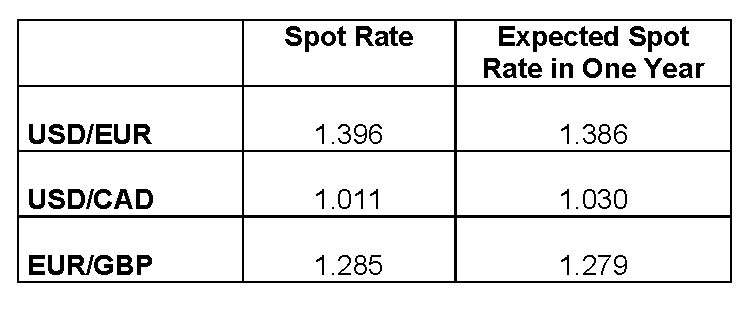

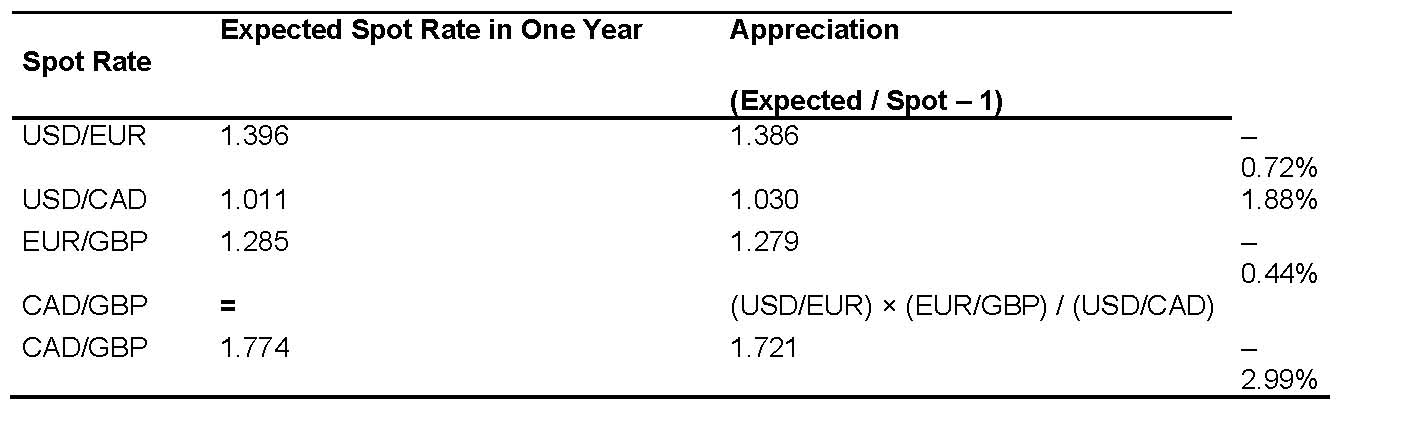

10、A research report produced by a dealer includes the following exchange rates:

The most accurate calculation of the expected appreciation (%) of the Canadian dollar (CAD) relative to the British pound (GBP) is:【单选题】

A.2.99%

B.0.7%.

C.-2.04%

正确答案:A

答案解析:

CAD/GBP = (USD/EUR) × (EUR/GBP)/(USD/CAD)

Spot rate of CAD/GBP = 1.396 × 1.285/1.011 = 1.774

Expected spot rate of CAD/GBP = 1.386 × 1.279/1.030 = 1.721

Previously it cost $1.774 to buy 1 GBP; it is expected to cost $1.721 to buy 1 GBP in 1 year so the Canadian dollar has appreciated by 2.99%

2014 CFA Level I

"Currency Exchange Rates," by William A. Barker, Paul D. McNelis, and Jerry Nickelsburg

Section 3.2

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料