下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、An investor purchases a three-month put option on a stock with an exercise price of $35.00. The risk-free rate is 4.50%. At expiration, the stock price is $33.50. The option's payoff is closest to:【单选题】

A.$1.48.

B.$0.

C.$1.50.

正确答案:C

答案解析:The put option is worth the greater of $0 or (Exercise price – Spot price at expiration). Because the exercise price is greater than the spot price at expiration, the put is worth ($35.00 – $33.50) = $1.50.

2014 CFA Level I

“Option Markets and Contracts,” by Don M. Chance

Section 5.1

2、Over a four-year period, a portfolio has returns of 10%, –2%, 18%, and –12%. The geometric mean return across the period is closest to:【单选题】

A.2.9%.

B.3.5%.

C.8.1%.

正确答案:A

答案解析:“Statistical Concepts and Market Returns,” Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle

2012 Modular Level I, Vol. 1, pp. 370–373

Study Session 2-7-e

Calculate and interpret measures of central tendency, including the population mean, sample mean, arithmetic mean, weighted average or mean (including a portfolio return viewed as a weighted mean), geometric mean, harmonic mean, median, and mode.

A is correct. The geometric mean return is calculated as

3、First degree price discrimination is best described as pricing that allows producers to increase their economic profit while consumer surplus:【单选题】

A.increases.

B.decreases.

C.is eliminated.

正确答案:C

答案解析:“The Firm and Market Structures,” Richard G. Fritz and Michele Gambera

2012 Modular Level I, Vol. 2, pp. 196–197

Study Session 4-16-d, e

Describe and determine the profit-maximizing price and output for firms under each market structure.

Explain the effects of demand changes, entry and exit of firms, and other factors on long-run equilibrium under each market structure.

C is correct. In the first degree price discrimination, the entire consumer surplus is captured by the producer: The consumer surplus falls to zero.

4、An analyst does research about the cost of capital and gathers the followinginformation about a company:

● Current share price is $60

● Current annual dividend per share is $1.50

● Stable retention ratio is 40%

● Historical return on equity is 12%

Using the dividend discount model approach, the cost of equity is closest to:【单选题】

A.7.30%

B.7.42%

C.9.88%

正确答案:B

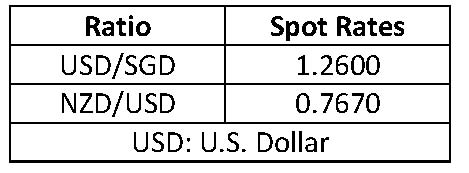

答案解析:使用股利贴现模型(Dividend Discount Model)的计算公式:

g = (return on equity)x(retention ratio),由此得:

g = 12% × 0.4 = 4.8%,所以 = $1.5 × (1 + 4.8%)/$60 + 4.8% = 7.42%.

= $1.5 × (1 + 4.8%)/$60 + 4.8% = 7.42%.

5、An investor opens a margin account with an initial deposit of $5,000. He then purchases 300 shares of a stock at $30. His margin account has a maintenance margin requirement of 30%. Ignoring commissions and interest, the price (in $) at which the investor receives a margin call is closest to:【单选题】

A.19.05.

B.23.08.

C.23.81.

正确答案:A

答案解析:“Organization and Functioning of Securities Markets,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 26-28

Study Session 13-52-g

Describe the process of buying a stock on margin, compute the rate of return on a margin transaction, define maintenance margin, and determine the stock price at which the investor would receive a margin call.

Determine the stock price at which the investor receives a margin call by solving for the critical stock price, P, as:

[(#of shares x p) – margin loan] / (# of shares x P) = % of Maintenance Margin

(300P – $4,000) / 300P = .30;

P = $4,000 / 210 = $19.05

6、An analyst doe research about a U.S.Treasury Inflation Protection Security(TIPS).With respect to a TIPS, Which of the following statements is mostaccurate? Changes in the reference price index resultin changes in:【单选题】

A.the TIPS' coupon rate.

B.the TIPS' principle amount.

C.both the TIPS' coupon rate and the TIPS' principle amount.

正确答案:B

答案解析:通货膨胀保护证券根据CPI修改的是本金而不是息票率。

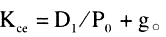

7、In early 2011, a New Zealand traveler returned from Singapore with SGD7,500 (Singapore dollars). A foreign exchange dealer provided the traveler with the following quotes:

The amount of New Zealand dollars (NZD) that the traveler would receive for his Singapore dollars is closest to:【单选题】

A.4,565.

B.7,248.

C.7,761.

正确答案:B

答案解析:“Currency Exchange Rates,” William A. Barker, Paul D. McNelis, and Jerry Nickelsburg

2012 Modular Level I, Vol. 2, pp. 521–525

Study Session 6-21-e

Calculate and interpret currency cross-rates.

B is correct. The NZD/SGD cross-rate is NZD/USD × USD/SGD = 0.7670 × 1.26 = 0.9664.

The traveler will receive 0.9664 NZD per SGD; 0.9664 NZD/SGD × 7,500 SGD = 7,248 NZD.

8、Amanda Covington, CFA, works for McJan Investment Management. McJan employees must receive prior clearance of their personal investments in accordance with McJan’s compliance procedures. To obtain prior clearance, McJan employees must provide a written request identifying the security, the quantity of the security to be purchased, and the name of the broker through which the transaction will be made. Pre cleared transactions are approved only for that trading day. As indicated below, Covington received prior clearance.

Two days after she received prior clearance, the price of Stock B had decreased so Covington decided to purchase 250 shares of Stock B only. In her decision to purchase 250 shares of Stock B only, did Covington violate any CFA Institute Standards of Professional Conduct?【单选题】

A.No.

B.Yes, relating to diligence and reasonable basis.

C.Yes, relating to her employer’s compliance procedures.

正确答案:C

答案解析:“Guidance for Standards I-VII”, CFA Institute

2010 Modular Level I, Vol. 1, pp. 80–81, 94-98

Study Session 1–2–a

Demonstrate a thorough knowledge of the Code of Ethics and Standards of Professional Conduct by applying the Code and Standards to situations involving issues of professional integrity.

Prior-clearance processes guard against potential and actual conflicts of interest; members are required to abide by their employer’s compliance procedures (Standard VI (B)).

9、A technical analyst observes a head and shoulders pattern in a stock she has been following. Shenotes the following information:

Based on this information, her estimate of the price target is closest to:【单选题】

A.$59.50.

B.$48.00.

C.$44.50.

正确答案:B

答案解析:Price target=Neckline-(Head-Neckline).

In this example, Price target=$65.75-($83.50-$65.75)=$65.75-$17.75=$48.00.

CFA Level I

"Technical Analysis," Barry M. Sine and Robert A. Strong

Section 3.3.1.3

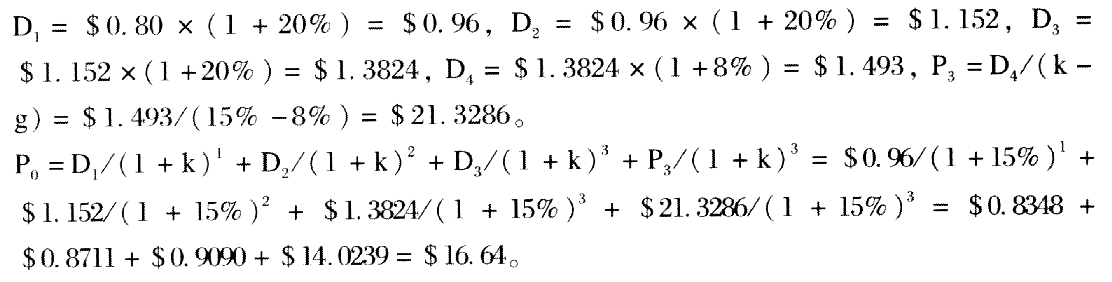

10、An analyst does research about equity valuation.A company's current annualdividend ( ) of $0.80 is expected to grow at a 20% rate for the next threeyears and at an 8% rate thereafter.If the required rate of return is 15%, the intrinsicvalue of the equity is closest to:【单选题】

) of $0.80 is expected to grow at a 20% rate for the next threeyears and at an 8% rate thereafter.If the required rate of return is 15%, the intrinsicvalue of the equity is closest to:【单选题】

A.$13.71

B.$16.64

C.$21.33

正确答案:B

答案解析:根据二阶段戈登股利增长模型(Gordon Dividend Growth Model),价格的计算如下:

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料